2025 Investment Outlook: MicroStrategy Stock Vs. Bitcoin

Table of Contents

Understanding MicroStrategy's Bitcoin Strategy

MicroStrategy's bold embrace of Bitcoin has fundamentally reshaped its business model and significantly influenced its stock price. Understanding this strategy is crucial to evaluating its investment potential alongside Bitcoin itself.

MicroStrategy's Bitcoin Holdings and Business Model

MicroStrategy, a business intelligence company, has made a massive bet on Bitcoin, accumulating a substantial hoard of BTC. This aggressive strategy directly links the company's valuation to Bitcoin's price performance. While this offers the potential for enormous gains if Bitcoin's price appreciates, it also exposes the company to significant losses if the cryptocurrency's value declines. This creates a high-risk, high-reward scenario.

- Massive Bitcoin accumulation by MicroStrategy: The company's Bitcoin holdings represent a significant portion of its overall assets, creating a strong correlation between MSTR stock and BTC price.

- Correlation between MSTR stock price and BTC price: MSTR stock price movements closely mirror Bitcoin's price fluctuations, making it a leveraged play on the cryptocurrency.

- Potential for significant gains or losses based on Bitcoin's trajectory: The success of a MicroStrategy investment is heavily dependent on Bitcoin's future price action.

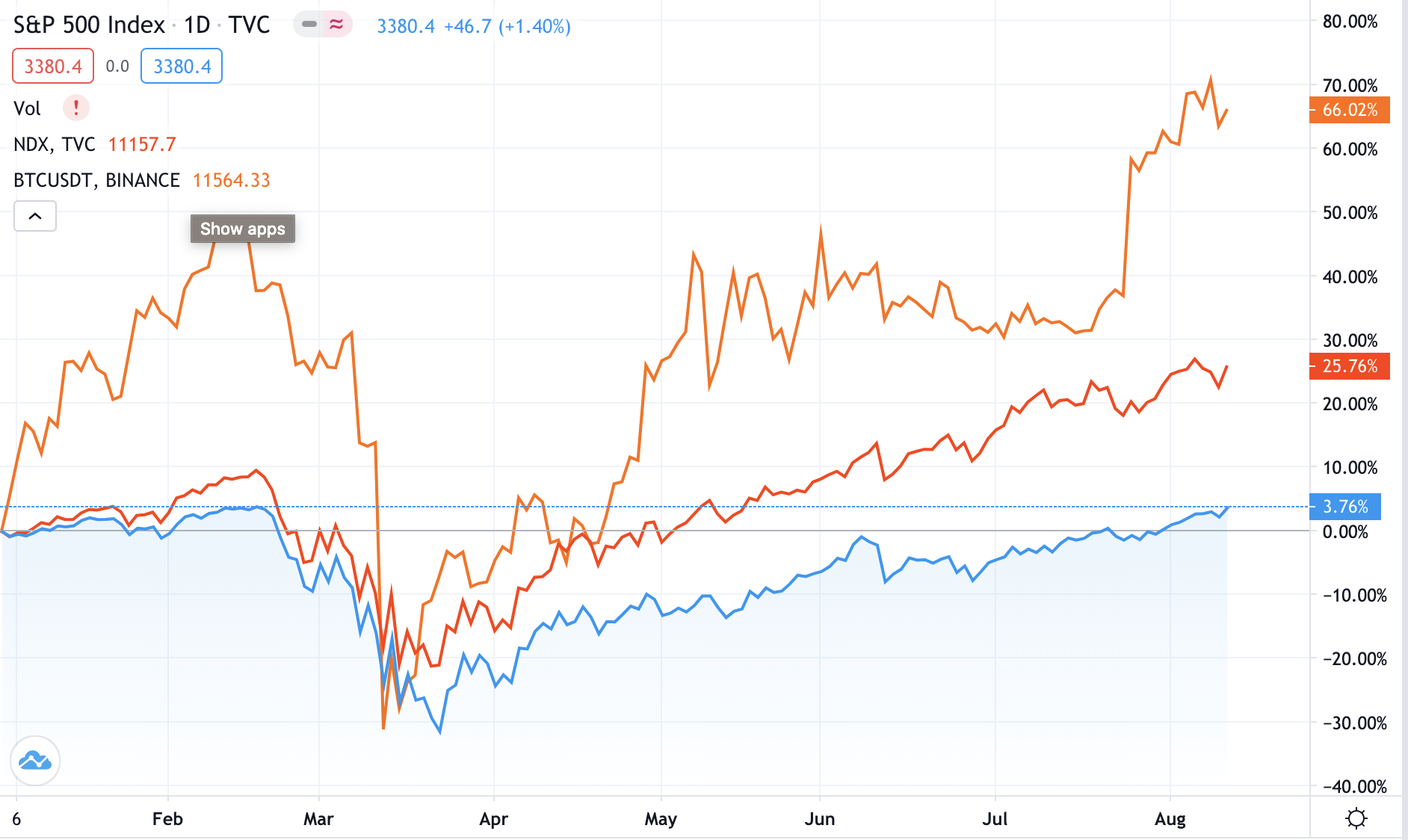

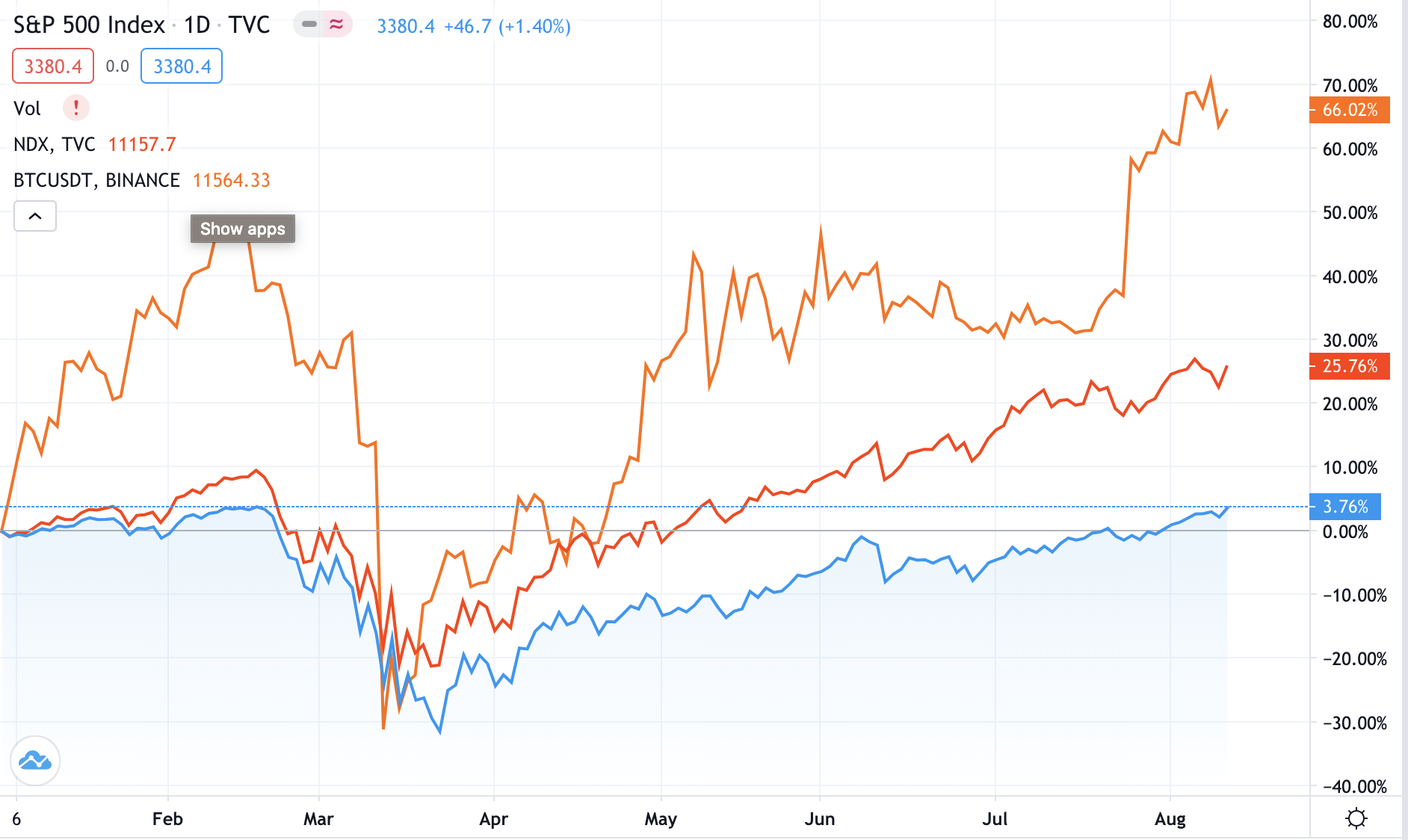

Analyzing MicroStrategy's Stock Performance

Analyzing MicroStrategy's historical stock performance provides valuable insights. While the company's stock has experienced periods of impressive growth fueled by Bitcoin's price rallies, it has also suffered during Bitcoin's price corrections. Understanding factors beyond Bitcoin's price is crucial. Macroeconomic factors, market sentiment towards the company's core business operations, and overall investor confidence all play a significant role.

- Historical stock chart analysis: A thorough analysis of MSTR's stock chart reveals a strong correlation with Bitcoin's price history.

- Influence of macroeconomic factors on MSTR: Global economic trends, interest rate changes, and overall market sentiment impact MSTR's stock price, independent of Bitcoin’s performance.

- Analyst predictions for MSTR stock in 2025: Consulting reputable financial analysts' reports can provide further insights into potential future price movements.

Bitcoin's Potential in 2025

Bitcoin, the original and most well-known cryptocurrency, continues to evolve. Predicting its price in 2025 remains a complex task, yet understanding its potential and associated risks is paramount for any investor.

Bitcoin's Price Prediction and Market Factors

Numerous sources offer Bitcoin price predictions for 2025, ranging from extremely bullish to cautiously bearish. These predictions often differ due to differing methodologies and assumptions about future adoption rates, regulatory changes, and technological advancements.

- Bullish vs. bearish Bitcoin predictions: A range of predictions exist, reflecting the inherent uncertainty in forecasting cryptocurrency prices.

- Impact of institutional adoption on Bitcoin's price: Increased adoption by institutional investors could significantly impact Bitcoin's price.

- Influence of regulatory frameworks on Bitcoin’s future: Government regulations and legal frameworks around the world will greatly influence Bitcoin's growth and adoption.

Risks and Rewards of Bitcoin Investment

Bitcoin's high volatility is both its greatest allure and its biggest risk. While the potential for substantial returns is undeniable, so is the possibility of significant losses.

- Volatility as a major risk factor for Bitcoin: Bitcoin's price can fluctuate dramatically in short periods, creating substantial risk for investors.

- Potential for substantial returns on Bitcoin investment: The history of Bitcoin demonstrates its potential for exponential growth.

- Importance of diversification and risk tolerance: Diversifying your portfolio and carefully assessing your risk tolerance are crucial before investing in Bitcoin.

MicroStrategy Stock vs. Bitcoin: A Direct Comparison

Comparing MicroStrategy stock and Bitcoin directly helps clarify the distinctions in their investment profiles and suitability for different investor types.

Investment Strategies and Risk Profiles

Investing in MicroStrategy stock offers a less direct, yet still highly correlated, exposure to Bitcoin's price. Directly holding Bitcoin offers more leveraged exposure, but also carries greater risk.

- Comparison of risk-reward ratios for both assets: MSTR offers a potentially lower risk-reward ratio than directly holding BTC, but still carries considerable volatility.

- Suitable investor profiles for MSTR vs. BTC: Investors with higher risk tolerance and a longer time horizon may prefer direct Bitcoin investment. More risk-averse investors might find MSTR more appealing.

- Diversification strategies combining MSTR and BTC: A diversified portfolio might incorporate both assets to balance risk and potential reward.

Conclusion: Making Informed Investment Decisions: MicroStrategy Stock vs. Bitcoin in 2025

Both MicroStrategy stock and Bitcoin present opportunities for significant returns but also carry considerable risk. The "MicroStrategy Stock vs. Bitcoin" decision hinges on your individual risk tolerance, investment goals, and understanding of the market. Remember that thorough research is crucial. Consider consulting financial advisors and utilizing reputable resources to inform your investment strategy. Continue researching "MicroStrategy Stock vs. Bitcoin" and other relevant assets before committing your capital. Remember to only invest what you can afford to lose. Make informed decisions based on your individual financial situation and risk appetite. Utilize resources like financial news websites and analyst reports to further your understanding of this dynamic investment landscape.

Featured Posts

-

Scholar Rock Stock Price Drop On Monday A Market Overview

May 08, 2025

Scholar Rock Stock Price Drop On Monday A Market Overview

May 08, 2025 -

Arsenal Ps Zh Vse Matchi V Evrokubkakh

May 08, 2025

Arsenal Ps Zh Vse Matchi V Evrokubkakh

May 08, 2025 -

Saturday Night Lives Impact On Counting Crows Career

May 08, 2025

Saturday Night Lives Impact On Counting Crows Career

May 08, 2025 -

Lotto 6aus49 Ziehungsergebnis Vom 12 April 2025

May 08, 2025

Lotto 6aus49 Ziehungsergebnis Vom 12 April 2025

May 08, 2025 -

Saturday Night Live And Counting Crows A Defining Moment In Music History

May 08, 2025

Saturday Night Live And Counting Crows A Defining Moment In Music History

May 08, 2025