5 Essential Dos And Don'ts To Succeed In The Private Credit Industry

Table of Contents

DO: Develop a Specialized Niche and Expertise

Success in private credit often hinges on specialization. Focusing your efforts allows for deeper market understanding and a significant competitive advantage.

Focus on a Specific Sector or Deal Type:

Specialization allows you to become a true expert, identifying undervalued opportunities others may miss.

- Focus on a specific industry: Develop deep knowledge in sectors like healthcare, technology, renewable energy, or real estate. This focused approach allows you to better assess the risks and opportunities within that specific vertical.

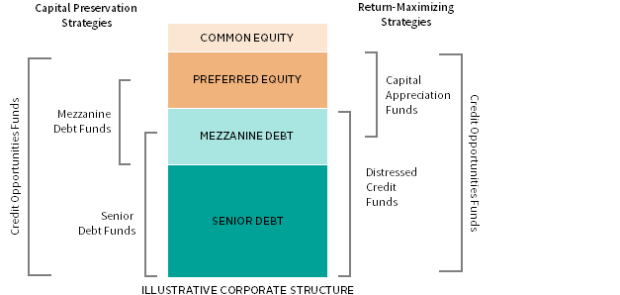

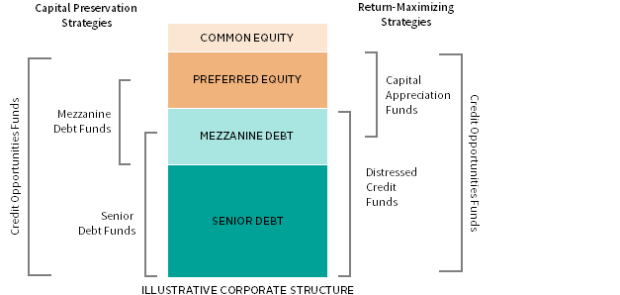

- Target specific deal structures: Master unitranche loans, mezzanine financing, direct lending, or other specialized structures. Understanding the nuances of these structures is key to successful deal execution.

- Leverage specialized knowledge: Your expertise will allow you to quickly identify attractive investment opportunities and negotiate favorable terms.

Build Strong Relationships with Industry Players:

Networking is paramount in private credit. Strong relationships unlock deal flow and provide invaluable insights.

- Attend industry conferences and events: These events are crucial for building relationships with potential borrowers, investors, and other key players.

- Cultivate relationships with intermediaries: Investment banks, brokers, and legal professionals can provide access to promising deals and crucial market intelligence.

- Develop a strong reputation: Professionalism, integrity, and consistent performance are vital for building trust and attracting lucrative opportunities.

DON'T: Underestimate Due Diligence and Risk Assessment

Thorough due diligence and robust risk assessment are non-negotiable in private credit. Neglecting this crucial step can lead to significant financial losses.

Thoroughly Investigate Borrowers and Their Businesses:

Comprehensive due diligence is your safeguard against unforeseen risks.

- Conduct in-depth financial analysis: Employ rigorous financial modeling, including stress testing and sensitivity analysis, to accurately assess the borrower's financial health.

- Evaluate management teams: Assess the experience, track record, and overall competence of the management team. A strong management team is often a key indicator of success.

- Verify collateral and assess risk: Thoroughly assess the value and liquidity of any collateral offered, and carefully evaluate the overall risk profile of the investment.

Neglect Legal and Regulatory Compliance:

Adherence to all applicable laws and regulations is paramount. Non-compliance can result in severe penalties and reputational damage.

- Stay up-to-date on regulations: The regulatory landscape in private credit is constantly evolving. Stay informed on the latest changes to avoid legal issues.

- Ensure compliant documentation: All loan agreements, security documents, and other legal documentation must be meticulously reviewed and comply with all relevant regulations.

- Seek legal counsel: Consult with experienced legal professionals to ensure compliance and mitigate legal risks.

DO: Cultivate Strong Investor Relationships

Building and maintaining strong relationships with investors is essential for securing funding and ensuring long-term success.

Transparency and Communication are Key:

Open and honest communication fosters trust and strengthens investor relationships.

- Provide regular updates and reports: Keep investors informed about portfolio performance, market trends, and any significant developments.

- Be responsive to inquiries: Promptly address investor questions and concerns to maintain transparency and build trust.

- Build trust through consistency: Consistent communication and reliable performance are key to fostering strong, long-lasting relationships.

Demonstrate a Clear Value Proposition:

Clearly articulate the benefits of investing in your private credit strategies.

- Highlight attractive risk-adjusted returns: Emphasize the potential for strong returns while mitigating risks.

- Emphasize diversification and downside protection: Showcase how your strategies offer diversification and protection against market downturns.

- Showcase a strong track record: A proven track record of successful investments builds confidence and attracts investors.

DON'T: Neglect Portfolio Management and Monitoring

Active portfolio management and consistent monitoring are crucial for optimizing returns and mitigating risks.

Active Portfolio Management is Essential:

Regular review and adjustments are vital to navigate changing market conditions.

- Track key performance indicators (KPIs): Monitor critical metrics to assess the performance of your portfolio and identify potential issues.

- Respond proactively to changes: Be prepared to adapt your strategies and take corrective action when borrower circumstances change.

- Regularly assess risk: Continuously monitor the overall risk profile of your portfolio and adjust your strategies accordingly.

Underestimate the Importance of Exit Strategies:

Planning for efficient portfolio exits is crucial for maximizing returns.

- Develop a comprehensive exit strategy: Develop a clear plan for exiting each investment, considering various scenarios.

- Explore various exit options: Explore options such as refinancings, sales to other investors, or public offerings.

- Adapt to market conditions: Be prepared to adjust your exit strategy based on changing market conditions.

DO: Embrace Technology and Data Analytics

Leveraging technology and data analytics provides a significant competitive advantage in the private credit industry.

Leverage Technology for Enhanced Efficiency:

Technology streamlines operations and improves decision-making.

- Employ data analytics for opportunities: Utilize data analytics to identify promising investment opportunities and assess risk more accurately.

- Automate workflows and reporting: Automate tasks such as portfolio monitoring, reporting, and communication to improve efficiency.

- Improve due diligence with technology: Use technology tools to enhance the speed and accuracy of your due diligence process.

Stay Updated on Industry Trends and Best Practices:

Continuous learning is crucial for staying ahead in the dynamic private credit market.

- Attend industry events and conferences: Network and learn about the latest trends and best practices.

- Read industry publications and research reports: Stay informed about market developments and regulatory changes.

- Network with other professionals: Engage with other professionals in the field to share knowledge and learn from their experiences.

Conclusion

Successfully navigating the private credit industry demands a strategic approach that blends proactive strategies with a keen awareness of potential risks. By following these essential dos and don'ts – specializing, performing thorough due diligence, cultivating strong investor relationships, actively managing your portfolio, and embracing technological advancements – you can substantially increase your chances of achieving sustainable success. Mastering private credit investment requires continuous learning, adaptation, and a commitment to excellence. Start implementing these strategies today and elevate your private credit business.

Featured Posts

-

3 En Tutumlu Burc Paranizi Nasil Yoenettiklerini Oegrenin

May 24, 2025

3 En Tutumlu Burc Paranizi Nasil Yoenettiklerini Oegrenin

May 24, 2025 -

Trade War Intensifies Amsterdam Stock Market Opens Down 7

May 24, 2025

Trade War Intensifies Amsterdam Stock Market Opens Down 7

May 24, 2025 -

The Sean Penn Woody Allen Dylan Farrow Controversy A Closer Look

May 24, 2025

The Sean Penn Woody Allen Dylan Farrow Controversy A Closer Look

May 24, 2025 -

Garazh Ryazanova Plenum Tsenzura I Neozhidannaya Pomosch Brezhneva

May 24, 2025

Garazh Ryazanova Plenum Tsenzura I Neozhidannaya Pomosch Brezhneva

May 24, 2025 -

90mph Refuel The Incredible Police Chase Story

May 24, 2025

90mph Refuel The Incredible Police Chase Story

May 24, 2025

Latest Posts

-

The Joe Jonas Feud A Married Couples Unexpected Argument

May 24, 2025

The Joe Jonas Feud A Married Couples Unexpected Argument

May 24, 2025 -

Joe Jonas And The Unexpected Fan Dispute

May 24, 2025

Joe Jonas And The Unexpected Fan Dispute

May 24, 2025 -

Joe Jonas Best Response To Married Couples Dispute

May 24, 2025

Joe Jonas Best Response To Married Couples Dispute

May 24, 2025 -

A Married Couples Fight Over Joe Jonas His Response

May 24, 2025

A Married Couples Fight Over Joe Jonas His Response

May 24, 2025 -

Joe Jonas Addresses Couples Argument About Him The Full Story

May 24, 2025

Joe Jonas Addresses Couples Argument About Him The Full Story

May 24, 2025