11% Drop: Amsterdam Stock Exchange's Continuing Market Decline

Table of Contents

Analyzing the 11% Drop: Key Contributing Factors

The AEX index's 11% drop, largely witnessed between [Insert Specific Dates Here], represents a substantial loss of value for investors. This steep decline isn't an isolated incident but rather a reflection of several interconnected global and regional factors.

-

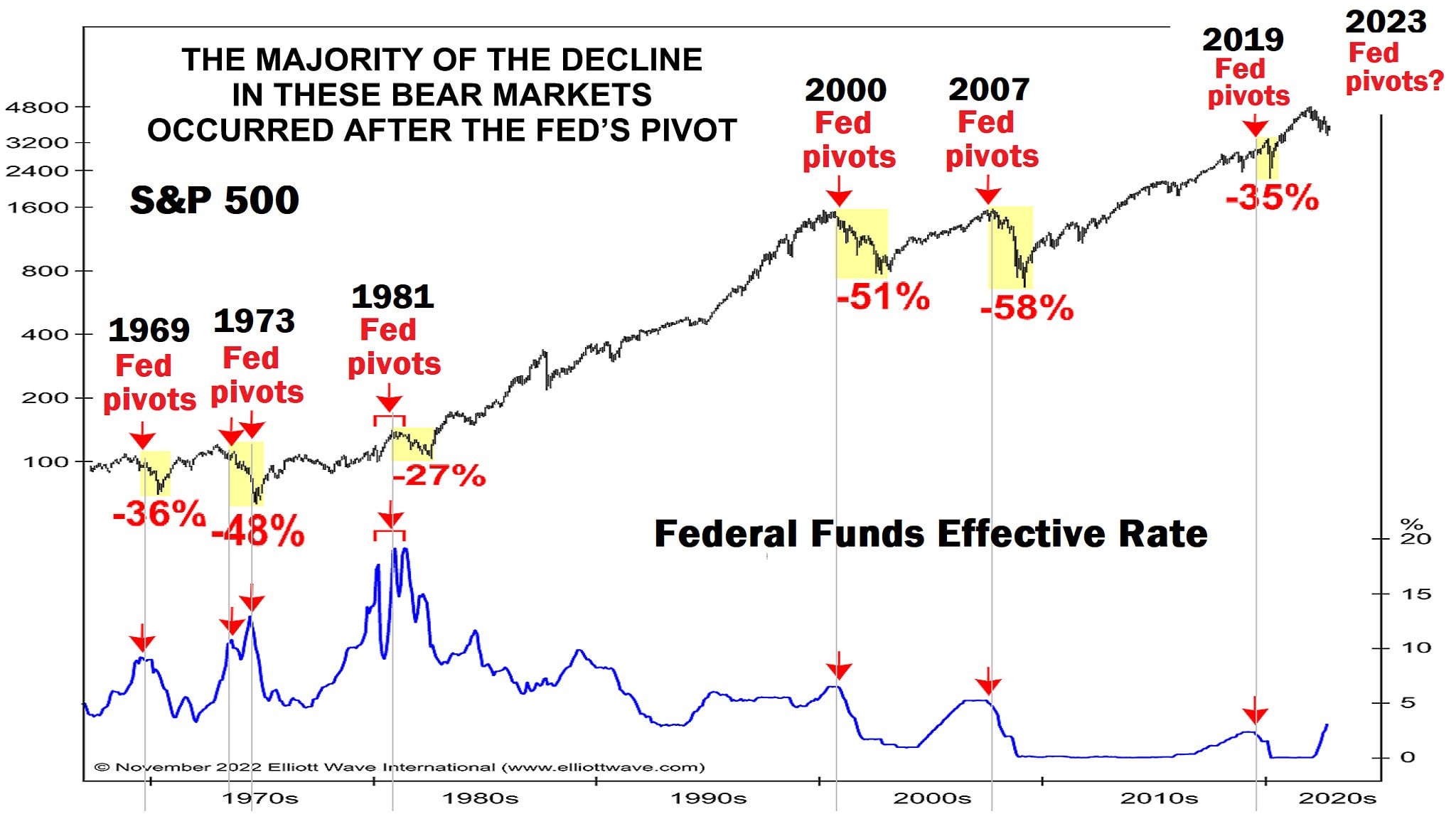

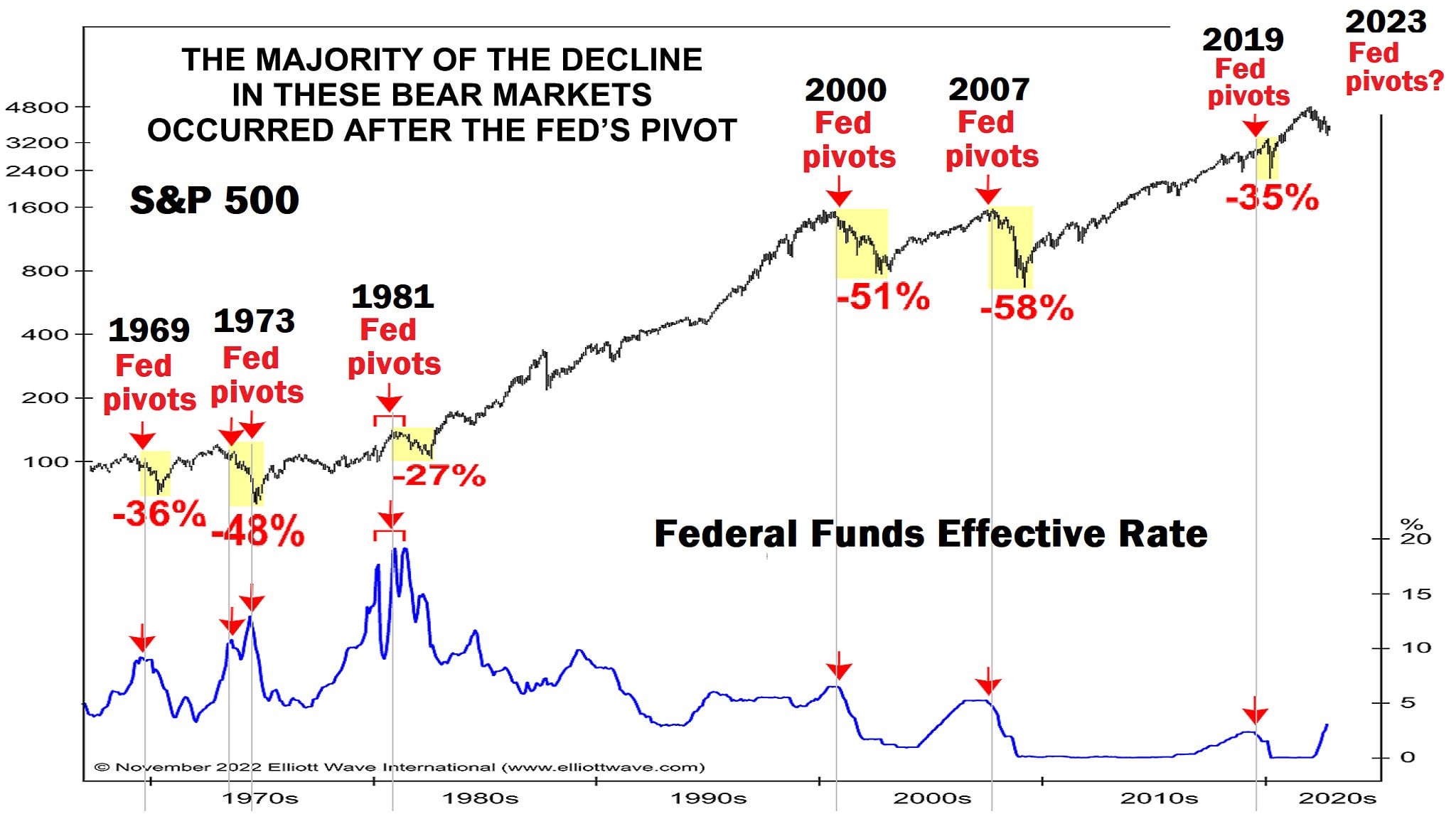

Global Economic Slowdown and Recession Fears: A looming global recession, fueled by persistent inflation and rising interest rates, has significantly dampened investor sentiment. The fear of reduced corporate profits and decreased consumer spending is driving capital flight from riskier assets, including stocks listed on the Amsterdam Stock Exchange.

-

Inflationary Pressures and Rising Interest Rates: Persistently high inflation rates across the globe have forced central banks, including the European Central Bank, to aggressively raise interest rates. Higher interest rates increase borrowing costs for businesses, hindering investment and potentially leading to economic contraction, impacting the AEX index negatively.

-

Geopolitical Instability: The ongoing war in Ukraine and the resulting energy crisis continue to weigh heavily on global markets. The Netherlands, heavily reliant on energy imports, is particularly vulnerable to these geopolitical uncertainties, impacting investor confidence in the Amsterdam Stock Exchange.

-

Specific Sector Performance within the AEX: Certain sectors within the AEX have been hit harder than others. For example, the energy sector, while initially benefiting from high prices, has seen a recent correction, while the technology sector has been impacted by global tech slowdowns. [Insert specific examples of company performance and sector data].

-

Impact of Specific Company Performance on the Overall Index: Poor performance by individual companies listed on the AEX, particularly those with significant market capitalization, can have a disproportionate effect on the overall index. [Insert examples of specific companies and their impact].

Impact on Dutch Investors and the Economy

The AEX decline has far-reaching consequences for Dutch investors and the broader economy.

-

Portfolio Value Losses and Decreased Investor Confidence: The 11% drop represents substantial losses for many individual investors, eroding their portfolio values and significantly impacting investor confidence in the Amsterdam Stock Exchange.

-

Impact on Retirement Savings and Pension Funds: Many Dutch citizens rely on pension funds and retirement savings invested in the stock market. The AEX decline directly affects the value of these investments, potentially jeopardizing retirement plans.

-

Potential Reduction in Consumer Spending: Decreased wealth stemming from stock market losses can lead to reduced consumer spending, creating a ripple effect throughout the Dutch economy and further impacting the AEX index.

-

Effect on the Broader Dutch Economy (GDP, Employment): A sustained decline in the AEX can negatively impact the Netherlands' GDP growth and employment levels, potentially leading to economic stagnation.

Comparison with Other European Markets

While the AEX has experienced a significant decline, it's crucial to compare its performance to other major European stock exchanges like the FTSE 100 (London) and the DAX (Frankfurt). [Insert comparative data and analysis of the performance of these indices]. This comparison will help determine whether the AEX's decline is unique to the Netherlands or part of a broader European trend, and identify any specific factors contributing to the differences in performance.

Expert Opinions and Predictions for the Future of the AEX

Financial analysts offer varying perspectives on the future of the AEX. [Include quotes and analysis from financial experts, referencing their affiliations and expertise]. Some suggest a potential recovery based on [reasons], while others foresee further declines due to [reasons]. The impact of future government policies and central bank actions, such as further interest rate hikes or stimulus measures, will also play a crucial role in shaping the AEX's trajectory.

Strategies for Investors During a Market Decline

Navigating a market decline requires a strategic approach.

-

Diversification Strategies to Mitigate Risk: Diversifying investments across different asset classes (stocks, bonds, real estate) can help reduce the impact of market fluctuations.

-

Importance of Long-Term Investment Strategies: Maintaining a long-term investment horizon is crucial during market downturns. Short-term market volatility should not dictate long-term investment decisions.

-

Risk Assessment and Tolerance Levels: Investors should carefully assess their risk tolerance and adjust their investment portfolios accordingly. High-risk investments should be avoided or reduced during periods of market uncertainty.

-

Seeking Professional Financial Advice: Seeking advice from a qualified financial advisor is highly recommended during times of market instability. A professional can help investors create a personalized investment strategy that aligns with their financial goals and risk tolerance.

Conclusion: Understanding and Navigating the Amsterdam Stock Exchange's Decline

The 11% drop in the AEX index represents a serious challenge for investors and the Dutch economy. This decline is a result of a confluence of factors, including global economic slowdown, inflation, geopolitical instability, and specific sector performance within the AEX. Understanding these contributing factors is crucial for navigating this turbulent period. To mitigate risks associated with the AEX index and the ongoing market decline, stay informed about market trends, diversify your investments, and seek professional financial advice. Continue following updates on the Amsterdam Stock Exchange to make informed investment decisions and protect your financial future.

Featured Posts

-

Porsche Cayenne Gts Coupe Recenzja I Test

May 24, 2025

Porsche Cayenne Gts Coupe Recenzja I Test

May 24, 2025 -

Kyle Walker And Annie Kilner New Ring Sparks Engagement Speculation

May 24, 2025

Kyle Walker And Annie Kilner New Ring Sparks Engagement Speculation

May 24, 2025 -

Amsterdam Exchange Plunges 11 Since Wednesday Three Days Of Losses

May 24, 2025

Amsterdam Exchange Plunges 11 Since Wednesday Three Days Of Losses

May 24, 2025 -

L Impatto Dei Dazi Sulle Importazioni Di Abbigliamento Negli Stati Uniti

May 24, 2025

L Impatto Dei Dazi Sulle Importazioni Di Abbigliamento Negli Stati Uniti

May 24, 2025 -

Serious M6 Crash Causes Extensive Traffic Disruption

May 24, 2025

Serious M6 Crash Causes Extensive Traffic Disruption

May 24, 2025

Latest Posts

-

Universals Epic 7 Billion Investment Reshaping The Theme Park Landscape

May 24, 2025

Universals Epic 7 Billion Investment Reshaping The Theme Park Landscape

May 24, 2025 -

Israeli Embassy Staffers Killed In Washington Museum Shooting Details Emerge

May 24, 2025

Israeli Embassy Staffers Killed In Washington Museum Shooting Details Emerge

May 24, 2025 -

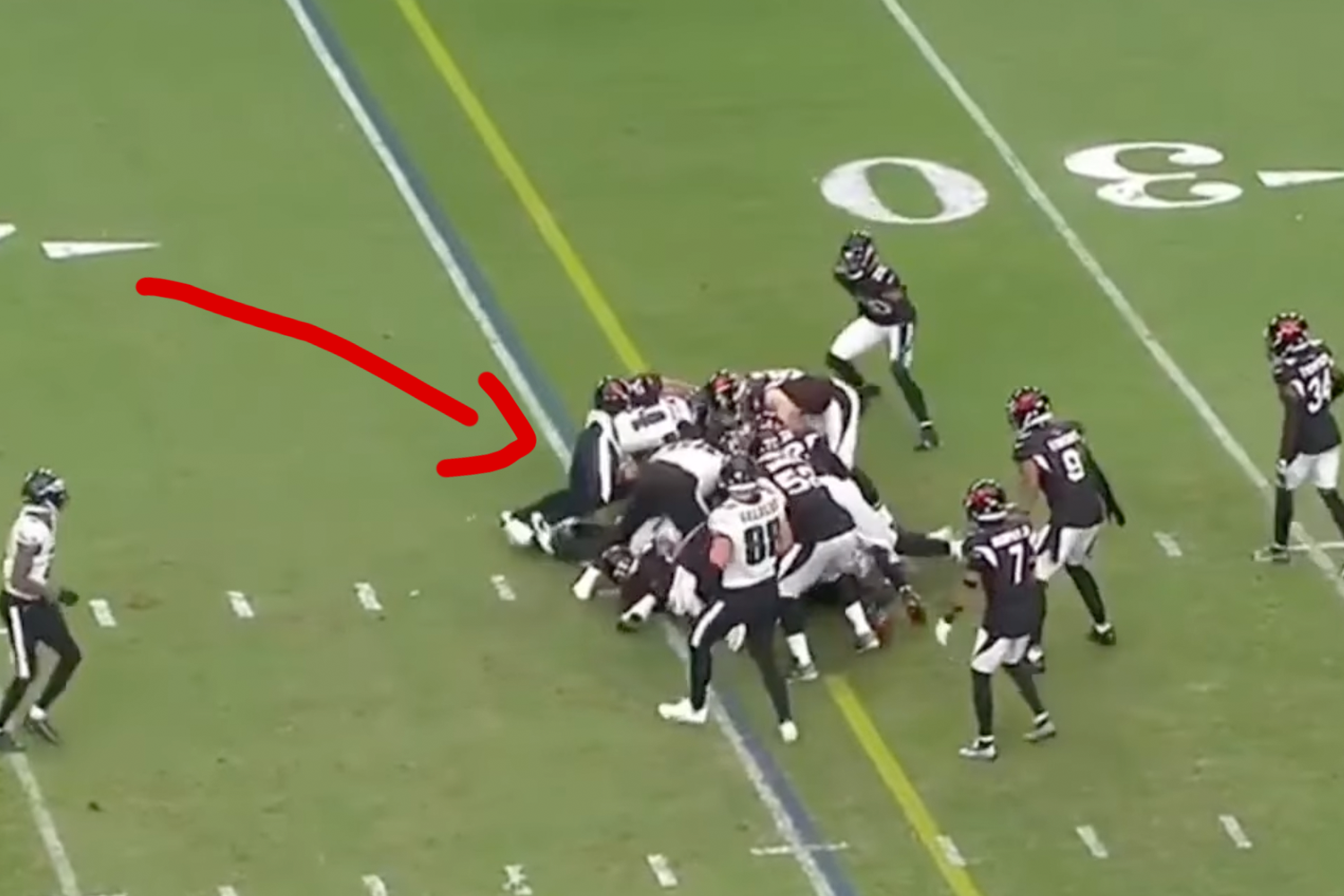

Nfl Celebration Rules The Unexpected Survival Of The Tush Push

May 24, 2025

Nfl Celebration Rules The Unexpected Survival Of The Tush Push

May 24, 2025 -

Universals 7 Billion Theme Park A New Era In The Disney Universal Rivalry

May 24, 2025

Universals 7 Billion Theme Park A New Era In The Disney Universal Rivalry

May 24, 2025 -

End Of The Line For Nfl Butt Related Bans The Tush Push Persists

May 24, 2025

End Of The Line For Nfl Butt Related Bans The Tush Push Persists

May 24, 2025