400% XRP Increase: Understanding The Recent Price Surge And Future Outlook

Table of Contents

Factors Contributing to the 400% XRP Price Increase

Several intertwined factors have contributed to the astonishing 400% XRP price increase. Let's examine the key drivers:

Positive Ripple Legal Developments

The ongoing SEC lawsuit against Ripple has significantly impacted XRP's price. Recent positive legal developments have been crucial in boosting investor confidence.

- Recent court filings showing progress in the SEC lawsuit: Favorable rulings and the judge's indications of a potential win for Ripple have significantly influenced market sentiment.

- Positive judicial interpretations: Legal experts interpreting the case's progress positively have further fueled the XRP price increase.

- Expert opinions suggesting a favorable outcome: Growing consensus among legal experts that Ripple has a strong case contributes to the bullish sentiment.

- Impact of these developments on investor sentiment: Positive legal news has directly translated into increased investor confidence and purchasing activity, driving up demand and price.

The specific arguments presented by Ripple, focusing on the lack of a clear regulatory framework for XRP and the SEC's inconsistent approach, have played a critical role in shaping the court's perception and, consequently, the market's reaction. Analysis of these legal arguments can be found in various reputable news sources and legal publications.

Increased Institutional and Retail Investor Interest

The surge isn't solely driven by legal wins; it's also fueled by increased investor interest from both institutional and retail levels.

- Rising adoption of XRP by institutional investors: Large financial institutions are increasingly showing interest in XRP's utility in cross-border payments.

- Increased trading volume on major exchanges: A noticeable rise in XRP trading volume across major cryptocurrency exchanges reflects heightened interest.

- Growing retail investor interest fueled by social media discussions and influencer endorsements: Positive social media sentiment and influencer endorsements have encouraged retail investors to enter the market.

- Impact of improved XRP liquidity: Improved liquidity on exchanges makes it easier for investors to buy and sell XRP, facilitating the price increase.

Data on trading volume and market capitalization readily available on cryptocurrency tracking websites clearly shows the significant increase in investor interest.

Technological Advancements and RippleNet Growth

Ripple's technological advancements and the expansion of RippleNet, its payment network, have also underpinned the price surge.

- Improvements in XRP Ledger technology: Enhancements to the XRP Ledger, like improved transaction speeds and scalability, have made it more attractive for financial institutions.

- Expansion of RippleNet’s global reach and partnerships: RippleNet's continued partnerships with financial institutions globally increase XRP's adoption and utility.

- Growing use cases for XRP in cross-border payments: The increasing use of XRP for facilitating faster and cheaper international payments strengthens its value proposition.

- Impact on the overall utility and value proposition of XRP: These advancements contribute to XRP's overall utility, making it a more attractive asset for investors.

Specific examples of RippleNet partnerships and their impact on transaction volume can be found on Ripple's official website and various industry news outlets.

Market Sentiment and Speculation

Market sentiment and speculation also play a significant role in XRP price fluctuations.

- Role of FOMO (Fear Of Missing Out): The rapid price increase has triggered FOMO, leading more investors to buy XRP to avoid missing out on potential gains.

- Impact of social media trends and influencer opinions: Positive social media sentiment and influencer opinions can dramatically influence short-term price movements.

- Short-term speculative trading: Short-term speculation adds to the volatility, exacerbating both upward and downward price swings.

- Overall market conditions and their influence on XRP's price volatility: Broader market trends in the cryptocurrency space also impact XRP's price.

Analyzing recent social media trends regarding XRP provides insights into the market sentiment driving the price increase. However, it's essential to acknowledge the risks associated with speculative bubbles.

Future Outlook and Predictions for XRP

While the 400% XRP price increase is impressive, analyzing its sustainability and future potential requires a careful examination.

Analyzing the Sustainability of the Price Surge

Predicting the future price of any cryptocurrency is challenging. However, a balanced approach considering various factors is crucial.

- Discussion of short-term vs. long-term price projections: Short-term projections are highly susceptible to volatility, whereas long-term projections require analyzing fundamental factors.

- Considerations of potential corrections or pullbacks: After a substantial price increase, corrections are common and should be anticipated.

- Analysis of fundamental vs. technical indicators: Both fundamental analysis (based on the underlying value) and technical analysis (chart patterns) need to be considered.

- Identifying potential risks: Factors like negative legal news or broader market downturns could negatively impact the price.

Technical analysis using price charts and indicators can help forecast short-term movements, but fundamental analysis considering the factors discussed earlier provides a more holistic long-term perspective.

Potential Catalysts for Further Price Growth

Several factors could potentially drive further price growth for XRP:

- Positive legal outcome of the SEC lawsuit: A decisive victory for Ripple would likely result in a significant price surge.

- Continued adoption by financial institutions: Increased adoption by large financial institutions would solidify XRP's position in the market.

- Expansion of RippleNet into new markets: Entering new markets would expand XRP's reach and utility.

- Further technological improvements: Continued improvements to the XRP Ledger will enhance its efficiency and attractiveness.

- Increasing market awareness: Greater market awareness and understanding of XRP's utility would boost investor confidence.

The impact of these catalysts needs to be assessed cautiously, and realistic scenarios need to be developed to accurately predict their influence on XRP’s price.

Risks and Challenges Facing XRP

Despite the positive momentum, several risks and challenges could hinder XRP's growth:

- Potential for negative regulatory changes: Unfavorable regulatory decisions could significantly impact XRP's price.

- Competition from other cryptocurrencies: Competition from other cryptocurrencies with similar functionalities poses a challenge.

- Impact of macroeconomic factors: Broader macroeconomic conditions can influence investor sentiment and the overall cryptocurrency market.

- Risks associated with speculative trading: Excessive speculation can create volatile price swings, leading to potential losses for investors.

Conclusion

The recent 400% XRP increase is a complex event resulting from a confluence of factors, including positive legal developments, growing investor interest, technological advancements, and market sentiment. While the future price of XRP remains uncertain—and any XRP price prediction should be treated cautiously—understanding these driving forces and potential risks is crucial for informed investment decisions. Further research into Ripple’s ongoing legal battles and technological innovations will be key to predicting future price movements. Stay informed about XRP price movements and future developments by continuing to follow reputable news sources and market analysis to make informed decisions regarding your XRP investment.

Featured Posts

-

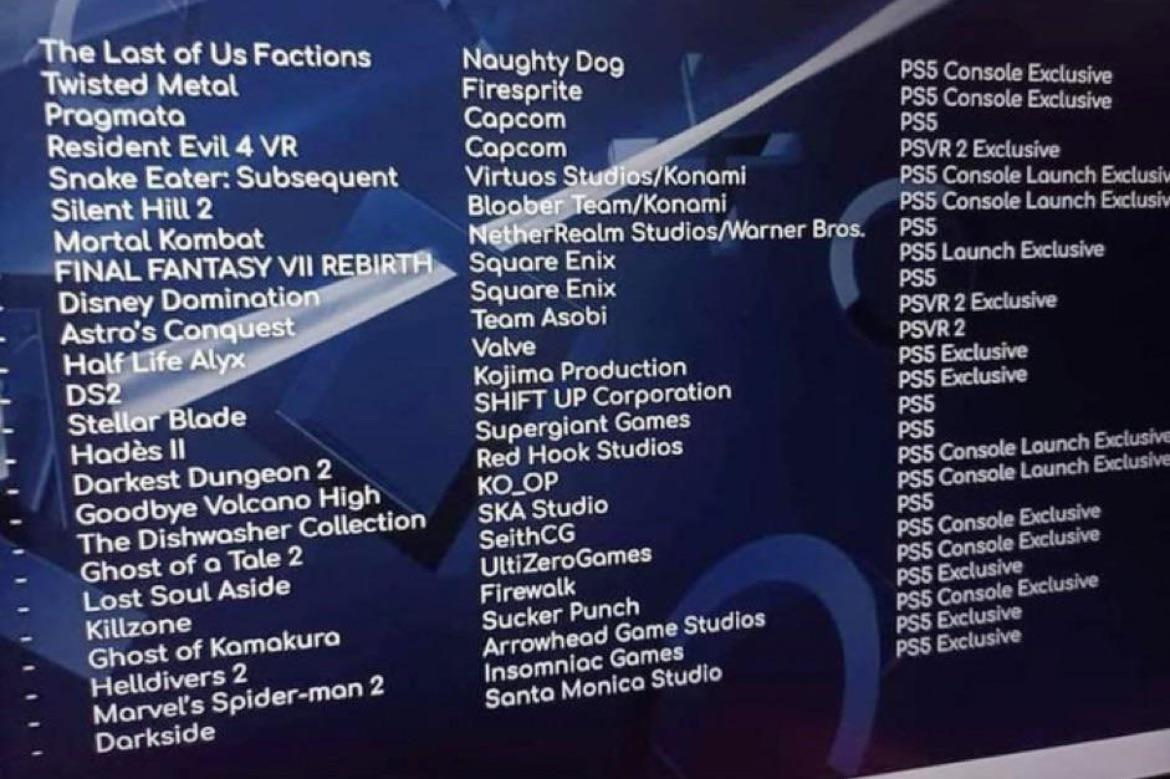

Play Station Showcase Ps 5 Game Reveals Expected Soon

May 02, 2025

Play Station Showcase Ps 5 Game Reveals Expected Soon

May 02, 2025 -

Winning Numbers Lotto Lotto Plus 1 And Lotto Plus 2 Draws

May 02, 2025

Winning Numbers Lotto Lotto Plus 1 And Lotto Plus 2 Draws

May 02, 2025 -

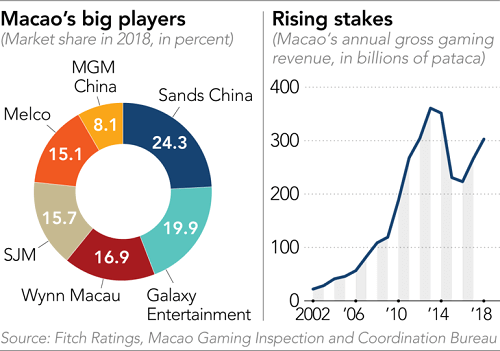

Macau Gaming Revenue Better Than Expected Before Golden Week

May 02, 2025

Macau Gaming Revenue Better Than Expected Before Golden Week

May 02, 2025 -

Melwmat Hsryt En Blay Styshn 6

May 02, 2025

Melwmat Hsryt En Blay Styshn 6

May 02, 2025 -

Boost Your Earnings 1 500 Flight Credit For Selling Paul Gauguin Cruises Via Ponant

May 02, 2025

Boost Your Earnings 1 500 Flight Credit For Selling Paul Gauguin Cruises Via Ponant

May 02, 2025