30% Tariffs On China: Evaluating The Long-Term Economic Effects Of Trump's Trade Policy

Table of Contents

Immediate Impacts of the 30% Tariffs

Increased Prices for Consumers

The 30% tariffs on Chinese goods directly translated into higher prices for US consumers. This was particularly noticeable for products heavily reliant on Chinese manufacturing, including electronics, clothing, furniture, and certain agricultural goods. For example, the tariffs increased the cost of imported washing machines by an estimated 15-20%, making them less affordable for many households.

- Specific Examples: Increased prices on solar panels, bicycles, steel, and various consumer electronics.

- Percentage Increases: Price increases varied depending on the product, ranging from single-digit percentages to over 20% in some cases.

- Consumer Burden: Millions of American consumers faced increased expenses, impacting their disposable income and potentially dampening consumer spending.

- Studies on Consumer Spending: Several economic studies have explored the relationship between tariff-induced price increases and changes in consumer behavior, indicating a reduction in overall spending in affected sectors.

Impact on US Businesses

US businesses that relied heavily on Chinese imports for raw materials or finished goods were significantly impacted by the 30% tariffs. Industries such as manufacturing and agriculture experienced increased input costs, reducing their competitiveness both domestically and internationally.

- Industries Significantly Impacted: Manufacturing (especially steel and aluminum), agriculture (soybeans and pork), and the technology sector.

- Challenges Faced by US Businesses: Increased input costs, reduced profitability, loss of market share, and difficulty competing with businesses sourcing from other countries.

- Business Relocation/Restructuring: Many businesses responded by relocating production to other countries (reshoring or nearshoring) or restructuring their supply chains to reduce their reliance on Chinese imports. This led to significant investment costs and potential job losses in some sectors.

Long-Term Economic Consequences

Shifting Global Supply Chains

The 30% tariffs on Chinese goods accelerated a pre-existing trend towards diversifying global supply chains. Businesses actively sought alternative sourcing locations to avoid the high tariffs, leading to a significant shift in manufacturing and production away from China.

- Production Relocation: Many companies moved production to countries such as Vietnam, Mexico, and India, seeking lower costs and greater supply chain stability.

- Global Supply Chain Diversification: This trend towards diversification aimed to mitigate risks associated with relying heavily on a single source country.

- Costs and Benefits of Reshoring/Nearshoring: Reshoring (bringing production back to the US) proved costly for many businesses, while nearshoring (moving production to nearby countries) offered a more balanced approach.

- Long-Term Effects on Global Trade Patterns: The long-term effects of these shifts on global trade patterns are still being assessed, but the trend indicates a move toward a more fragmented and diversified global economy.

Impact on US-China Relations

The 30% tariffs significantly damaged US-China trade relations, creating a period of heightened tension and uncertainty. This impacted broader diplomatic relations and international cooperation on global issues.

- Damage to US-China Trade Relations: The trade war created distrust and animosity between the two countries, hindering future collaboration on trade and economic matters.

- Impact on International Trade Agreements: The trade war undermined the multilateral trading system and raised questions about the future of global trade agreements and organizations.

- Political and Diplomatic Ramifications: The trade dispute strained diplomatic relations across various sectors, from technology to human rights.

- Efforts to De-escalate Trade Tensions: Subsequent administrations have attempted to de-escalate tensions through negotiations and dialogues, but the lingering effects of the tariffs remain.

Overall Economic Growth and Development

The long-term effects of the 30% tariffs on US and global economic growth are complex and subject to ongoing debate. While some argue that the tariffs protected domestic industries and stimulated job creation, others point to the negative impacts on consumer prices and global trade.

- Effects on US Economic Growth: Studies on the economic impact vary, with some suggesting a minimal effect on overall growth while others point to a reduction in potential GDP.

- Effects on Global Economic Growth: The trade war undoubtedly slowed global economic growth, contributing to uncertainty and dampening investment.

- Economic Models and Projections: Various economic models and projections provide differing estimates of the overall long-term economic impact, highlighting the complexity of the issue.

- Data and Statistics from Reputable Sources: Analysis requires a careful consideration of data and statistics from reputable sources, including the World Bank, IMF, and academic research institutions.

Conclusion

The 30% tariffs on Chinese goods initiated by the Trump administration had far-reaching and complex consequences. While some intended benefits may have been realized, the long-term economic effects – encompassing increased consumer prices, altered global supply chains, and strained US-China relations – are significant and require continued monitoring. The true economic cost and lasting impact remain subjects of ongoing debate and research.

Call to Action: To better understand the full implications of these policies and their ongoing effects on the global economy, further research and analysis of the long-term economic effects of the 30% tariffs on China are crucial. Continue to follow reputable economic sources for the latest updates on this evolving trade landscape.

Featured Posts

-

Latest Police Blotter Reports For Austintown And Boardman

May 17, 2025

Latest Police Blotter Reports For Austintown And Boardman

May 17, 2025 -

Are Modular Homes The Answer To Canadas Housing Affordability Problems

May 17, 2025

Are Modular Homes The Answer To Canadas Housing Affordability Problems

May 17, 2025 -

The Knicks Roster Crunch The Landry Shamet Factor

May 17, 2025

The Knicks Roster Crunch The Landry Shamet Factor

May 17, 2025 -

Understanding Cassie Venturas Role Insights From The Diddy Trial Cross Examination

May 17, 2025

Understanding Cassie Venturas Role Insights From The Diddy Trial Cross Examination

May 17, 2025 -

Apple Tv 3 Month Discount For 3 Limited Time Offer

May 17, 2025

Apple Tv 3 Month Discount For 3 Limited Time Offer

May 17, 2025

Latest Posts

-

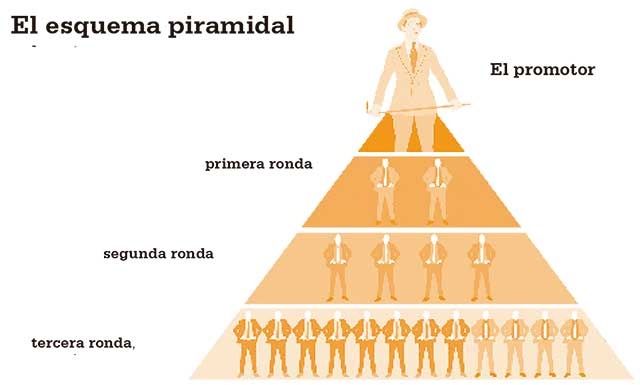

Koriun Inversiones Descifrando Su Fraudulento Esquema Ponzi

May 17, 2025

Koriun Inversiones Descifrando Su Fraudulento Esquema Ponzi

May 17, 2025 -

El Esquema Ponzi De Koriun Inversiones Una Explicacion Detallada

May 17, 2025

El Esquema Ponzi De Koriun Inversiones Una Explicacion Detallada

May 17, 2025 -

Que Fue El Esquema Ponzi De Koriun Inversiones

May 17, 2025

Que Fue El Esquema Ponzi De Koriun Inversiones

May 17, 2025 -

Actualizacion Sobre El Descongelamiento De Cuentas De Koriun Para Inversionistas

May 17, 2025

Actualizacion Sobre El Descongelamiento De Cuentas De Koriun Para Inversionistas

May 17, 2025 -

Recuperacion De Capital El Descongelamiento De Cuentas De Koriun Para Inversionistas

May 17, 2025

Recuperacion De Capital El Descongelamiento De Cuentas De Koriun Para Inversionistas

May 17, 2025