$500 Million IPO: EToro's Renewed Funding Drive

Table of Contents

The Significance of eToro's $500 Million IPO Target

eToro's pursuit of a $500 million IPO is not merely a fundraising exercise; it's a strategic maneuver designed to propel the company to new heights. Securing this substantial funding offers several key advantages:

- Aggressive Expansion: The influx of capital will enable eToro to expand its operations into new, lucrative markets globally, reaching a wider audience of investors. This could involve setting up new regional offices and tailoring its services to specific local regulatory requirements.

- Technological Advancements: A significant portion of the funds will likely be allocated to enhancing eToro's technological infrastructure. This includes investing in Artificial Intelligence (AI) for improved trading algorithms and risk management, as well as integrating blockchain technology for enhanced security and transparency.

- Strategic Acquisitions: The $500 million could fuel acquisitions of smaller FinTech companies, bringing valuable expertise, technology, or customer bases into the eToro ecosystem. This could significantly accelerate its growth and consolidate its market position.

- Enhanced Brand Awareness: A successful IPO will elevate eToro's profile, boosting its brand credibility and attracting new users and investors. This increased visibility is particularly important in a crowded market.

eToro's Growth Trajectory and Market Position

eToro's ambition is underpinned by a strong track record of growth and success. The platform has consistently demonstrated impressive performance, evidenced by:

- Rapid User Growth: eToro boasts millions of registered users globally, showcasing strong organic growth fueled by its user-friendly interface and innovative features.

- Significant Revenue Increase: The company has experienced substantial year-on-year revenue growth, indicating a robust and scalable business model.

- Market Share Gains: eToro is steadily increasing its market share in the competitive online trading space, highlighting its ability to attract and retain customers.

- Strategic Partnerships and Product Launches: Successful partnerships and the introduction of new products and features have contributed significantly to eToro's growth and market penetration. This includes the expansion into cryptocurrencies and other asset classes.

Investor Interest and Market Expectations for the eToro IPO

The eToro IPO is anticipated to attract considerable interest from a wide range of investors:

- Institutional Investors: Large institutional investors, including mutual funds and hedge funds, are likely to view eToro as an attractive investment opportunity given its growth potential and market position.

- Retail Investors: Given eToro's own platform's accessibility, retail investors will also be highly interested in participating in the IPO.

- Valuation Expectations: The market anticipates a significant valuation for eToro, reflecting its strong growth trajectory and the potential of the social trading sector. However, market volatility and overall economic conditions could influence the final valuation.

- Potential Challenges: Regulatory hurdles, compliance issues, and overall market sentiment will be crucial factors influencing the success of the IPO.

The Role of Social Trading in eToro's Success and IPO Prospectus

eToro's unique social trading platform is a core component of its success story and will undoubtedly be a key focus in its IPO prospectus.

- Copy Trading: eToro's copy trading feature, allowing users to automatically mirror the trades of experienced investors, has been a major driver of user acquisition and engagement.

- Community Influence: The active and engaged social trading community on the platform creates a powerful network effect, attracting new users and contributing to a vibrant trading ecosystem.

- Regulatory Considerations: The regulatory landscape surrounding social trading is evolving, and eToro will need to address these considerations in its IPO prospectus to maintain investor confidence.

eToro's $500 Million IPO: A Game-Changer for Social Trading?

eToro's planned $500 million IPO represents a pivotal moment for the company and the social trading industry. The significant funding will undoubtedly fuel its expansion, technological advancements, and market dominance. The success of the IPO will depend on several factors, including market conditions, investor sentiment, and the company's ability to navigate the regulatory landscape. However, given eToro's strong growth trajectory and innovative platform, the IPO has the potential to be a game-changer, solidifying its position as a leader in the Fintech space. Stay updated on the eToro IPO and its impact on the social trading market by subscribing to our newsletter or following us on social media for the latest news and analysis on eToro funding and the future of social trading IPOs.

Featured Posts

-

Urgent Recall Walmart Pulls Tortilla Chips And Jewelry Kits From Shelves

May 14, 2025

Urgent Recall Walmart Pulls Tortilla Chips And Jewelry Kits From Shelves

May 14, 2025 -

Nordstrom Rack Best Deals On Calvin Klein Euphoria Perfume

May 14, 2025

Nordstrom Rack Best Deals On Calvin Klein Euphoria Perfume

May 14, 2025 -

Suits La Premiere Recap A Comprehensive Look At The Event

May 14, 2025

Suits La Premiere Recap A Comprehensive Look At The Event

May 14, 2025 -

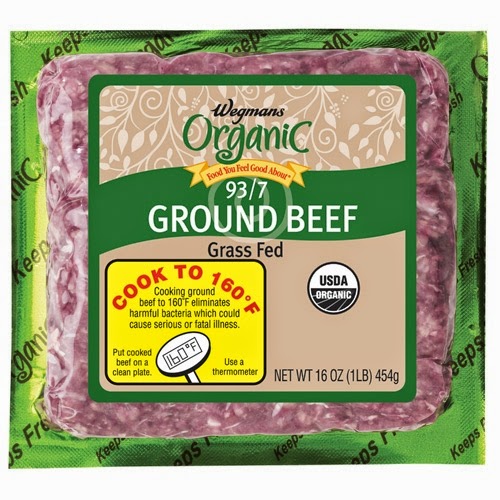

Recall Alert Wegmans Braised Beef With Vegetables Important Information

May 14, 2025

Recall Alert Wegmans Braised Beef With Vegetables Important Information

May 14, 2025 -

Newcastle United Transfer News Blow As Club Misses Out On Top Target

May 14, 2025

Newcastle United Transfer News Blow As Club Misses Out On Top Target

May 14, 2025