$200 Million Tariff Burden: Colgate (CL) Reports Reduced Sales And Profits

Table of Contents

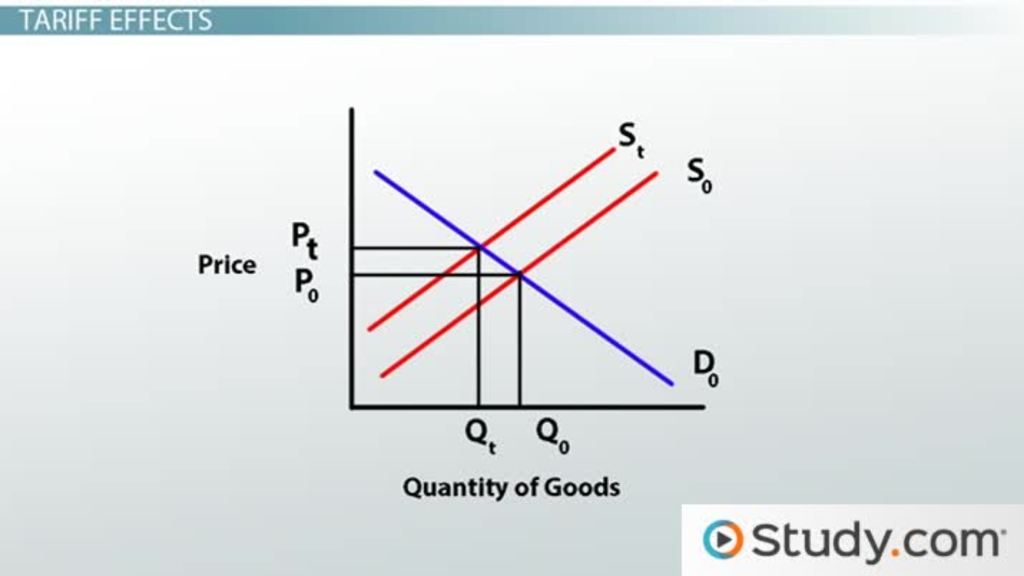

The $200 Million Tariff Burden: A Detailed Breakdown

Colgate's $200 million tariff burden stems from increased import costs on various products and across different global markets. The exact breakdown by product and region isn't always publicly specified by Colgate in granular detail, but analysis of financial reports and industry news points to several key factors.

- Increased Import Costs on Oral Care Products: A significant portion of the tariff burden likely stems from increased costs associated with importing oral care products – toothbrushes, toothpaste, and mouthwash – to key markets. These products are often subject to tariffs when imported into certain countries.

- Impact on Personal Care Products: Similarly, Colgate's personal care product lines (soaps, shampoos, etc.) have likely been affected by import tariffs in specific regions.

- Regional Variations: The impact of tariffs is not uniform across all regions. Some markets, notably those with higher import duties on consumer goods, have likely contributed disproportionately to Colgate's overall tariff burden.

[Insert a chart or graph here visually representing the estimated breakdown of tariff costs by product category or region, if data is available. If not, a general illustrative chart can be used.]

Keywords: Colgate tariffs, tariff impact, import costs, cost analysis, financial statement analysis

Impact on Colgate's Sales Figures: A Year-Over-Year Comparison

The $200 million tariff burden has demonstrably impacted Colgate's sales figures. A year-over-year comparison reveals a significant decline in revenue, largely attributable to the increased costs passed on to consumers or absorbed by Colgate as reduced profit margins.

- Reduced Sales Volumes: Higher prices, a direct consequence of tariffs, have likely led to decreased sales volumes in certain markets. Consumers, facing higher costs, may have reduced their consumption or switched to lower-priced alternatives.

- Geographic Variations: Sales declines have likely been more pronounced in regions with higher tariff rates.

- Product-Specific Impacts: Some product lines may have been affected more severely than others, depending on the specific tariff rates applied to those products.

[Include a table here comparing Colgate's sales figures (in relevant currency) for a period before and after the tariff implementation. Include percentage changes for clarity.]

Keywords: Colgate sales decline, sales revenue, year-over-year comparison, market share, consumer demand

Effect on Profit Margins and Overall Profitability

The tariffs have significantly squeezed Colgate's profit margins. The $200 million burden directly reduces net income, impacting the company's earnings per share (EPS) and overall profitability.

- Reduced Profit Margins: Increased input costs, due to tariffs, directly reduce profit margins on each unit sold.

- Impact on Net Income: The direct financial effect of the tariff burden is a significant reduction in net income.

- EPS Decline: The decrease in net income translates into a lower earnings per share (EPS), impacting investor returns and potentially the stock price.

- Mitigation Strategies: Colgate is likely employing various strategies to mitigate losses, such as price increases (where feasible), cost-cutting measures in other areas of the business, and potentially seeking alternative sourcing for some products.

Keywords: profit margin, net income, EPS, profitability, cost-cutting measures, price adjustments

Investor Response and Stock Performance

The market reacted negatively to Colgate's announcement of the significant tariff burden. The stock price likely experienced fluctuations reflecting investor concerns about the impact on future earnings.

- Stock Price Volatility: The news likely caused temporary volatility in Colgate's stock price as investors processed the information and reassessed the company's prospects.

- Analyst Ratings: Financial analysts have likely revised their ratings or outlooks for Colgate in light of the tariff impact.

- Investor Sentiment: Investor sentiment towards Colgate may have shifted negatively in the short term, reflecting uncertainty about the long-term consequences of the tariff burden.

Keywords: Colgate stock price, investor reaction, stock market impact, market analysis, investment implications

Potential Future Implications and Strategies for Colgate

The long-term implications of the $200 million tariff burden are significant for Colgate's business strategy. The company may need to adapt to navigate the evolving trade landscape.

- Supply Chain Diversification: Colgate might explore diversifying its supply chains to reduce reliance on regions with high tariff rates.

- Price Adjustments: Further price adjustments may be necessary, although this carries the risk of impacting sales volume further.

- Product Innovation: Investing in product innovation and differentiation may allow Colgate to lessen the reliance on imported products subject to tariffs.

- Lobbying Efforts: Colgate may engage in lobbying efforts to influence trade policy and reduce tariffs on its products.

Keywords: future outlook, business strategy, risk management, long-term growth, trade policy

Conclusion: Navigating the Tariff Landscape: Colgate's Path Forward

The $200 million tariff burden represents a significant financial challenge for Colgate. The impact on sales, profits, and investor sentiment is undeniable. The company's ability to adapt to this changing global trade environment will significantly determine its long-term success. Understanding the impact of tariffs on Colgate, and similar analyses of other companies, is crucial for investors and business leaders navigating the complexities of global trade. Stay informed about Colgate’s performance and the ongoing impact of tariffs on global businesses. Further research into the impact of tariffs on other companies in similar sectors will provide a broader understanding of this evolving economic landscape. Keywords: Colgate tariff impact, impact of tariffs on Colgate.

Featured Posts

-

Podcast Creation Ais Role In Processing Repetitive Scatological Data

Apr 26, 2025

Podcast Creation Ais Role In Processing Repetitive Scatological Data

Apr 26, 2025 -

The Impact Of Trump Tariffs Ceos Detail Economic Slowdown And Consumer Fear

Apr 26, 2025

The Impact Of Trump Tariffs Ceos Detail Economic Slowdown And Consumer Fear

Apr 26, 2025 -

Stock Market Update Dow Futures Chinas Economic Policy And Tariff Implications

Apr 26, 2025

Stock Market Update Dow Futures Chinas Economic Policy And Tariff Implications

Apr 26, 2025 -

The Rise Of Chinese Automakers A Look At The Future Of Vehicles

Apr 26, 2025

The Rise Of Chinese Automakers A Look At The Future Of Vehicles

Apr 26, 2025 -

Why Middle Managers Are Essential For Company Success

Apr 26, 2025

Why Middle Managers Are Essential For Company Success

Apr 26, 2025

Latest Posts

-

Upset In Charleston Pegulas Dramatic Win Against Collins

Apr 27, 2025

Upset In Charleston Pegulas Dramatic Win Against Collins

Apr 27, 2025 -

Charleston Open Pegulas Epic Comeback Defeats Collins

Apr 27, 2025

Charleston Open Pegulas Epic Comeback Defeats Collins

Apr 27, 2025 -

Pegula Stuns Collins In Thrilling Charleston Open Final

Apr 27, 2025

Pegula Stuns Collins In Thrilling Charleston Open Final

Apr 27, 2025 -

Pegulas Charleston Open Comeback Stunning Victory Over Collins

Apr 27, 2025

Pegulas Charleston Open Comeback Stunning Victory Over Collins

Apr 27, 2025 -

Dubai Return Svitolina Triumphs In First Round

Apr 27, 2025

Dubai Return Svitolina Triumphs In First Round

Apr 27, 2025