$14.6 Billion Deficit Projected For Ontario: The Role Of Tariffs

Table of Contents

The Direct Impact of Tariffs on Ontario Businesses

Tariffs, essentially taxes on imported goods, have a direct and often devastating impact on Ontario businesses. This impact manifests in two key ways: increased costs for imported goods and reduced export opportunities.

Increased Costs for Imported Goods

Tariffs directly increase the cost of importing raw materials and finished goods. This affects virtually every sector, from manufacturing to retail. Higher input costs translate to reduced profit margins, making Ontario businesses less competitive both domestically and internationally.

-

Examples of affected industries: The automotive industry, heavily reliant on imported parts, faces significant cost increases. The manufacturing sector, which utilizes various imported components, also experiences substantial price hikes. Even seemingly unaffected sectors feel the ripple effect through increased input costs.

-

Data points illustrating increased prices: A recent study showed a 15% increase in the cost of steel imports following the imposition of tariffs, directly impacting manufacturers relying on this crucial material. Similar increases have been observed across various sectors.

-

Pass-through effect on consumers: Businesses often pass these increased costs onto consumers, leading to higher prices for everyday goods and services, further impacting consumer spending and economic growth.

Reduced Export Opportunities

Retaliatory tariffs imposed by other countries on Ontario exports significantly reduce sales and revenue for Ontario businesses. This creates a vicious cycle where decreased export opportunities lead to job losses and further economic slowdown, exacerbating the Ontario budget deficit.

-

Examples of impacted export industries: Ontario's agricultural sector, notably its dairy and pork industries, has experienced significant export setbacks due to retaliatory tariffs. The technology sector, a significant contributor to Ontario's economy, also faces challenges in accessing international markets.

-

Statistics on decreased export volumes: Data indicates a sharp decline in export volumes for several key Ontario industries since the implementation of tariffs, highlighting the tangible impact on businesses and the provincial economy.

-

Impact on employment in export-oriented sectors: Job losses in export-oriented sectors directly contribute to increased unemployment claims and a greater demand for social assistance programs, further straining the provincial budget.

Indirect Economic Consequences of Tariffs on Ontario's Budget

The consequences of tariffs extend beyond the direct impact on businesses. The indirect effects create a ripple effect that significantly impacts the Ontario government's budget.

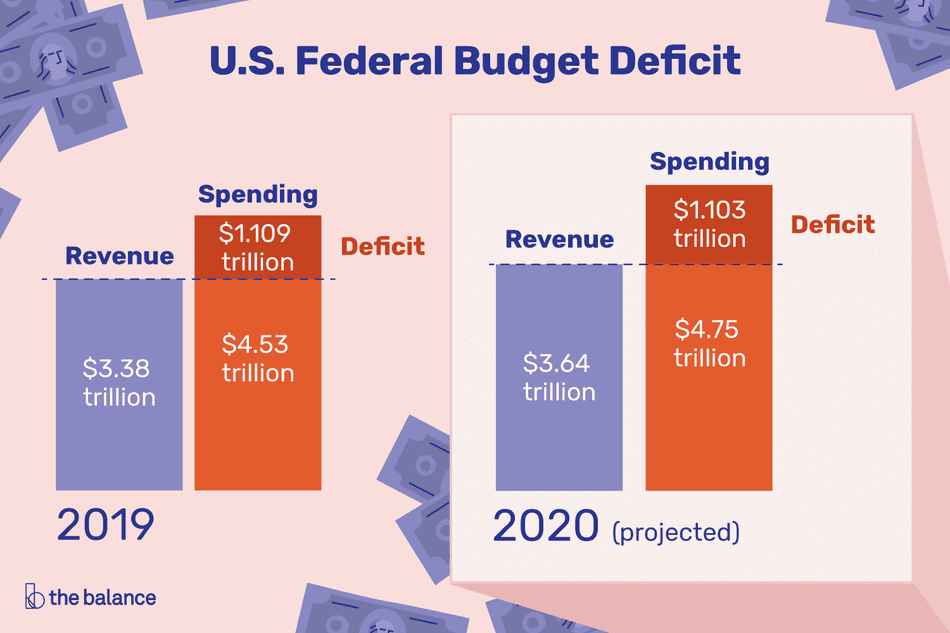

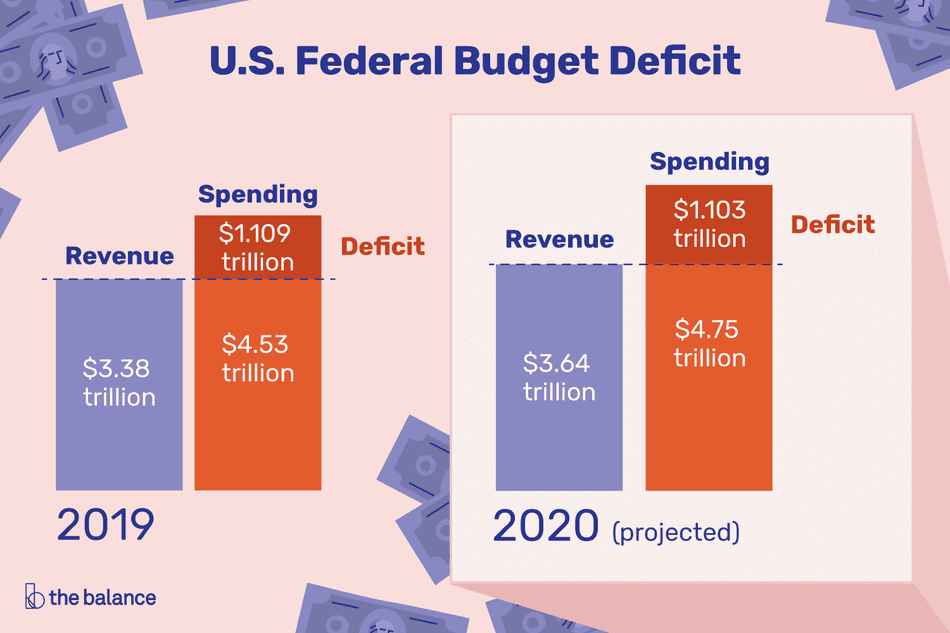

Decreased Tax Revenue

Reduced business activity and employment due to tariffs translate to lower tax revenues for the Ontario government. This decreased revenue stream directly contributes to the widening budget deficit.

-

Breakdown of affected tax revenue streams: Corporate income tax revenue decreases as businesses struggle with reduced profitability. Sales tax revenue also declines as consumer spending falls due to higher prices and economic uncertainty.

-

Estimates of tax revenue losses: Economic models suggest significant tax revenue losses directly attributable to the negative economic effects of tariffs, further fueling the growth of the Ontario budget deficit.

Increased Demand for Social Programs

Job losses and economic hardship caused by tariffs increase the demand for social assistance programs, placing further strain on the provincial budget. This puts added pressure on already stretched resources.

-

Examples of impacted social programs: Unemployment benefits, social housing, and other social support programs experience increased demand as individuals and families struggle to cope with economic hardship resulting from tariff-related job losses.

-

Projected increases in social program spending: The increased demand for social programs necessitates higher government spending, which directly contributes to the widening Ontario budget deficit.

Impact on Investment and Growth

The uncertainty and reduced profitability created by tariffs discourage both foreign and domestic investment, hindering economic growth in Ontario. This long-term impact is perhaps the most concerning aspect.

-

Data on decreased investment: Data shows a decline in both foreign direct investment (FDI) and domestic investment in Ontario, directly linked to the uncertainty and reduced business confidence created by tariffs.

-

Impact on long-term economic growth: Reduced investment significantly impacts long-term economic growth projections, suggesting a potentially prolonged period of fiscal challenges for Ontario.

Potential Mitigation Strategies

Addressing the negative impacts of tariffs requires a multi-pronged approach involving strategic policy interventions.

Diversification of Trade Partners

Reducing reliance on countries imposing tariffs requires a concerted effort to diversify trade relationships. Exploring new markets and strengthening ties with diverse trading partners can help mitigate the risks associated with tariff wars.

Support for Affected Industries

Government support programs, such as subsidies, tax breaks, and retraining initiatives, are crucial to help businesses cope with increased costs and reduced competitiveness. These programs can ease the burden and facilitate adaptation to changing market conditions.

Advocacy for Trade Liberalization

Advocating for trade agreements that reduce or eliminate tariffs is essential for long-term economic health. Active participation in international trade negotiations and fostering collaborative relationships with trading partners can create a more stable and predictable trade environment.

Conclusion

The projected $14.6 billion deficit in Ontario's budget is significantly impacted by tariffs. The increased costs for businesses, reduced export opportunities, decreased tax revenue, and increased demand for social programs all contribute to this fiscal challenge. Proactive strategies, including diversifying trade partners, supporting affected industries, and advocating for trade liberalization, are crucial to mitigate these negative consequences. Understanding the complexities of the Ontario budget deficit and the role of tariffs Ontario is vital for informed policymaking and economic recovery. Learn more about the impact of trade impact Ontario and advocate for policies that support a healthy and resilient economy. Stay informed on developments related to the Ontario budget deficit and the ongoing effects of tariffs.

Featured Posts

-

Greenkos Orix Stake Indian Founders Acquisition Plans

May 17, 2025

Greenkos Orix Stake Indian Founders Acquisition Plans

May 17, 2025 -

Smart Shopping Getting Quality On A Budget

May 17, 2025

Smart Shopping Getting Quality On A Budget

May 17, 2025 -

Tom Thibodeau And Mikal Bridges Resolve Conflict Following Contrasting Statements

May 17, 2025

Tom Thibodeau And Mikal Bridges Resolve Conflict Following Contrasting Statements

May 17, 2025 -

The Red Carpets Broken Rules Guest Conduct And Consequences

May 17, 2025

The Red Carpets Broken Rules Guest Conduct And Consequences

May 17, 2025 -

Tom Thibodeau How Fixing An Old Flaw Saved The Knicks From Disaster

May 17, 2025

Tom Thibodeau How Fixing An Old Flaw Saved The Knicks From Disaster

May 17, 2025

Latest Posts

-

The Warner Bros Pictures Presentation Cinema Con 2025 Recap

May 17, 2025

The Warner Bros Pictures Presentation Cinema Con 2025 Recap

May 17, 2025 -

Warner Bros Pictures At Cinema Con 2025 Film Announcements And More

May 17, 2025

Warner Bros Pictures At Cinema Con 2025 Film Announcements And More

May 17, 2025 -

Strengthening Floridas School Lockdown Procedures A Multi Generational Approach

May 17, 2025

Strengthening Floridas School Lockdown Procedures A Multi Generational Approach

May 17, 2025 -

Key Takeaways From Warner Bros Pictures Cinema Con 2025 Presentation

May 17, 2025

Key Takeaways From Warner Bros Pictures Cinema Con 2025 Presentation

May 17, 2025 -

Florida School Safety Lockdown Protocols And The Experiences Of Multiple Generations

May 17, 2025

Florida School Safety Lockdown Protocols And The Experiences Of Multiple Generations

May 17, 2025