$2.4 Billion Catalyst Business Deal: Honeywell Takes Over From Johnson Matthey

Table of Contents

Deal Details and Financial Implications of the Honeywell Acquisition

The Acquisition Price and Structure

Honeywell's acquisition of Johnson Matthey's catalyst technologies business closed at a staggering $2.4 billion. The deal structure likely involved a combination of cash and potentially some form of stock, although the exact breakdown hasn't been publicly detailed. Contingent considerations, such as performance-based payments tied to future revenue or profitability targets, may also be part of the agreement. The finalized details were likely subject to standard due diligence and regulatory approvals.

Honeywell's Strategic Rationale

Honeywell's acquisition of this specific business unit stems from several key strategic drivers:

- Expanding market share: Honeywell aims to significantly boost its presence in the lucrative catalyst market, gaining a competitive edge against established players.

- Access to cutting-edge technologies and intellectual property: Johnson Matthey possesses a wealth of patented technologies and expertise in catalyst development, providing Honeywell with immediate access to innovative solutions.

- Synergies with existing Honeywell businesses: The acquired technologies are likely to create synergies with Honeywell's existing operations in areas such as automotive, aerospace, and chemical processing, leading to operational efficiencies and cost savings.

- Long-term growth potential: The catalyst market is projected to experience significant growth in the coming years, driven by increasing demand from various industries. Honeywell is positioning itself to capitalize on this growth potential.

Impact on Johnson Matthey

For Johnson Matthey, the sale represents a strategic refocusing of its business portfolio. By divesting its catalyst technologies business, they can concentrate resources on other core areas, potentially leading to increased profitability and market competitiveness in their chosen sectors. The proceeds from the sale will likely be reinvested to bolster research and development, acquisitions, or debt reduction, furthering their long-term strategic goals.

Catalyst Technology and Market Analysis

Types of Catalysts Involved

The acquired business unit encompassed a range of catalyst technologies, primarily focused on automotive emission control catalysts and catalysts for chemical processing applications. Specific details regarding the precise types and formulations of catalysts included in the deal may be limited due to competitive sensitivity.

Market Size and Growth Potential

The global catalyst market is a multi-billion dollar industry with considerable growth potential. Market research firms project substantial growth in the coming years, driven by factors such as stricter environmental regulations, the increasing demand for cleaner energy solutions, and the expansion of various industrial processes that rely heavily on catalysts. The precise market figures and forecasts vary depending on the source, but the overall outlook points to a positive trajectory.

Competitive Landscape

This acquisition significantly alters the competitive landscape of the catalyst market. Honeywell becomes a major player, challenging existing industry leaders and potentially accelerating consolidation within the sector. The competitive dynamics are expected to become more intense as companies vie for market share and pursue innovation.

Regulatory and Legal Aspects of the Honeywell Catalyst Deal

Regulatory Approvals

The $2.4 billion Honeywell acquisition required various regulatory approvals from competition authorities worldwide to ensure compliance with antitrust laws. These approvals are crucial for the deal's completion and may have involved a thorough review process to assess the potential impact on market competition.

Legal Implications

The legal aspects of such a large-scale acquisition are complex and involve significant due diligence, contract negotiation, and regulatory compliance. Potential legal challenges could arise, though these are usually addressed proactively during the acquisition process.

Future Outlook and Predictions

Integration Challenges and Opportunities

Integrating the acquired business into Honeywell's existing operations presents both challenges and opportunities. Honeywell will need to effectively manage the transition, retaining key personnel, streamlining operations, and leveraging synergies to maximize returns on investment. Successful integration will require careful planning, efficient execution, and a clear vision for the future.

Long-Term Impact on the Industry

The $2.4 Billion Catalyst Business Deal: Honeywell Acquisition is likely to have a significant long-term impact on the catalyst industry. Increased competition, accelerated innovation, and potential further industry consolidation are all probable consequences. The deal could also stimulate investment and research & development in catalyst technologies.

Conclusion

The $2.4 billion Honeywell acquisition of Johnson Matthey's catalyst technologies business is a landmark deal with profound implications for the catalyst market. The acquisition strengthens Honeywell's position, reshapes competitive dynamics, and signals a major strategic shift in the industry. The long-term impact will depend on successful integration and the evolving market landscape. Stay tuned for updates on this monumental $2.4 billion catalyst business deal as Honeywell integrates this significant acquisition into its operations. For a deeper dive into the intricacies of the catalyst market, explore [link to relevant resource].

Featured Posts

-

Brundles Unsettling Discoveries The Lewis Hamilton Story

May 23, 2025

Brundles Unsettling Discoveries The Lewis Hamilton Story

May 23, 2025 -

Airlifting Cows The Swiss Village Rescue Mission

May 23, 2025

Airlifting Cows The Swiss Village Rescue Mission

May 23, 2025 -

Is Cat Deeleys M And S Midi Dress Still In Stock

May 23, 2025

Is Cat Deeleys M And S Midi Dress Still In Stock

May 23, 2025 -

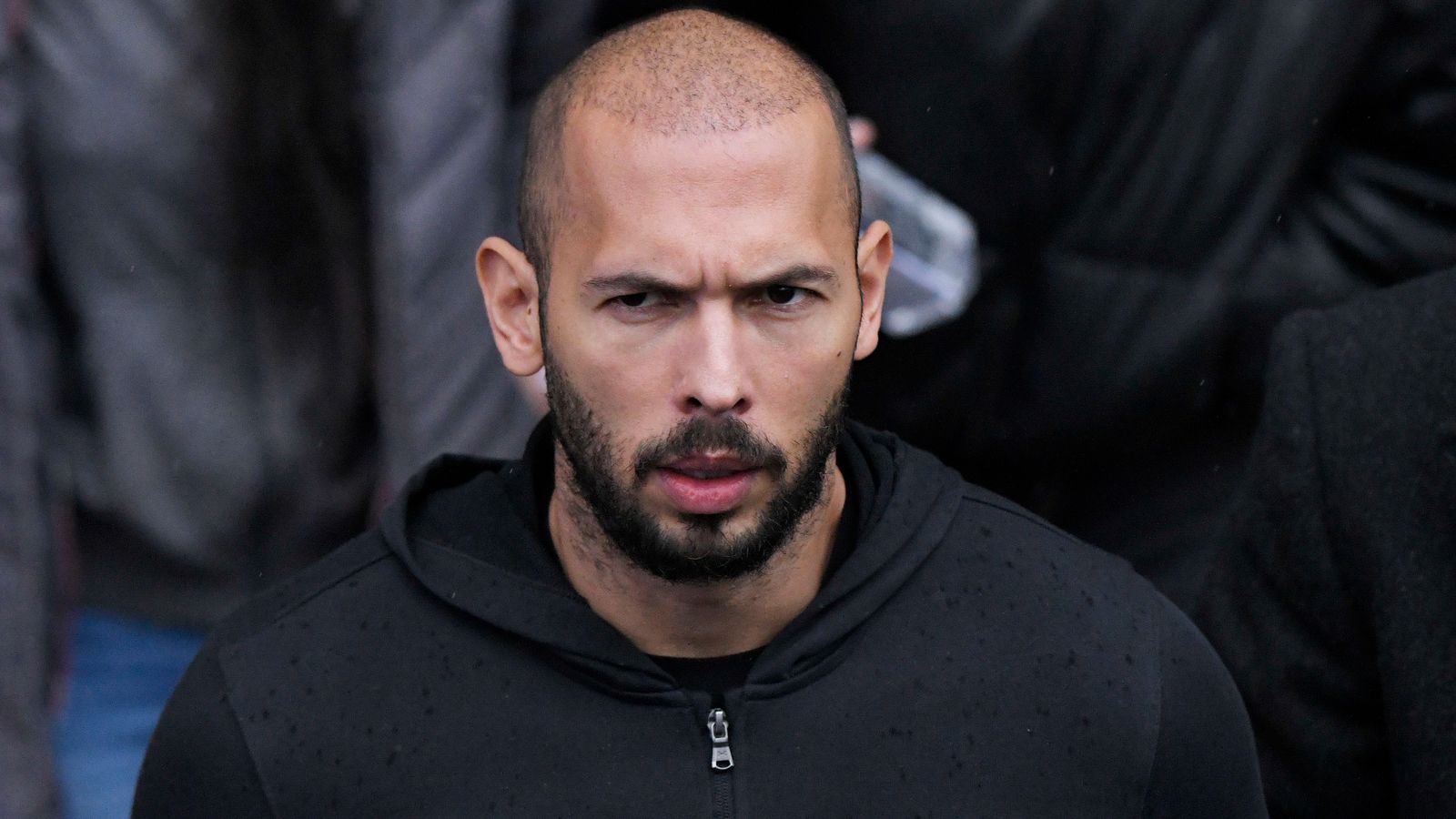

Fratii Tate Defileaza Prin Bucuresti Imagini Video De La Sosirea In Romania

May 23, 2025

Fratii Tate Defileaza Prin Bucuresti Imagini Video De La Sosirea In Romania

May 23, 2025 -

Mc Larens F1 Pace Setter Car Performance Driver Skill And Strategy

May 23, 2025

Mc Larens F1 Pace Setter Car Performance Driver Skill And Strategy

May 23, 2025

Latest Posts

-

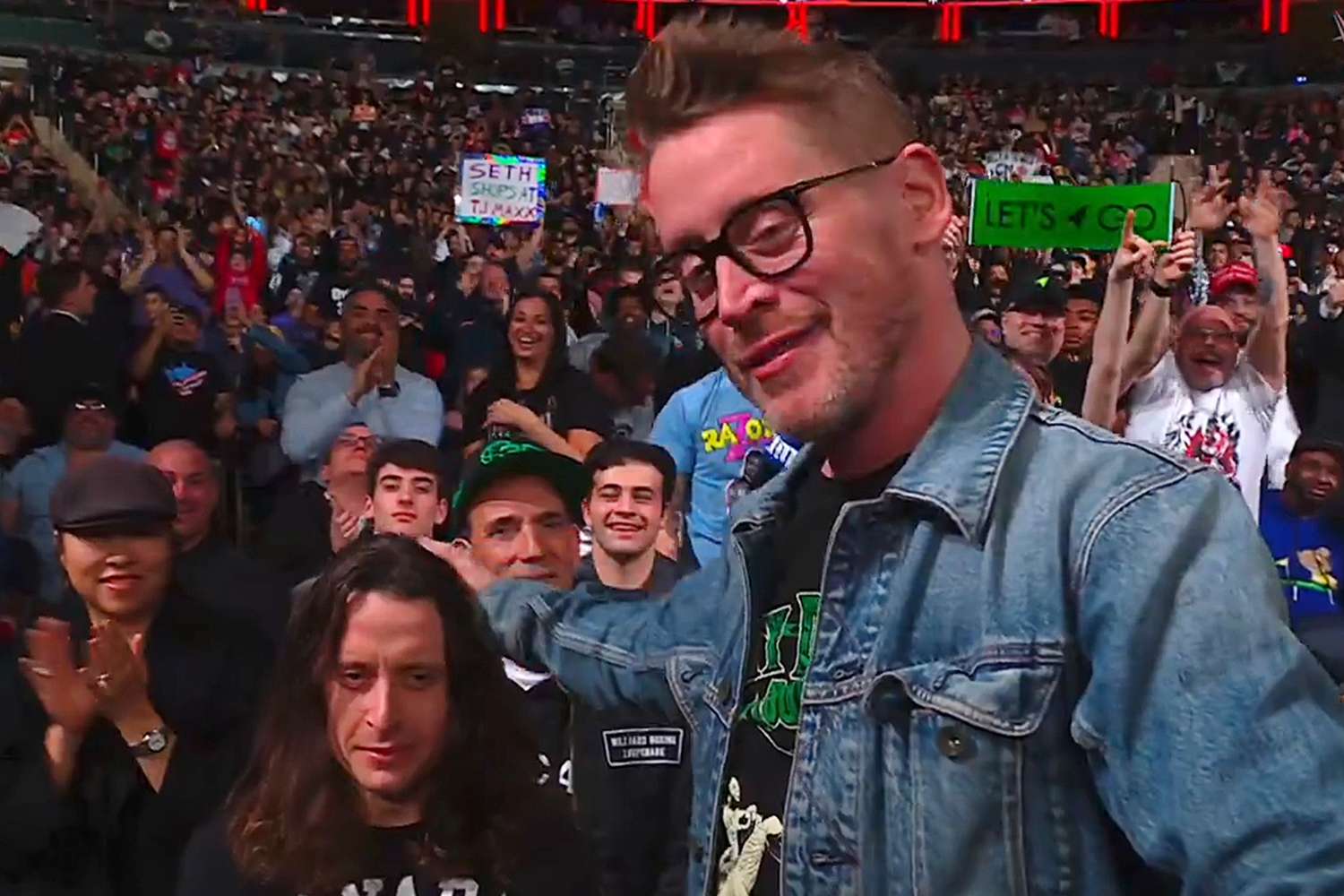

Macaulay Culkins Wwe Raw Appearance With Brother Rory Sparks Fan Frenzy

May 23, 2025

Macaulay Culkins Wwe Raw Appearance With Brother Rory Sparks Fan Frenzy

May 23, 2025 -

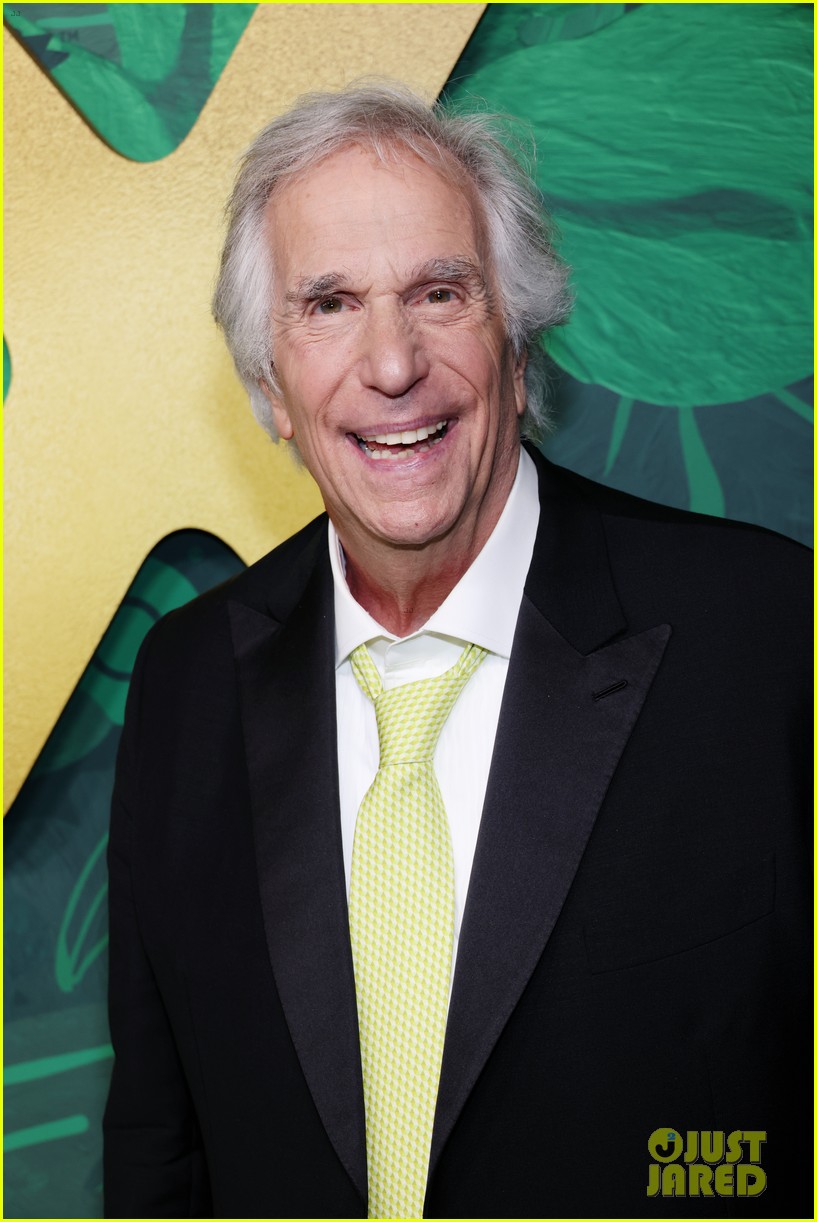

Exploring Kieran Culkins Relationship With Michael Jackson Facts And Speculation

May 23, 2025

Exploring Kieran Culkins Relationship With Michael Jackson Facts And Speculation

May 23, 2025 -

Andres Regret The A Real Pain Role He Turned Down

May 23, 2025

Andres Regret The A Real Pain Role He Turned Down

May 23, 2025 -

Reactia Publicului La Anuntul Lui Andrew Tate Despre Conducere

May 23, 2025

Reactia Publicului La Anuntul Lui Andrew Tate Despre Conducere

May 23, 2025 -

Macaulay Culkin And Rory Culkin Spotted Together At Wwe Raw Fans React

May 23, 2025

Macaulay Culkin And Rory Culkin Spotted Together At Wwe Raw Fans React

May 23, 2025