$100,000 Bitcoin? Evaluating Trump's Influence On Cryptocurrency Markets

Table of Contents

Trump's Past Statements on Cryptocurrency and Their Market Impact

Trump's public pronouncements, or lack thereof, regarding cryptocurrencies have generated considerable market volatility. Analyzing both his positive and negative sentiments helps understand his potential future influence.

Positive Statements and Their Effect

While Trump hasn't explicitly endorsed Bitcoin, certain actions and statements have been interpreted positively by the crypto community.

- Implicit Endorsement of Blockchain: While not directly mentioning Bitcoin, Trump's administration explored the potential applications of blockchain technology in various sectors, suggesting a degree of openness towards the underlying technology.

- Focus on Financial Innovation: His emphasis on deregulation and financial innovation could be interpreted as indirectly favorable to the cryptocurrency space.

These perceived positive signals have, at times, correlated with Bitcoin rallies. For example, [cite specific instance and source, linking to credible financial news]. The market sentiment often reacted positively to these perceived endorsements, driving up trading volume and propelling Bitcoin's price upwards. This highlights the importance of market sentiment and the potential for even indirect political statements to significantly impact crypto adoption.

Negative Statements and Their Effect

Conversely, periods of perceived negativity towards crypto have often been followed by market corrections.

- Absence of Direct Endorsement: The lack of direct, positive statements from Trump or his administration concerning Bitcoin and other cryptocurrencies can be viewed negatively by some market participants, causing uncertainty.

- Regulatory Uncertainty: While no explicit anti-crypto stance was adopted, the potential for stricter regulation under his administration contributed to regulatory uncertainty, which often leads to Bitcoin price drops. [cite specific instance and source, linking to credible financial news].

These episodes illustrate the significant impact of regulatory uncertainty on the Bitcoin market. A negative stance, or even the perception of one, can trigger a "Bitcoin crash" or at least a substantial market correction.

Trump's Economic Policies and Their Influence on Bitcoin

Trump's economic policies can indirectly, but significantly, affect Bitcoin's price.

Fiscal Policy and Inflation

Trump's fiscal policies, including significant tax cuts and increased government spending, contributed to concerns about rising inflation.

- Inflation as a Bitcoin Driver: Bitcoin is often considered a hedge against inflation. As the value of fiat currencies erodes due to inflation, the demand for Bitcoin as a store of value could potentially increase.

- Safe Haven Asset: During periods of economic uncertainty, investors might seek "safe haven" assets, potentially increasing the demand for Bitcoin, regardless of Trump's direct involvement.

This suggests that regardless of specific statements, Trump's economic approach could lead to increased demand for Bitcoin as an inflation hedge. However, high inflation can also trigger broader economic instability, potentially impacting Bitcoin negatively.

Regulatory Environment and Uncertainty

The regulatory environment under Trump, or potentially under a future Trump administration, plays a crucial role in Bitcoin's price.

- Stricter Regulation: Increased regulatory scrutiny from bodies like the SEC and CFTC could stifle institutional investment and hinder broader crypto adoption, negatively impacting Bitcoin's price.

- Lenient Regulation: Conversely, a less interventionist approach could foster innovation and attract institutional capital, potentially boosting Bitcoin's price.

The level of regulatory clarity and certainty directly impacts institutional confidence, a vital component in driving sustainable growth for Bitcoin and the broader cryptocurrency market.

Comparing Trump's Influence to Other Macroeconomic Factors

While Trump's influence is significant, it's crucial to acknowledge that other macroeconomic factors and technological advancements affect Bitcoin's price independently.

Global Economic Conditions

Global economic factors, such as recession fears or geopolitical instability, can significantly impact Bitcoin's price regardless of Trump's actions.

- Flight to Safety: During global crises, investors often move funds into perceived safe havens, potentially increasing Bitcoin's value.

- Risk-Off Sentiment: Conversely, periods of global economic uncertainty can also lead to a "risk-off" sentiment, driving investors away from volatile assets like Bitcoin.

These global trends highlight the interconnectedness of Bitcoin's price with the overall health of the global economy.

Technological Advancements in the Crypto Space

Innovations within the crypto space itself, such as Layer-2 scaling solutions and the growth of decentralized finance (DeFi), directly influence Bitcoin's value regardless of political climates.

- Increased Efficiency: Layer-2 solutions improve Bitcoin's scalability and transaction speed, potentially increasing its usability and appeal.

- DeFi Growth: The expansion of DeFi applications can create new use cases for Bitcoin and boost overall demand.

These technological developments, inherent to the cryptocurrency ecosystem, will continue to shape the future of Bitcoin and its price regardless of political figures' influence.

Conclusion: The Trump Factor and the $100,000 Bitcoin Question

Predicting Bitcoin's price is an inherently complex endeavor. While Donald Trump's actions and statements can undoubtedly influence the cryptocurrency market, it's crucial to recognize the interplay of many factors – from inflation and global economic conditions to technological advancements within the crypto space itself. His potential influence on Bitcoin price prediction and overall market sentiment remains significant, but it’s not the sole determining factor. To accurately assess the path to a $100,000 Bitcoin, we need to continue to analyze Trump's policies and their potential implications, but also stay informed on Bitcoin price movements stemming from global events and the ongoing evolution of blockchain technology and DeFi. Stay informed on Bitcoin price, analyze Trump's policies, and invest in cryptocurrency wisely.

Featured Posts

-

Dwp Warning 12 Benefits Requiring Urgent Bank Account Action

May 08, 2025

Dwp Warning 12 Benefits Requiring Urgent Bank Account Action

May 08, 2025 -

Kripto Para Yatirimcilari Icin Kritik Duyuru Spk Nin Son Karari

May 08, 2025

Kripto Para Yatirimcilari Icin Kritik Duyuru Spk Nin Son Karari

May 08, 2025 -

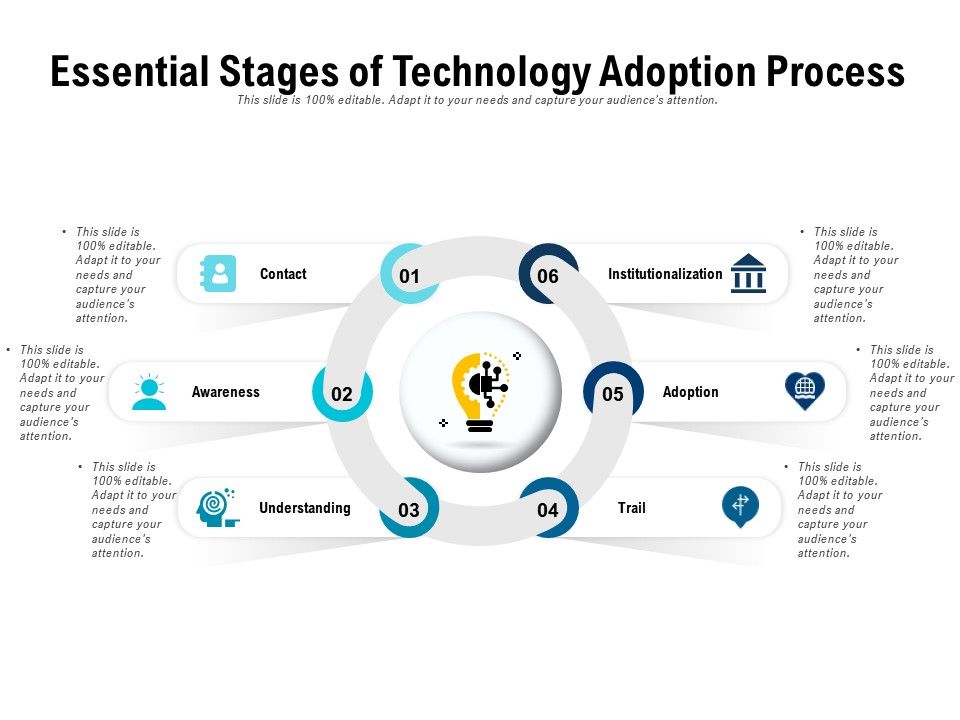

Technology Adoption Ahsans Plan To Strengthen Made In Pakistan Exports

May 08, 2025

Technology Adoption Ahsans Plan To Strengthen Made In Pakistan Exports

May 08, 2025 -

Is 1500 The Next Ethereum Price Target Current Support Level Analyzed

May 08, 2025

Is 1500 The Next Ethereum Price Target Current Support Level Analyzed

May 08, 2025 -

Thunder Vs Trail Blazers Game Time Tv Schedule And Streaming Options March 7th

May 08, 2025

Thunder Vs Trail Blazers Game Time Tv Schedule And Streaming Options March 7th

May 08, 2025

Latest Posts

-

Star Wars After 48 Years Is This The Long Awaited Planet

May 08, 2025

Star Wars After 48 Years Is This The Long Awaited Planet

May 08, 2025 -

Andor Cast A Behind The Scenes Look At The Rogue One Prequel Series Finale

May 08, 2025

Andor Cast A Behind The Scenes Look At The Rogue One Prequel Series Finale

May 08, 2025 -

Is This The Planet Star Wars Has Teased For 48 Years

May 08, 2025

Is This The Planet Star Wars Has Teased For 48 Years

May 08, 2025 -

Could Andor Season 2 Feature Familiar Faces From Rebels A Look At The Timeline

May 08, 2025

Could Andor Season 2 Feature Familiar Faces From Rebels A Look At The Timeline

May 08, 2025 -

Everything We Know About Andor Season 2 Release Date And Trailer Speculation

May 08, 2025

Everything We Know About Andor Season 2 Release Date And Trailer Speculation

May 08, 2025