$2,700 Ethereum Price Target: Is The Wyckoff Accumulation Phase Over?

Table of Contents

Ethereum's price has shown intriguing behavior recently, sparking debate among analysts about whether the market has passed through a Wyckoff accumulation phase and is poised for a significant price increase towards the coveted $2,700 target. This article delves into the technical indicators, market sentiment, and potential hurdles to determine if the accumulation phase is indeed over and what investors can expect. We'll explore the possibility of ETH reaching $2700 and beyond, examining the implications of a potential $2700 Ethereum target.

Understanding the Wyckoff Accumulation Phase

The Wyckoff method is a technical analysis approach focusing on identifying market manipulation and predicting significant price movements. It posits that large players (whales) accumulate assets before a price surge, leaving behind characteristic chart patterns. A key element of the Wyckoff methodology is the identification of accumulation phases.

These phases are characterized by:

- High volume at relatively low prices: This suggests significant buying pressure at discounted levels.

- Sideways or range-bound trading: Consolidation before a major breakout.

- Testing of support levels: Price dips to test the commitment of buyers.

Key elements within the Wyckoff accumulation phase include:

- Upthrust: A sharp price increase followed by a reversal, designed to shake out weak holders.

- Spring: A final price drop to lure in more buyers at a low price before the uptrend begins. Identifying these elements is crucial for spotting potential accumulation phases and predicting future price movements. Examples of past Wyckoff accumulation phases in crypto markets, while difficult to definitively prove, are often suggested in analyses of Bitcoin and other major altcoins prior to significant bull runs.

Analyzing Ethereum's Price Action (Technical Indicators)

Analyzing recent Ethereum price charts reveals key support and resistance levels. Examining these levels in conjunction with technical indicators helps determine if the potential $2700 Ethereum target is feasible.

Relative Strength Index (RSI)

The RSI is a momentum oscillator. A reading below 30 generally suggests an oversold market, indicating potential for a price rebound. Conversely, readings above 70 suggest an overbought market, potentially signaling a price correction. Analyzing the recent RSI readings for Ethereum provides insight into the potential for further price increases towards the $2700 mark.

Moving Averages (MA)

Comparing short-term (e.g., 50-day MA) and long-term (e.g., 200-day MA) moving averages offers further perspective on price trends. A bullish crossover (short-term MA crossing above the long-term MA) can be a strong signal of an uptrend, supporting the $2700 Ethereum price prediction.

Volume Analysis

Analyzing trading volume alongside price movements is vital. Increased volume during price increases confirms the strength of the uptrend, while decreasing volume during uptrends can be a warning sign. Conversely, high volume during price declines can indicate a stronger bearish trend.

- Chart Example: (Insert image of Ethereum chart highlighting support/resistance, RSI, MAs, volume, and relevant candlestick patterns like hammers or engulfing patterns, with numerical data clearly labeled). This chart visually illustrates the recent price action and the potential for a move towards our $2700 Ethereum target.

Market Sentiment and News Affecting Ethereum's Price

Current market sentiment towards Ethereum is crucial. Positive news and developments generally lead to bullish sentiment, pushing the price higher. Conversely, negative news often results in bearish sentiment and price corrections.

Regulatory Developments

Regulatory clarity or uncertainty significantly impacts cryptocurrency prices. Positive regulatory developments tend to foster investor confidence, while negative news often causes sell-offs.

Network Upgrades/Developments

Significant Ethereum network upgrades (like the Shanghai upgrade) or technological advancements generally boost investor confidence and fuel price increases. Conversely, delays or setbacks can negatively impact sentiment.

Major Institutional Investments

Large institutional investments signal confidence in the asset and often trigger price increases. Monitoring institutional activity, such as Grayscale's holdings, provides valuable insight into potential price movements.

- News Sources: (Insert links to relevant news articles and reports on regulatory changes, network upgrades, and institutional investments). The impact of these news events on investor confidence and the overall market sentiment influences the Ethereum price prediction and its potential to reach $2700.

Potential Hurdles to Reaching the $2,700 Ethereum Price Target

Several factors could hinder Ethereum's price from reaching $2,700:

- Macroeconomic Factors: Global economic conditions (inflation, interest rates) heavily influence investor risk appetite and cryptocurrency prices. A downturn in the broader economy could negatively affect the Ethereum price prediction.

- Market Corrections: Crypto markets are known for their volatility. Sharp corrections are common, potentially halting progress towards the $2,700 target.

- Competition: Competition from other cryptocurrencies offering similar functionalities could divert investor interest and limit Ethereum's price growth.

Conclusion

Analyzing Ethereum's price action through the lens of the Wyckoff accumulation phase reveals a complex picture. While indicators suggest the potential for significant price increases, reaching the $2,700 Ethereum price target is not guaranteed. Many factors, from macroeconomic conditions to regulatory developments, could impact the price trajectory. Whether the Wyckoff accumulation phase is truly over remains a subject of debate, necessitating ongoing analysis.

Call to Action: Should you invest in Ethereum based on this analysis? This is a crucial question for investors considering a $2700 Ethereum target. Our analysis suggests potential, but considerable risk remains. Before investing in Ethereum or any other cryptocurrency, conduct your own thorough research, carefully assess your risk tolerance, and consider consulting with a qualified financial advisor. Remember that this article is for informational purposes only and does not constitute financial advice. The "Wyckoff accumulation Ethereum" analysis, while insightful, is just one piece of the puzzle in predicting the Ethereum price. Further research is strongly encouraged before making any investment decisions concerning Ethereum price predictions and the potential for an ETH price to hit $2700.

Featured Posts

-

Rusya Merkez Bankasi Kripto Para Islemlerini Uyariyor Guevenlik Ve Yasal Riskler

May 08, 2025

Rusya Merkez Bankasi Kripto Para Islemlerini Uyariyor Guevenlik Ve Yasal Riskler

May 08, 2025 -

Russell Westbrook Rumors Nuggets Player Offers Insight

May 08, 2025

Russell Westbrook Rumors Nuggets Player Offers Insight

May 08, 2025 -

Psg Vs Arsenal Gary Nevilles Prediction And Match Preview

May 08, 2025

Psg Vs Arsenal Gary Nevilles Prediction And Match Preview

May 08, 2025 -

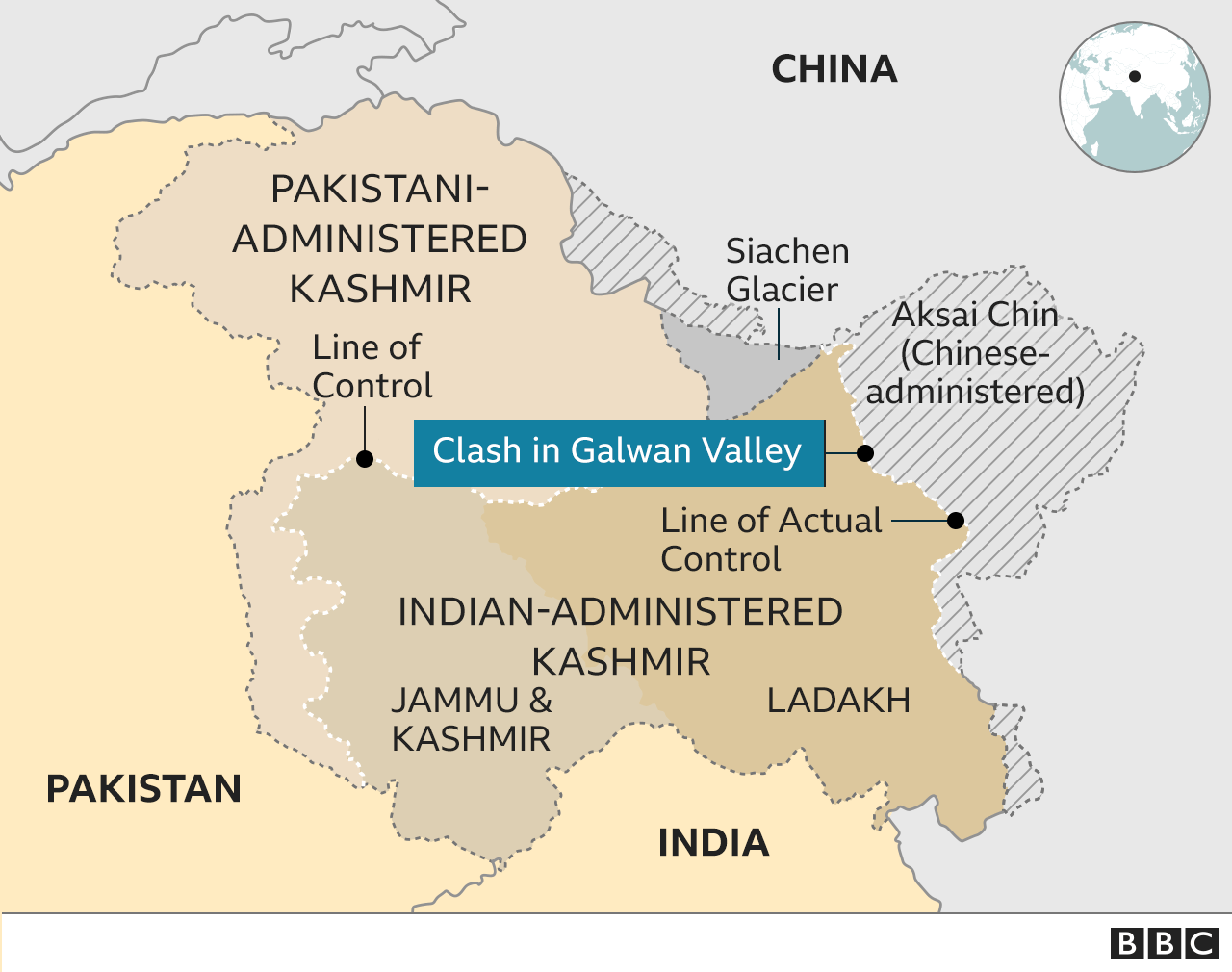

Roots Of India Pakistan Tensions The Kashmir Dispute And The Threat Of War

May 08, 2025

Roots Of India Pakistan Tensions The Kashmir Dispute And The Threat Of War

May 08, 2025 -

Lotto Results Winning Numbers For Lotto Lotto Plus 1 And Lotto Plus 2 Draws

May 08, 2025

Lotto Results Winning Numbers For Lotto Lotto Plus 1 And Lotto Plus 2 Draws

May 08, 2025