30-Year Treasury Yield Hits 5%: Implications For The "Sell America" Narrative

Table of Contents

Understanding the 5% 30-Year Treasury Yield

Factors Contributing to the Yield Increase

Several interconnected factors contribute to the 30-year Treasury yield reaching 5%. These include:

-

Inflationary Pressures: Persistent inflation, as measured by indicators like the Consumer Price Index (CPI) and Producer Price Index (PPI), forces the Federal Reserve to implement tighter monetary policy. Higher inflation erodes the purchasing power of future bond payments, driving down bond prices and pushing yields higher. Interest rates are a key tool used to combat inflation.

-

Federal Reserve Monetary Policy: The Federal Reserve's aggressive interest rate hikes aim to curb inflation. Higher interest rates make existing bonds less attractive, increasing demand for newly issued bonds with higher yields. This directly impacts bond yields, including the 30-year Treasury. Monetary policy decisions significantly influence interest rates and bond yields.

-

Increased Government Borrowing: The US government's substantial borrowing needs to fund its budget deficit increase the supply of Treasury bonds. Increased supply, without a corresponding increase in demand, can push yields upward. Fiscal policy, including government spending and taxation, plays a crucial role in determining borrowing levels.

-

Global Economic Uncertainty: Geopolitical instability and global economic slowdowns can cause investors to seek safe haven assets. While typically favoring US Treasuries, the current environment sees some investors looking for higher yields elsewhere, impacting the 30-year yield.

-

Flight to Safety (A Counter-Intuitive Aspect): Ironically, the increase in the 30-year Treasury yield can also reflect a flight to safety. During periods of uncertainty, investors often flock to US Treasuries, considered a relatively safe investment. However, increased demand can still result in higher yields, even in a "flight to safety" scenario.

Historical Context and Comparison

The current 5% 30-year Treasury yield is historically significant. While yields have been higher in the past, a comparison to previous periods reveals important nuances. For example, the yield curve's shape—the relationship between short-term and long-term interest rates—offers valuable insights into market expectations. Analyzing historical bond yields, particularly during periods of high inflation or economic uncertainty, provides context for understanding the current situation. Examining the yield curve and long-term interest rates alongside other economic indicators helps paint a complete picture.

The "Sell America" Narrative: Fact or Fiction?

Analyzing Capital Flows

The "Sell America" narrative suggests a significant divestment from US assets by foreign and domestic investors. Analyzing capital flows provides a more nuanced perspective:

-

Foreign Direct Investment (FDI): While some FDI may be shifting, a complete withdrawal from the US market is not evident. Foreign investors still see opportunities in the American economy.

-

Portfolio Investment: Shifts in portfolio investment, involving stocks and bonds, are more dynamic. However, these shifts don't necessarily indicate a complete "sell-off." They may reflect adjustments to portfolio allocations based on various factors.

-

Capital Flight: While capital flight is a concern, the scale of it is debatable. Data on the balance of payments helps to assess the overall flow of capital into and out of the US.

Alternative Explanations for Capital Flows

Several other factors contribute to shifting capital flows, challenging the "Sell America" narrative:

-

Global Macroeconomic Conditions: Global economic growth, inflation rates, and monetary policies in other countries influence investment decisions. Investors will often move capital to areas with more attractive growth prospects.

-

Currency Valuations: Fluctuations in currency exchange rates impact the attractiveness of US assets for foreign investors. A strong US dollar can make US assets more expensive for those holding other currencies.

-

Relative Investment Opportunities: Investors constantly seek higher returns. If investment opportunities in other markets become more lucrative, capital will naturally flow towards those markets. This is a standard process in global finance and portfolio diversification.

Implications for the US Economy

Impact on Borrowing Costs

The 5% 30-year Treasury yield has significant implications for borrowing costs across the economy:

-

Government Debt: Higher yields increase the cost of servicing the national debt, impacting the federal budget deficit and potentially constraining government spending.

-

Corporate Bonds: Corporate borrowing costs rise, potentially slowing business investment and economic growth. Companies may delay expansion plans or reduce hiring if borrowing becomes too expensive.

-

Mortgage Rates: Higher yields translate to higher mortgage rates, potentially cooling the housing market and affecting consumer spending. This has significant implications for the real estate sector and the broader economy.

Impact on the Dollar

The relationship between interest rates and currency exchange rates is complex:

-

Currency Appreciation: Higher US interest rates, as reflected in higher Treasury yields, can attract foreign investment, leading to increased demand for the US dollar and potential appreciation. However, other factors can influence this relationship.

-

International Trade: A stronger dollar can make US exports more expensive and imports cheaper, affecting the trade balance. This can be both a boon and a bane, depending on the state of the global economy.

Conclusion

The 5% 30-year Treasury yield reflects a confluence of factors, including inflationary pressures, Federal Reserve policy, government borrowing, and global economic uncertainty. The "Sell America" narrative, while capturing some aspects of capital flows, oversimplifies a complex situation. Higher yields have significant implications for the US economy, impacting borrowing costs, the federal budget, and the value of the US dollar. Careful analysis of these dynamics is crucial for understanding the current economic landscape.

To stay informed about developments in the bond market and their implications for long-term investments, monitor the 30-year Treasury yield closely. Understanding the implications of rising interest rates and staying informed about the "Sell America" narrative are critical for navigating the complexities of the global financial market. The dynamics of the 30-year Treasury yield and its impact on the global economy will continue to shape investment strategies and economic policy for the foreseeable future.

Featured Posts

-

Projet D Adressage D Abidjan Explication Du Marquage Des Numeros De Batiments

May 20, 2025

Projet D Adressage D Abidjan Explication Du Marquage Des Numeros De Batiments

May 20, 2025 -

Lewis Hamilton And Ferraris Heated Tea Break Confrontation At Miami Gp

May 20, 2025

Lewis Hamilton And Ferraris Heated Tea Break Confrontation At Miami Gp

May 20, 2025 -

Philippines Rejects Chinese Demands Missile System Remains

May 20, 2025

Philippines Rejects Chinese Demands Missile System Remains

May 20, 2025 -

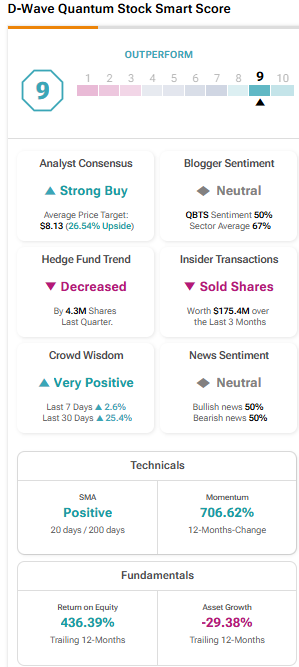

D Wave Quantum Qbts Stock Performance Analyzing Mondays Decrease

May 20, 2025

D Wave Quantum Qbts Stock Performance Analyzing Mondays Decrease

May 20, 2025 -

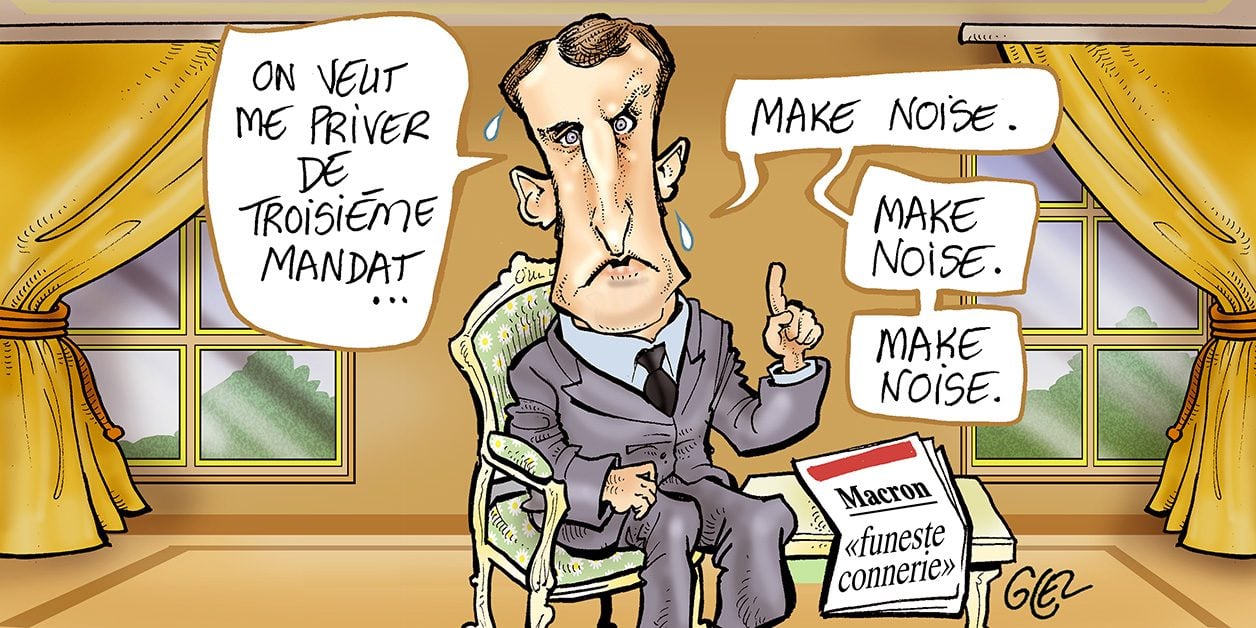

Politique Camerounaise Macron Troisieme Mandat Et Perspectives Pour 2032

May 20, 2025

Politique Camerounaise Macron Troisieme Mandat Et Perspectives Pour 2032

May 20, 2025

Latest Posts

-

D Wave Quantum Inc Qbts Stock Surge On Monday Reasons Explained

May 20, 2025

D Wave Quantum Inc Qbts Stock Surge On Monday Reasons Explained

May 20, 2025 -

D Wave Quantum Qbts Stock Plunge Kerrisdale Capitals Valuation Concerns

May 20, 2025

D Wave Quantum Qbts Stock Plunge Kerrisdale Capitals Valuation Concerns

May 20, 2025 -

D Wave Quantum Qbts A Top Quantum Computing Investment

May 20, 2025

D Wave Quantum Qbts A Top Quantum Computing Investment

May 20, 2025 -

What Fueled D Wave Quantum Qbts S Stock Price Rocket This Week

May 20, 2025

What Fueled D Wave Quantum Qbts S Stock Price Rocket This Week

May 20, 2025 -

D Wave Quantum Qbts Stock Price Movement On Friday Causes And Implications

May 20, 2025

D Wave Quantum Qbts Stock Price Movement On Friday Causes And Implications

May 20, 2025