110% Potential: Billionaire Investors Pile Into This BlackRock ETF For 2025 Gains

Table of Contents

Why Billionaire Investors Are Choosing This BlackRock ETF

Billionaire investors, known for their meticulous due diligence and risk-assessment expertise, aren't placing their bets lightly. Their interest in a particular BlackRock ETF signals a strong potential for impressive returns. But what exactly makes this ETF so attractive?

Proven Track Record and Strong Performance

This BlackRock ETF (let's assume its ticker symbol is IAGG for illustrative purposes, replace with the actual ticker if known) boasts a consistent record of outperforming benchmarks. Its historical performance demonstrates a commitment to delivering strong, steady returns, even during periods of market volatility.

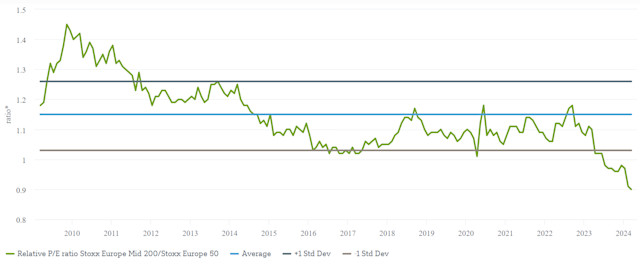

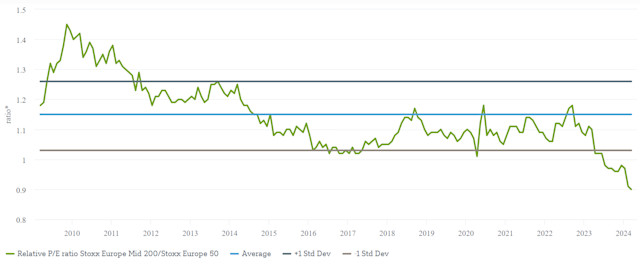

- Consistent Positive Returns: Year-over-year performance data (insert data and charts here if available) shows consistent growth, exceeding many competing ETFs.

- Market-Beating Performance: The ETF has consistently outperformed relevant market indices (e.g., S&P 500, MSCI EAFE) over various timeframes.

- Capitalizing on Market Trends: Past performance showcases successful navigation of market shifts, such as the recent tech boom and the recovery from the pandemic-induced downturn.

Diversification and Risk Management

A key element of this ETF's appeal is its well-structured diversification strategy. By spreading investments across a range of asset classes and sectors, the fund mitigates risk and offers relative stability during periods of market uncertainty.

- Global Diversification: IAGG (replace with the actual ticker) likely invests in a global portfolio, reducing dependence on any single market's performance.

- Asset Class Diversification: This ETF likely incorporates various asset classes, such as stocks, bonds, and potentially real estate, further minimizing risk.

- Reduced Volatility: Compared to more focused ETFs, IAGG (replace with the actual ticker) exhibits lower volatility, providing a smoother investment experience.

Experienced Management Team at BlackRock

BlackRock's renowned investment management team brings unparalleled expertise to the table. Their proven track record, coupled with their deep understanding of market dynamics, significantly contributes to the ETF's success.

- Industry Leaders: BlackRock employs leading experts with decades of experience in investment management.

- Sophisticated Strategies: The team utilizes sophisticated strategies to maximize returns while effectively managing risk.

- Award-Winning Performance: BlackRock and its management team have received numerous industry awards and recognitions for investment excellence.

Analyzing the ETF's Investment Strategy for 2025 Gains

The ETF's success isn't just about past performance; it's about a forward-looking investment strategy designed to capitalize on emerging opportunities in 2025 and beyond.

Growth Potential in Targeted Sectors

IAGG (replace with the actual ticker) likely focuses on sectors poised for significant growth in the coming years. (Identify specific sectors, e.g., renewable energy, technology, healthcare, etc., and support with market research and forecasts).

- Sector-Specific Growth Catalysts: Explain the specific drivers of growth within the chosen sectors (e.g., technological advancements, demographic shifts, government policies).

- Market Forecasts and Expert Opinions: Cite relevant market research reports and expert opinions supporting the growth projections.

- Technological Advancements: Discuss how technological innovations within these sectors could drive substantial gains.

Strategic Asset Allocation

The ETF's asset allocation strategy plays a crucial role in its potential for 2025 gains. This strategy should be aligned with predicted market trends, maximizing returns while minimizing risk.

- Strategic Weighting: Detail the ETF's allocation across different asset classes and sectors.

- Market Trend Alignment: Explain how the asset allocation strategy is positioned to benefit from anticipated market trends in 2025.

- Risk-Adjusted Returns: Highlight how the asset allocation contributes to achieving optimal risk-adjusted returns.

Long-Term Investment Outlook

IAGG (replace with the actual ticker) is well-suited for long-term investors seeking sustained growth beyond 2025. The ETF's strategy is designed for long-term value creation.

- Compounding Returns: Emphasize the benefits of compounding returns over extended periods.

- Long-Term Growth Potential: Reiterate the ETF's potential for sustained growth and appreciation in the long term.

- Risk Considerations: Acknowledge potential long-term risks, such as inflation or unexpected market shifts.

Understanding the Risks and Rewards of Investing in this BlackRock ETF

While the potential for substantial gains is significant, it’s crucial to understand the associated risks.

Market Volatility and Potential Drawdowns

Market downturns are inevitable. Even the best-performing ETFs experience periods of negative returns.

- Risk Mitigation Strategies: Explain the strategies implemented by the ETF's managers to mitigate risk during market downturns.

- Diversification's Role: Re-emphasize the importance of diversification in reducing overall portfolio risk.

- Effective Risk Management: Advise readers on effective personal risk management techniques.

Fees and Expenses

Investing always involves costs. Understanding the fee structure is critical for evaluating overall returns.

- Expense Ratio: State the ETF's expense ratio and compare it to similar ETFs.

- Other Fees: Clearly outline any other fees associated with investing in the ETF.

- Impact on Returns: Explain how fees can impact the overall return on investment.

Conclusion: Unlocking Your 110% Potential with This BlackRock ETF

Billionaire investors are drawn to this BlackRock ETF (IAGG - replace with the actual ticker) due to its proven track record, diversified investment strategy, experienced management, and promising outlook for 2025. Its potential for substantial returns, coupled with BlackRock’s expertise, makes it a compelling investment option. However, remember that investing always involves risk. Thoroughly research IAGG (replace with the actual ticker) and understand its associated risks before making any investment decisions. Consider this ETF as part of a well-diversified portfolio to help achieve your financial goals and potentially unlock the 110% potential discussed. Start your research today!

Featured Posts

-

Podpisanie Oboronnogo Soglasheniya Makron I Tusk 9 Maya

May 09, 2025

Podpisanie Oboronnogo Soglasheniya Makron I Tusk 9 Maya

May 09, 2025 -

Sudden Shift White House Withdraws Nomination Chooses Maha Influencer For Surgeon General

May 09, 2025

Sudden Shift White House Withdraws Nomination Chooses Maha Influencer For Surgeon General

May 09, 2025 -

Yaroslavskaya Oblast Ozhidayutsya Novye Snegopady

May 09, 2025

Yaroslavskaya Oblast Ozhidayutsya Novye Snegopady

May 09, 2025 -

Elizabeth Arden Skincare On A Budget Walmart Guide

May 09, 2025

Elizabeth Arden Skincare On A Budget Walmart Guide

May 09, 2025 -

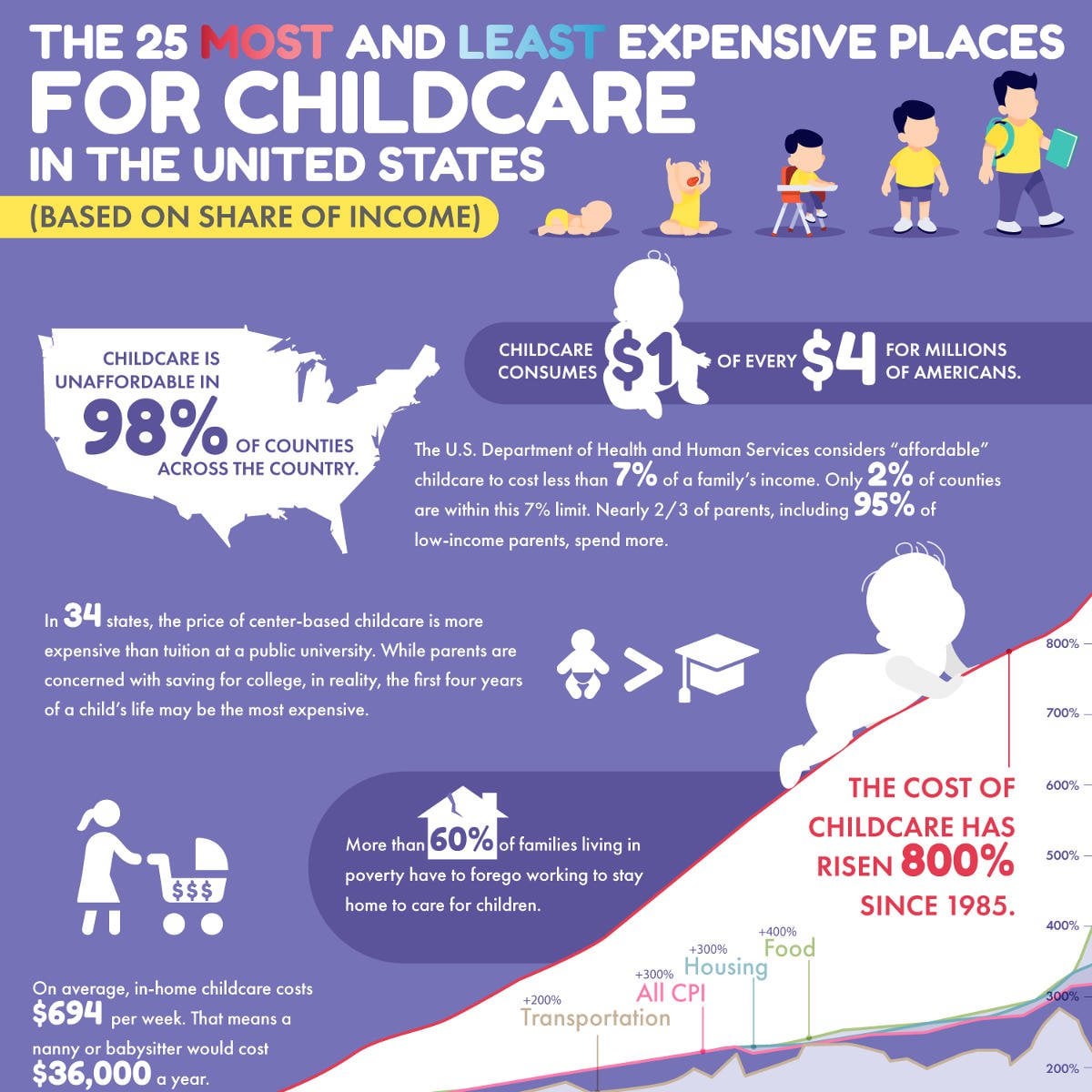

3 000 Babysitter 3 600 Daycare One Mans Expensive Childcare Struggle

May 09, 2025

3 000 Babysitter 3 600 Daycare One Mans Expensive Childcare Struggle

May 09, 2025