$30 Million Deal: Hudson's Bay Sells Name And Key Brands To Canadian Tire

Table of Contents

The $30 Million Deal: Key Terms and Conditions

This $30 million transaction represents a significant brand acquisition in the Canadian retail sector. The deal specifics involve a licensing agreement granting Canadian Tire the rights to use the Hudson's Bay name and certain key brands. Understanding the financial terms and conditions is crucial to grasping the full impact of this deal.

- Financial Details: While the overall price tag is $30 million, the precise breakdown of payments and any potential future royalties hasn't been publicly disclosed. Further details regarding the financial aspects of the agreement are expected to be released in due course.

- Duration of the Agreement: The length of the licensing agreement between HBC and Canadian Tire remains undisclosed. The duration will significantly impact Canadian Tire's long-term strategy and the potential for future expansion.

- Brands and Intellectual Property: The agreement covers the use of the Hudson's Bay name and certain associated brands. Precisely which brands are included requires further clarification from both companies. The transfer of intellectual property rights is a key component of this transaction.

- Stipulations and Conditions: Any specific stipulations or conditions attached to the deal, such as restrictions on usage or marketing strategies, are currently unknown to the public. These conditions will likely play a vital role in shaping the future of the Hudson's Bay brand under Canadian Tire's umbrella.

- Potential for Expansion: The licensing agreement may contain clauses allowing for future expansion, incorporating additional brands or broadening the scope of usage. This possibility holds significant implications for the long-term success of the deal.

Impact on Hudson's Bay Company (HBC)

The sale of its iconic name and key brands marks a significant strategic restructuring for HBC. The financial implications are profound, affecting the company's overall health and long-term viability.

- Financial Health: The $30 million injection will undoubtedly improve HBC's immediate financial position, allowing it to focus on other aspects of its business. However, the long-term effects depend heavily on HBC's ability to capitalize on this restructuring.

- Future Plans: HBC is expected to refocus its efforts on its remaining assets and explore new strategic avenues for growth. This might involve divesting from other non-core brands or exploring opportunities in different market segments.

- Long-Term Viability: The success of this strategy will determine HBC's long-term viability in the competitive Canadian market. Its ability to adapt and innovate will be crucial in navigating the changing retail landscape.

- Shareholder Reaction: The market response from HBC shareholders and investors will provide insight into the overall perception of this strategic decision. Positive investor sentiment would suggest a successful restructuring.

- Refocusing on Other Ventures: This sale frees HBC to potentially invest more heavily in its other remaining brands or explore entirely new retail ventures. This could be a turning point for the company's future expansion and diversification.

Benefits for Canadian Tire

The acquisition provides Canadian Tire with a significant opportunity to expand its brand portfolio, increase its market share, and strengthen its position in the Canadian retail landscape.

- Strengthened Brand Portfolio: Adding the Hudson's Bay brand and its associated history significantly enhances Canadian Tire's overall brand portfolio, diversifying its offerings and attracting a broader customer base.

- Market Share and Consumer Reach: This acquisition allows Canadian Tire to reach a wider consumer base, potentially capturing customers who traditionally shopped at Hudson's Bay stores. The expansion into new demographics could significantly increase market share.

- Synergy and Cross-Promotion: Canadian Tire can leverage synergies between its existing brands and the newly acquired Hudson's Bay assets. Cross-promotional opportunities can further enhance brand awareness and drive sales.

- Expansion into New Market Segments: The acquisition provides potential entry points into new market segments that were previously unavailable to Canadian Tire. This could lead to greater diversification and increased profitability.

- Long-Term Strategic Goals: This acquisition aligns with Canadian Tire's long-term strategic goals of expansion, market dominance, and enhanced brand recognition. This move consolidates their position within the Canadian retail market.

Consumer Impact and the Future of Zellers

The deal's impact on consumers familiar with the Hudson's Bay and Zellers brands is significant. The future of Zellers stores under Canadian Tire's ownership is a key area of consumer interest.

- Consumer Reaction: Consumer reaction will depend on how effectively Canadian Tire integrates the acquired brands into its existing ecosystem. Positive consumer experiences will foster brand loyalty.

- Integration of Brands: Canadian Tire's integration strategy will determine the success of this acquisition. A seamless transition will help maintain brand recognition and minimize customer confusion.

- Future of Zellers Stores: The future of Zellers stores, many of which operate within Canadian Tire locations, is still uncertain. Canadian Tire's plans for these stores will likely influence consumer perceptions and loyalty.

- New Product Lines: The acquired brands might pave the way for new product lines or initiatives. This diversification would strengthen Canadian Tire's overall retail presence and consumer appeal.

- Competitive Landscape: This acquisition significantly alters the competitive landscape, potentially impacting other department stores and retailers in the Canadian market.

Conclusion

The $30 million sale of Hudson's Bay's name and key brands to Canadian Tire represents a pivotal moment in Canadian retail history. This transaction significantly impacts both companies, altering their strategic direction and market positioning. The long-term implications for consumers, competitors, and the overall retail landscape will undoubtedly be significant. While the full consequences of this deal remain to be seen, its impact on the Canadian retail industry is undeniable.

Call to Action: Stay informed about the ongoing developments surrounding this landmark $30 million deal and the future of Hudson's Bay and Canadian Tire. Follow our blog for continued coverage and analysis of the Hudson's Bay-Canadian Tire acquisition.

Featured Posts

-

Fake Quotes And Their Impact The Angel Reese Example

May 17, 2025

Fake Quotes And Their Impact The Angel Reese Example

May 17, 2025 -

Analisis Laporan Keuangan Kunci Sukses Bisnis Anda

May 17, 2025

Analisis Laporan Keuangan Kunci Sukses Bisnis Anda

May 17, 2025 -

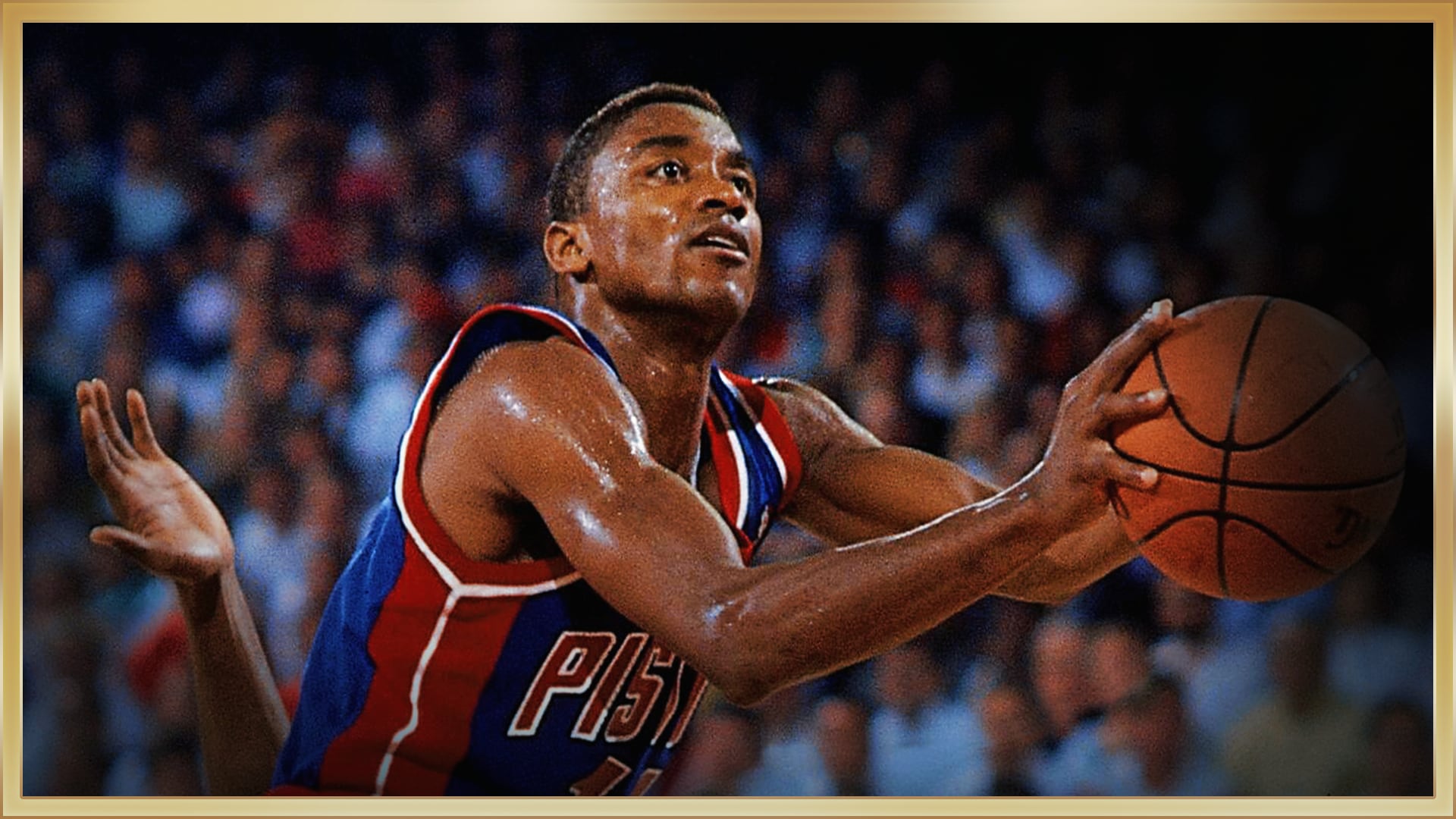

Nba Playoffs Pistons Fury Over Game 4 Foul Call

May 17, 2025

Nba Playoffs Pistons Fury Over Game 4 Foul Call

May 17, 2025 -

Value For Money Finding Affordable Quality Items

May 17, 2025

Value For Money Finding Affordable Quality Items

May 17, 2025 -

Atlantic Canadas Lobster Fishers Struggle Amidst Falling Prices And Global Uncertainty

May 17, 2025

Atlantic Canadas Lobster Fishers Struggle Amidst Falling Prices And Global Uncertainty

May 17, 2025

Latest Posts

-

Top Bitcoin Casinos 2025 Easy Withdrawals Exclusive Bonuses And Best Crypto Gambling Sites

May 17, 2025

Top Bitcoin Casinos 2025 Easy Withdrawals Exclusive Bonuses And Best Crypto Gambling Sites

May 17, 2025 -

Best Crypto Casinos 2025 Top Bitcoin Casinos With Easy Withdrawals And Exclusive Bonuses

May 17, 2025

Best Crypto Casinos 2025 Top Bitcoin Casinos With Easy Withdrawals And Exclusive Bonuses

May 17, 2025 -

Jackbit Your Best Crypto Casino Choice In 2025

May 17, 2025

Jackbit Your Best Crypto Casino Choice In 2025

May 17, 2025 -

Review Of Jackbit A Top Bitcoin Casino With Fast Withdrawals

May 17, 2025

Review Of Jackbit A Top Bitcoin Casino With Fast Withdrawals

May 17, 2025 -

Top Bitcoin Online Casino 2025 Why Jackbit Leads The Pack

May 17, 2025

Top Bitcoin Online Casino 2025 Why Jackbit Leads The Pack

May 17, 2025