$150 Million Settlement For Credit Suisse Whistleblowers

Table of Contents

The Allegations Against Credit Suisse

The settlement stems from allegations of serious financial misconduct at Credit Suisse, encompassing a range of activities that undermined financial transparency and eroded public trust. Reputable sources indicate the allegations involved facilitating illicit financial flows and failing to adequately comply with anti-money laundering regulations. These actions represent a serious breach of regulatory standards and ethical conduct within the financial industry.

- Facilitating money laundering for high-risk clients: Credit Suisse allegedly facilitated the laundering of money for clients known to be involved in high-risk activities, including organized crime and drug trafficking. This directly violated international anti-money laundering laws and regulations.

- Failure to report suspicious activity: The bank allegedly failed to adequately report suspicious financial transactions, a critical violation of its regulatory obligations and a major impediment to financial transparency.

- Misrepresenting financial information to investors: Allegations suggest that Credit Suisse misrepresented its financial health and risk profile to investors, misleading them about the true extent of its exposure to risky activities. This constitutes serious securities fraud.

The Role of the Whistleblowers

The $150 million settlement wouldn't have been possible without the bravery and dedication of the whistleblowers. These individuals, risking their careers and personal safety, played a crucial role in uncovering and exposing the alleged wrongdoing at Credit Suisse. Their actions are a testament to the power of individuals in holding corporations accountable.

- Internal reporting efforts: The whistleblowers reportedly made repeated attempts to report their concerns internally within Credit Suisse, but their warnings were allegedly ignored or dismissed.

- External reporting to regulatory bodies (SEC, etc.): Facing inaction within the organization, the whistleblowers ultimately turned to external regulatory bodies, including the Securities and Exchange Commission (SEC), providing critical evidence to support their claims.

- Providing substantial evidence: The whistleblowers provided substantial documentation and testimony, which was instrumental in the SEC's investigation and the subsequent settlement. Their detailed evidence was vital in building a strong case against Credit Suisse.

The $150 Million Settlement

The $150 million settlement represents a significant victory for the whistleblowers and underscores the potential financial consequences of corporate wrongdoing. While the exact distribution among the whistleblowers is confidential, the substantial amount reflects the severity of the alleged misconduct and the importance of their contributions.

- Amount received by each whistleblower: The precise amount received by each whistleblower remains confidential to protect their identities and safety.

- Conditions or stipulations attached to the payment: While specific details are undisclosed, it is likely that the settlement includes confidentiality agreements and non-disclosure clauses.

- Admission of guilt or liability by Credit Suisse: While Credit Suisse did not explicitly admit guilt, the settlement itself represents a tacit acknowledgment of wrongdoing and a commitment to resolve the allegations.

Implications for Future Corporate Governance and Whistleblower Protection

The $150 million Credit Suisse whistleblower settlement has far-reaching implications for corporate governance, regulatory enforcement, and whistleblower protection. This landmark case is likely to influence future practices and legislation, strengthening accountability within the financial industry.

- Increased scrutiny on financial institutions: The settlement will undoubtedly lead to increased scrutiny of financial institutions and their compliance with anti-money laundering regulations and other relevant laws. Expect more thorough audits and investigations.

- Strengthened whistleblower protection laws: The case may prompt legislative action aimed at strengthening whistleblower protection laws, ensuring greater protection for individuals who report corporate misconduct. This includes potentially expanding legal protections and increasing reward amounts.

- Deterrent effect on future corporate wrongdoing: The significant financial penalty serves as a strong deterrent to other financial institutions considering similar actions. The message is clear: engaging in illicit activities carries substantial risk.

Increased SEC Enforcement Activity

The Credit Suisse settlement signals a more assertive approach by the SEC in pursuing cases involving corporate wrongdoing and inadequate anti-money laundering practices. We can expect to see an increase in SEC investigations and enforcement actions in the financial sector. This proactive approach will contribute to increased financial transparency.

The Importance of Robust Internal Reporting Mechanisms

This case highlights the critical need for companies to establish robust internal mechanisms for reporting potential misconduct. Effective internal reporting channels are essential to fostering a culture of ethics and compliance, and preventing such large-scale issues from occurring in the first place.

Conclusion

The $150 million settlement in the Credit Suisse whistleblower case marks a watershed moment for financial transparency and corporate accountability. It underscores the importance of protecting whistleblowers who expose corporate wrongdoing and the serious consequences that corporations face when engaging in illegal activities. The settlement sends a clear message: the pursuit of profit cannot come at the expense of ethical conduct and legal compliance.

Understanding the implications of the Credit Suisse whistleblower settlement is crucial for safeguarding financial integrity. Stay informed about important developments in whistleblower protection and corporate accountability. Seek out resources from organizations like the SEC and other relevant regulatory bodies to learn more about whistleblower protections and reporting mechanisms.

Featured Posts

-

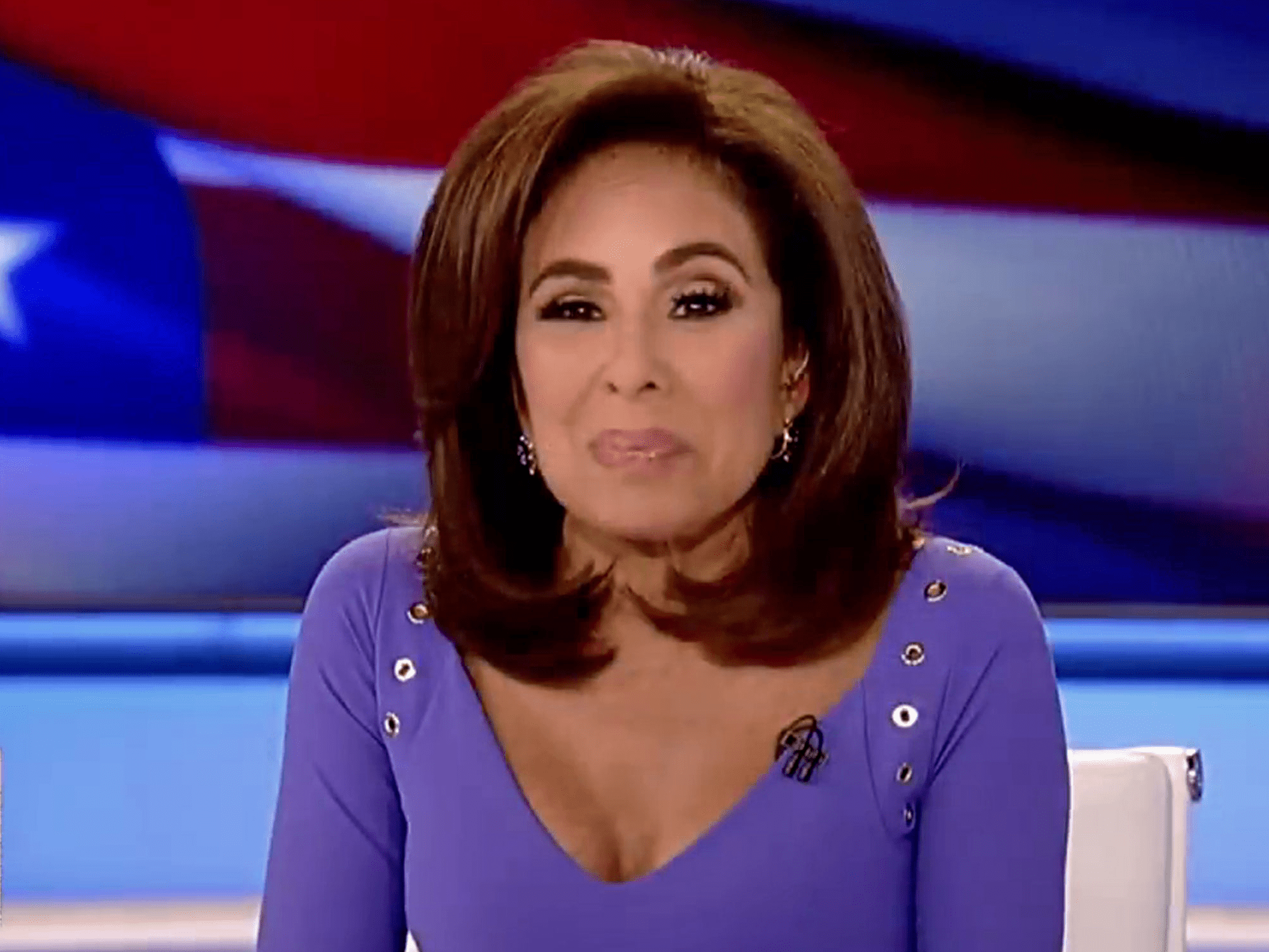

Fox News Jeanine Pirro A Behind The Scenes Look

May 09, 2025

Fox News Jeanine Pirro A Behind The Scenes Look

May 09, 2025 -

Ozhidaemoe Oboronnoe Soglashenie Makrona I Tuska 9 Maya Analiz I Prognozy

May 09, 2025

Ozhidaemoe Oboronnoe Soglashenie Makrona I Tuska 9 Maya Analiz I Prognozy

May 09, 2025 -

Handhaven Van De Band Tussen Brekelmans En India

May 09, 2025

Handhaven Van De Band Tussen Brekelmans En India

May 09, 2025 -

Doohans F1 Fate Montoyas Claim Of A Pre Decided Outcome

May 09, 2025

Doohans F1 Fate Montoyas Claim Of A Pre Decided Outcome

May 09, 2025 -

How Us Politics And Economics Shape Elon Musks Billions

May 09, 2025

How Us Politics And Economics Shape Elon Musks Billions

May 09, 2025