30-Year Treasury Yield Hits 5%: Implications For The "Sell America" Trade

Table of Contents

The 5% 30-Year Treasury Yield: A Sign of Strength or Weakness?

The climb of the 30-year Treasury yield to 5% is a complex phenomenon with multiple contributing factors. Understanding these factors is crucial to interpreting its significance for the US economy and the "Sell America" trade.

- Increased Inflation Concerns: Persistent inflation, even with recent cooling, continues to pressure the bond market, driving yields higher. The Federal Reserve's efforts to control inflation directly influence interest rates.

- Stronger-than-Expected Economic Data: Positive economic indicators, such as robust job growth and increased consumer spending, can boost investor confidence, leading to higher demand for US Treasuries and thus higher yields.

- Federal Reserve Monetary Policy Expectations: The market closely scrutinizes the Federal Reserve's pronouncements on future interest rate hikes. Expectations of continued rate increases contribute to rising bond yields.

- Global Demand for US Treasuries: Despite global economic uncertainty, the US remains a safe haven for investors, leading to ongoing international demand for US Treasuries, pushing yields upward.

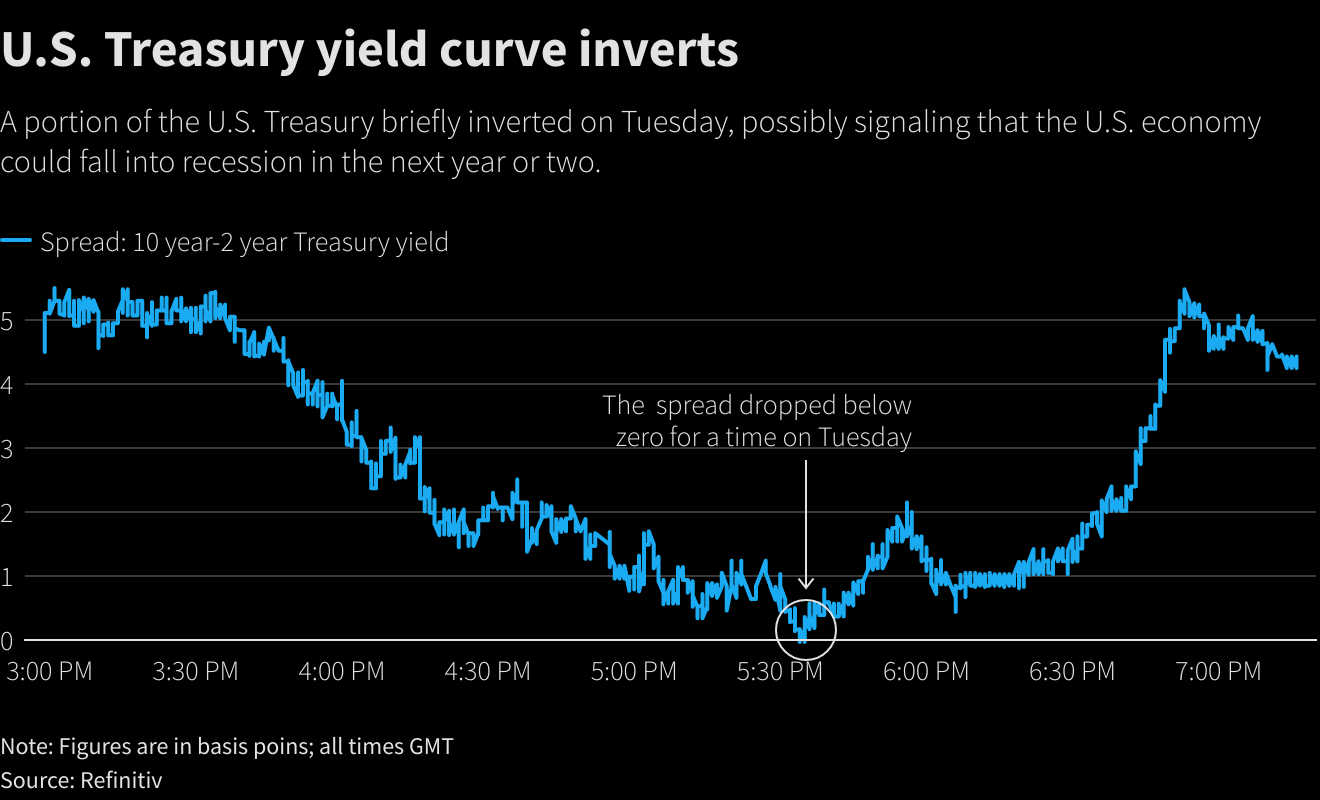

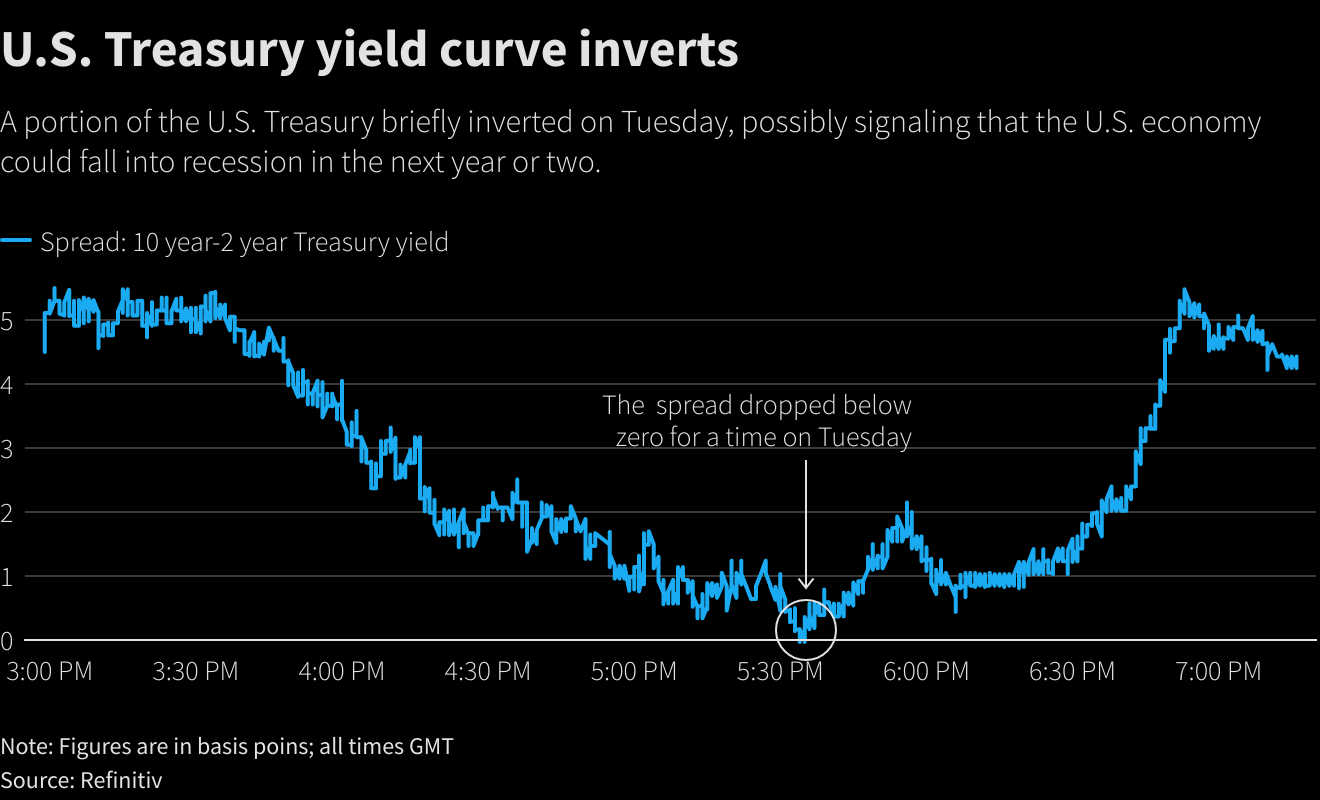

However, the interpretation of this yield increase remains contested. Some see it as a sign of a resilient US economy, attracting investment and bolstering the dollar. Others view it as a precursor to an economic slowdown, as higher borrowing costs could stifle economic growth. Further analysis of economic data and market trends is necessary to ascertain the true implications. [Insert relevant chart/graph showing 30-year Treasury yield trend].

Impact on the "Sell America" Trade: Short-Term vs. Long-Term Perspectives

The increased 30-year Treasury yield significantly impacts the attractiveness of US assets to investors engaged in the "Sell America" trade.

- Higher yields make US bonds more competitive globally: The higher yield makes US bonds a more appealing investment compared to bonds in other countries, potentially reducing the attractiveness of shorting US assets.

- Potential impact on the US dollar: Higher yields can strengthen the US dollar, making US assets relatively cheaper for foreign investors and potentially weakening the "Sell America" thesis.

- Influence on foreign investment flows into the US: Increased yields could attract significant foreign investment, counteracting the bearish sentiment underpinning the "Sell America" trade.

- Short-term vs. long-term implications for the “Sell America” trade: The short-term impact might be limited, but sustained high yields could significantly alter the long-term viability of the "Sell America" strategy.

This rise in yields could potentially shift investor sentiment, prompting a reevaluation of the "Sell America" trade and a reconsideration of shorting strategies.

Alternative Investment Strategies in Light of the Rising Yield

For investors previously invested in the "Sell America" trade, the 5% 30-year Treasury yield necessitates a reevaluation of their strategies. Alternative investment options include:

- Diversification into other asset classes (e.g., emerging markets): Spreading investments across different markets and asset classes can help mitigate risk associated with a potential US slowdown.

- Focus on value investing in the US market: Higher yields might create opportunities for value investors to identify undervalued US companies.

- Hedging strategies to mitigate risk: Employing hedging strategies can help protect portfolios from potential losses in a volatile market.

The risk-reward profiles of these alternatives must be carefully assessed in relation to the current economic climate and individual investor risk tolerance.

Geopolitical Factors and the 30-Year Treasury Yield

Geopolitical events play a significant role in shaping the 30-year Treasury yield and influencing the "Sell America" trade.

- Impact of global economic uncertainty: Global instability can increase demand for safe-haven assets like US Treasuries, pushing yields higher.

- Influence of international relations and conflicts: Geopolitical tensions can create volatility in the markets, making it difficult to predict the trajectory of the 30-year Treasury yield.

- Safe-haven demand for US Treasuries during times of crisis: During periods of global uncertainty, investors often flock to US Treasuries, leading to increased demand and higher yields.

Geopolitical developments can significantly alter the dynamics of the "Sell America" trade, making it crucial for investors to monitor global events closely.

Conclusion: Re-evaluating the "Sell America" Trade in a 5% Yield Environment

The 5% 30-year Treasury yield presents a complex scenario, requiring careful consideration of multiple factors. While the yield increase might suggest economic strength, it also raises concerns about potential future slowdowns. Its impact on the "Sell America" trade is equally multifaceted, affecting investor sentiment and potentially altering shorting strategies. Both short-term and long-term perspectives are critical in assessing the implications for investment decisions.

Investors engaged in or considering the "Sell America" trade must carefully analyze the evolving economic landscape, including the implications of the 30-year Treasury yield. Diversifying portfolios and seeking professional financial advice are crucial to navigate this complex environment. A thorough understanding of the bond market, interest rates, and the US economy is essential for making informed investment decisions in the face of this significant shift in the 30-year Treasury yield.

Featured Posts

-

Wintry Mix Rain And Snow Forecast

May 21, 2025

Wintry Mix Rain And Snow Forecast

May 21, 2025 -

Improved Wireless Headphones A Review Of Top Models

May 21, 2025

Improved Wireless Headphones A Review Of Top Models

May 21, 2025 -

Kamerbrief Verkoopprogramma Certificaten Abn Amro Een Complete Gids

May 21, 2025

Kamerbrief Verkoopprogramma Certificaten Abn Amro Een Complete Gids

May 21, 2025 -

Juergen Klopps Return To Liverpool Before The Final Whistle

May 21, 2025

Juergen Klopps Return To Liverpool Before The Final Whistle

May 21, 2025 -

Mild Temperatures And Dry Conditions Predicted

May 21, 2025

Mild Temperatures And Dry Conditions Predicted

May 21, 2025

Latest Posts

-

The Kartel Rum Culture Connection Insights From Stabroek News

May 22, 2025

The Kartel Rum Culture Connection Insights From Stabroek News

May 22, 2025 -

Understanding Kartel Through The Lens Of Rum Culture Stabroek News

May 22, 2025

Understanding Kartel Through The Lens Of Rum Culture Stabroek News

May 22, 2025 -

Kartels Impact On Rum Culture In Stabroek News

May 22, 2025

Kartels Impact On Rum Culture In Stabroek News

May 22, 2025 -

From Fan To Tourmate Nuffys Journey With Vybz Kartel

May 22, 2025

From Fan To Tourmate Nuffys Journey With Vybz Kartel

May 22, 2025 -

Nuffys Vybz Kartel Collaboration A Dream Come True

May 22, 2025

Nuffys Vybz Kartel Collaboration A Dream Come True

May 22, 2025