£3 Billion Spending Cut By SSE: Analysis And Implications For Investors

Table of Contents

Reasons Behind SSE's £3 Billion Spending Cut

Several interconnected factors have driven SSE's decision to slash its spending by £3 billion. The current economic climate plays a significant role.

-

Economic Headwinds: Soaring inflation, aggressive interest rate hikes by the Bank of England, and the looming threat of a recession have significantly impacted investment decisions across all sectors, including energy. The increased cost of borrowing makes large-scale projects considerably less attractive.

-

Internal Strategic Realignment: SSE is undertaking a strategic review of its investment portfolio. This involves a shift in focus towards its core business areas and a reassessment of the profitability and long-term viability of certain projects. This is a common response to economic uncertainty and a need to prioritize shareholder value.

-

Specific Areas Affected: The £3 billion cut will impact several areas, including:

- Renewable Energy Projects: A reduction in investment in new renewable energy projects, potentially leading to delays or cancellations of some schemes. The exact percentage reduction hasn't been fully specified, but analysts suggest a considerable impact.

- Network Infrastructure: Less investment in upgrading and expanding the electricity network, which could affect the UK's capacity to handle future energy demands.

- Operational Costs: SSE will likely implement measures to streamline operations and reduce ongoing expenses.

The overall impact on capital expenditure will be substantial, likely representing a double-digit percentage reduction compared to previous plans. This reflects a cautious approach to investment in the face of economic uncertainty. The precise breakdown of the £3 billion cut across these areas is still emerging, and further details are awaited from SSE’s upcoming financial reports. This uncertainty is contributing to the current volatility in SSE's share price.

Implications for Investors

The immediate impact of SSE's announcement was a dip in the company's share price, reflecting investor concerns about reduced growth prospects. However, the long-term implications are more nuanced.

-

SSE Share Price Volatility: The share price reaction highlights the market's sensitivity to this significant strategic shift. Short-term volatility is expected, but the longer-term impact depends on the success of SSE's revised strategy.

-

Dividend Payouts: While the spending cut aims to improve financial stability, there’s a potential risk to future dividend payouts. SSE will need to carefully balance its commitment to shareholders with its revised investment priorities.

-

Risks and Opportunities:

- Risks: Reduced growth potential, potential loss of market share in certain sectors, and increased vulnerability to future economic shocks.

- Opportunities: Improved financial stability, enhanced focus on core profitable areas, and a more resilient business model adapted to a challenging economic environment.

-

Alternative Investment Options: Investors are now reevaluating their positions in SSE and seeking alternative investment options within the energy sector. This includes exploring companies with a stronger focus on specific areas like renewable energy or those demonstrating greater financial stability.

Impact on Renewable Energy Projects

The spending cut's impact on SSE's renewable energy portfolio is particularly noteworthy, given the UK's ambitious net-zero targets. While SSE remains committed to renewable energy, the delay or cancellation of some projects could hinder progress towards these goals. The extent of the impact will depend on which specific projects are affected and the alternative timelines for their completion. This situation also raises questions about the broader implications for the UK's renewable energy investment landscape and whether other energy companies will adopt similar cost-cutting measures.

Future Outlook for SSE

SSE's future trajectory will depend heavily on the success of its revised strategic direction. The company will need to demonstrate a clear path to profitability and sustainable growth under the new investment strategy.

-

Revised Strategic Direction: A focus on core business areas, operational efficiency, and a more cautious approach to new investments are likely to shape SSE's future.

-

Future Growth Scenarios: The projected growth will likely be more moderate compared to previous projections, reflecting the reduced investment levels. Success will depend on maintaining existing market share and effectively managing costs.

-

Further Restructuring: Further restructuring or cost-cutting measures cannot be entirely ruled out, depending on future economic developments and the company's financial performance.

Conclusion: Navigating the Aftermath of SSE's £3 Billion Spending Cut

SSE's £3 billion spending cut is a significant event with far-reaching implications for the energy sector and investors. The decision, driven by economic headwinds and internal strategic reassessment, necessitates a careful re-evaluation of investment strategies. While the cut presents short-term risks, including share price volatility and potential impacts on renewable energy projects, it also presents opportunities for improved financial stability and a more focused business model. The future success of SSE will hinge on the effective implementation of its revised strategy and its ability to navigate the complexities of the current economic climate. Stay informed on the latest developments in SSE's investment strategy and learn more about the long-term implications of this significant spending cut before making any investment decisions. Thorough research is crucial before investing in SSE or any other energy company in this rapidly evolving market.

Featured Posts

-

Freddie Flintoffs New Chapter Life After A Devastating Crash And Ptsd

May 23, 2025

Freddie Flintoffs New Chapter Life After A Devastating Crash And Ptsd

May 23, 2025 -

Onlarin Cekim Guecue Seytan Tueyue Olan Burclar

May 23, 2025

Onlarin Cekim Guecue Seytan Tueyue Olan Burclar

May 23, 2025 -

Best Memorial Day Appliance Sales 2025 Forbes Verified

May 23, 2025

Best Memorial Day Appliance Sales 2025 Forbes Verified

May 23, 2025 -

F1 Testing Concludes Russell Emerges As Top Driver

May 23, 2025

F1 Testing Concludes Russell Emerges As Top Driver

May 23, 2025 -

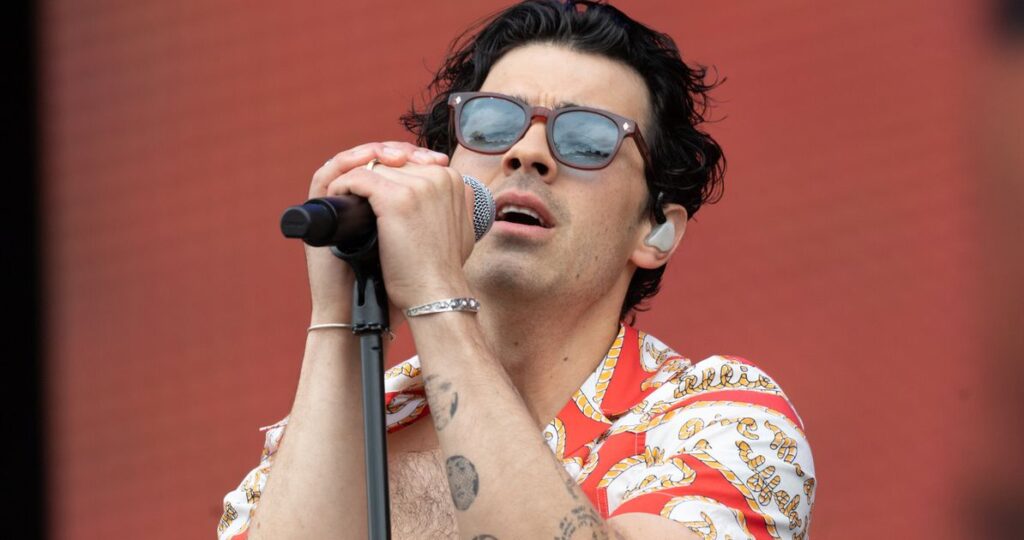

Couples Fight Over Joe Jonas His Unexpected Reaction

May 23, 2025

Couples Fight Over Joe Jonas His Unexpected Reaction

May 23, 2025

Latest Posts

-

Actress Mia Farrow Demands Trumps Imprisonment Regarding Venezuelan Deportations

May 24, 2025

Actress Mia Farrow Demands Trumps Imprisonment Regarding Venezuelan Deportations

May 24, 2025 -

Mia Farrows Plea Jail Trump For Deporting Venezuelan Gang Members

May 24, 2025

Mia Farrows Plea Jail Trump For Deporting Venezuelan Gang Members

May 24, 2025 -

Mia Farrow Calls For Trumps Arrest Over Venezuelan Deportations

May 24, 2025

Mia Farrow Calls For Trumps Arrest Over Venezuelan Deportations

May 24, 2025 -

Farrows Plea Jail Trump For Handling Of Venezuelan Deportations

May 24, 2025

Farrows Plea Jail Trump For Handling Of Venezuelan Deportations

May 24, 2025 -

Actress Mia Farrow Trump Should Be Jailed For Venezuelan Deportation Policy

May 24, 2025

Actress Mia Farrow Trump Should Be Jailed For Venezuelan Deportation Policy

May 24, 2025