100 Days Of Pain: How Trump Inauguration Donations Cost Tech Billionaires $194 Billion

Table of Contents

The Ripple Effect of Political Alignment: How Donations Impacted Market Sentiment

The initial euphoria surrounding the Trump presidency among some tech investors quickly dissipated as early policy decisions began to unfold. The perception of a business-friendly administration gave way to concerns about the potential negative consequences of certain policies. The early days of the Trump administration were marked by significant uncertainty, particularly regarding key areas impacting the tech sector.

-

Impact of Early Policy Decisions: Early policy decisions, including those related to immigration and trade, significantly impacted investor confidence. The unpredictability of these policies created market volatility, leading to a decline in investment values.

-

Specific Examples of Negative Effects:

- Increased Trade Tensions: The imposition of tariffs and trade wars disrupted global supply chains, increasing costs and impacting the profitability of many tech companies reliant on international trade. This uncertainty caused significant investment losses.

- Anti-Immigration Policies: Restrictive immigration policies hampered the tech industry's access to a global talent pool, creating labor shortages and slowing innovation. The resulting difficulties in attracting and retaining skilled workers negatively impacted the growth trajectory of many tech firms.

Analyzing the $194 Billion Loss: A Breakdown of Investments and Losses

The $194 billion loss wasn't evenly distributed across the tech industry. The impact varied significantly depending on the sector and specific companies involved. While precise attribution to inauguration donations alone is complex, the correlation between the political climate and market downturn is undeniable.

-

Losses Across Tech Sectors: Losses were felt across the board, including software companies facing increased regulatory scrutiny, hardware manufacturers dealing with supply chain disruptions, and biotech firms experiencing setbacks in research funding and regulatory approvals.

-

Specific Companies Impacted: While pinpointing the exact financial impact on individual companies solely due to inauguration donations is challenging, several major tech firms experienced substantial drops in market capitalization during this period. (Note: This section would ideally include specific examples, citing verifiable financial reports and news articles).

-

Methodology for Calculating the $194 Billion Figure: This figure represents an aggregate estimate based on market capitalization changes, considering the overall downturn in the tech sector following the inauguration. (This section would require detailed explanation and sourcing of data).

Beyond the Dollar Figures: Long-Term Consequences for Tech Investors

The $194 billion loss represents more than just a financial setback; it signifies a profound shift in the landscape of tech investing. The erosion of trust in political stability led to a reassessment of risk tolerance and long-term investment strategies.

-

Erosion of Trust and Investment Strategies: The experience highlighted the vulnerability of large investments to sudden shifts in political climate. This led many investors to diversify their portfolios and adopt more cautious strategies.

-

Shift in Investment Focus: Investors increasingly sought opportunities in more politically stable regions and sectors less exposed to sudden policy changes.

-

Changes in Corporate Social Responsibility: The events surrounding the Trump inauguration spurred many tech companies to reassess their approaches to corporate social responsibility and political engagement, with a heightened focus on mitigating political risk.

Lessons Learned: Avoiding Future Political Investment Risks

The "100 Days of Pain" following the Trump inauguration serve as a stark reminder of the importance of considering political risk in investment decisions. Here are key lessons for tech investors:

-

Diversification: Diversifying investment portfolios across different sectors and geographic locations is crucial to mitigate risk.

-

Due Diligence: Conducting thorough due diligence, including a comprehensive assessment of political risk, is essential before making any significant investment.

-

Alternative Investment Strategies: Exploring alternative investment strategies, such as hedging against political risk or investing in politically stable markets, can help reduce exposure to potential losses.

-

Monitoring Political Landscape: Continuous monitoring of the political landscape and potential policy changes is vital for informed decision-making.

Conclusion: The Enduring Legacy of the Trump Inauguration Donations – A Cautionary Tale for Tech Investors

The $194 billion loss incurred by tech billionaires in the aftermath of the Trump inauguration serves as a powerful cautionary tale. This article has explored the complex interplay between Trump inauguration donations, political risk, and the significant financial consequences faced by the tech industry. The ripple effects of these donations extended far beyond the initial investment, impacting market sentiment, long-term investment strategies, and corporate social responsibility. Understand the implications of political decisions on your investments. Learn more about mitigating political risk and avoiding a repeat of the "100 Days of Pain" experienced by tech giants. By carefully considering political risk and diversifying investments, tech investors can better protect their portfolios and navigate the often unpredictable landscape of political influence on markets.

Featured Posts

-

Arrestan A Universitaria Transgenero Por Usar Bano Femenino El Caso Que Desato La Polemica

May 10, 2025

Arrestan A Universitaria Transgenero Por Usar Bano Femenino El Caso Que Desato La Polemica

May 10, 2025 -

Municipales Dijon 2026 L Ambition Ecologiste

May 10, 2025

Municipales Dijon 2026 L Ambition Ecologiste

May 10, 2025 -

Tomas Hertls Two Hat Tricks Fuel Golden Knights Victory

May 10, 2025

Tomas Hertls Two Hat Tricks Fuel Golden Knights Victory

May 10, 2025 -

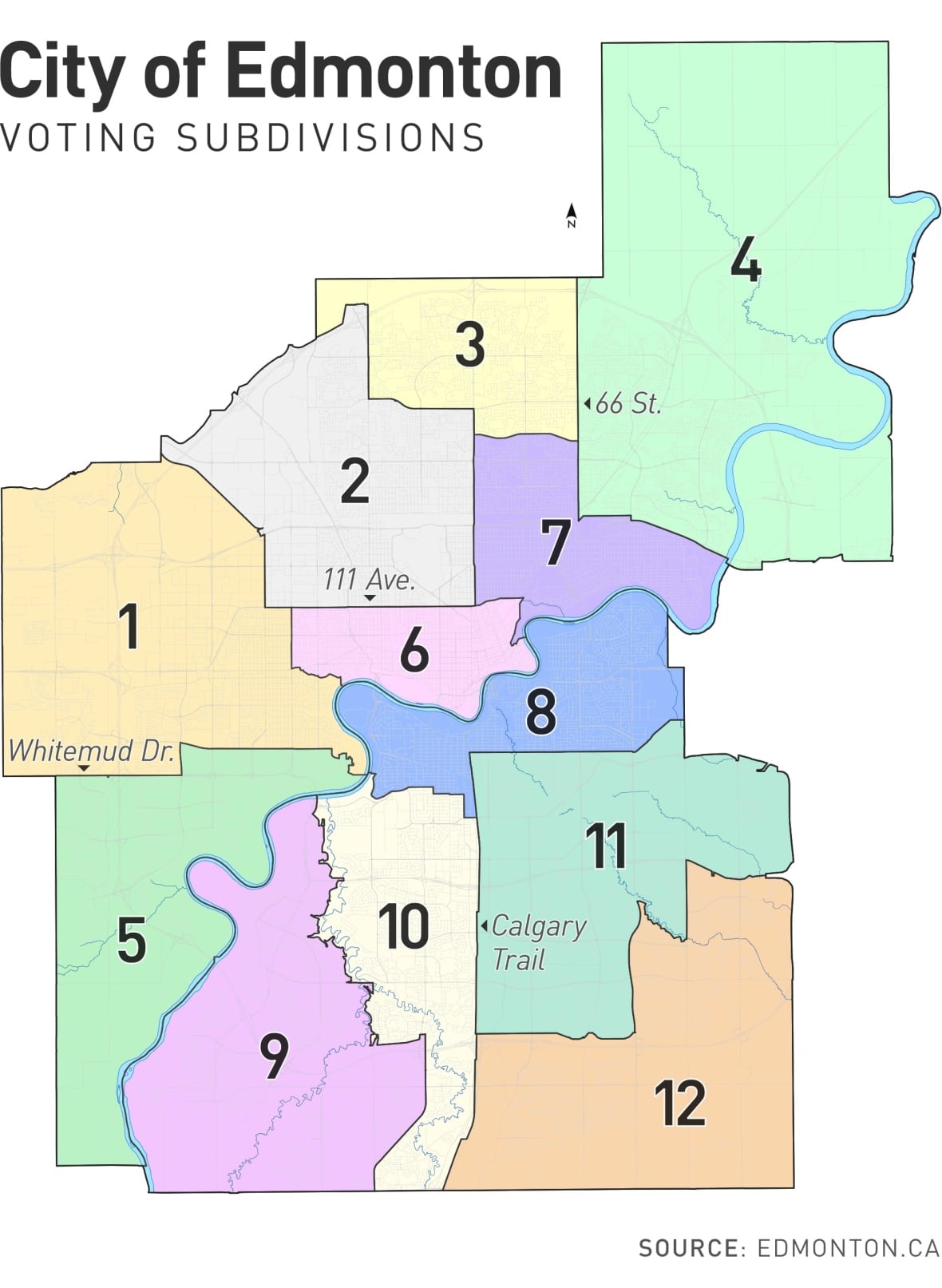

Edmonton Federal Riding Changes What Voters Need To Know

May 10, 2025

Edmonton Federal Riding Changes What Voters Need To Know

May 10, 2025 -

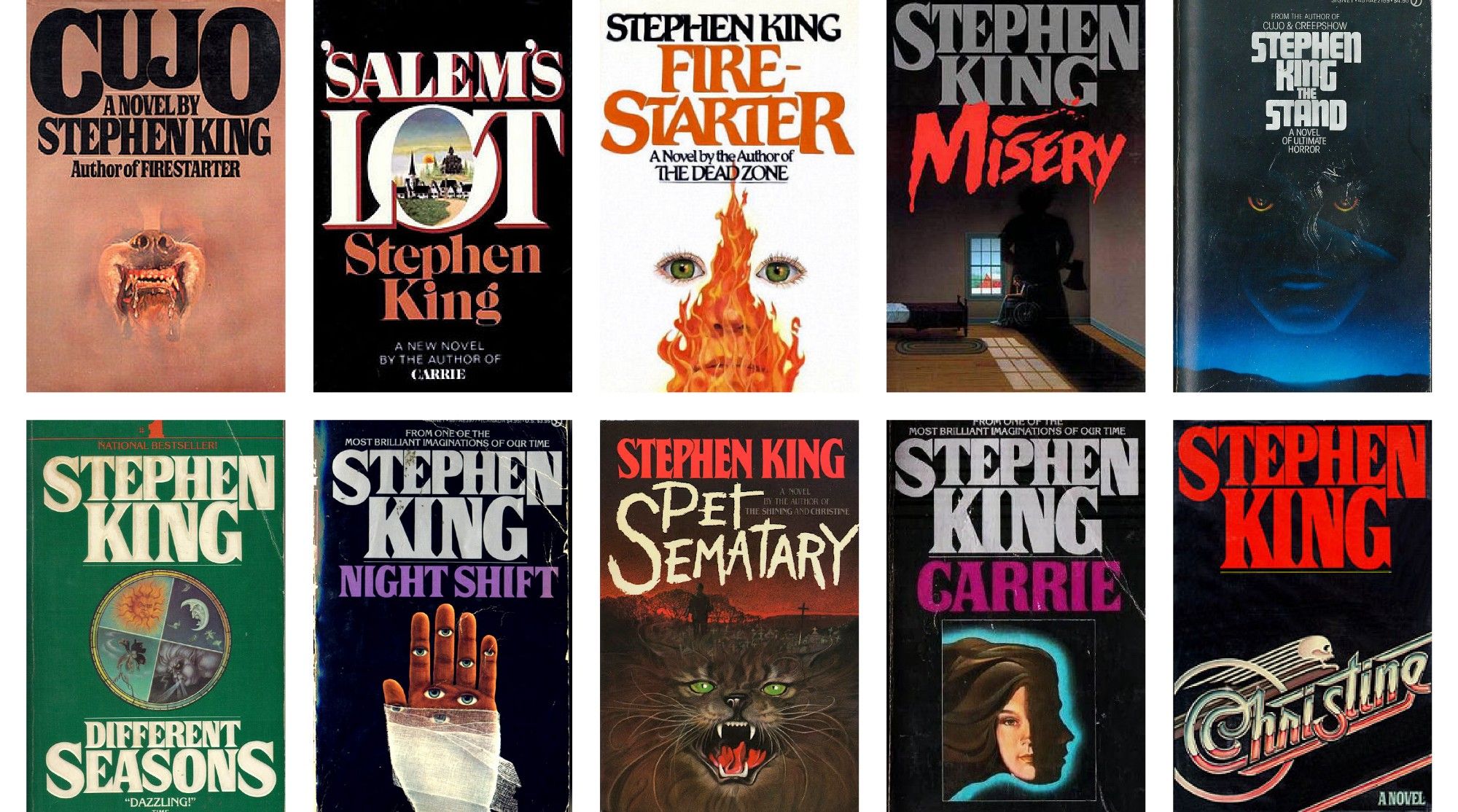

The It Factor Stephen Kings Opinion On Stranger Things Similarities

May 10, 2025

The It Factor Stephen Kings Opinion On Stranger Things Similarities

May 10, 2025