5 Do's And Don'ts For Landing A Job In The Private Credit Boom

Table of Contents

Do's for Landing a Job in the Private Credit Boom

Do Your Research: Understand the Private Credit Landscape

Before diving into your job search, thorough research is paramount. The private credit industry encompasses various firms, each with unique investment strategies. Understanding these nuances is key to targeting your applications effectively.

- Research different private credit firms: Explore hedge funds, direct lenders, private equity firms with credit arms, and other players in the market. Identify firms whose investment strategies align with your skills and interests.

- Understand their investment strategies: Familiarize yourself with different debt strategies like unitranche, direct lending, mezzanine financing, and other specialized credit products. This knowledge will significantly enhance your interview performance.

- Leverage industry resources: Utilize reputable sources like PEI Media, Private Debt Investor, and other specialized publications to stay updated on market trends and firm activities. Attend industry networking events and conferences to gather information and build connections.

Network Strategically: Build Connections in the Private Credit Industry

Networking is crucial in a niche market like private credit. Actively building relationships can significantly increase your chances of landing a job.

- Attend industry events: Conferences and smaller networking events offer opportunities to meet professionals and learn about unadvertised job openings.

- Leverage LinkedIn: Optimize your LinkedIn profile, connect with professionals in the private credit industry, join relevant groups, and engage in discussions.

- Conduct informational interviews: Reach out to professionals for informational interviews to gain insights into their roles, firms, and the industry in general. This demonstrates initiative and can open unexpected doors.

Tailor Your Resume and Cover Letter: Showcase Relevant Skills and Experience

Your resume and cover letter are your first impression. Tailoring them to each specific application is vital for success in securing a job in private credit.

- Use relevant keywords: Incorporate keywords like "underwriting," "due diligence," "portfolio management," "credit analysis," "financial modeling," and "valuation" throughout your resume and cover letter.

- Quantify achievements: Don't just list your responsibilities; quantify your accomplishments using metrics and numbers to showcase your impact.

- Craft a compelling executive summary: Start with a strong executive summary highlighting your most relevant skills and experience, immediately capturing the recruiter's attention.

Ace the Interview: Prepare for Behavioral and Technical Questions

The interview process for private credit jobs is rigorous. Preparation is essential to showcase your technical and soft skills.

- Prepare for common questions: Practice answering behavioral questions ("Tell me about a time you failed...") and technical questions ("How do you assess risk in private credit investments?").

- Demonstrate your expertise: Showcase your proficiency in financial modeling, valuation techniques (DCF, LBO), credit analysis, and understanding of key financial ratios.

- Research the interviewers: Research the interviewers on LinkedIn to understand their background and experience, allowing you to tailor your responses and ask insightful questions.

Follow Up Professionally: Demonstrate Your Interest and Enthusiasm

Following up after each interview demonstrates your continued interest and professionalism.

- Send thank-you notes: Send personalized thank-you notes within 24 hours of each interview, reiterating your interest and highlighting key discussion points.

- Follow up on application status: Politely inquire about the status of your application after a reasonable timeframe, showing your persistence without being overly demanding.

Don'ts for Landing a Job in the Private Credit Boom

Don't Neglect the Fundamentals: Ensure Strong Financial Modeling Skills

Proficiency in financial modeling is non-negotiable. Mastering these skills is crucial for success in private credit jobs.

- Excel proficiency: Demonstrate advanced Excel skills, including proficiency in functions, macros, and data analysis.

- Financial modeling software: Familiarity with Bloomberg Terminal, Argus, or other relevant software is highly advantageous.

- Understanding key metrics: Master key financial ratios and metrics used in credit analysis, such as leverage ratios, interest coverage ratios, and default probabilities.

Don't Underestimate the Importance of Soft Skills

Technical skills are important, but soft skills are equally crucial in a collaborative environment.

- Communication skills: Excellent written and verbal communication skills are essential for effectively conveying complex information.

- Teamwork: Demonstrate your ability to work effectively within a team and contribute to a positive work environment.

- Problem-solving abilities: Highlight your problem-solving skills and ability to handle challenging situations under pressure.

Don't Apply Broadly Without Targeting

Sending generic applications won't cut it. Targeted applications demonstrate your genuine interest and understanding of the firm.

- Research specific companies: Thoroughly research each firm's investment strategy, portfolio, and culture before applying.

- Tailor your application: Customize your resume and cover letter to reflect the specific requirements and preferences of each firm.

- Highlight relevant experience: Focus on the experience most relevant to the specific role and the firm's investment strategy.

Don't Be Afraid to Negotiate: Know Your Worth

Knowing your worth and negotiating your compensation package is crucial.

- Research salary ranges: Research salary ranges for similar roles in the private credit industry to understand your market value.

- Prepare your justification: Prepare a justification for your desired salary based on your skills, experience, and market value.

- Negotiate confidently: Negotiate confidently and professionally, advocating for your worth while maintaining a positive relationship with the employer.

Don't Give Up: Persistence Pays Off

The job search process can be challenging. Persistence and a positive attitude are crucial.

- Stay positive: Maintain a positive attitude and focus on continuous improvement.

- Network persistently: Continue networking and building relationships within the industry.

- Learn and adapt: Continuously learn and adapt your strategies based on your experiences and feedback.

Securing Your Place in the Private Credit Boom

To recap, landing a job in this booming sector requires meticulous research, strategic networking, tailored applications, strong interview preparation, and persistent follow-up. Remember, the private credit job market is competitive, so preparation and strategic planning are vital. Start implementing these tips today and secure your place in the exciting world of private credit jobs and private credit careers!

Featured Posts

-

Airbus Tariff On Us Airlines A Breakdown Of The Implications

May 03, 2025

Airbus Tariff On Us Airlines A Breakdown Of The Implications

May 03, 2025 -

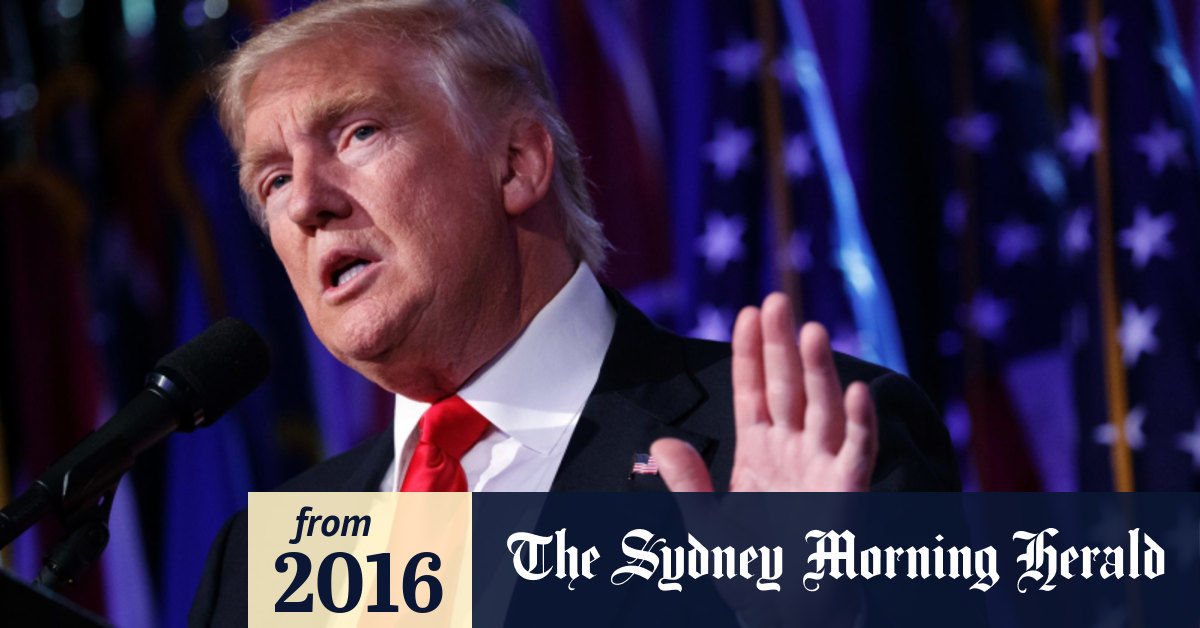

Exclusive Report Paramount Leaders In Talks To Settle Trump Lawsuit For 20 Million

May 03, 2025

Exclusive Report Paramount Leaders In Talks To Settle Trump Lawsuit For 20 Million

May 03, 2025 -

Como Escolher A Melhor Mini Camera Chaveiro Para Voce

May 03, 2025

Como Escolher A Melhor Mini Camera Chaveiro Para Voce

May 03, 2025 -

Cotswolds Mansion Paint Job Lands Daisy May Cooper In 30 000 Legal Fight

May 03, 2025

Cotswolds Mansion Paint Job Lands Daisy May Cooper In 30 000 Legal Fight

May 03, 2025 -

Mother Daughter Style Icons Kate And Lila Mosss Matching Lbds At Lfw

May 03, 2025

Mother Daughter Style Icons Kate And Lila Mosss Matching Lbds At Lfw

May 03, 2025

Latest Posts

-

Trai Cay Xua Nay Len Ngoi Dac San 60 000d Kg Duoc Dan Thanh Pho San Lung

May 04, 2025

Trai Cay Xua Nay Len Ngoi Dac San 60 000d Kg Duoc Dan Thanh Pho San Lung

May 04, 2025 -

Kham Pha Loai Qua Xua Nay Gay Bao Voi Gia 60 000d Kg

May 04, 2025

Kham Pha Loai Qua Xua Nay Gay Bao Voi Gia 60 000d Kg

May 04, 2025 -

Qua Xua Hon 60 000d Kg Dac San Noi Tieng Voi Huong Vi Dac Biet

May 04, 2025

Qua Xua Hon 60 000d Kg Dac San Noi Tieng Voi Huong Vi Dac Biet

May 04, 2025 -

Dari Sampah Menjadi Harta Manfaat Cangkang Telur Bagi Pertanian Dan Peternakan

May 04, 2025

Dari Sampah Menjadi Harta Manfaat Cangkang Telur Bagi Pertanian Dan Peternakan

May 04, 2025 -

Raya Promotion Free Hpc Ev Charging On Shell Recharge East Coast

May 04, 2025

Raya Promotion Free Hpc Ev Charging On Shell Recharge East Coast

May 04, 2025