10-Year Mortgages In Canada: Exploring The Reasons For Low Adoption

Table of Contents

The Canadian mortgage landscape is predominantly shaped by the ubiquitous 5-year fixed-rate mortgage. However, a longer-term alternative exists: the 10-year mortgage. Offering the potential for significant long-term savings and financial stability, these mortgages surprisingly remain underutilized. This article delves into the key reasons why 10-year mortgages in Canada haven't gained widespread adoption, exploring the factors that deter Canadian homeowners from embracing this longer-term financing solution.

Higher Initial Interest Rates and Potential Rate Increases

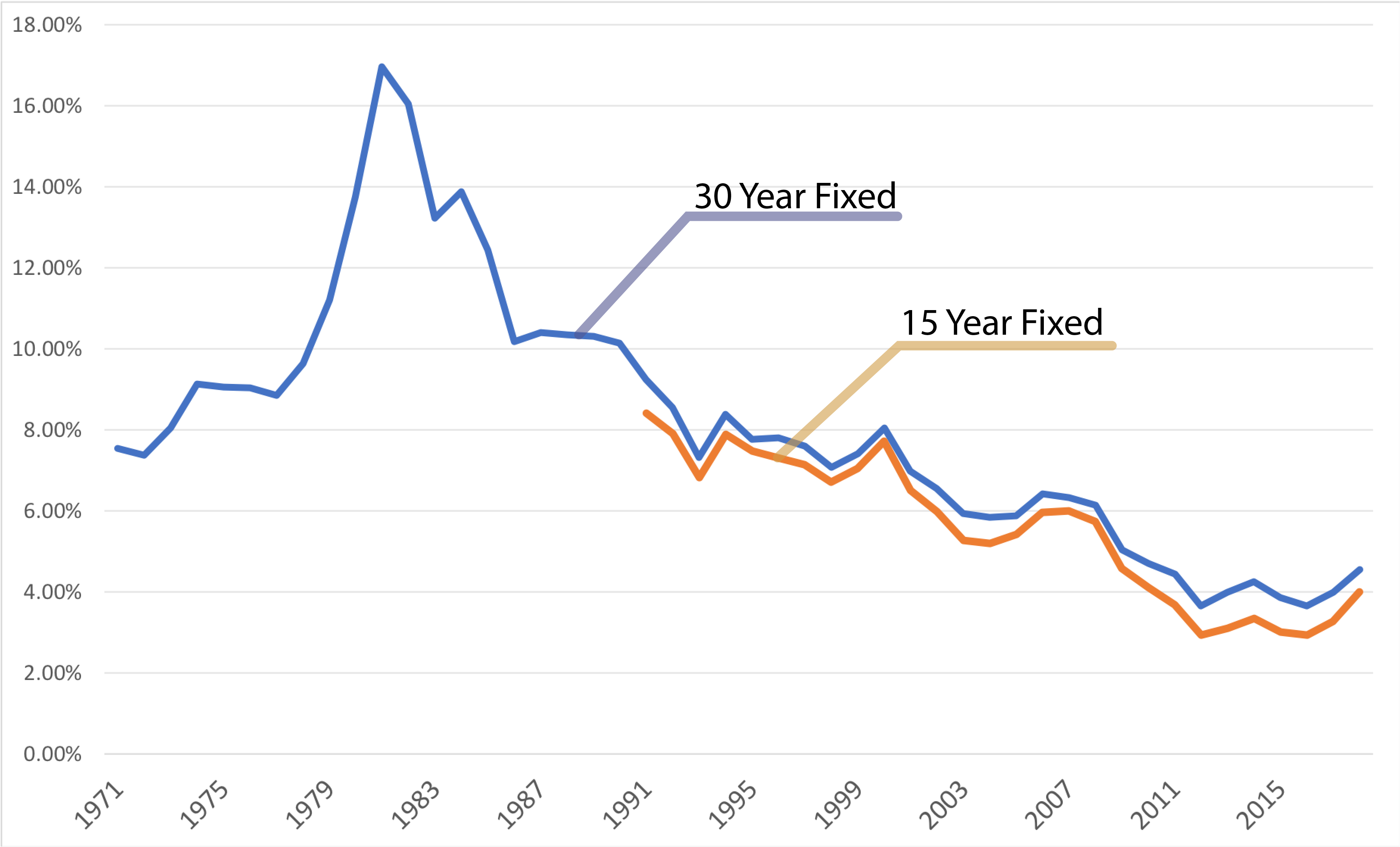

A primary reason for the low adoption of 10-year mortgages is the often higher initial interest rate compared to shorter-term options. This difference, even if seemingly small, significantly impacts affordability and can act as a major barrier for many borrowers.

The upfront cost concern

The upfront cost is a critical factor. Borrowers are acutely sensitive to initial payments, often prioritizing lower monthly payments in the short term, even if it means paying more in the long run. This short-term focus makes the higher initial rate of a 10-year mortgage a significant deterrent.

- Higher initial payments: The higher interest rate translates directly into larger monthly payments at the outset, making a 10-year mortgage seem less accessible than a shorter-term option.

- Uncertainty about future rates: The uncertainty around future interest rate fluctuations magnifies the perceived risk. While a fixed rate provides certainty for the 10-year term, a rate hike during the term is a worry.

- Potential for higher overall interest: If interest rates rise substantially during the 10-year term, the overall interest paid over the life of the mortgage could exceed that of a shorter-term mortgage, even with a lower initial rate.

Predicting long-term interest rates

Predicting interest rate movements over a decade is inherently difficult. Economic forecasting is an inexact science, and unexpected shifts can significantly impact long-term mortgage costs.

- Imperfect economic forecasting: The inherent uncertainty in predicting economic trends and interest rate behaviour over such a long period makes a 10-year commitment feel risky.

- Economic shocks: Unforeseen economic downturns or inflation spikes can negatively affect borrowers locked into a long-term, fixed-rate mortgage.

- Missed refinancing opportunities: The possibility of missing out on potentially lower interest rates if rates decline during the 10-year term weighs heavily on many borrowers' minds. This fear of missed opportunities is a significant psychological barrier.

Limited Availability and Lender Restrictions

The limited availability of 10-year mortgages from Canadian lenders further contributes to their low adoption. This scarcity restricts borrower choices and introduces additional challenges.

Fewer Lenders Offering 10-Year Mortgages

Not all Canadian mortgage lenders offer 10-year mortgage options. This limited selection reduces competition and potentially impacts the terms and conditions offered.

- Increased competition among borrowers: A smaller pool of lenders offering 10-year mortgages creates a more competitive environment for borrowers, potentially leading to less favorable terms.

- Reduced flexibility: Borrowers might find it harder to secure specific mortgage features or terms with fewer lenders offering this type of mortgage.

- Challenges for non-standard financial situations: Borrowers with non-standard financial situations might find it even more difficult to secure a 10-year mortgage due to the limited lender options.

Stricter Lending Criteria

Lenders often apply stricter lending criteria to 10-year mortgages, reflecting the longer-term commitment and associated risk.

- Higher credit scores: Applicants are often required to have higher credit scores to qualify for a 10-year mortgage.

- Larger down payments: A larger down payment might be needed to mitigate the lender’s risk.

- Stringent income verification: Lenders will conduct more thorough income verification processes to ensure long-term repayment capacity.

The Psychological Barrier of Long-Term Commitment

Beyond the financial considerations, a significant psychological barrier prevents many Canadians from opting for a 10-year mortgage.

Uncertainty and Life Changes

Life is inherently unpredictable. A 10-year commitment can feel daunting to borrowers anticipating potential life changes—job relocation, family expansion, or unexpected financial challenges.

- Penalties for early repayment: The penalties for breaking a 10-year mortgage can be substantial, making early repayment a costly option.

- Unforeseen circumstances: Unforeseen circumstances could create significant financial hardship if locked into a long-term agreement with inflexible terms.

- Preference for shorter-term planning: Many Canadians prefer the flexibility of shorter-term mortgages, aligning better with their shorter-term planning horizons.

Fear of Missed Opportunities

The fear of missing out on lower interest rates is another psychological deterrent.

- Limited refinancing opportunities: A 10-year mortgage significantly limits the opportunity to refinance at more favorable rates should interest rates decline.

- Fluctuating interest rates: This concern is particularly acute in an environment of fluctuating interest rates, where the potential for better terms in the future is a strong consideration.

- Desire for flexibility: Borrowers often prefer the flexibility to adjust their mortgage terms in response to market changes, a flexibility a 10-year mortgage does not offer.

Conclusion

The relatively low adoption of 10-year mortgages in Canada results from a combination of factors: higher initial interest rates, limited availability, stricter lending criteria, and the psychological barriers associated with a long-term financial commitment. While offering potential long-term cost savings and stability, the perceived risks and lack of widespread availability deter many. If you're considering your home financing options, carefully weigh the advantages and disadvantages of a 10-year mortgage against shorter-term alternatives. Consult with a mortgage professional to determine if a 10-year mortgage in Canada aligns with your individual financial circumstances, risk tolerance, and long-term goals. Explore the possibilities—a 10-year mortgage might be the right choice for you.

Featured Posts

-

Sabrina Carpenter To Headline Fortnite Virtual Festival Fans React

May 06, 2025

Sabrina Carpenter To Headline Fortnite Virtual Festival Fans React

May 06, 2025 -

The Case Against 10 Year Mortgages A Canadian Perspective

May 06, 2025

The Case Against 10 Year Mortgages A Canadian Perspective

May 06, 2025 -

The Economic Fallout Of Trumps Trade Deal Strategy

May 06, 2025

The Economic Fallout Of Trumps Trade Deal Strategy

May 06, 2025 -

Rihannas Parisian Fenty Beauty Glam A Sweet Fan Moment

May 06, 2025

Rihannas Parisian Fenty Beauty Glam A Sweet Fan Moment

May 06, 2025 -

Russias Putin Avoiding Nuclear Weapons In Ukraine Conflict

May 06, 2025

Russias Putin Avoiding Nuclear Weapons In Ukraine Conflict

May 06, 2025

Latest Posts

-

Savage X Fenty Rihannas Wedding Night Lingerie Campaign

May 06, 2025

Savage X Fenty Rihannas Wedding Night Lingerie Campaign

May 06, 2025 -

Shop Rihannas Wedding Night Lingerie Collection From Savage X Fenty

May 06, 2025

Shop Rihannas Wedding Night Lingerie Collection From Savage X Fenty

May 06, 2025 -

Wedding Night Lingerie Rihannas Savage X Fenty Collection Revealed

May 06, 2025

Wedding Night Lingerie Rihannas Savage X Fenty Collection Revealed

May 06, 2025 -

Rihannas Savage X Fenty Lingerie For The Ultimate Wedding Night

May 06, 2025

Rihannas Savage X Fenty Lingerie For The Ultimate Wedding Night

May 06, 2025 -

Rihanna And A Ap Rocky Relationship Rumors Heat Up

May 06, 2025

Rihanna And A Ap Rocky Relationship Rumors Heat Up

May 06, 2025