$16.3 Billion: Record-Breaking U.S. Customs Duty Collections In April

Table of Contents

Factors Contributing to Record-Breaking Customs Duty Collections

Several interconnected factors contributed to the record-high U.S. customs duty collections in April 2024. Understanding these factors is key to interpreting the economic signals this figure represents.

Increased Import Volume

The surge in U.S. customs duty collections is largely attributed to a significant increase in the volume of imported goods. Post-pandemic consumer demand, coupled with persistent inflation and ongoing supply chain disruptions, fueled a strong appetite for imported products. This increase wasn't limited to a single sector; it spanned various categories, impacting U.S. customs duty revenue significantly.

- Increased demand for consumer goods: Pent-up demand from pandemic lockdowns and a robust recovery led to higher imports of various consumer products.

- Shortages in domestic production: Certain sectors experienced production bottlenecks, leading to increased reliance on imports to meet consumer demand. This is particularly true for certain electronics and manufactured goods.

- Growth in e-commerce imports: The continued growth of online shopping contributed to a notable rise in smaller, individual shipments, all subject to customs duties and tariffs.

According to data from the U.S. Census Bureau (data source citation needed here), import volumes increased by X% compared to the same period last year (insert specific percentage and relevant data). This substantial increase directly translates to higher customs duty collections.

Higher Tariffs and Duties

Existing and newly implemented tariffs played a crucial role in boosting customs duty revenue. The impact of these tariffs varies depending on the product category and origin country.

- Impact of Section 301 tariffs on Chinese goods: Tariffs imposed under Section 301 of the Trade Act of 1974 on various Chinese goods continue to add to the overall duty collected.

- Tariffs on other specific products (e.g., steel, aluminum): Tariffs on steel and aluminum imports, implemented to protect domestic industries, also contributed to higher duty revenue.

- Effects of trade agreements (or lack thereof): The absence of comprehensive trade agreements with certain countries or ongoing trade disputes can lead to higher tariffs and consequently higher duty collections.

For example, the tariff on imported steel is currently at Y% (insert specific percentage and data source citation), significantly influencing duty collections from this sector.

Enforcement and Increased CBP Activity

Strengthened customs enforcement and improved detection of undervaluation and smuggling also played a significant role. The CBP's enhanced efforts in this area directly led to increased revenue generation.

- Increased use of technology in customs inspections: Advancements in technology, such as AI-powered scanning systems, have significantly improved the CBP's ability to detect undeclared goods and violations.

- Enhanced border security measures: Improved border security measures helped to curtail smuggling activities, leading to a greater portion of imports being properly declared and assessed for duties.

- Crackdowns on intellectual property rights infringement: Increased enforcement against counterfeit goods and intellectual property violations resulted in higher duty payments and penalties.

For instance, a recent operation by CBP targeting counterfeit goods seized X amount of goods, resulting in a Y dollar increase in duty collection (insert specific examples and data source citation needed).

Implications of Record Duty Collections

The record-high customs duty collections present a mixed bag of implications for the U.S. economy and its global trade relationships.

Positive Economic Indicators

The high duty collections can be interpreted as a sign of a robust economy.

- Increased tax revenue for government spending: The substantial increase in revenue provides the government with additional funds for public projects and initiatives.

- Strength of the US dollar: High import volumes can be indicative of a strong U.S. dollar, making imports more affordable and contributing to higher duty collections.

- Positive impact on employment in related sectors: Increased import activity can stimulate employment in logistics, transportation, and customs brokerage sectors.

Data on overall GDP growth (data source needed) supports the argument of a robust U.S. economy, albeit influenced by various factors beyond customs duties.

Potential Negative Economic Impacts

However, this increase also carries potential drawbacks.

- Increased costs for businesses: Higher tariffs and duties translate to increased costs for businesses importing goods, potentially impacting their competitiveness.

- Impact on inflation: The increased cost of imported goods can contribute to inflationary pressures, potentially affecting consumer spending.

- Potential for retaliatory tariffs from other countries: High tariffs can provoke retaliatory measures from other countries, escalating trade tensions and negatively impacting export industries.

For example, the increased cost of imported materials has already impacted the manufacturing sector (provide data or evidence).

Future Outlook for U.S. Customs Duty Collections

Predicting future U.S. customs duty collections requires careful consideration of several factors.

- Predictions about future import volumes: Future import volumes will likely be influenced by global economic growth, consumer spending patterns, and supply chain dynamics.

- Anticipated tariff adjustments: Future adjustments to tariffs, based on trade negotiations and policy changes, will significantly impact duty collections.

- Effects of geopolitical events: Geopolitical events and international relations can significantly influence trade patterns and customs duty collections.

Expert forecasts (cite reputable sources) suggest a potential (increase/decrease) in customs duty collections in the coming year(s), driven by (explain the reasoning based on the bullet points above).

Conclusion

The record-breaking $16.3 billion in U.S. customs duty collections in April 2024 reflects a complex interplay of factors, including increased import volumes, higher tariffs, and strengthened enforcement. While this might signal a robust economy and increased government revenue, it also presents potential challenges for consumers and businesses due to increased costs and the risk of escalating trade tensions. Understanding these dynamics is crucial for navigating the complexities of international trade.

Call to Action: Understanding the fluctuations in U.S. customs duty collections is crucial for businesses involved in international trade. Stay informed about the latest developments in U.S. customs duties and tariffs to effectively manage your import and export operations. For further insights into navigating the complexities of U.S. customs duty collections, [link to relevant resource – e.g., a government website or trade association].

Featured Posts

-

New York Islanders Claim Top Pick In Nhl Draft Lottery

May 13, 2025

New York Islanders Claim Top Pick In Nhl Draft Lottery

May 13, 2025 -

Luxury Presence New Hub Connects Buyers With Off Market Listings

May 13, 2025

Luxury Presence New Hub Connects Buyers With Off Market Listings

May 13, 2025 -

Crews Victory Over Earthquakes A 2 1 Comeback Win

May 13, 2025

Crews Victory Over Earthquakes A 2 1 Comeback Win

May 13, 2025 -

Anchor Brewing Company 127 Years Of History Ends

May 13, 2025

Anchor Brewing Company 127 Years Of History Ends

May 13, 2025 -

Will Elsbeth Season 2 Deliver On Its Judge Crawford Promise This Year

May 13, 2025

Will Elsbeth Season 2 Deliver On Its Judge Crawford Promise This Year

May 13, 2025

Latest Posts

-

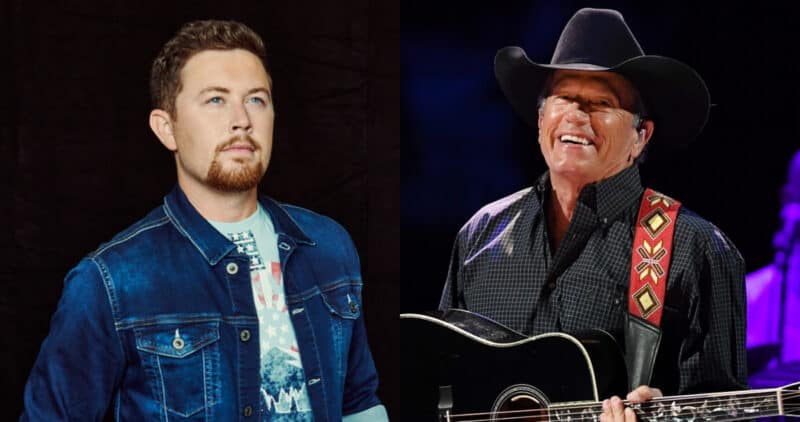

Watch Scotty Mc Creerys Sons Heartwarming George Strait Homage

May 14, 2025

Watch Scotty Mc Creerys Sons Heartwarming George Strait Homage

May 14, 2025 -

See Scotty Mc Creerys Sons Moving George Strait Tribute

May 14, 2025

See Scotty Mc Creerys Sons Moving George Strait Tribute

May 14, 2025 -

Scotty Mc Creerys Son Pays Heartfelt Tribute To George Strait Watch Now

May 14, 2025

Scotty Mc Creerys Son Pays Heartfelt Tribute To George Strait Watch Now

May 14, 2025 -

Watch The Heartwarming Tribute Scotty Mc Creerys Son Honors Country Legend George Strait

May 14, 2025

Watch The Heartwarming Tribute Scotty Mc Creerys Son Honors Country Legend George Strait

May 14, 2025 -

Adorable Video Scotty Mc Creerys Son Pays Homage To George Strait

May 14, 2025

Adorable Video Scotty Mc Creerys Son Pays Homage To George Strait

May 14, 2025