2024 ING Group Form 20-F: Financial Performance And Outlook

Table of Contents

ING Group's 2024 Financial Performance: A Deep Dive

The ING Group 20-F filing offers a granular view of the company's 2024 financial performance. Analyzing key metrics provides a clear picture of its profitability and stability.

Revenue and Net Income Analysis

ING's revenue streams are diverse, spanning banking, insurance, and investments. Analyzing the performance of each segment is crucial. The 20-F will likely reveal:

- Wholesale Banking: Performance in areas like lending, trading, and corporate finance. Did revenue growth meet expectations in this sector?

- Retail Banking: Analysis of mortgage lending, consumer loans, and deposit accounts. What was the impact of interest rate changes on this segment's profitability?

- Insurance: Performance of various insurance products and their contribution to overall revenue. Were there significant claims impacting profitability?

- Investment Management: Performance of asset management products and their contribution to revenue. How did market volatility influence this segment?

Comparing these revenue streams to previous years’ performance, using percentage changes and identifying trends, is essential for evaluating overall revenue growth and profitability. The 20-F will likely detail the factors influencing net income, providing insights into profitability. Keywords like "revenue growth," "net income," and "profitability" are key to understanding this section.

Key Financial Ratios and Metrics

Assessing ING's financial health requires examining several key financial ratios. The 20-F will include data allowing calculation of:

- Return on Equity (ROE): Measures the profitability of a company relative to shareholder equity. A higher ROE generally indicates better efficiency.

- Return on Assets (ROA): Indicates how efficiently a company uses its assets to generate earnings. This ratio is crucial for evaluating overall efficiency.

- Debt-to-Equity Ratio: Measures the proportion of debt financing relative to equity financing. A high ratio can signify higher risk.

- Liquidity Ratios: These ratios (like the current ratio and quick ratio) reveal the company’s ability to meet its short-term obligations.

These ratios, when compared to industry benchmarks and previous years' performance, will provide a comprehensive view of ING's financial stability and solvency.

Risk Management and Capital Adequacy

The ING Group 20-F will detail the company's risk management strategies and capital adequacy levels. This is crucial for understanding the potential risks and the company's preparedness to handle them. Key aspects to examine include:

- Credit Risk: The risk of borrowers defaulting on their loans. How does ING mitigate this risk?

- Market Risk: Risks associated with market fluctuations and volatility. What strategies does ING employ to hedge against this risk?

- Operational Risk: The risk of losses due to internal processes or external events. What are the key operational risks ING faces?

- Capital Adequacy Ratio (CAR): This ratio, under Basel III regulations, measures a bank's capital relative to its risk-weighted assets. A strong CAR indicates the bank's ability to absorb losses.

Analyzing these elements provides critical insights into ING's financial stability and its ability to withstand economic shocks.

ING Group's 2024 Outlook and Future Strategies

The ING Group 20-F provides a glimpse into the company's future plans and strategies. Understanding these projections is crucial for evaluating long-term investment potential.

Growth Projections and Strategic Initiatives

ING's 20-F will outline its growth projections and strategic initiatives for 2024 and beyond. This includes:

- Expansion into new markets: Is ING planning to expand its operations geographically?

- Investment in new technologies: How does ING plan to leverage technology for growth?

- Product diversification: Is ING planning to introduce new financial products or services?

- Mergers and acquisitions: Are there any plans for acquisitions or mergers to boost growth?

Assessing the feasibility and potential success of these initiatives will help investors gauge future performance.

Technological Advancements and Digital Transformation

ING's investments in technology and its digital transformation strategy are critical to its future outlook. The 20-F will likely showcase:

- Investments in fintech: How is ING collaborating with or investing in fintech companies?

- Digital banking platforms: What improvements are being made to enhance the customer experience through digital channels?

- Data analytics and AI: How is ING leveraging these technologies to improve efficiency and decision-making?

ESG Performance and Sustainability Initiatives

Increasingly, ESG factors influence investor decisions. ING's commitment to sustainability is reflected in its 20-F filing. Key areas to examine include:

- Carbon footprint reduction targets: What are ING's targets for reducing its environmental impact?

- Social responsibility initiatives: What programs are in place to promote social equity and inclusion?

- Governance practices: What measures are in place to ensure ethical and responsible corporate governance?

Conclusion: Understanding the Implications of the ING Group 20-F for 2024

The ING Group 20-F filing for 2024 offers a comprehensive view of the company's financial performance, risk management, and future outlook. Analyzing the key financial ratios, growth projections, and strategic initiatives provides crucial insights for investors and stakeholders. By understanding ING's financial health, risk profile, and future plans, informed investment decisions can be made. Download the full ING Group 20-F filing to conduct your own thorough analysis of ING Group's 2024 financial performance data and stay informed about ING Group's 2024 outlook. A deep dive into the ING Group 20-F is essential for anyone seeking a comprehensive understanding of this global financial institution.

Featured Posts

-

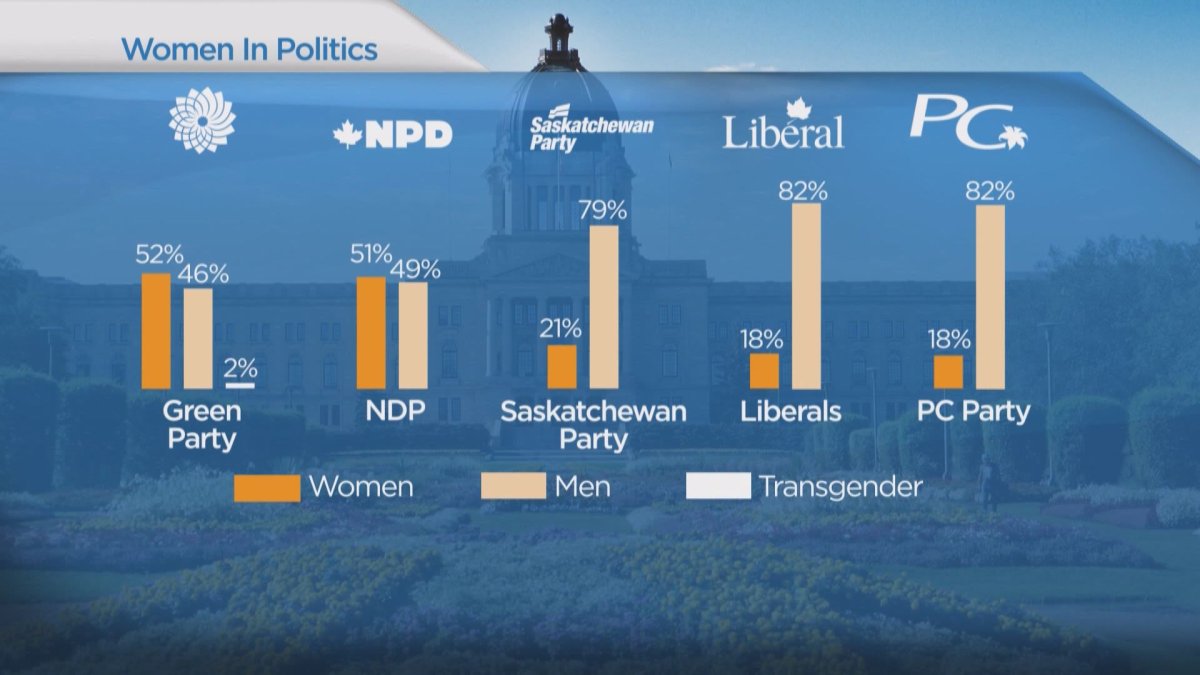

Costco And Saskatchewan Politics Examining A Recent Campaign

May 22, 2025

Costco And Saskatchewan Politics Examining A Recent Campaign

May 22, 2025 -

Clisson Retour Sur Le Festival Le Bouillon Et Ses Spectacles Engages

May 22, 2025

Clisson Retour Sur Le Festival Le Bouillon Et Ses Spectacles Engages

May 22, 2025 -

The Love Monster Within How To Cultivate Self Love And Acceptance

May 22, 2025

The Love Monster Within How To Cultivate Self Love And Acceptance

May 22, 2025 -

Oh Jun Sung Wins Wtt Star Contender Chennai Match Highlights

May 22, 2025

Oh Jun Sung Wins Wtt Star Contender Chennai Match Highlights

May 22, 2025 -

Geen Online Betalingen Voor Abn Amro Opslag Wat Nu

May 22, 2025

Geen Online Betalingen Voor Abn Amro Opslag Wat Nu

May 22, 2025

Latest Posts

-

Bbc Breakfast Guest Interrupts Live Show Are You Still There

May 22, 2025

Bbc Breakfast Guest Interrupts Live Show Are You Still There

May 22, 2025 -

Unexpected Moment Guest Interrupts Bbc Breakfast Live

May 22, 2025

Unexpected Moment Guest Interrupts Bbc Breakfast Live

May 22, 2025 -

Trans Australia Run World Record An Update

May 22, 2025

Trans Australia Run World Record An Update

May 22, 2025 -

British Ultrarunners Bid For Australian Crossing Speed Record

May 22, 2025

British Ultrarunners Bid For Australian Crossing Speed Record

May 22, 2025 -

Bbc Breakfast Presenters Are You Still There Moment Guest Interruption Explained

May 22, 2025

Bbc Breakfast Presenters Are You Still There Moment Guest Interruption Explained

May 22, 2025