1,050% Price Hike: AT&T Sounds Alarm On Broadcom's VMware Deal

Table of Contents

AT&T's Concerns and the 1,050% Figure

AT&T's dramatic claim of a 1,050% price hike stems from their analysis of Broadcom's potential pricing strategies post-acquisition. While Broadcom hasn't publicly confirmed this specific figure, AT&T's assessment focuses on the potential for significant increases in the cost of crucial VMware products and services they rely on for their extensive network infrastructure. Specific VMware products affected are likely to include those integral to AT&T's virtualization, network management, and cloud operations. The exact products haven't been publicly specified by AT&T, but industry analysts speculate it encompasses a range of enterprise-grade software solutions.

- Potential Impacts on AT&T's Infrastructure and Operational Costs:

- Massive increase in licensing fees for core VMware products.

- Significant disruptions to ongoing IT operations and potential service outages during transitions.

- Increased capital expenditure (CAPEX) required to adapt to new pricing structures.

- Potential need for significant restructuring of existing IT infrastructure.

AT&T executives have expressed serious concerns, stating the potential price increase is unsustainable and poses a significant threat to their business model and the broader telecommunications industry. The exact quotes and statements will need to be sourced from official AT&T press releases and communications once available. These concerns extend beyond just AT&T, highlighting potential antitrust concerns around the acquisition.

Broadcom's Response and Acquisition Details

Broadcom, in response to AT&T's concerns, has generally downplayed the possibility of such drastic price increases. They maintain that the acquisition will ultimately benefit customers through innovation and increased efficiency. However, they haven't provided specific denials or counterarguments to the 1050% figure presented by AT&T, leading to continued uncertainty.

- Acquisition Details: The proposed acquisition, valued at over $61 billion, is subject to regulatory approval from various bodies, including the Federal Trade Commission (FTC) in the US and the European Commission (EU). The timeline for completion remains uncertain pending these approvals.

- Broadcom's Acquisition History: Broadcom has a history of significant acquisitions, and concerns exist about their impact on market competition. Past acquisitions have raised concerns about potential monopolistic practices, which may inform the regulatory review of the VMware deal.

The sheer size of the deal and Broadcom’s history necessitates a thorough regulatory review to determine whether the acquisition will stifle competition and lead to anti-competitive pricing practices.

Potential Implications for Consumers and Businesses

While the 1,050% figure remains contested, even a more moderate price increase from Broadcom post-acquisition will have a ripple effect throughout the technology landscape. Businesses heavily reliant on VMware virtualization technologies will face increased operational costs, potentially impacting their competitiveness.

- Increased Cloud Computing Costs: The rising cost of VMware products will inevitably increase the overall cost of cloud computing services, impacting businesses of all sizes.

- Reduced Accessibility: Higher prices may make VMware products less accessible to smaller businesses and startups, potentially hindering innovation and competition.

- Impact on IT Spending: Businesses will need to re-evaluate their IT budgets and potentially cut spending in other areas to accommodate the increased cost of VMware solutions.

The potential impact extends beyond direct VMware customers. The price increase could trigger price hikes in other related technologies and services, creating a broader economic impact.

Regulatory Scrutiny and Antitrust Concerns

The Broadcom-VMware acquisition is currently under intense regulatory scrutiny from bodies like the FTC and the EU. The primary concern centers on potential antitrust violations, as the merger would significantly consolidate market share in the enterprise virtualization and cloud computing sectors.

- Antitrust Arguments: Opponents argue the merger will reduce competition, leading to higher prices and less innovation. Proponents, however, contend that the combined entity will be more efficient and better positioned to compete in the global market.

- Legal Challenges: It's possible that legal challenges and lawsuits will emerge as the regulatory review process unfolds, adding further uncertainty to the deal's future.

The outcome of the regulatory review will be crucial in determining the final pricing structure and market implications of the Broadcom-VMware merger.

Conclusion

AT&T’s alarm regarding a potential 1,050% price hike from Broadcom post-VMware acquisition highlights significant concerns about this mega-merger. While the exact figure remains debated, the potential for substantial price increases, coupled with antitrust concerns, necessitates close monitoring. The ripple effect on consumers and businesses, particularly in the cloud computing and IT sectors, could be significant. Regulatory scrutiny from the FTC, EU, and potential legal challenges will shape the final outcome.

Call to Action: Stay informed about the unfolding situation regarding the Broadcom VMware acquisition. Continue to monitor the regulatory process and potential impacts on VMware pricing and the broader technology market. Search for updates on the Broadcom VMware acquisition and its implications. Learn more about potential VMware price increases and how they may affect your business.

Featured Posts

-

Moodys 5 30 Year Yield Reassessment Of The Sell America Narrative

May 21, 2025

Moodys 5 30 Year Yield Reassessment Of The Sell America Narrative

May 21, 2025 -

Trans Australia Run A New Record In The Making

May 21, 2025

Trans Australia Run A New Record In The Making

May 21, 2025 -

Amazon Warehouse Closures In Quebec Union Takes Case To Labour Tribunal

May 21, 2025

Amazon Warehouse Closures In Quebec Union Takes Case To Labour Tribunal

May 21, 2025 -

Female Pub Landlords Explosive Outburst Caught On Tape

May 21, 2025

Female Pub Landlords Explosive Outburst Caught On Tape

May 21, 2025 -

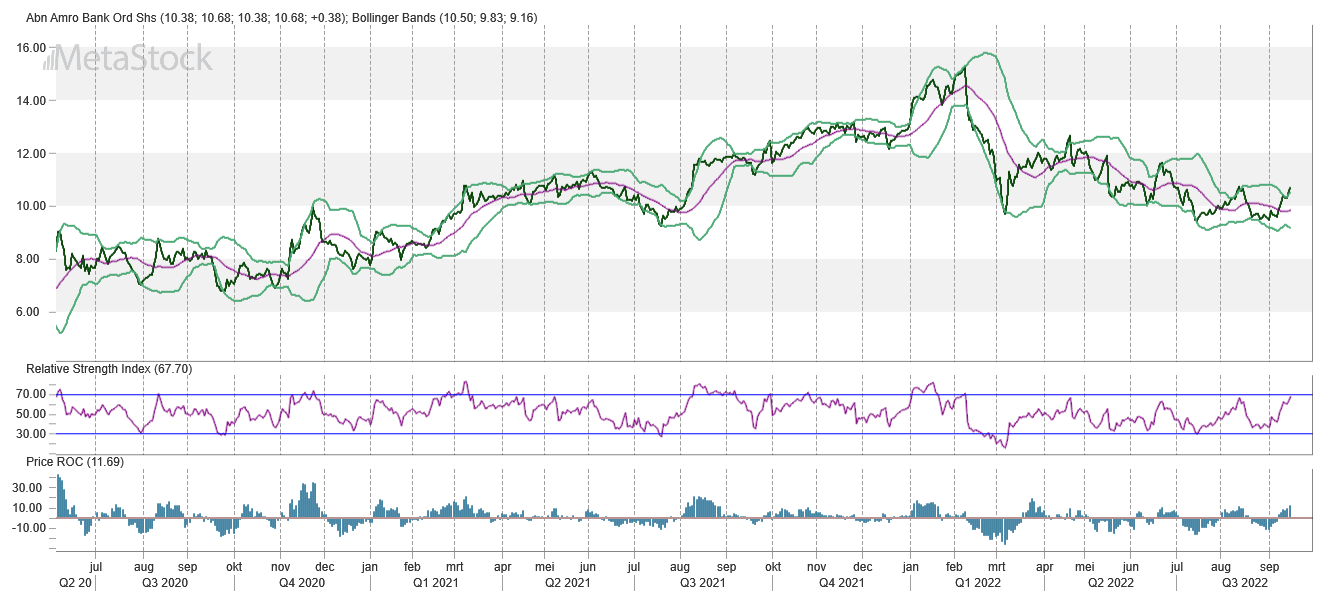

Abn Amro Sterke Stijging Occasionverkoop Door Groeiend Autobezit

May 21, 2025

Abn Amro Sterke Stijging Occasionverkoop Door Groeiend Autobezit

May 21, 2025

Latest Posts

-

19 Indian Table Tennis Players Participate In Wtt Star Contender Chennai

May 22, 2025

19 Indian Table Tennis Players Participate In Wtt Star Contender Chennai

May 22, 2025 -

Wtt Chennai Arunas Unexpected Early Defeat

May 22, 2025

Wtt Chennai Arunas Unexpected Early Defeat

May 22, 2025 -

Arunas Wtt Chennai Campaign Cut Short

May 22, 2025

Arunas Wtt Chennai Campaign Cut Short

May 22, 2025 -

Musique Metal Le Hellfest Debarque A Mulhouse

May 22, 2025

Musique Metal Le Hellfest Debarque A Mulhouse

May 22, 2025 -

Inside Aimscaps Strategy For The World Trading Tournament Wtt

May 22, 2025

Inside Aimscaps Strategy For The World Trading Tournament Wtt

May 22, 2025