1050% VMware Price Hike: AT&T Challenges Broadcom's Acquisition Proposal

Table of Contents

The Shocking 1050% VMware Price Hike Claim

AT&T's assertion of a potential 1050% price increase on VMware products post-acquisition has ignited a firestorm of debate. While specific product pricing details haven't been publicly released by AT&T, the sheer magnitude of the claimed increase points to a potentially monopolistic outcome should Broadcom successfully acquire VMware. The claim suggests that essential VMware solutions, crucial for many businesses, could become prohibitively expensive.

- Magnitude of the Impact: A 1050% increase represents an astronomical jump in cost, potentially crippling many businesses, particularly small and medium-sized businesses (SMBs) that heavily rely on VMware's virtualization and cloud management solutions.

- Industries Affected: Sectors like finance, healthcare, and telecommunications, which heavily utilize VMware technologies for their critical infrastructure, face a significant threat. The increased costs could lead to reduced investment in innovation and digital transformation within these industries.

- Impact on SMBs: Smaller companies often operate on tighter budgets and lack the resources to absorb such drastic price increases. This could force them to seek less effective, less secure alternatives, hindering their growth and competitiveness.

AT&T's Arguments Against the Broadcom Acquisition

AT&T's opposition to the Broadcom acquisition rests primarily on its concerns regarding the potential for monopolistic practices and the stifling of competition. The alleged 1050% VMware price hike serves as a central argument in their case. AT&T argues that Broadcom, having a dominant market position, would leverage its control over VMware to significantly increase prices, harming consumers and reducing innovation.

- Stifling Competition: By controlling both Broadcom and VMware, the combined entity would have a near-monopoly on critical infrastructure technologies. This eliminates competition, removing the incentive to innovate and improve products at competitive prices.

- Reduced Choice and Quality: With fewer choices available, businesses would be forced to accept higher prices and potentially lower-quality services, impacting their operational efficiency and productivity.

- Antitrust Concerns: AT&T’s lobbying efforts emphasize the potential violation of antitrust laws. The company argues that the merger would create an unfair market advantage, harming fair competition and consumer welfare.

Broadcom's Response to AT&T's Challenge

Broadcom has vehemently denied AT&T's claims, arguing that the acquisition will bring significant benefits to consumers and the market. They maintain that the merger will foster innovation and improve efficiency. However, they have not directly addressed the specific 1050% VMware price hike claim, offering general assurances of continued competitiveness.

- Acquisition Justification: Broadcom emphasizes the synergies between their businesses and VMware's, claiming the merger will streamline operations and create a more efficient and integrated technology offering.

- Counter-Arguments: Broadcom likely argues that increased scale and efficiency will actually reduce prices in the long run. However, they have not provided concrete evidence to counteract AT&T’s claims of a substantial price hike.

- Claimed Benefits: Broadcom’s official statements likely highlight the potential for enhanced innovation, improved services, and broader access to technology as potential benefits of the acquisition.

Regulatory Scrutiny and Future Implications

The proposed merger is under intense scrutiny from regulatory bodies worldwide, including the Federal Trade Commission (FTC) in the US and the European Commission. The outcome will depend on a comprehensive review of the potential anti-competitive effects of the acquisition.

- Regulatory Bodies Involved: Multiple regulatory agencies are examining the potential impact on competition and pricing. Decisions will consider the VMware price hike claim alongside other concerns.

- Potential Outcomes: Possible outcomes include full approval, rejection of the acquisition, or conditional approval subject to remedies like divestments or behavioral commitments.

- Alternatives if Blocked: If the acquisition is blocked, Broadcom might explore alternative strategies, potentially involving partnerships or focusing on organic growth. VMware would remain an independent entity, fostering competition in the market.

The Broader Impact on the Tech Industry

The outcome of this merger will have wide-ranging consequences for the tech industry. The potential for a substantial VMware price hike and reduced competition significantly impacts the cloud computing and virtualization markets.

- Impact on Cloud Providers: The merger's outcome will influence the competitive dynamics between cloud providers, potentially shifting the market share and pricing strategies.

- Enterprise IT Budgets: Businesses will need to reassess their IT budgets and strategies depending on VMware's future pricing and the availability of alternative solutions.

- Industry Consolidation: This deal could set a precedent for further industry consolidation, potentially leading to reduced competition and innovation in other technology sectors.

Conclusion

The 1050% VMware price hike claim, at the heart of AT&T’s challenge to Broadcom’s acquisition, underscores the significant risks associated with this merger. The potential for reduced competition, increased prices, and a chilling effect on innovation are substantial concerns. The regulatory review will determine the future of VMware, the competitive landscape, and the pricing of critical infrastructure technologies.

Call to Action: Stay updated on the latest developments concerning this critical case affecting the future of VMware and the broader technology industry. Follow this blog for further updates on the VMware price hike and Broadcom acquisition. Share your insights and concerns about this potentially impactful merger in the comments below.

Featured Posts

-

Pfc Dividend 2025 Expected Cash Reward Announcement Date March 12th

Apr 27, 2025

Pfc Dividend 2025 Expected Cash Reward Announcement Date March 12th

Apr 27, 2025 -

How To Buy Ariana Grandes Lovenote Fragrance Set Online Pricing And Best Deals

Apr 27, 2025

How To Buy Ariana Grandes Lovenote Fragrance Set Online Pricing And Best Deals

Apr 27, 2025 -

Garantia De Gol Con Alberto Ardila Olivares

Apr 27, 2025

Garantia De Gol Con Alberto Ardila Olivares

Apr 27, 2025 -

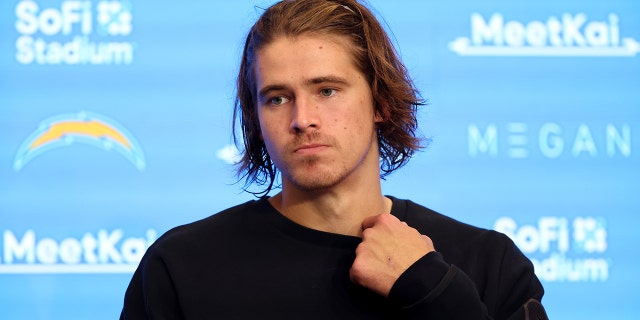

Confirming The Rumors Justin Herbert Chargers And A 2025 Brazil Game

Apr 27, 2025

Confirming The Rumors Justin Herbert Chargers And A 2025 Brazil Game

Apr 27, 2025 -

Sorpresivas Derrotas Paolini Y Pegula Fuera Del Wta 1000 Dubai

Apr 27, 2025

Sorpresivas Derrotas Paolini Y Pegula Fuera Del Wta 1000 Dubai

Apr 27, 2025

Latest Posts

-

Office365 Data Breach Hacker Makes Millions Targeting Executive Inboxes

Apr 28, 2025

Office365 Data Breach Hacker Makes Millions Targeting Executive Inboxes

Apr 28, 2025 -

Millions Stolen Office365 Breach Nets Criminal Millions Fbi Investigation Reveals

Apr 28, 2025

Millions Stolen Office365 Breach Nets Criminal Millions Fbi Investigation Reveals

Apr 28, 2025 -

Execs Office365 Accounts Targeted Millions Made In Cybercrime Feds Say

Apr 28, 2025

Execs Office365 Accounts Targeted Millions Made In Cybercrime Feds Say

Apr 28, 2025 -

Investigation Into Lingering Toxic Chemicals Following Ohio Train Derailment

Apr 28, 2025

Investigation Into Lingering Toxic Chemicals Following Ohio Train Derailment

Apr 28, 2025 -

Voice Assistant Creation Simplified Key Announcements From Open Ais 2024 Event

Apr 28, 2025

Voice Assistant Creation Simplified Key Announcements From Open Ais 2024 Event

Apr 28, 2025