£3 Billion Cut To SSE Spending Plan: Impact Of Slower Economic Growth

Table of Contents

Reasons Behind the £3 Billion Spending Cut

Soaring inflation and increased interest rates are the primary drivers behind SSE's drastic cost reduction measures. The cost of borrowing has skyrocketed, making large-scale energy infrastructure projects significantly less financially viable. This is further exacerbated by volatile energy prices and reduced consumer demand, creating uncertainty within the energy market and impacting investment decisions.

- Soaring Inflation and Interest Rates: Increased borrowing costs directly impact the feasibility of multi-billion-pound projects. The higher the interest rate, the more expensive it becomes to finance these endeavors, leading to project delays or cancellations.

- Volatile Energy Prices and Reduced Demand: Fluctuations in energy prices and a potential decrease in consumer demand due to economic uncertainty make predicting future returns on investment extremely challenging. This risk aversion leads to a more cautious approach to investment.

- Regulatory Uncertainty and Policy Shifts: Changes in government regulations and potential policy shifts regarding energy production and distribution introduce additional risk factors. Uncertainty surrounding future policies makes long-term investment planning incredibly difficult.

- Increased Material and Labor Costs: The rising costs of materials and labor have added significant pressure to project budgets, further contributing to the need for cost reduction. These increased expenses make it even harder to justify large-scale investments.

- Global Economic Headwinds: The current global economic climate, characterized by inflation and recessionary fears, has forced SSE to adopt a more conservative approach to investment, prioritizing projects with a lower risk profile.

Impact on SSE's Future Projects

The £3 billion spending cut will undeniably impact SSE's future projects, particularly in the renewable energy sector. This reduction could lead to delays or even cancellations of crucial initiatives aimed at achieving the UK's net-zero targets. The consequences extend beyond renewable energy, impacting essential network upgrades and transmission projects.

- Renewable Energy Project Delays: Several renewable energy projects, including wind farms and solar power plants, might experience significant delays or face outright cancellation. This slows the UK's transition to cleaner energy sources.

- Network Upgrade Postponements: Planned upgrades to the electricity network, crucial for ensuring grid stability and increasing capacity, may be scaled back or postponed, potentially leading to future grid instability and power outages.

- Transmission Project Setbacks: Transmission projects, vital for transporting renewable energy from generation sites to consumption areas, could also face significant setbacks, hindering the efficient integration of renewable energy into the national grid.

- Job Losses Across SSE and Supply Chains: The spending cuts could unfortunately result in job losses within SSE and across its supply chain, negatively impacting employment within the energy sector and related industries.

- Slower Energy Transition: The overall pace of the UK's energy transition, crucial for achieving climate goals, might be significantly slowed down as a consequence of these budget reductions.

Wider Economic Implications of the SSE Cuts

The SSE spending cuts are not isolated incidents; they reflect broader concerns about economic growth and investment in the UK. The ripple effects extend beyond SSE, impacting job creation, supply chains, and investor confidence.

- UK Economic Slowdown: The reduced spending signals a potential slowdown in investment across the UK economy, adding to existing concerns about economic growth. This decreased investment could have far-reaching consequences across multiple sectors.

- Job Losses and Economic Uncertainty: The cutbacks could lead to job losses not only within SSE but also in related industries, contributing to economic uncertainty and potentially dampening consumer spending.

- Supply Chain Disruption: Companies within the supply chain that rely on SSE projects may experience disruptions and potential financial difficulties, leading to further economic instability.

- Impact on Investor Confidence: The SSE spending cuts contribute to a climate of economic uncertainty, potentially impacting investor confidence and discouraging future investment in the UK.

- Climate Target Challenges: The government's ability to meet its ambitious climate targets could be severely affected by delays in vital energy infrastructure projects resulting from these cost-cutting measures.

Conclusion

The £3 billion cut to SSE's spending plan serves as a stark indicator of the economic challenges facing the UK, particularly within the energy sector. This reduction significantly impacts SSE's future projects, potentially delaying renewable energy initiatives and affecting the UK's energy transition goals. The wider economic implications, including job losses and supply chain disruption, further highlight the severity of the situation. Understanding the implications of these SSE spending cuts is crucial for stakeholders across the energy sector and the UK economy. Stay informed about the evolving situation surrounding SSE spending and its impact on the future of energy investment. Follow our updates for further analysis on the £3 billion SSE spending cuts and the impact of slower economic growth.

Featured Posts

-

Goroskopy I Predskazaniya Lyubov Karera Finansy

May 24, 2025

Goroskopy I Predskazaniya Lyubov Karera Finansy

May 24, 2025 -

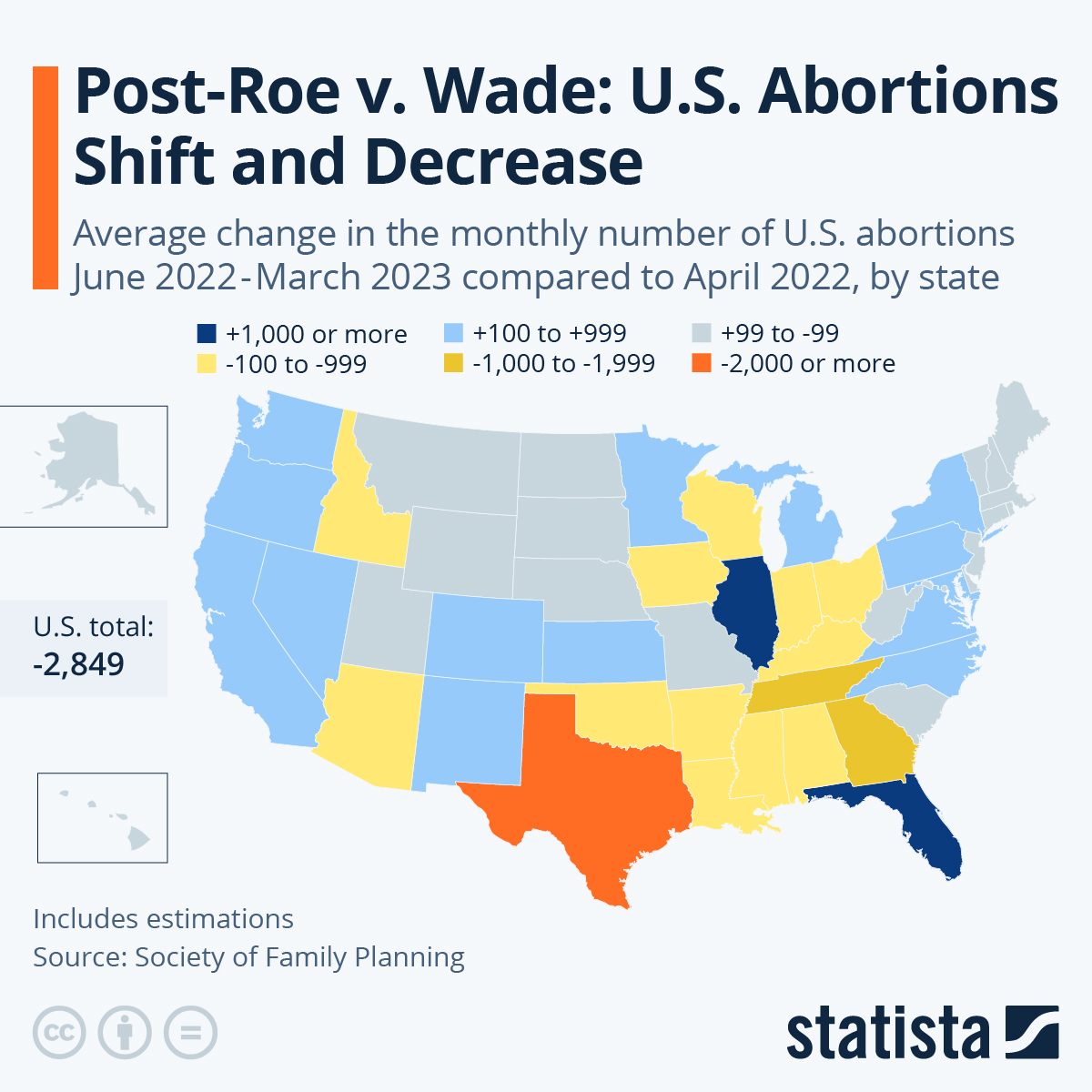

Over The Counter Birth Control Implications For Reproductive Health After Roe V Wade

May 24, 2025

Over The Counter Birth Control Implications For Reproductive Health After Roe V Wade

May 24, 2025 -

Electric Vehicle Mandate Faces Renewed Opposition From Car Dealers

May 24, 2025

Electric Vehicle Mandate Faces Renewed Opposition From Car Dealers

May 24, 2025 -

Test Naskolko Khorosho Vy Znaete Roli Olega Basilashvili

May 24, 2025

Test Naskolko Khorosho Vy Znaete Roli Olega Basilashvili

May 24, 2025 -

Ecb Faiz Indirimi Avrupa Borsalarinda Karisik Bir Guen

May 24, 2025

Ecb Faiz Indirimi Avrupa Borsalarinda Karisik Bir Guen

May 24, 2025

Latest Posts

-

Historic Commencement Famous Amphibian Delivers Address At University Of Maryland

May 24, 2025

Historic Commencement Famous Amphibian Delivers Address At University Of Maryland

May 24, 2025 -

2025 Umd Graduation The Unexpected Kermit The Frog Announcement

May 24, 2025

2025 Umd Graduation The Unexpected Kermit The Frog Announcement

May 24, 2025 -

The Muppet Maestro Kermit At The University Of Maryland Commencement

May 24, 2025

The Muppet Maestro Kermit At The University Of Maryland Commencement

May 24, 2025 -

World Famous Amphibian To Deliver Commencement Speech At University Of Maryland

May 24, 2025

World Famous Amphibian To Deliver Commencement Speech At University Of Maryland

May 24, 2025 -

Umd Commencement 2025 Kermit The Frogs Inspiring Address

May 24, 2025

Umd Commencement 2025 Kermit The Frogs Inspiring Address

May 24, 2025