5 Key Do's & Don'ts: Succeeding In The Private Credit Job Market

Table of Contents

Breaking into the competitive private credit job market requires more than just a strong resume. This guide outlines five crucial dos and don'ts to help you navigate this specialized field and land your dream role in the private credit industry. Mastering these strategies will significantly increase your chances of success in this lucrative and rapidly expanding sector of finance. The private credit job market is highly sought after, and this guide will give you the edge you need.

<h2>Do: Network Strategically within the Private Credit Community</h2>

Networking is paramount in the private credit job market. Building relationships with professionals in the field can open doors to unadvertised opportunities and provide invaluable insights.

<h3>Attend Industry Events and Conferences</h3>

Actively participate in private credit conferences, seminars, and networking events. These provide invaluable opportunities to meet potential employers and learn about the latest industry trends. These events are often where private credit firms recruit.

- Research upcoming events: Target those relevant to your desired niche within private credit (e.g., distressed debt, real estate lending, mezzanine financing).

- Prepare insightful questions: Demonstrate your genuine interest and knowledge of the private credit job market. Asking informed questions shows initiative and engagement.

- Follow up with meaningful connections: After each event, connect via email or LinkedIn, referencing a specific conversation you had.

<h3>Leverage Your Professional Network</h3>

Don't underestimate your existing network. Inform your contacts of your job search and ask for introductions within the private credit sector.

- Update your LinkedIn profile: Highlight your private credit-related skills and experience, using relevant keywords like "credit analysis," "financial modeling," and "underwriting."

- Actively engage in relevant industry groups and online forums: Participate in discussions, share insights, and establish yourself as a knowledgeable professional in the private credit space.

- Don't underestimate informational interviews: Schedule calls with professionals working in private credit to learn about their experiences and gain insights. These can be incredibly valuable.

<h2>Don't: Neglect Specialized Skills Development</h2>

The private credit job market demands a specific skillset. Failing to develop these skills will significantly hinder your chances of success.

<h3>Focus on Financial Modeling and Analysis</h3>

Master advanced financial modeling techniques, including discounted cash flow (DCF) analysis, leveraged buyout (LBO) modeling, and credit risk assessment. These are essential skills in the private credit job market.

- Pursue relevant certifications: A CFA charter or CAIA designation demonstrates your commitment to professional excellence and deepens your understanding of finance.

- Practice building financial models using real-world case studies: This hands-on experience is crucial to showcasing your capabilities.

- Showcase your modeling skills: Highlight your proficiency in your resume and cover letter with specific examples and quantifiable results.

<h3>Underestimate the Importance of Credit Analysis</h3>

Deepen your understanding of credit underwriting, risk management, and due diligence processes. This is the core of private credit work.

- Gain hands-on experience: Seek internships or volunteer work in related fields to build practical experience.

- Read industry publications: Stay up-to-date on the latest credit analysis techniques and market trends. Publications like Debtwire and GlobalCapital are good starting points.

- Develop strong analytical and problem-solving skills: These are essential for evaluating complex financial situations and making sound investment decisions.

<h2>Do: Tailor Your Resume and Cover Letter to Each Application</h2>

Generic applications rarely succeed in the competitive private credit job market. Each application should be tailored to the specific requirements of the role.

<h3>Highlight Relevant Experience</h3>

Showcase your experience in areas such as financial modeling, credit analysis, underwriting, or portfolio management, emphasizing quantifiable achievements.

- Use action verbs and quantify your accomplishments: Instead of saying "Managed a portfolio," say "Managed a $50 million portfolio, resulting in a 10% increase in ROI."

- Use keywords relevant to the specific job description: Analyze the job posting carefully and incorporate relevant keywords throughout your resume and cover letter.

- Tailor your resume and cover letter: Adapt your materials to match the specific requirements and responsibilities outlined in each job posting.

<h3>Craft a Compelling Narrative</h3>

Your resume and cover letter should tell a story that highlights your skills and experience in relation to the private credit industry. Demonstrate your passion and commitment to this sector.

- Research the company and its investment strategy: Show your understanding of their focus and how your skills align.

- Express your understanding of the firm's culture and values: Demonstrate that you've done your homework and are a good fit.

- Proofread carefully: Ensure your application is free of grammatical errors and typos.

<h2>Don't: Underprepare for the Interview Process</h2>

The interview process is crucial in securing a private credit job. Thorough preparation is essential.

<h3>Practice Your Interview Skills</h3>

Prepare for common private credit interview questions, focusing on your technical skills, experience, and problem-solving abilities. Expect questions on financial modeling, credit analysis, and market trends.

- Practice your answers out loud: This helps you refine your responses and identify areas needing improvement.

- Prepare insightful questions to ask the interviewer: This shows your genuine interest and initiative.

- Research the interviewer's background and experience: This allows you to tailor your conversation and make connections.

<h3>Neglect Behavioral Questions</h3>

Prepare to discuss your strengths, weaknesses, and experiences in handling challenging situations using the STAR method (Situation, Task, Action, Result).

- Reflect on past experiences: Showcase your teamwork, problem-solving, and communication skills.

- Practice responding confidently and concisely: Avoid rambling and focus on delivering clear, impactful answers.

- Use specific examples to illustrate your points: Provide concrete examples that demonstrate your abilities and experiences.

<h2>Do: Follow Up After Interviews</h2>

Following up after interviews demonstrates your continued interest and professionalism.

<h3>Send Thank-You Notes</h3>

Send personalized thank-you notes to each interviewer, expressing your gratitude and reiterating your interest in the position.

- Mention something specific you discussed: Personalize the note to show you were engaged in the conversation.

- Proofread carefully: Avoid any errors that could detract from your professionalism.

- Send within 24 hours: Prompt follow-up shows your enthusiasm and attentiveness.

<h3>Maintain Professionalism</h3>

Throughout the entire job search process, maintain a professional demeanor and attitude. Your professionalism will leave a positive lasting impression.

- Respond to emails and calls promptly: Show respect for the interviewers' time and consideration.

- Be prepared for any questions or requests: Maintain organized documentation and be ready to provide any additional information requested.

- Express your continued interest: Respectfully follow up to reiterate your interest in the role.

<h2>Conclusion</h2>

Securing a position in the competitive private credit job market requires a strategic and multifaceted approach. By following these key dos and don'ts—from strategic networking and skill development to meticulous interview preparation and follow-up—you can significantly improve your chances of success. Remember to tailor your application materials, showcase your expertise in financial modeling and credit analysis, and cultivate a strong professional network within the private credit community. Don't delay – start implementing these strategies today and take a confident step towards your desired career in the private credit job market. Good luck in your private credit job search!

Featured Posts

-

New Ja Morant Investigation Launched By The Nba A Deeper Look

Apr 24, 2025

New Ja Morant Investigation Launched By The Nba A Deeper Look

Apr 24, 2025 -

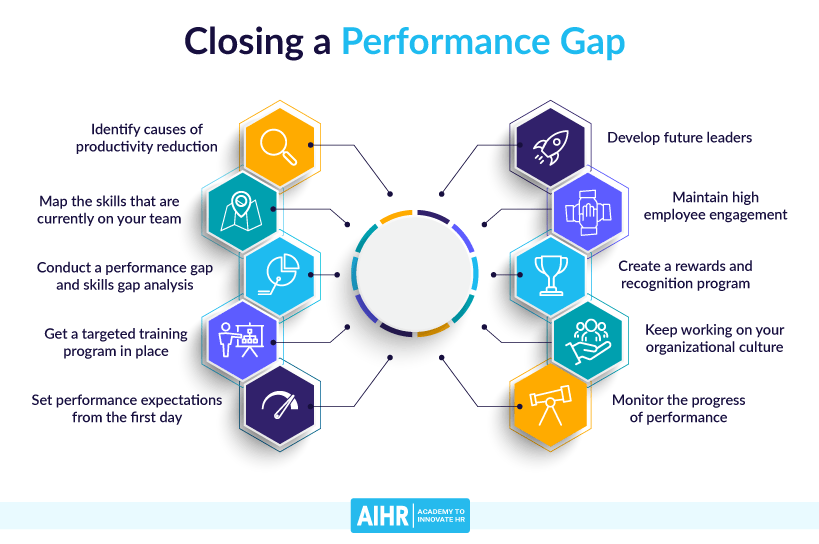

Middle Management Bridging The Gap Between Leadership And Employees For Improved Performance

Apr 24, 2025

Middle Management Bridging The Gap Between Leadership And Employees For Improved Performance

Apr 24, 2025 -

Elite Colleges Under Pressure Increased Fundraising Amidst Trump Era Funding Concerns

Apr 24, 2025

Elite Colleges Under Pressure Increased Fundraising Amidst Trump Era Funding Concerns

Apr 24, 2025 -

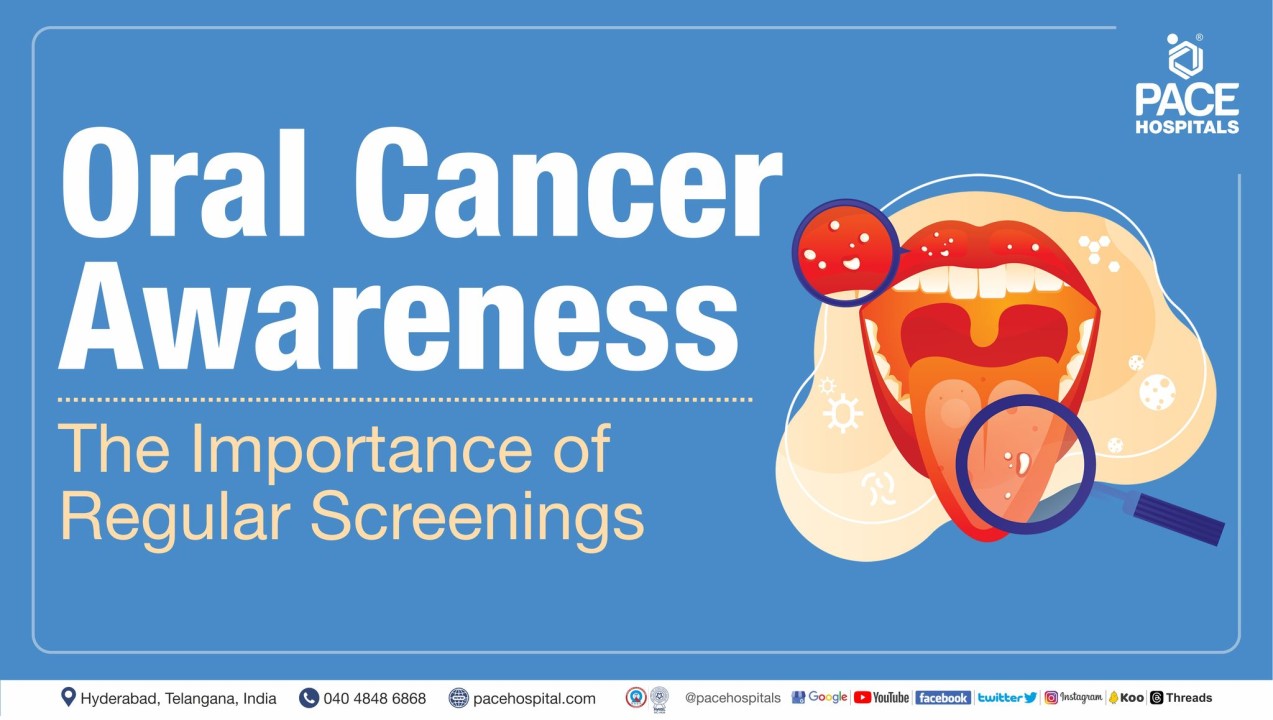

Breast Cancer Awareness Tina Knowles Story And The Significance Of Regular Screenings

Apr 24, 2025

Breast Cancer Awareness Tina Knowles Story And The Significance Of Regular Screenings

Apr 24, 2025 -

Film Koji Je Tarantino Odbio Pogledati Detalji I Spekulacije

Apr 24, 2025

Film Koji Je Tarantino Odbio Pogledati Detalji I Spekulacije

Apr 24, 2025

Latest Posts

-

Adidas 3 D Printed Shoes Performance Design And Innovation

May 12, 2025

Adidas 3 D Printed Shoes Performance Design And Innovation

May 12, 2025 -

Adidas 3 D Printed Sneaker Review A Detailed Look

May 12, 2025

Adidas 3 D Printed Sneaker Review A Detailed Look

May 12, 2025 -

Wildlife Filmmaking In Florida Focusing On Spring Alligators

May 12, 2025

Wildlife Filmmaking In Florida Focusing On Spring Alligators

May 12, 2025 -

The Challenges Of Filming Alligators In Floridas Springs

May 12, 2025

The Challenges Of Filming Alligators In Floridas Springs

May 12, 2025 -

Summers Arrival Delayed The Impact Of Recent Hailstorms

May 12, 2025

Summers Arrival Delayed The Impact Of Recent Hailstorms

May 12, 2025