1,050% Price Increase: AT&T Sounds Alarm On Broadcom's VMware Deal

Table of Contents

The 1050% Price Increase: A Deep Dive into AT&T's Concerns

The specifics of the price hike are staggering. AT&T reports a 1050% increase across specific VMware licensing and support services. While the exact services affected haven't been publicly disclosed in full detail, it's understood that this pertains to critical infrastructure components vital to AT&T's network operations. If the previous price for a specific service was, for example, $100,000 annually, the new price would be a staggering $1,050,000. This represents a massive financial burden for AT&T.

From AT&T's perspective, this increase is not simply a matter of negotiating a higher price; it’s a fundamental shift that threatens their profitability and long-term strategic planning. Such a drastic increase undermines their ability to invest in network upgrades, research and development, and ultimately, maintaining a competitive edge in a rapidly evolving market.

- Reduced profit margins: The sheer scale of the increase dramatically cuts into AT&T's profit margins, impacting their overall financial health.

- Potential impact on future investments: Reduced profitability forces AT&T to potentially scale back investments in vital infrastructure upgrades and new technologies.

- Difficulty in maintaining competitiveness: The unexpected cost increase puts AT&T at a disadvantage against competitors who may not face similar price hikes.

Broadcom's Acquisition of VMware: The Context of the Price Hike

Broadcom's $61 billion acquisition of VMware aimed to expand its software portfolio and strengthen its position in the enterprise technology market. The merger created a tech giant with significant market power. However, this consolidation has sparked considerable antitrust concerns. The acquisition significantly increases Broadcom's control over crucial enterprise software, potentially stifling competition and innovation.

The deal has faced regulatory scrutiny, with various antitrust authorities investigating its potential anti-competitive implications. Concerns center on the reduced choice and potential for price gouging that may arise from a lack of competitive pressure.

- Increased market consolidation: The merger leads to a significant concentration of power in the hands of Broadcom, reducing competition.

- Potential for reduced innovation due to less competition: A less competitive market may stifle innovation as the dominant player has less incentive to push boundaries.

- Impact on other telecommunication companies and their contracts with VMware: AT&T’s situation suggests that other telecom companies reliant on VMware may also face substantial price increases.

Impact on the Telecommunications Industry and Beyond

The ramifications of this 1050% price increase extend far beyond AT&T. Other telecommunication companies that rely on VMware solutions may find themselves facing similarly exorbitant price hikes. This could lead to a ripple effect, causing a general increase in the cost of telecommunication services for both businesses and consumers.

- Increased costs for telecommunication services: Higher costs for telecom providers will likely translate to higher prices for consumers, impacting affordability.

- Reduced consumer choice: Increased market consolidation may lead to less choice for consumers in terms of service providers and technology.

- Impact on innovation and development in the tech sector: Reduced competition could slow down innovation as the dominant player has less incentive to push boundaries.

Potential Responses and Future Outlook

AT&T's response remains to be seen. Negotiations with Broadcom are likely, but the magnitude of the price increase suggests a significant challenge. They may explore alternative solutions, such as migrating to competing technologies, a costly and time-consuming process.

Regulatory intervention is another possibility. Antitrust authorities could step in to investigate the price increase and potentially impose price caps or other measures to prevent anti-competitive practices.

- Negotiation between AT&T and Broadcom: A successful negotiation could mitigate the price increase, but the success of this is uncertain given the significant disparity.

- Regulatory intervention and price caps: Governments might intervene to regulate pricing and prevent exploitation.

- Long-term impact on industry pricing and competition: The outcome of this situation will significantly impact future pricing and competition within the telecommunications and broader tech sectors.

Conclusion: The Future of Pricing in the Wake of the Broadcom VMware Deal

The 1050% price increase imposed on AT&T by Broadcom following its acquisition of VMware serves as a stark warning. This case highlights the potential for market consolidation to lead to significantly inflated prices and reduced competition, impacting not just major corporations but ultimately, consumers. The future implications for VMware pricing, Broadcom acquisition impact, and telecommunications industry pricing remain uncertain, depending on the outcome of ongoing negotiations and potential regulatory actions. Stay informed about developments in this evolving situation by following reputable news sources and regulatory updates on the Broadcom VMware deal and its ramifications for the future of pricing in the tech and telecommunications sectors.

Featured Posts

-

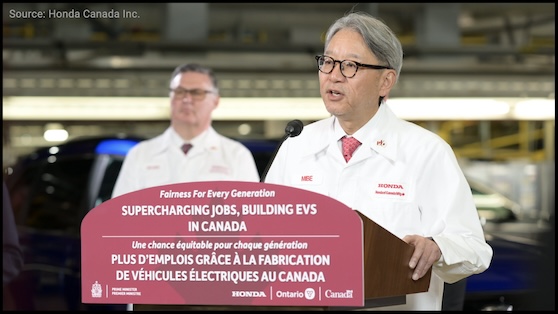

Ontario Ev Plant Honda Hits The Brakes On 15 Billion Investment

May 16, 2025

Ontario Ev Plant Honda Hits The Brakes On 15 Billion Investment

May 16, 2025 -

May 8th Mlb Dfs Top Sleeper Picks And Hitter To Fade

May 16, 2025

May 8th Mlb Dfs Top Sleeper Picks And Hitter To Fade

May 16, 2025 -

Transgender Master Sergeant Fights For Reinstatement After Forced Discharge

May 16, 2025

Transgender Master Sergeant Fights For Reinstatement After Forced Discharge

May 16, 2025 -

Androids Refreshed Ui Impact And Implications

May 16, 2025

Androids Refreshed Ui Impact And Implications

May 16, 2025 -

From Written Off To Title Contender Paddy Pimbletts Journey

May 16, 2025

From Written Off To Title Contender Paddy Pimbletts Journey

May 16, 2025

Latest Posts

-

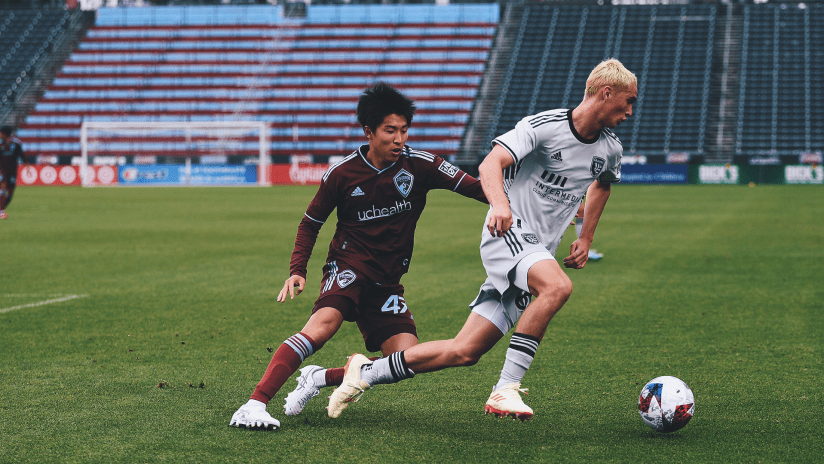

Earthquakes Loss To Rapids Analyzing Steffens Contribution

May 16, 2025

Earthquakes Loss To Rapids Analyzing Steffens Contribution

May 16, 2025 -

Colorado Rapids Triumph Over Earthquakes Despite Steffens Presence

May 16, 2025

Colorado Rapids Triumph Over Earthquakes Despite Steffens Presence

May 16, 2025 -

Analysis Zach Steffens Subpar Performance In Earthquakes Loss To Rapids

May 16, 2025

Analysis Zach Steffens Subpar Performance In Earthquakes Loss To Rapids

May 16, 2025 -

Rapids Defeat Earthquakes Steffens Performance Under Scrutiny

May 16, 2025

Rapids Defeat Earthquakes Steffens Performance Under Scrutiny

May 16, 2025 -

Colorado Rapids Shutout Earthquakes Steffens Performance A Key Factor In Loss

May 16, 2025

Colorado Rapids Shutout Earthquakes Steffens Performance A Key Factor In Loss

May 16, 2025