400% XRP Price Jump: Investment Opportunities And Risks

Table of Contents

Factors Contributing to the 400% XRP Price Surge

Several intertwined factors contributed to the remarkable 400% surge in XRP's price. Understanding these elements is crucial for assessing future potential and mitigating risk.

Positive Ripple News and Developments

Positive developments surrounding Ripple Labs have significantly impacted XRP's price. Recent news and legal progress have fueled investor confidence.

- Ripple Lawsuit Updates: Positive developments in Ripple's ongoing legal battle with the SEC (Securities and Exchange Commission) have been a major catalyst. Favorable court rulings or settlements could significantly boost XRP's value. (Note: Always refer to official court documents and reputable news sources for the latest updates.)

- Strategic Partnerships: Ripple's expansion into new partnerships and collaborations within the financial industry has strengthened its market position and increased investor confidence. Examples include partnerships with major financial institutions for cross-border payments. (Specific examples and dates should be added here based on current events.)

- Technological Advancements: Continuous development and improvement of Ripple's technology, particularly in areas such as scalability and transaction speed, enhance its appeal and long-term potential. (Mention specific technological improvements and their impact.) Keywords: Ripple lawsuit, XRP price prediction, Ripple partnerships, technological advancements.

Increased Market Demand and Speculation

The surge in XRP's price is not solely attributable to Ripple's progress. Market sentiment and speculation played a crucial role.

- Fear of Missing Out (FOMO): The rapid price increase itself fueled further buying pressure as investors, fearing they would miss out on potential gains, rushed to acquire XRP.

- Increased Trading Volume: A dramatic increase in trading volume accompanied the price surge, indicating significant market activity and investor interest. (Include data on trading volume increases if available.)

- Social Media Hype: Positive sentiment and discussions on social media platforms significantly influenced the market's perception of XRP and amplified the price increase. Keywords: market sentiment, FOMO, trading volume, cryptocurrency speculation.

Macroeconomic Factors and Crypto Market Trends

Broader market trends and macroeconomic factors also influenced XRP's performance.

- Bitcoin's Performance: Positive performance by Bitcoin, the dominant cryptocurrency, often has a ripple effect on the entire crypto market, including altcoins like XRP.

- Overall Market Sentiment: A generally positive sentiment within the broader cryptocurrency market can boost investor confidence and lead to increased investment in various cryptocurrencies, including XRP. Keywords: Bitcoin price, cryptocurrency market trends, macroeconomic factors, market capitalization.

Potential Investment Opportunities in XRP

Despite the risks, the 400% XRP price jump presents potential investment opportunities for those willing to navigate the inherent volatility.

Strategic Entry Points and Risk Management

Successful investment requires a strategic approach.

- Dollar-Cost Averaging (DCA): Investing a fixed amount of money at regular intervals helps mitigate the risk of buying high and reduces the impact of price fluctuations.

- Stop-Loss Orders: Setting stop-loss orders helps limit potential losses by automatically selling your XRP if the price drops to a predetermined level.

- Portfolio Diversification: Don't put all your eggs in one basket. Diversify your investment portfolio across different assets to reduce overall risk. Keywords: dollar-cost averaging, stop-loss order, risk management, investment strategy, portfolio diversification.

Long-Term vs. Short-Term Investment Horizons

The choice between a long-term or short-term investment strategy depends on your risk tolerance and financial goals.

- Long-Term Investment: A long-term investment strategy focuses on holding XRP for an extended period, aiming to benefit from potential long-term growth. This approach mitigates the impact of short-term price fluctuations.

- Short-Term Trading: Short-term trading involves frequent buying and selling of XRP to capitalize on short-term price movements. This approach carries significantly higher risk. Keywords: long-term investment, short-term trading, investment horizon, holding strategy.

Risks Associated with Investing in XRP Following the 400% Jump

While the potential rewards are tempting, significant risks are associated with investing in XRP after such a dramatic price increase.

Market Volatility and Price Corrections

The cryptocurrency market is inherently volatile.

- Price Corrections: After a substantial price surge, significant price corrections are common. The 400% jump makes a correction highly probable.

- Market Crashes: While less frequent, the possibility of a broader market crash cannot be ignored, which could severely impact XRP's value. Keywords: cryptocurrency volatility, price correction, market crash, risk assessment.

Regulatory Uncertainty and Legal Concerns

Regulatory uncertainty remains a significant risk factor.

- SEC Lawsuit: The ongoing legal battle between Ripple and the SEC creates uncertainty regarding XRP's regulatory status in various jurisdictions.

- Legal Risks: Investing in XRP involves inherent legal risks associated with its regulatory status and potential future rulings. Keywords: regulatory uncertainty, SEC lawsuit, legal risk, compliance.

Scams and Security Risks

Cryptocurrency investments are susceptible to scams and security breaches.

- Cryptocurrency Scams: Be wary of fraudulent schemes promising unrealistic returns.

- Security Breaches: Ensure you use secure and reputable cryptocurrency exchanges to minimize the risk of theft or hacking. Keywords: cryptocurrency scams, security breaches, phishing, exchange security.

Conclusion: Navigating the XRP Landscape After the 400% Price Jump

The 400% XRP price jump is a complex event driven by positive Ripple news, increased market demand, and broader market trends. While potential investment opportunities exist, substantial risks remain, including market volatility, regulatory uncertainty, and security threats. Thorough research, understanding your risk tolerance, and implementing robust risk management strategies are crucial before considering any XRP investment. Before making any decisions related to the XRP price jump, learn more about XRP investment strategies and risk management techniques. Consider investing wisely and responsibly.

Featured Posts

-

Yankees Fall To Guardians Despite Aaron Judges Performance

May 01, 2025

Yankees Fall To Guardians Despite Aaron Judges Performance

May 01, 2025 -

Remembering Priscilla Pointer Celebrated Dalla Actress Dies At 100

May 01, 2025

Remembering Priscilla Pointer Celebrated Dalla Actress Dies At 100

May 01, 2025 -

Win Big At Eurovision 2025 Comprehensive Betting Guide

May 01, 2025

Win Big At Eurovision 2025 Comprehensive Betting Guide

May 01, 2025 -

Dragons Den A Guide To Success For Entrepreneurs

May 01, 2025

Dragons Den A Guide To Success For Entrepreneurs

May 01, 2025 -

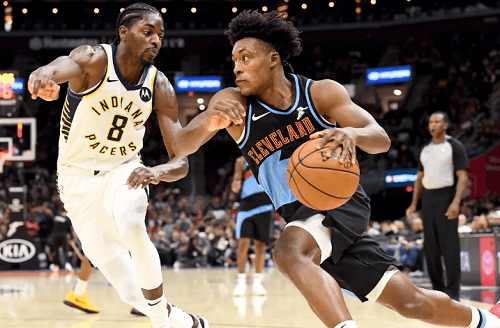

Indiana Pacers Vs Cleveland Cavaliers Complete Game Guide

May 01, 2025

Indiana Pacers Vs Cleveland Cavaliers Complete Game Guide

May 01, 2025