$440 Million Acquisition: CMA CGM Expands Into Turkish Logistics

Table of Contents

Details of the CMA CGM Acquisition in Turkey

Target Company and Assets

CMA CGM's $440 million investment secured a substantial stake in a significant Turkish logistics operator, although the specific name of the acquired company may not yet be publicly disclosed. The acquisition encompasses a wide range of assets, crucial for bolstering CMA CGM's operational capabilities within Turkey. The deal's primary focus appears to be on enhancing port operations and inland logistics.

- Acquisition of the Port of Ambarli: This key asset significantly increases CMA CGM's container handling capacity within Turkey, providing direct access to a strategically important port facility. The Port of Ambarli's location provides excellent connectivity to major transportation networks, enhancing efficiency.

- Extensive Inland Logistics Network: The acquisition also includes a substantial inland logistics network, encompassing trucking fleets and warehousing facilities strategically located across Turkey. This allows CMA CGM to offer end-to-end logistics solutions, moving goods seamlessly from port to final destination.

- Advanced Technology Integration: The acquired assets are believed to include advanced technology for port management, logistics optimization, and supply chain visibility. This integration will further enhance CMA CGM's operational efficiency and provide customers with real-time tracking capabilities.

Financial Implications and Strategic Rationale

The $440 million price tag reflects the strategic importance of this acquisition for CMA CGM. This significant investment is justified by Turkey's strategic location and its burgeoning role as a key transit point between Europe and Asia. The acquisition allows CMA CGM to:

- Expand Market Share: Gain a significant market share in the Turkish logistics sector, a rapidly growing market with high potential.

- Access Strategic Trade Routes: Secure access to crucial trade routes connecting Europe and Asia, significantly enhancing CMA CGM’s global network.

- Achieve Synergies: Integrate the acquired assets with existing CMA CGM operations, creating synergies that enhance operational efficiency and reduce costs.

- Strengthen Global Network: Solidify its position as a leading global player, offering comprehensive end-to-end logistics solutions.

Impact on the Turkish Logistics Market

Increased Competition and Market Consolidation

The CMA CGM acquisition will undoubtedly reshape the competitive landscape of the Turkish logistics industry.

- Increased Competition: The entry of such a major global player will intensify competition, potentially driving down prices and improving service offerings for shippers in Turkey.

- Market Consolidation: The acquisition could spark further consolidation within the Turkish market, as smaller players seek to either merge or find strategic partnerships to remain competitive.

- Improved Efficiency: CMA CGM's expertise and resources could improve overall efficiency within the Turkish logistics sector, leading to more streamlined operations.

Boost to Turkish Infrastructure and Economic Growth

CMA CGM's significant investment signals confidence in the Turkish economy and its future growth potential.

- Infrastructure Improvements: Investments in port infrastructure and technological upgrades will enhance the efficiency of Turkish ports, facilitating smoother cargo handling and reducing transit times.

- Foreign Direct Investment: The acquisition could serve as a catalyst for further foreign direct investment in Turkey's logistics sector, boosting economic growth and job creation.

- Job Creation: The expansion of CMA CGM's operations in Turkey is expected to generate numerous jobs, both directly and indirectly, contributing to the overall employment landscape.

Global Implications of CMA CGM's Turkish Expansion

Strengthened Global Supply Chain Network

This strategic acquisition significantly enhances CMA CGM's global reach and capabilities, improving its overall supply chain network.

- Improved Connectivity: The enhanced infrastructure and logistics network improve connectivity between Europe and Asia, leading to more efficient and reliable global supply chains.

- End-to-End Solutions: CMA CGM can now offer more comprehensive end-to-end logistics solutions, managing the entire transportation process from origin to destination.

- Reduced Transit Times and Costs: Improvements in efficiency and infrastructure could lead to reduced transit times and overall costs for shippers utilizing CMA CGM's services.

Geopolitical Significance

Turkey’s strategic geographic location makes this acquisition a significant geopolitical move for CMA CGM.

- Key Transit Point: Turkey's position at the crossroads of Europe and Asia makes it a vital transit point for global trade, and CMA CGM's increased presence strengthens its influence in this crucial region.

- Trade Facilitation: The acquisition will likely facilitate increased trade between Europe and Asia, boosting economic activity in both regions.

- Regional Influence: CMA CGM's expansion could have broader geopolitical implications, increasing its influence and engagement within the region.

Conclusion

The $440 million acquisition by CMA CGM represents a pivotal moment for the Turkish logistics sector and the broader global shipping industry. This strategic investment highlights Turkey's growing importance as a major logistics hub and promises to stimulate economic growth, improve global supply chain efficiency, and increase competition within the Turkish logistics market. CMA CGM's expansion underscores the ongoing consolidation in the industry and the continuous drive for market dominance. To stay ahead in this dynamic environment, businesses involved in international trade must closely monitor developments in the global logistics landscape, particularly the impact of major players like CMA CGM on markets like Turkish logistics. Understanding these shifts is crucial for navigating the complexities of the global supply chain.

Featured Posts

-

Wichtige Bekanntmachung Von Pne Ag Gemaess Artikel 40 Absatz 1 Wp Hg

Apr 27, 2025

Wichtige Bekanntmachung Von Pne Ag Gemaess Artikel 40 Absatz 1 Wp Hg

Apr 27, 2025 -

Wta 1000 Dubai Fin Del Camino Para Paolini Y Pegula

Apr 27, 2025

Wta 1000 Dubai Fin Del Camino Para Paolini Y Pegula

Apr 27, 2025 -

Lifting The Farm Imports Ban Progress In South Africa Tanzania Discussions

Apr 27, 2025

Lifting The Farm Imports Ban Progress In South Africa Tanzania Discussions

Apr 27, 2025 -

Como Alberto Ardila Olivares Garantiza El Exito En El Gol

Apr 27, 2025

Como Alberto Ardila Olivares Garantiza El Exito En El Gol

Apr 27, 2025 -

Pne Groups Wind Energy Portfolio Expansion Two New Projects Added

Apr 27, 2025

Pne Groups Wind Energy Portfolio Expansion Two New Projects Added

Apr 27, 2025

Latest Posts

-

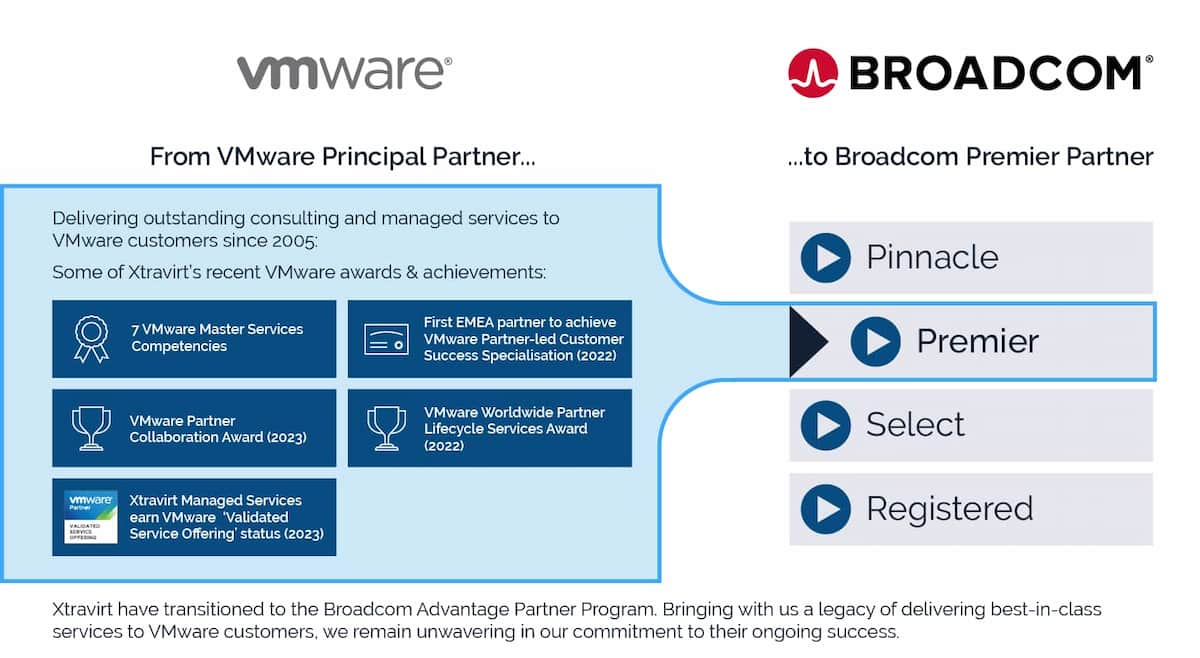

Broadcoms V Mware Acquisition At And T Highlights Extreme Price Increase Concerns

Apr 28, 2025

Broadcoms V Mware Acquisition At And T Highlights Extreme Price Increase Concerns

Apr 28, 2025 -

1 050 Price Hike At And T Challenges Broadcoms V Mware Acquisition Proposal

Apr 28, 2025

1 050 Price Hike At And T Challenges Broadcoms V Mware Acquisition Proposal

Apr 28, 2025 -

Assessing The Us Economy The Immediate Effects Of A Canadian Travel Boycott

Apr 28, 2025

Assessing The Us Economy The Immediate Effects Of A Canadian Travel Boycott

Apr 28, 2025 -

Canadian Travel Boycott A Fed Snapshot Reveals Economic Repercussions

Apr 28, 2025

Canadian Travel Boycott A Fed Snapshot Reveals Economic Repercussions

Apr 28, 2025 -

Car Dealerships Renew Pushback Against Electric Vehicle Regulations

Apr 28, 2025

Car Dealerships Renew Pushback Against Electric Vehicle Regulations

Apr 28, 2025