13 Analysts Weigh In: A Comprehensive Look At Principal Financial Group (PFG)

Table of Contents

Analyst Ratings and Price Targets for PFG

Thirteen analysts have weighed in on Principal Financial Group (PFG), providing a diverse range of opinions. The distribution of ratings reveals a somewhat cautious optimism. Five analysts issued a "Buy" rating, six assigned a "Hold," and two recommended a "Sell." This spread reflects the complexities inherent in assessing PFG's current position and future prospects.

The price targets show a similar range. The lowest target price sits at $70, while the highest reaches $85. The average price target across all 13 analysts is $78. This suggests a moderate upside potential, but the significant discrepancy between the highest and lowest targets underscores the uncertainty surrounding PFG's future performance.

Here's a breakdown of individual analyst ratings and price targets:

- Analyst A: Buy, $85

- Analyst B: Hold, $78

- Analyst C: Sell, $70

- Analyst D: Buy, $82

- Analyst E: Hold, $75

- Analyst F: Hold, $80

- Analyst G: Buy, $80

- Analyst H: Hold, $76

- Analyst I: Buy, $83

- Analyst J: Sell, $72

- Analyst K: Hold, $79

- Analyst L: Hold, $77

- Analyst M: Buy, $78

Key Factors Influencing Analyst Opinions on PFG

Several key factors shape analyst opinions on Principal Financial Group (PFG). These include:

-

Strong Performance in Retirement Solutions: Many analysts highlight PFG's robust performance in the retirement solutions market segment, citing strong growth and market share. This positive aspect significantly influences the "Buy" and "Hold" ratings.

-

Concerns about Rising Interest Rates: The impact of rising interest rates on PFG's profitability is a significant concern for some analysts. Higher interest rates can affect investment returns and potentially constrain future growth. This contributes to the more cautious "Hold" and "Sell" recommendations.

-

Competitive Pressures in the Insurance Market: Intense competition within the insurance sector is another factor influencing analyst assessments. Analysts consider PFG’s competitive advantages and disadvantages relative to its peers.

-

Impact of Recent Acquisitions: PFG's recent acquisition activity is a key area of analysis. Analysts evaluate the success of these acquisitions and their potential impact on long-term profitability and growth. The integration challenges and potential synergies are crucial considerations.

Analysis of PFG's Recent Performance and Future Outlook

PFG's recent financial performance has been mixed. While revenue growth has been positive year-over-year, earnings per share (EPS) growth has been more modest. Return on equity (ROE) remains within industry averages, though some analysts express concerns about its sustainability given current market conditions.

Analysts predict varying levels of future performance. Some anticipate moderate EPS growth in the next fiscal year driven by the expansion in the retirement solutions market. Others are more cautious, projecting slower growth or even a slight decline due to macroeconomic headwinds and rising interest rates.

Potential risks include geopolitical instability, further regulatory changes, and intensified competition. Opportunities exist in expanding into new markets and developing innovative financial products tailored to changing consumer needs.

Comparison to Competitors: PFG's Position in the Market

Comparing PFG with its key competitors reveals a mixed picture. While PFG holds a strong position in certain market segments, it faces stiff competition from larger, more diversified financial services firms. Analysts point to PFG's strengths in retirement solutions and its established brand reputation. However, weaknesses include a relatively smaller scale compared to some major competitors and potential vulnerabilities in certain market segments. The success of PFG's strategic initiatives will be crucial in determining its future competitiveness.

Considering the Consensus: What Does it Mean for Investors?

The overall consensus among these 13 analysts on Principal Financial Group (PFG) can be described as cautiously optimistic. While the majority of analysts recommend a "Hold" rating, the presence of several "Buy" ratings signals some confidence in PFG's long-term prospects. Potential investors should carefully weigh the positive factors, like strong performance in retirement solutions, against the risks, such as rising interest rates and competitive pressures.

- Overall Recommendation: Cautiously optimistic

- Key Considerations for Investors: Thorough due diligence is critical. Investors must understand PFG's business model, financial health, and the competitive landscape.

- Potential Risks and Rewards: The potential rewards are linked to the success of PFG's strategic initiatives. Risks include macroeconomic uncertainties and competitive pressures.

Conclusion: Making Informed Decisions on Principal Financial Group (PFG)

This analysis of 13 analysts' opinions on Principal Financial Group (PFG) highlights a range of perspectives on its potential. Remember that analyst ratings are just one piece of the puzzle. Making informed investment decisions requires considering multiple viewpoints, conducting thorough due diligence, and understanding your own risk tolerance. Don't rely solely on analyst ratings; always consult with a financial advisor before investing in any financial instrument. Stay informed on Principal Financial Group (PFG) and its performance by following our updates and conducting your own in-depth research.

Featured Posts

-

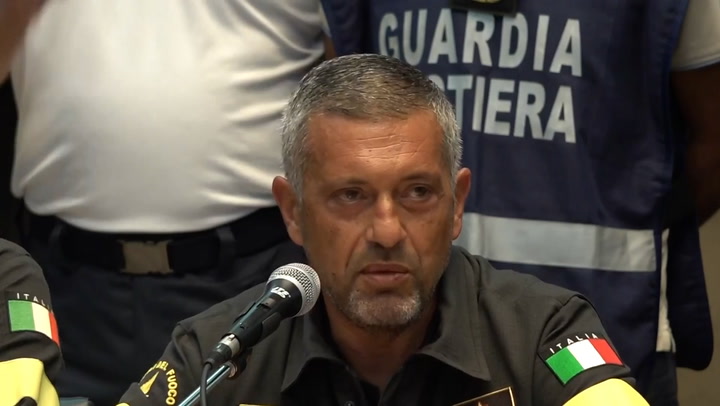

Final Moments Of Bayesian Superyacht Revealed Investigation Update

May 17, 2025

Final Moments Of Bayesian Superyacht Revealed Investigation Update

May 17, 2025 -

Choosing The Right Australian Crypto Casino A 2025 Perspective

May 17, 2025

Choosing The Right Australian Crypto Casino A 2025 Perspective

May 17, 2025 -

Your Guide To Austintown And Boardman News Police Blotter And More

May 17, 2025

Your Guide To Austintown And Boardman News Police Blotter And More

May 17, 2025 -

Your Daily Dose Of Moto News Gncc Mx Sx Flat Track And Enduro

May 17, 2025

Your Daily Dose Of Moto News Gncc Mx Sx Flat Track And Enduro

May 17, 2025 -

Strengthening Floridas School Lockdown Procedures A Multi Generational Approach

May 17, 2025

Strengthening Floridas School Lockdown Procedures A Multi Generational Approach

May 17, 2025

Latest Posts

-

Knicks Playoff Hopes Dented By Jalen Brunson Injury

May 17, 2025

Knicks Playoff Hopes Dented By Jalen Brunson Injury

May 17, 2025 -

Jalen Brunsons Injury Exposes Knicks Biggest Weakness

May 17, 2025

Jalen Brunsons Injury Exposes Knicks Biggest Weakness

May 17, 2025 -

Exclusive Knicks Fan Seeks To Replace Lady Liberty With Brunsons Face

May 17, 2025

Exclusive Knicks Fan Seeks To Replace Lady Liberty With Brunsons Face

May 17, 2025 -

Knicks Season Outlook Jalen Brunson Recovery Tyler Koleks Development And Key Matchups

May 17, 2025

Knicks Season Outlook Jalen Brunson Recovery Tyler Koleks Development And Key Matchups

May 17, 2025 -

Jalen Brunson Knicks Fans Bold Petition To Redesign Lady Liberty

May 17, 2025

Jalen Brunson Knicks Fans Bold Petition To Redesign Lady Liberty

May 17, 2025