5 Key Actions To Secure A Private Credit Role

Table of Contents

Master the Fundamentals of Private Credit Investing

To excel in the private credit industry, a solid understanding of its core principles is paramount. This involves more than just theoretical knowledge; it requires practical application and a keen understanding of the market dynamics.

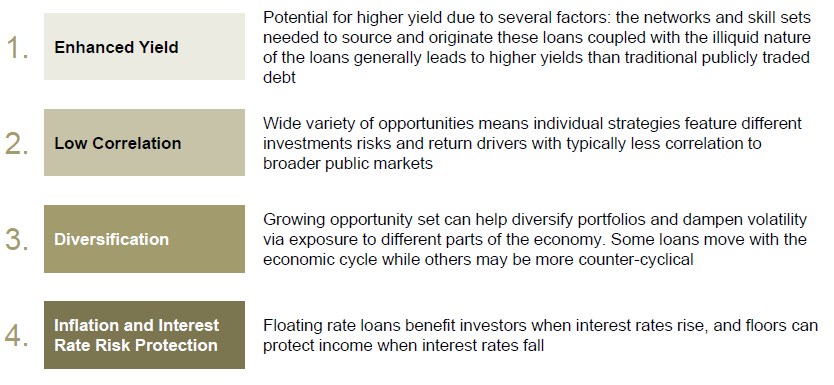

Understand Different Private Credit Strategies

The private credit market offers diverse investment strategies. Familiarity with these is crucial for any aspiring professional. Key strategies include:

- Direct Lending: Providing loans directly to companies, often mid-market businesses, bypassing traditional banks. This requires strong underwriting skills and a deep understanding of credit analysis. Keywords: direct lending, private debt, senior secured loans, mezzanine financing.

- Fund Investing: Investing in private credit funds managed by specialized firms. This requires an understanding of fund structures, due diligence processes, and performance evaluation. Keywords: private credit funds, fund of funds, LP investing, fund manager selection.

- Distressed Debt Investing: Investing in debt securities of financially troubled companies, aiming to restructure or recover value. This demands in-depth financial analysis and negotiation skills. Keywords: distressed debt investing, credit restructuring, workouts, special situations.

Understanding the nuances of each strategy, including the risks and rewards, is key to navigating the complexities of the private credit world.

Develop a Strong Financial Modeling Skillset

Financial modeling is the backbone of private credit analysis. Proficiency in this area is non-negotiable.

- LBO Modeling: Crucial for analyzing leveraged buyouts, a common transaction in private credit. Understanding leverage, debt structures, and returns is essential. Keywords: LBO modeling, leveraged buyout, debt financing, exit strategies.

- Cash Flow Projections: Accurately forecasting future cash flows is vital for credit risk assessment and valuation. Mastering techniques like DCF analysis is a must. Keywords: DCF analysis, cash flow modeling, pro forma statements, private credit valuation.

Consider taking relevant courses or reading books on advanced financial modeling techniques to strengthen your skillset.

Network Strategically Within the Private Credit Industry

Networking is crucial for landing a private credit role. Building relationships within the industry opens doors and provides invaluable insights.

Attend Industry Events and Conferences

Industry events are prime networking opportunities.

- Conferences: Attend relevant conferences such as those hosted by industry associations or private equity firms. Keywords: private credit networking, industry events, conferences, private equity conferences.

- Networking Events: Look for smaller, more focused networking events to build deeper connections.

Prepare talking points highlighting your skills and interests. Follow up with contacts after these events.

Leverage LinkedIn and Professional Contacts

LinkedIn is a powerful tool for connecting with private credit professionals.

- Optimize your profile: Make sure your LinkedIn profile is up-to-date and showcases your skills and experience in private credit. Keywords: LinkedIn networking, private credit professionals, industry connections.

- Informational Interviews: Reach out to professionals for informational interviews to learn about their careers and gain insights into the industry.

Building genuine relationships, not just collecting contacts, is key.

Tailor Your Resume and Cover Letter to Private Credit Roles

Your resume and cover letter are your first impression. Tailoring them to specific roles and firms is crucial.

Showcase Relevant Experience and Skills

Even if your experience isn't directly in private credit, highlight transferable skills.

- Quantifiable Achievements: Use quantifiable achievements to demonstrate your impact in previous roles. Keywords: private credit experience, relevant skills, resume optimization, achievements.

- Keywords: Incorporate relevant keywords from job descriptions to improve your resume's visibility to applicant tracking systems (ATS).

Research the Specific Firm and Role

Demonstrate genuine interest in the firm and the role.

- Investment Strategy: Research the firm's investment strategy, target sectors, and recent transactions. Keywords: target firm, investment strategy, cover letter, due diligence.

- Tailored Approach: Tailor your resume and cover letter to align with the firm's values and investment approach.

Prepare for the Private Credit Interview Process

Thorough interview preparation is key to success.

Practice Behavioral and Technical Interview Questions

Expect both behavioral and technical questions.

- Behavioral Questions: Practice answering behavioral questions that assess your skills and experience. Keywords: private credit interview questions, behavioral questions, technical questions, case studies.

- Technical Questions: Prepare for technical questions related to financial modeling, valuation, and credit analysis.

Demonstrate Your Passion for Private Credit

Show genuine enthusiasm for the field.

- Relevant Projects: Discuss projects or experiences that demonstrate your interest in private credit. Keywords: passion for finance, investment enthusiasm, private credit market.

- Market Trends: Show knowledge of current market trends and challenges in private credit.

Follow Up After the Interview and Maintain Contact

Effective follow-up is crucial.

Send a Thank-You Note

Send a personalized thank-you note within 24 hours. Keywords: follow-up email, thank-you note, professionalism.

Maintain Contact with Recruiters and Hiring Managers

Stay in touch even if you don't hear back immediately. Keywords: recruiters, hiring managers, professional relationships. Stay updated on industry news and opportunities.

Conclusion

Securing a private credit role requires dedication, strategic planning, and a focused approach. By mastering the fundamentals, networking effectively, tailoring your application materials, preparing thoroughly for interviews, and maintaining consistent follow-up, you significantly increase your chances of success. Don't hesitate to leverage these five key actions to advance your career in the competitive field of private credit. Start implementing these strategies today and take the crucial steps toward landing your dream private credit role!

Featured Posts

-

Philippe Candeloro Et Chantal Ladesou Invites D Honneur De La Vente Des Vins De Nuits Saint Georges

May 12, 2025

Philippe Candeloro Et Chantal Ladesou Invites D Honneur De La Vente Des Vins De Nuits Saint Georges

May 12, 2025 -

Full List Famous Faces Affected By The Palisades Fire

May 12, 2025

Full List Famous Faces Affected By The Palisades Fire

May 12, 2025 -

Payton Pritchard Game 1 Playoff Performance And Its Significance For The Boston Celtics

May 12, 2025

Payton Pritchard Game 1 Playoff Performance And Its Significance For The Boston Celtics

May 12, 2025 -

Adam Sandler The Unifying Force America Needs

May 12, 2025

Adam Sandler The Unifying Force America Needs

May 12, 2025 -

From Scatological Data To Engaging Audio Ai Driven Poop Podcast Creation

May 12, 2025

From Scatological Data To Engaging Audio Ai Driven Poop Podcast Creation

May 12, 2025

Latest Posts

-

New Islamic City In Texas Proactive Approach To Addressing Public Concerns About Sharia Law

May 13, 2025

New Islamic City In Texas Proactive Approach To Addressing Public Concerns About Sharia Law

May 13, 2025 -

North Texas Clergy Speak Out Against Governor Abbotts Epic City Investigations

May 13, 2025

North Texas Clergy Speak Out Against Governor Abbotts Epic City Investigations

May 13, 2025 -

Gov Abbotts Directive Texas Rangers Probe Plano Islamic Center Development Plan

May 13, 2025

Gov Abbotts Directive Texas Rangers Probe Plano Islamic Center Development Plan

May 13, 2025 -

Dispute Over Epic City Development Abbotts Warning Vs Developer Claims

May 13, 2025

Dispute Over Epic City Development Abbotts Warning Vs Developer Claims

May 13, 2025 -

Dispute Over Epic City Development Abbotts Warning Vs Developer Statements

May 13, 2025

Dispute Over Epic City Development Abbotts Warning Vs Developer Statements

May 13, 2025