1,050% Price Hike: AT&T's Concerns Over Broadcom's VMware Deal

Table of Contents

AT&T's Allegations of a 1,050% Price Increase

AT&T alleges that Broadcom, post-acquisition of VMware, has implemented a drastic 1,050% increase in interconnection fees. This claim centers on the critical network infrastructure services that allow different telecommunication companies to seamlessly connect and exchange data. The alleged price increase, if accurate, would represent a massive blow to AT&T's operational budget. The impact on profitability could be substantial, forcing the company to absorb increased costs or pass them on to consumers.

- Specific examples of services impacted: AT&T claims the price hike affects crucial interconnection points, impacting data transfer speeds and overall network performance.

- Quantitative data illustrating the scale of the price increase: While specific dollar amounts remain undisclosed, the 1,050% figure highlights the sheer magnitude of the alleged increase, potentially impacting billions in annual spending.

- Potential effect on AT&T's services and customers: This could result in reduced service quality, slower internet speeds, and ultimately, potential price increases for AT&T's customers.

Broadcom's Response to AT&T's Concerns

Broadcom has yet to publicly address the specific 1,050% figure cited by AT&T. However, their official statements generally focus on the integration process following the VMware acquisition, emphasizing synergies and efficiencies. Broadcom’s justification, if any, will likely center around the integration of VMware's technology into their existing infrastructure and the associated costs.

- Key points from Broadcom's public statements or filings: Their official statements will need to be reviewed for any details regarding pricing adjustments for interconnection services.

- Any evidence presented by Broadcom to support their pricing: Broadcom's defense may include arguments concerning market rates for such services and the complex cost structure involved in integrating VMware's technology.

- Potential legal challenges or responses to AT&T's claims: Broadcom will likely respond to the allegations, potentially by launching a counter-argument, initiating arbitration, or engaging in legal proceedings.

Antitrust Implications and Regulatory Scrutiny

The Broadcom-VMware deal has already attracted significant regulatory scrutiny due to its sheer size and potential impact on market competition. AT&T's allegations of a massive price increase further fuel concerns about potential antitrust violations. Regulatory bodies are likely to investigate whether the price hike constitutes anti-competitive behavior aimed at stifling competition.

- Relevant antitrust laws and regulations that could be applicable: Investigations will likely focus on relevant laws regarding market monopolies and anti-competitive practices.

- Details on any ongoing investigations or legal actions: The progress of any investigation will be crucial in determining whether the price increase is justified.

- Potential outcomes of regulatory scrutiny and their impact on the deal: Outcomes could range from fines to structural remedies such as divestitures, significantly altering the landscape of the deal.

The Broader Impact on the Telecommunications Industry

The potential ripple effect of Broadcom's actions extends beyond AT&T. Other telecommunication companies negotiating interconnection agreements with Broadcom/VMware may face similar price hikes. This could lead to a significant shift in the competitive landscape, influencing pricing strategies and potentially escalating costs for consumers across the board.

- Potential impact on other companies negotiating with Broadcom/VMware: Smaller telecommunication companies might be particularly vulnerable to price increases, potentially compromising their competitiveness.

- Long-term implications for consumer pricing and service quality: Increased costs for telecommunication providers may translate directly into higher prices or reduced service quality for consumers.

- How the deal might shape future mergers and acquisitions in the telecom space: The outcome of this situation could influence future mergers and acquisitions, prompting greater regulatory scrutiny and potentially slowing down industry consolidation.

Conclusion: Navigating the Aftermath of the VMware-Broadcom Deal and its Impact on Pricing

AT&T's claim of a 1,050% price increase following Broadcom's acquisition of VMware underscores the significant potential impact of this deal on the telecommunications industry. The ongoing regulatory scrutiny, potential antitrust implications, and broader industry consequences demand close attention. The situation remains fluid, and further developments are crucial to understanding the long-term impact of Broadcom's VMware acquisition impact. Stay informed about updates related to VMware price increases and AT&T's response to Broadcom, and follow relevant news sources for the latest information. This situation is likely to significantly shape the future of telecom pricing and competition.

Featured Posts

-

Another Win For The Sf Giants Flores And Lees Contributions

Apr 23, 2025

Another Win For The Sf Giants Flores And Lees Contributions

Apr 23, 2025 -

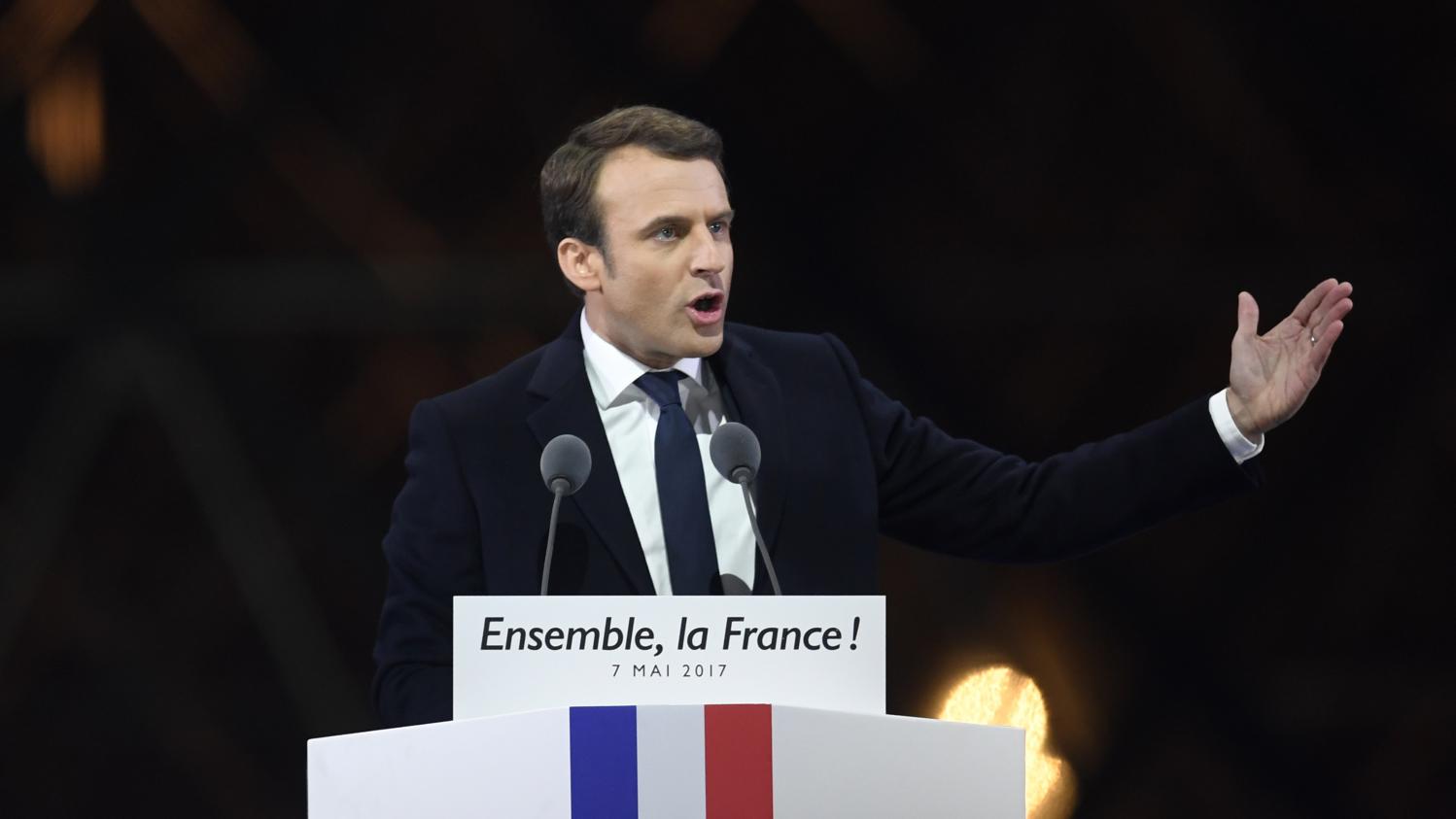

Macrons Snap Election Bid What It Means For Frances Future

Apr 23, 2025

Macrons Snap Election Bid What It Means For Frances Future

Apr 23, 2025 -

Easter Weekend In Pei A Guide To Store Openings And Closings

Apr 23, 2025

Easter Weekend In Pei A Guide To Store Openings And Closings

Apr 23, 2025 -

January 6th Hearing Star Cassidy Hutchinson To Publish Memoir

Apr 23, 2025

January 6th Hearing Star Cassidy Hutchinson To Publish Memoir

Apr 23, 2025 -

My 77 Inch Lg C3 Oled Tv A Detailed Review

Apr 23, 2025

My 77 Inch Lg C3 Oled Tv A Detailed Review

Apr 23, 2025