2025 Market Analysis: Deconstructing The D-Wave Quantum (QBTS) Stock Fall

Table of Contents

The Macroeconomic Impact on QBTS Stock Performance

The broader economic climate of 2025 significantly influenced QBTS stock performance, mirroring the impact on other tech stocks, particularly those in nascent sectors like quantum computing. The year was marked by considerable volatility, impacting investor confidence and risk appetite.

-

Increased interest rates: The Federal Reserve's aggressive interest rate hikes to combat inflation made borrowing more expensive, impacting the valuations of high-growth, speculative stocks like QBTS. Investors shifted towards safer, more stable investments with higher yields, reducing capital available for riskier ventures.

-

General market corrections: The overall market experienced several corrections throughout 2025. These corrections disproportionately affected riskier assets, including QBTS, as investors sought to protect their portfolios from potential losses. This market volatility created a downward pressure on QBTS share price.

-

Reduced investor appetite for long-term, high-risk ventures: The uncertainty surrounding the global economy led to a reduced appetite for long-term, high-risk investments. Quantum computing, being a relatively new and unproven technology, faced heightened scrutiny and reduced investor enthusiasm. This resulted in decreased demand for QBTS shares, contributing to the price decline.

The correlation between overall market trends and the QBTS stock price was stark. (Ideally, a chart showing this correlation would be included here). Periods of market volatility directly corresponded with sharp drops in QBTS valuation, highlighting the inherent risk associated with investing in this sector during times of economic uncertainty. Understanding the interplay between macroeconomic factors and quantum computing investment risk is crucial for future investment strategies.

D-Wave Quantum's Technological Challenges and Competitor Landscape

D-Wave Quantum's technological hurdles and the competitive landscape played a crucial role in the QBTS stock fall. While D-Wave was a pioneer in quantum annealing, several factors eroded investor confidence.

-

Competition from other quantum computing companies: The emergence of competitors with potentially superior technologies, such as companies focusing on gate-based quantum computing, presented a significant challenge. These advancements in alternative approaches to quantum computing created doubt about the long-term viability of D-Wave's quantum annealing approach.

-

Challenges in scaling D-Wave's quantum annealers: Scaling quantum annealers to meet growing market demands proved difficult. The limitations in scalability hampered D-Wave's ability to offer commercially competitive solutions, impacting investor perceptions of future growth potential.

-

Slow progress in delivering commercially viable quantum applications: The lack of widespread adoption of D-Wave's technology, and the slow pace in delivering commercially viable quantum applications, further dampened investor enthusiasm. This underscored the technological maturity gap and the considerable time required before significant returns on investment could be expected.

Keywords like "quantum annealing," "gate-based quantum computing," "competitive landscape," "scalability challenges," "commercial applications of quantum computing," and "quantum supremacy" were heavily discussed in industry analysis throughout 2025, reflecting the pressures faced by D-Wave.

Disappointment in Revenue Projections and Financial Performance

D-Wave's 2025 financial reports revealed areas of underperformance that negatively impacted investor sentiment, contributing substantially to the QBTS stock fall.

-

Missed revenue targets: D-Wave consistently missed its revenue targets throughout 2025, raising concerns about the company's ability to generate sufficient revenue to support its operations and future growth. This directly impacted stock valuation and investor confidence.

-

Increased operating costs: Rising operating costs, particularly related to research and development, further strained the company's financial performance. The increasing gap between revenue and expenses fueled concerns about the company's long-term sustainability.

-

Negative cash flow: The combination of missed revenue targets and escalating costs resulted in negative cash flow, raising serious concerns among investors about the company's ability to remain solvent. This uncertainty significantly impacted the stock price.

These financial indicators, alongside discussions surrounding "financial performance," "revenue growth," "profitability margins," "cash flow projections," and "stock valuation models," dominated financial news and analyst reports, leading to a sell-off in QBTS shares.

Impact of negative news and press coverage on QBTS stock

Negative news, analyst downgrades, and social media sentiment significantly impacted the QBTS stock price during 2025.

-

Specific examples of negative news: Several news articles highlighted missed deadlines, technological setbacks, and concerns about the company's long-term financial stability, directly contributing to negative investor sentiment.

-

Analysis of social media sentiment: Social media platforms reflected a generally negative sentiment surrounding QBTS, with many discussions focusing on the company's challenges and the uncertainty surrounding its future prospects.

-

The role of financial news outlets: Major financial news outlets played a significant role in shaping investor perceptions, disseminating negative news and analysis to a wide audience, thereby exacerbating the stock price decline.

The interplay of "negative news cycles," "analyst ratings downgrades," "social media sentiment analysis," "media coverage impact," and "investor perception management" played a crucial role in the QBTS stock fall, showcasing the importance of public perception in the volatile world of tech stocks.

Conclusion

The significant drop in D-Wave Quantum (QBTS) stock in 2025 resulted from a confluence of factors, including macroeconomic headwinds, internal technological challenges, disappointing financial results, and amplified negative press coverage. Understanding these contributing elements is crucial for investors seeking to navigate the complexities of the quantum computing market. Further research into D-Wave's strategic direction and technological advancements, along with careful monitoring of macroeconomic conditions, will be vital in predicting future QBTS stock performance. Therefore, continuous monitoring of the D-Wave Quantum (QBTS) stock and the broader quantum computing market is essential for savvy investors.

Featured Posts

-

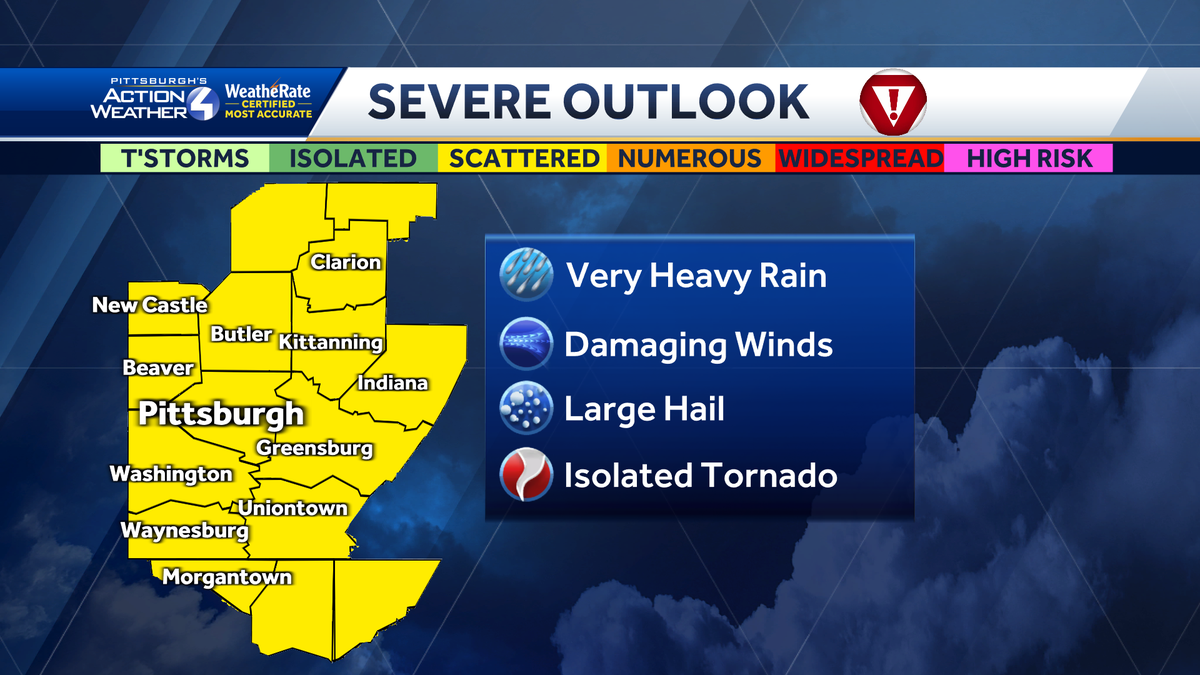

When To Watch For Damaging Winds From Fast Storms

May 21, 2025

When To Watch For Damaging Winds From Fast Storms

May 21, 2025 -

Razvod Vanje Mijatovic Sta Se Zapravo Dogodilo

May 21, 2025

Razvod Vanje Mijatovic Sta Se Zapravo Dogodilo

May 21, 2025 -

May 19 2025 Wwe Raw Results Full Show Grades And Winners

May 21, 2025

May 19 2025 Wwe Raw Results Full Show Grades And Winners

May 21, 2025 -

The Porsche Paradox Straddling Two Luxury Markets In A Time Of Trade Uncertainty

May 21, 2025

The Porsche Paradox Straddling Two Luxury Markets In A Time Of Trade Uncertainty

May 21, 2025 -

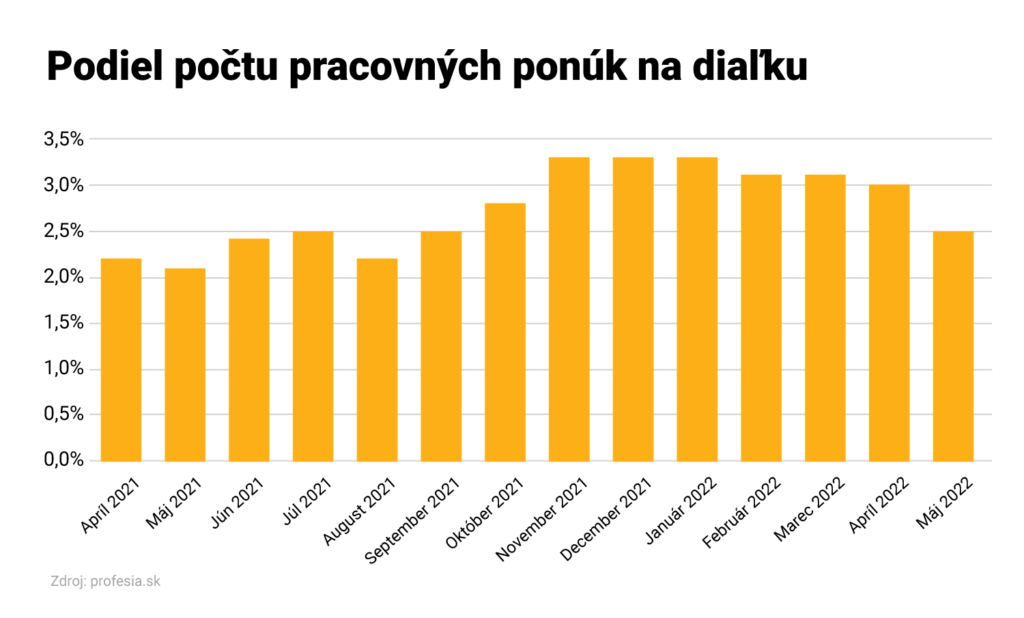

Flexibilna Praca Home Office Kancelaria Alebo Kombinacia Obidvoch

May 21, 2025

Flexibilna Praca Home Office Kancelaria Alebo Kombinacia Obidvoch

May 21, 2025

Latest Posts

-

Mntkhb Amryka Thlath Mfajat Fy Qaymt Bwtshytynw Aljdydt

May 22, 2025

Mntkhb Amryka Thlath Mfajat Fy Qaymt Bwtshytynw Aljdydt

May 22, 2025 -

Thlatht Njwm Yndmwn Lawl Mrt Lmntkhb Amryka Tht Qyadt Bwtshytynw

May 22, 2025

Thlatht Njwm Yndmwn Lawl Mrt Lmntkhb Amryka Tht Qyadt Bwtshytynw

May 22, 2025 -

Tweet Leads To Imprisonment Southport Stabbing Case And Mothers Home Confinement

May 22, 2025

Tweet Leads To Imprisonment Southport Stabbing Case And Mothers Home Confinement

May 22, 2025 -

Tory Wifes Jail Sentence Stands Following Southport Migrant Comments

May 22, 2025

Tory Wifes Jail Sentence Stands Following Southport Migrant Comments

May 22, 2025 -

Connolly Loses Appeal Former Tory Councillors Wife Sentenced For Racial Hatred Post

May 22, 2025

Connolly Loses Appeal Former Tory Councillors Wife Sentenced For Racial Hatred Post

May 22, 2025