2025 Gold Market: Analysis Of Recent Price Drops

Table of Contents

Impact of Rising Interest Rates on Gold Prices

Rising interest rates significantly impact the gold market. Gold, unlike interest-bearing assets, doesn't offer a yield. This means rising interest rates increase the opportunity cost of holding gold. Investors can earn a return on their investments elsewhere, making dollar-denominated assets, such as high-yield bonds and savings accounts, more attractive. This shift in investor preference often leads to decreased demand for gold and subsequently lower prices.

-

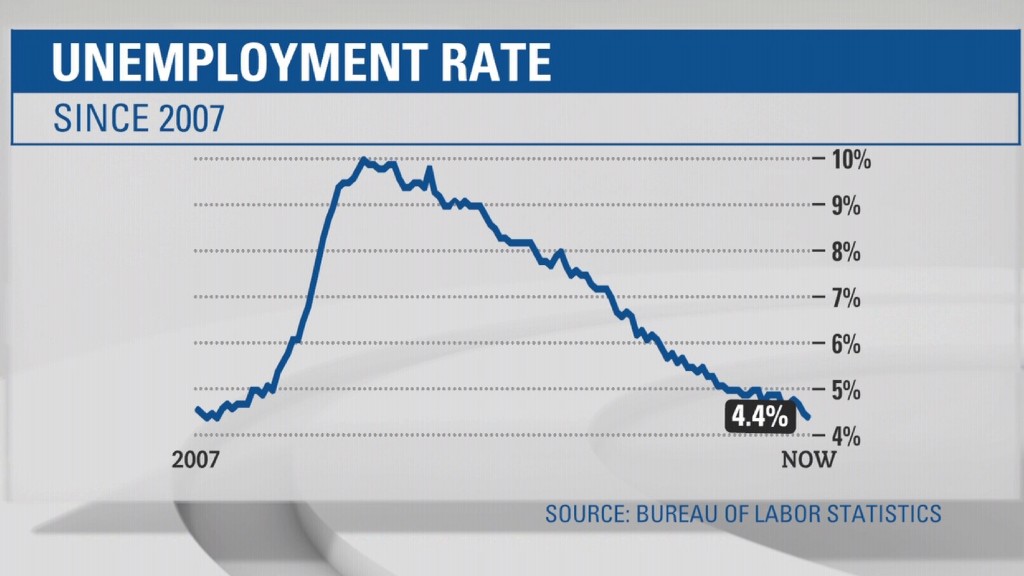

Correlation between Interest Rate Hikes and Gold Price Movements: Historically, there's a negative correlation between interest rate hikes (for example, those implemented by the Federal Reserve) and gold prices. As interest rates rise, gold prices tend to fall, and vice-versa.

-

Historical Data Analysis: Examining past periods of rising interest rates reveals a consistent pattern of gold price declines. For instance, [cite relevant historical data and sources]. This demonstrates the significant impact of monetary policy on gold's performance.

-

Alternative Investments: The rise in interest rates has spurred the popularity of alternative investments offering higher yields, drawing capital away from the gold market and further contributing to price drops.

Geopolitical Factors Influencing the Gold Market 2025

Geopolitical uncertainty is a major driver of gold prices. Gold is often considered a "safe-haven" asset, meaning investors flock to it during times of political and economic turmoil. However, the current geopolitical landscape presents a complex picture. While some events might increase gold demand, others could suppress it.

-

Specific Geopolitical Events and their Impact: Recent conflicts, trade wars, and political instability have influenced gold prices. For example, [cite specific examples and their impact on gold prices]. These events create uncertainty, prompting investors to seek the safety of gold.

-

Gold as a Safe Haven Asset: The role of gold as a safe haven asset is well-established. However, the effectiveness of this role depends on the nature and severity of the geopolitical event. Sometimes, other assets might also be considered safe havens depending on the context.

-

Influence of Specific Countries/Regions: The gold demand from countries like India and China, major consumers of gold jewelry, plays a significant role in price dynamics. Changes in their economic growth or policies can directly affect the overall gold market.

Inflation and its Effect on the Gold Price

Historically, gold has been considered a hedge against inflation. However, the relationship between gold and inflation isn't always linear. Several factors influence how gold performs during inflationary periods.

-

Current Inflation Rates and their Effect on Gold: Analyzing current inflation rates and comparing them to historical levels is crucial to understand the current relationship between inflation and gold prices. [Cite relevant inflation data and source].

-

Comparison with Historical Periods: Examining past inflationary periods and their impact on gold prices provides valuable insights. [Cite historical examples and analysis]. This helps to put the current situation into perspective.

-

Stagflation and its Effect on the Gold Market 2025: The possibility of stagflation (a combination of slow economic growth and high inflation) poses a unique challenge. Its impact on gold prices would depend on a number of factors, potentially increasing or decreasing gold's appeal as a safe-haven asset.

Supply and Demand Dynamics in the Gold Market

The interplay of supply and demand is fundamental to gold price determination. Mining production levels, jewelry demand, and central bank activities all affect the overall market equilibrium.

-

Gold Mining Production and Future Output: Analyzing current gold mining production levels and forecasting future output is crucial for understanding potential supply-side pressures on prices. [Cite data and projections from reputable sources].

-

Impact of Shifting Jewelry Demand: Changes in jewelry demand, particularly in major markets like India and China, can significantly influence gold prices. Economic factors and cultural trends impact these demand fluctuations.

-

Role of Central Bank Gold Reserves: Central banks' actions, such as buying or selling gold reserves, can have a considerable effect on the overall supply and demand balance in the market, impacting gold prices.

Investor Sentiment and Market Speculation

Investor sentiment and market speculation play a crucial role in gold price volatility. Short-term fluctuations are often driven by these factors, creating both opportunities and risks for investors.

-

Recent Investor Sentiment Towards Gold: Analyzing recent investor sentiment surveys and market reports helps to understand the prevailing mood towards gold investments.

-

Influence of Large Institutional Investors: Large institutional investors can significantly influence gold prices through their buying and selling activities. Their decisions are often based on macroeconomic forecasts and risk assessments.

-

Impact of Speculative Trading: Speculative trading activities can amplify short-term price fluctuations, creating significant volatility in the gold market. Understanding these trends is essential for managing risk effectively.

Conclusion

The recent price drops in the gold market are a complex interplay of factors, including rising interest rates, geopolitical instability, inflationary pressures, supply and demand dynamics, and investor sentiment. While predicting the Gold Market 2025 with certainty is impossible, understanding these key drivers allows for a more informed assessment. Further analysis and monitoring of these factors are crucial for navigating the future of gold investments. Stay informed about these developments to make well-informed decisions in the dynamic Gold Market 2025. For further insights into the future of the gold market, continue researching factors influencing the gold price and consider consulting a financial advisor.

Featured Posts

-

April Jobs Report 177 000 New Jobs Unemployment Steady At 4 2

May 05, 2025

April Jobs Report 177 000 New Jobs Unemployment Steady At 4 2

May 05, 2025 -

New Jobs Report U S Employment Up 177 000 In April Unemployment 4 2

May 05, 2025

New Jobs Report U S Employment Up 177 000 In April Unemployment 4 2

May 05, 2025 -

Ufc 314 Revised Fight Card After Prates Neal Bout Cancellation

May 05, 2025

Ufc 314 Revised Fight Card After Prates Neal Bout Cancellation

May 05, 2025 -

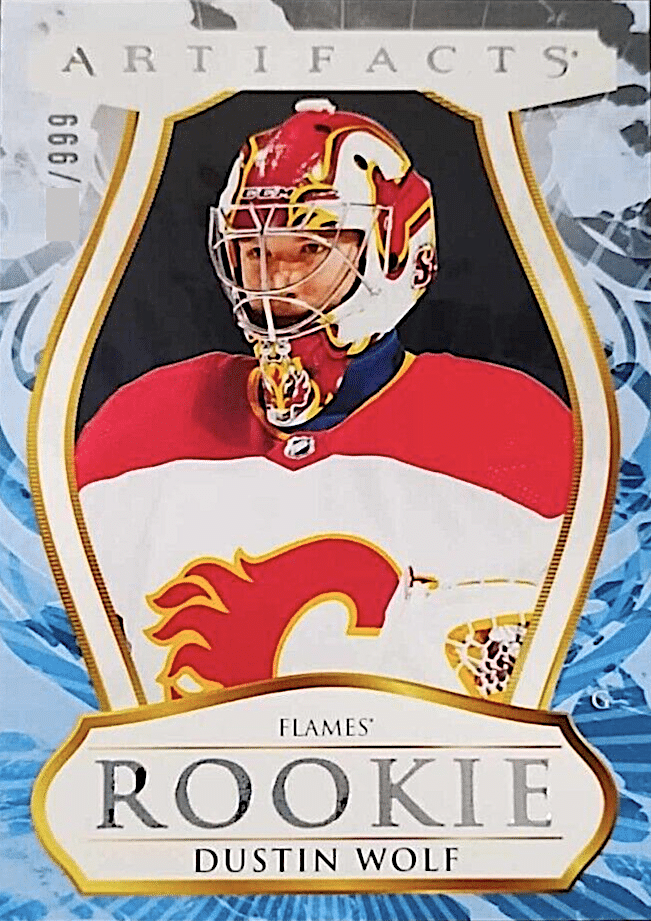

Calgary Flames Wolf Playoff Outlook And Calder Trophy Possibilities In Nhl Com Interview

May 05, 2025

Calgary Flames Wolf Playoff Outlook And Calder Trophy Possibilities In Nhl Com Interview

May 05, 2025 -

The Future Of Darjeeling Tea Facing Production Challenges

May 05, 2025

The Future Of Darjeeling Tea Facing Production Challenges

May 05, 2025

Latest Posts

-

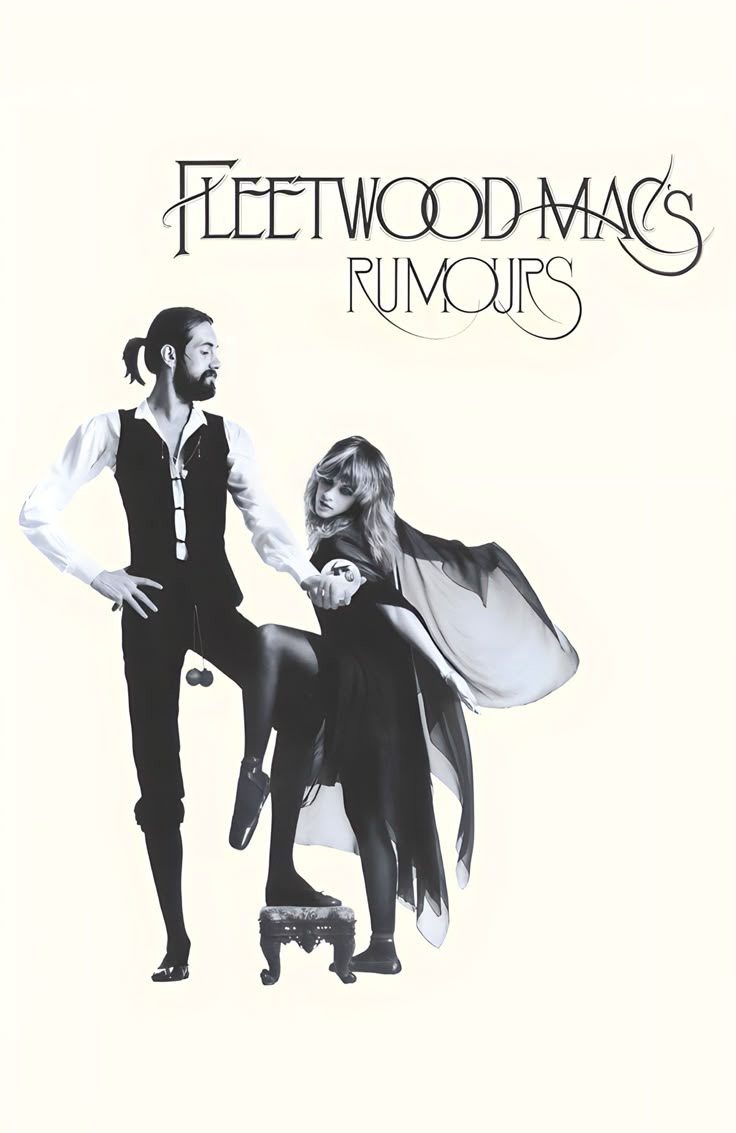

The Untold Story Behind Fleetwood Macs Rumours 48 Years Of Influence

May 05, 2025

The Untold Story Behind Fleetwood Macs Rumours 48 Years Of Influence

May 05, 2025 -

Rumours At 48 The Impact Of Fleetwood Macs Implosion On Music History

May 05, 2025

Rumours At 48 The Impact Of Fleetwood Macs Implosion On Music History

May 05, 2025 -

The Fleetwood Mac Phenomenon Debunking The First Supergroup Rumours

May 05, 2025

The Fleetwood Mac Phenomenon Debunking The First Supergroup Rumours

May 05, 2025 -

Buckingham And Fleetwoods Studio Sessions A Collaboration

May 05, 2025

Buckingham And Fleetwoods Studio Sessions A Collaboration

May 05, 2025 -

Fleetwood Macs Rumours A 48 Year Retrospective Of Heartbreak And Hitmaking

May 05, 2025

Fleetwood Macs Rumours A 48 Year Retrospective Of Heartbreak And Hitmaking

May 05, 2025