177,000 Jobs Added In April: U.S. Unemployment Rate Remains At 4.2%

Table of Contents

Sectoral Breakdown of Job Growth

The 177,000 job increase in April wasn't evenly distributed across all sectors. Analyzing sectoral employment reveals a dynamic picture of the US labor market. The leisure and hospitality sector, still recovering from pandemic-related setbacks, contributed significantly to job growth. Other key contributors included:

- Professional and Business Services: This sector saw a substantial increase, reflecting strong demand for skilled professionals.

- Healthcare: Continued growth in this sector underscores the ongoing need for healthcare workers.

- Government: Government jobs also experienced modest growth.

Conversely, some sectors experienced job losses, including:

- Construction: This sector saw a slight decline, potentially due to fluctuating material costs and economic uncertainty.

Keywords: sectoral employment, industry job growth, hospitality jobs, professional services jobs.

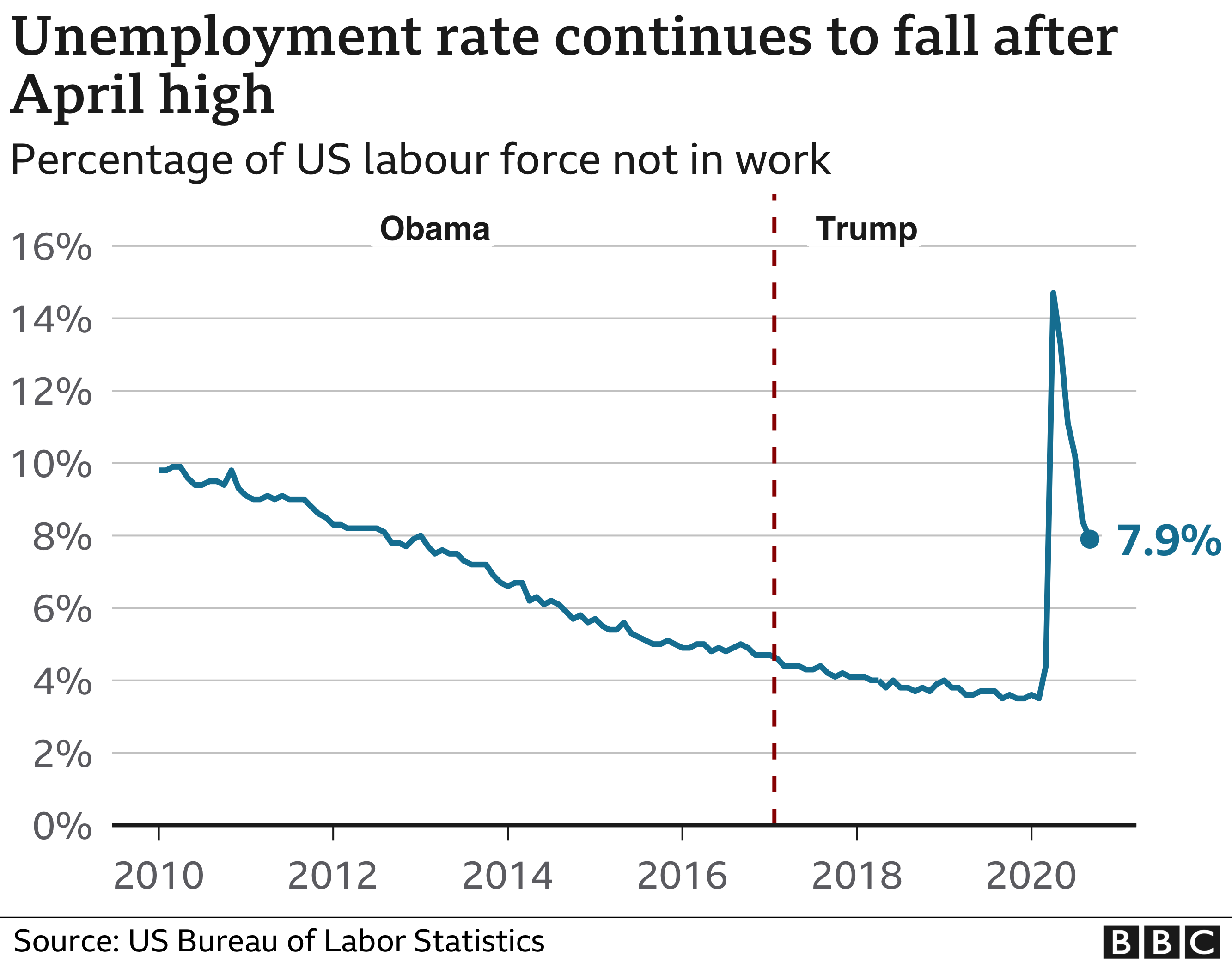

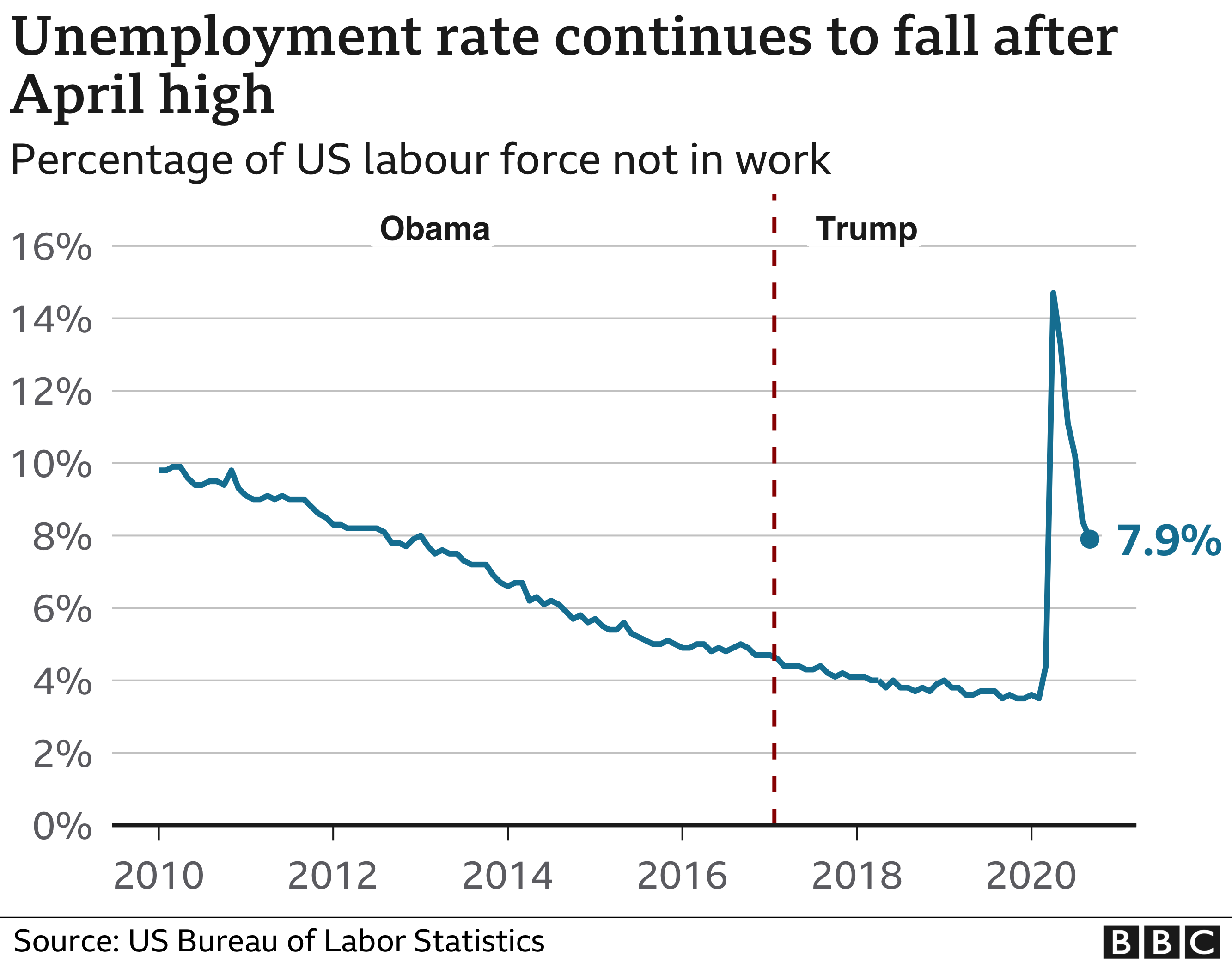

Analysis of the Unemployment Rate

The unemployment rate remaining stable at 4.2% is a noteworthy aspect of the April unemployment figures. This stability doesn't necessarily mean a stagnant labor market; it reflects a balance between job creation and labor force participation. Several factors contribute to this stability:

- Labor Force Participation Rate: While the unemployment rate stayed constant, the labor force participation rate might offer further insights. A rising participation rate could indicate increased confidence in the job market, leading to more people actively seeking employment. Conversely, a falling rate could signify people leaving the workforce for various reasons.

- Types of Unemployment: The current unemployment rate likely incorporates a mix of frictional (temporary unemployment between jobs), structural (mismatch between skills and available jobs), and cyclical (due to economic downturns) unemployment. Understanding the composition of these types is crucial for a comprehensive analysis.

Keywords: Unemployment figures, labor force participation rate, types of unemployment, labor market trends.

Wage Growth and Inflation

Average hourly earnings continue to increase, although the wage growth rate needs to be considered in the context of inflation. While wage increases are positive for workers, they can also fuel inflationary pressures if they outpace productivity growth. The relationship between wage growth rate and inflation rate is complex and requires careful monitoring. Increased wages directly impact consumer spending, which in turn influences overall economic growth. However, rapid wage growth exceeding productivity gains could contribute to a wage-price spiral, further exacerbating inflation.

Keywords: Average hourly earnings, wage growth rate, inflation rate, consumer spending.

Implications for Monetary Policy

The April job growth data significantly impacts the Federal Reserve's monetary policy decisions. The ongoing debate centers on balancing the need to control inflation without stifling economic growth. The strong employment figures could lead the Fed to consider further interest rates hikes to curb inflation. However, the Fed must carefully weigh the risks of raising rates too aggressively, which could potentially trigger a recession. The interplay between job growth, inflation, and the Federal Reserve's response is crucial to observe.

Keywords: Federal Reserve, monetary policy, interest rates, inflation control.

Future Economic Outlook Based on April Jobs Report

The April jobs report paints a generally positive picture of the short-term economic outlook. However, several uncertainties remain:

- Geopolitical Risks: Global events can significantly impact the US economy.

- Supply Chain Issues: Ongoing supply chain disruptions could still constrain economic growth.

- Inflationary Pressures: High inflation rates present a significant challenge to maintaining economic stability.

These factors suggest a need for cautious optimism. While the current job growth is encouraging, sustained economic strength depends on managing these risks effectively. This necessitates careful consideration of economic policy adaptations to navigate the complexities of the current economic landscape.

Keywords: Economic forecast, future job growth, economic risks, economic policy.

Conclusion: Assessing the April Jobs Report and its Impact on the U.S. Economy

The April jobs report showcases a resilient US economy with 177,000 jobs added and the unemployment rate holding steady at 4.2%. The sectoral breakdown revealed strong growth in key areas, though certain sectors faced challenges. Wage growth remains a key factor to monitor in relation to inflation. The data has important implications for the Federal Reserve's monetary policy decisions. While the outlook is positive, uncertainties remain. Stay tuned for updates on the next jobs report and continue to monitor the impact of this positive job growth on the U.S. economy. The ongoing evolution of US employment and the economic outlook require consistent observation and analysis.

Featured Posts

-

Singapores Political Landscape The Implications Of The Next Election

May 05, 2025

Singapores Political Landscape The Implications Of The Next Election

May 05, 2025 -

Singapore Election 2024 A Crucial Test For The Pap

May 05, 2025

Singapore Election 2024 A Crucial Test For The Pap

May 05, 2025 -

Twitchs Next Big Thing Lizzos New Music Era

May 05, 2025

Twitchs Next Big Thing Lizzos New Music Era

May 05, 2025 -

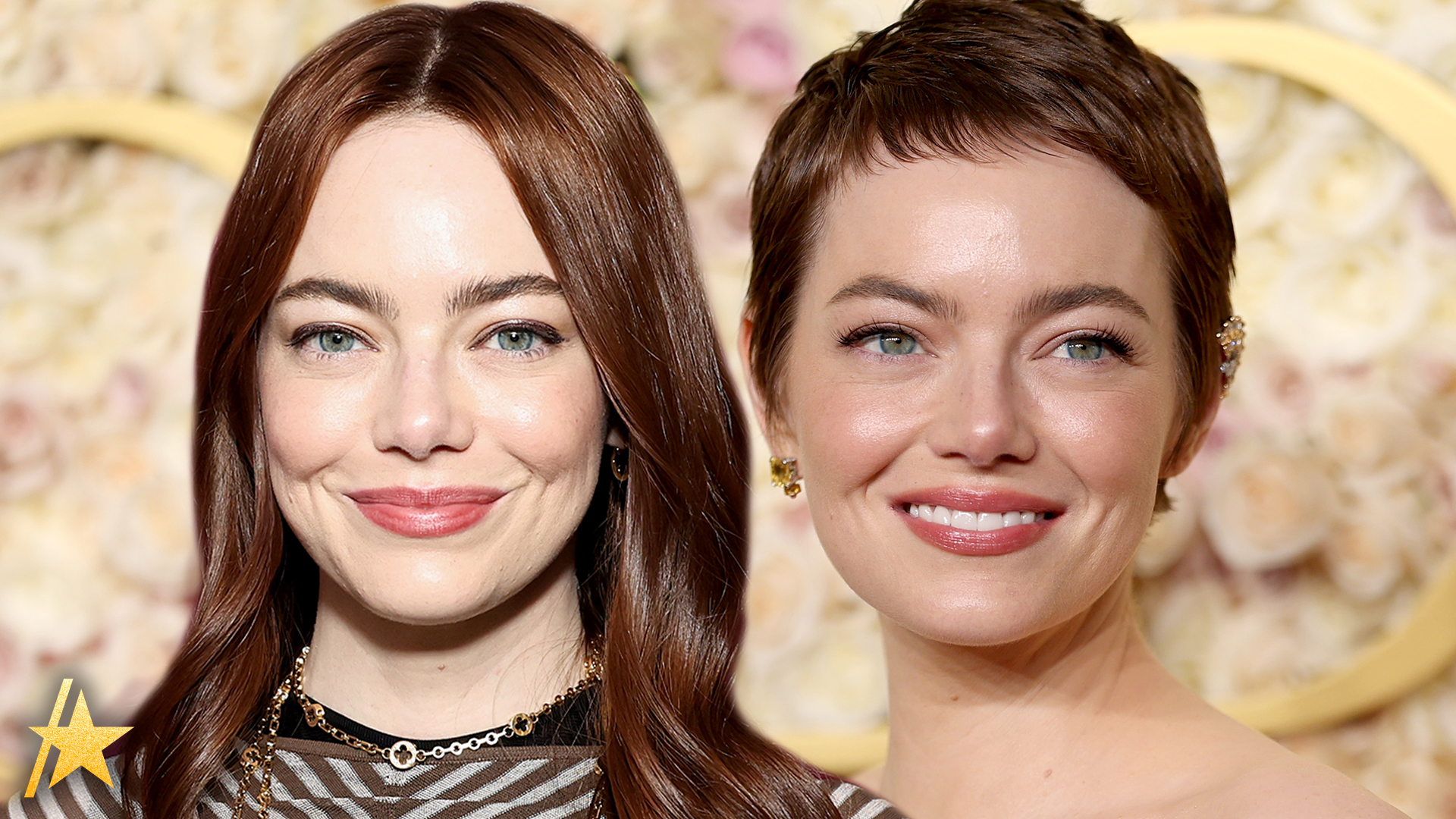

Oscars 2025 Fashion Emma Stones Stunning Sequin Louis Vuitton Creation

May 05, 2025

Oscars 2025 Fashion Emma Stones Stunning Sequin Louis Vuitton Creation

May 05, 2025 -

The Truth Behind The Emma Stone And Margaret Qualley Oscars Drama

May 05, 2025

The Truth Behind The Emma Stone And Margaret Qualley Oscars Drama

May 05, 2025

Latest Posts

-

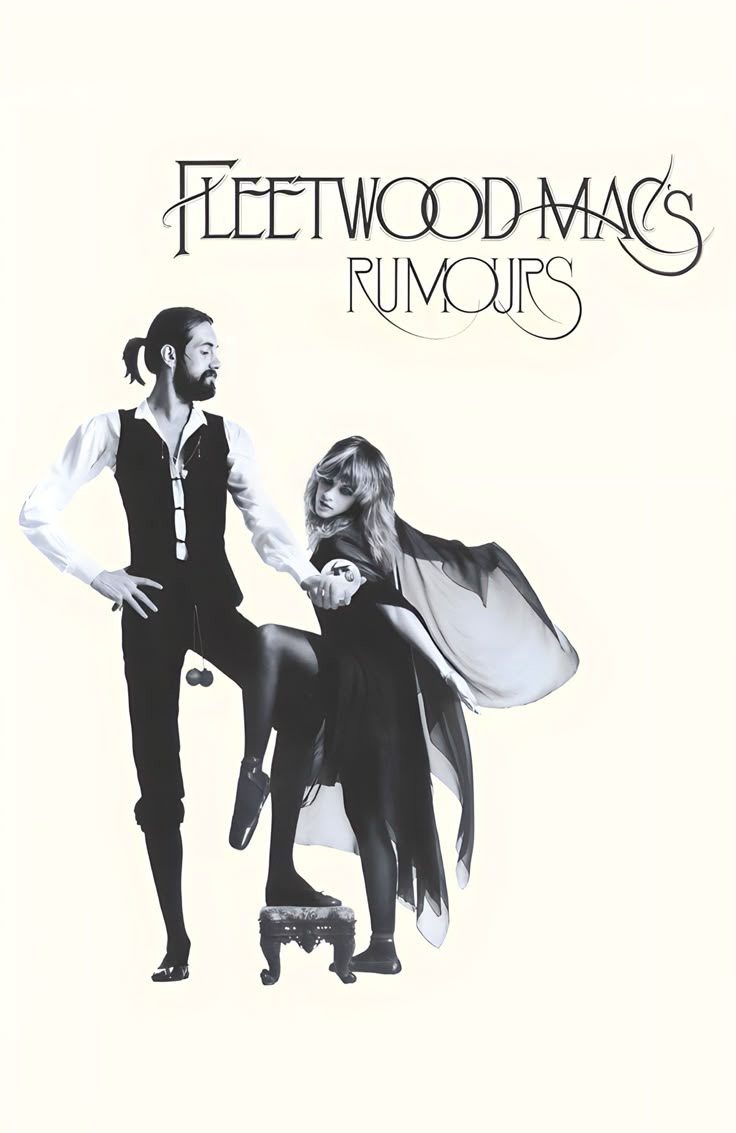

The Untold Story Behind Fleetwood Macs Rumours 48 Years Of Influence

May 05, 2025

The Untold Story Behind Fleetwood Macs Rumours 48 Years Of Influence

May 05, 2025 -

Rumours At 48 The Impact Of Fleetwood Macs Implosion On Music History

May 05, 2025

Rumours At 48 The Impact Of Fleetwood Macs Implosion On Music History

May 05, 2025 -

The Fleetwood Mac Phenomenon Debunking The First Supergroup Rumours

May 05, 2025

The Fleetwood Mac Phenomenon Debunking The First Supergroup Rumours

May 05, 2025 -

Buckingham And Fleetwoods Studio Sessions A Collaboration

May 05, 2025

Buckingham And Fleetwoods Studio Sessions A Collaboration

May 05, 2025 -

Fleetwood Macs Rumours A 48 Year Retrospective Of Heartbreak And Hitmaking

May 05, 2025

Fleetwood Macs Rumours A 48 Year Retrospective Of Heartbreak And Hitmaking

May 05, 2025