$5000 Personal Loans: Options For Borrowers With Bad Credit

Table of Contents

Understanding Your Credit Score and its Impact on Loan Approval

Your credit score is a three-digit number that lenders use to assess your creditworthiness. It reflects your history of borrowing and repaying debts. A higher credit score indicates a lower risk to the lender, resulting in better loan terms. For a $5000 personal loan, a good credit score significantly increases your chances of approval and secures you a more favorable interest rate. Conversely, bad credit makes loan approval more challenging and often results in higher interest rates and less favorable loan terms.

- Check your credit report for errors: Errors on your credit report can negatively impact your score. Review your reports from all three major credit bureaus (Equifax, Experian, and TransUnion) annually for inaccuracies.

- Understand the factors affecting your credit score: Your credit score is calculated based on several factors:

- Payment history (35%): Consistent on-time payments are crucial.

- Amounts owed (30%): Keeping your credit utilization low (the amount of credit you use compared to your total available credit) is important.

- Length of credit history (15%): A longer history of responsible credit use generally leads to a better score.

- New credit (10%): Opening many new accounts in a short period can negatively impact your score.

- Credit mix (10%): Having a variety of credit accounts (credit cards, installment loans) can be beneficial.

- Explore ways to improve your credit score before applying: Before applying for a $5000 personal loan, work on improving your credit score. This might involve paying down debt, correcting errors on your credit report, and maintaining responsible credit habits.

Exploring Loan Options for Borrowers with Bad Credit

Obtaining a $5000 personal loan with bad credit requires exploring various options. Each comes with its own set of advantages and disadvantages.

Secured Loans

Secured loans require collateral, an asset you pledge to the lender as security for the loan. If you default on payments, the lender can seize the collateral. Examples include auto title loans or loans secured by a savings account.

- Lower interest rates: Secured loans typically offer lower interest rates than unsecured loans because the lender has less risk.

- Higher risk of asset repossession: Missing payments can lead to the loss of your collateral.

- Requires collateral: You need to own an asset of sufficient value to secure the loan.

Unsecured Loans

Unsecured loans don't require collateral. However, lenders consider them riskier, resulting in higher interest rates. Online lenders often specialize in unsecured loans for borrowers with bad credit.

- Higher interest rates: Expect significantly higher interest rates compared to secured loans or loans for those with good credit.

- No collateral required: This is a significant advantage if you don't own valuable assets.

- May require a co-signer: To improve your chances of approval, a co-signer with good credit might be necessary.

Payday Loans (and why they should generally be avoided)

Payday loans are short-term, high-interest loans designed to be repaid on your next payday. They are generally considered predatory loans due to their extremely high annual percentage rates (APRs) and short repayment periods.

- Extremely high APR: Payday loans can have APRs exceeding 400%.

- Short repayment periods: The short repayment period makes it difficult for many borrowers to repay the loan on time, leading to a cycle of debt.

- Potential for a cycle of debt: The high interest and short repayment period can trap borrowers in a cycle of debt, making it increasingly difficult to repay. Avoid payday loans at all costs.

Credit Unions

Credit unions are member-owned financial institutions that often offer more lenient lending criteria than traditional banks. They might be a good option for borrowers with bad credit seeking a $5000 personal loan.

- Often have more flexible lending criteria: Credit unions may be more willing to work with borrowers who have less-than-perfect credit histories.

- Community-focused institutions: Credit unions prioritize their members' financial well-being.

- May offer financial education resources: Many credit unions provide resources to help members improve their financial literacy.

Tips for Increasing Your Chances of Loan Approval with Bad Credit

Even with bad credit, you can improve your chances of securing a $5000 personal loan.

- Improve your credit score before applying: As discussed above, improving your credit score is crucial.

- Shop around and compare loan offers: Compare interest rates, fees, and repayment terms from multiple lenders.

- Consider a co-signer: A co-signer with good credit can significantly improve your chances of approval.

- Provide thorough documentation: Support your income and expenses with comprehensive documentation.

- Be prepared to explain any negative marks on your credit report: Be honest and transparent about any past credit issues.

Conclusion

Securing a $5000 personal loan with bad credit requires careful planning and research. Understanding your credit score and exploring options like secured and unsecured loans, credit unions, and avoiding predatory payday loans is crucial. Remember to shop around, compare offers, and be prepared to provide thorough documentation. Start exploring your options for a $5000 personal loan today. Don't let bad credit hold you back from securing the funding you need. Research lenders carefully and choose the best option for your individual circumstances. Remember, responsible borrowing is key when taking out a $5000 personal loan, even with less-than-perfect credit.

Featured Posts

-

Analyzing Arsenals Performance Against Psv Eindhoven Over The Past Five Games

May 28, 2025

Analyzing Arsenals Performance Against Psv Eindhoven Over The Past Five Games

May 28, 2025 -

Watch Pacers Vs Hawks Live Game Time Tv Schedule And Streaming Options March 8th

May 28, 2025

Watch Pacers Vs Hawks Live Game Time Tv Schedule And Streaming Options March 8th

May 28, 2025 -

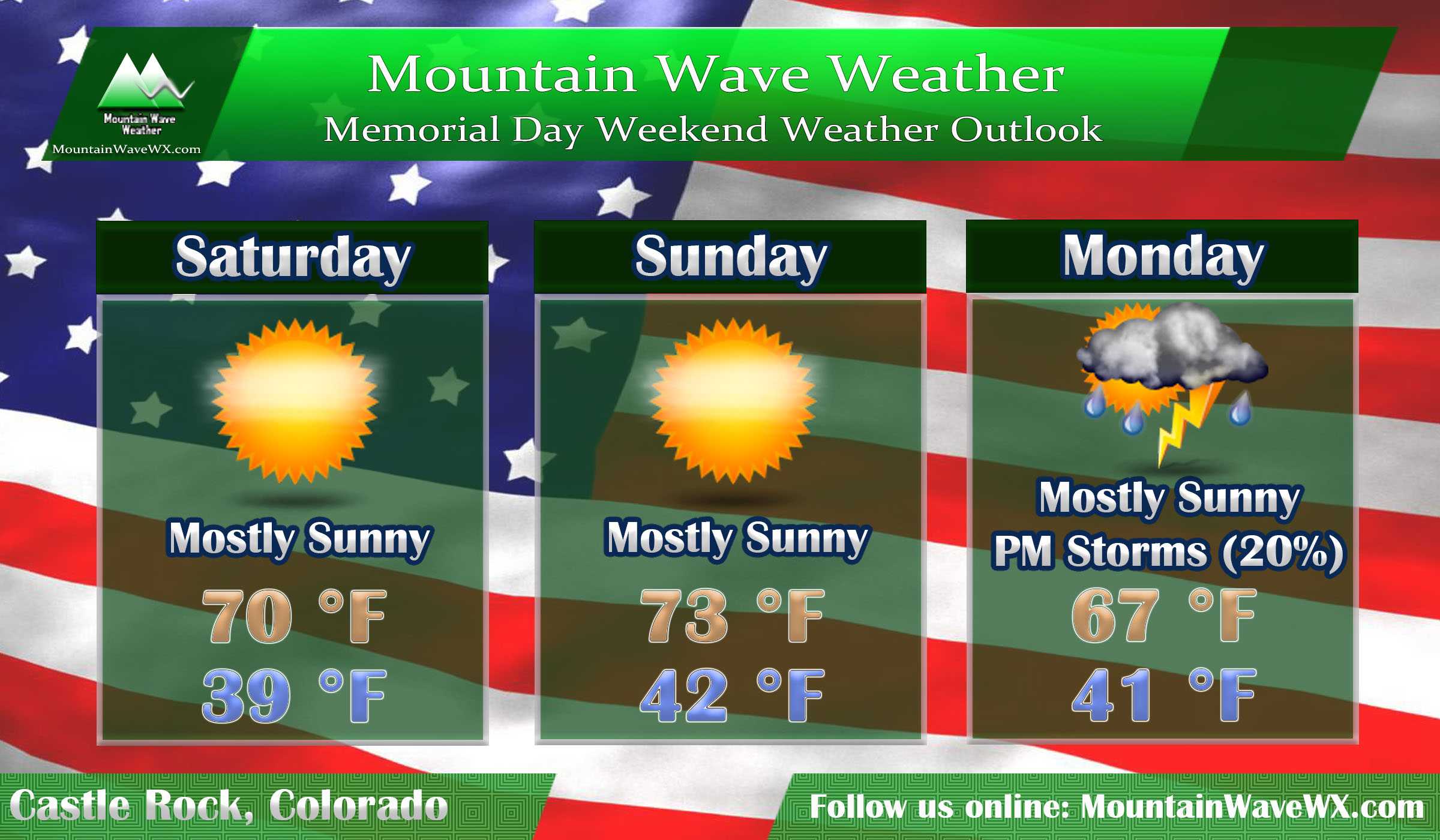

Persistent Rain In Seattle Weekend Weather Outlook

May 28, 2025

Persistent Rain In Seattle Weekend Weather Outlook

May 28, 2025 -

Los Angeles Wildfires And The Disturbing Trend Of Betting On Natural Disasters

May 28, 2025

Los Angeles Wildfires And The Disturbing Trend Of Betting On Natural Disasters

May 28, 2025 -

El Regreso De Jack Sparrow Depp Y El Productor De Piratas Se Reunen Para Discutir El Futuro De La Franquicia

May 28, 2025

El Regreso De Jack Sparrow Depp Y El Productor De Piratas Se Reunen Para Discutir El Futuro De La Franquicia

May 28, 2025

Latest Posts

-

Exploring The Best Areas Of Paris A Neighborhood Guide

May 30, 2025

Exploring The Best Areas Of Paris A Neighborhood Guide

May 30, 2025 -

Greve Sncf Philippe Tabarot Juge Les Revendications Illegitimes

May 30, 2025

Greve Sncf Philippe Tabarot Juge Les Revendications Illegitimes

May 30, 2025 -

Recours De L Etat Le Projet A69 Pourrait Reprendre Malgre Son Annulation

May 30, 2025

Recours De L Etat Le Projet A69 Pourrait Reprendre Malgre Son Annulation

May 30, 2025 -

Pagaille Sncf La Greve Est Elle Inevitable Declaration Ministerielle

May 30, 2025

Pagaille Sncf La Greve Est Elle Inevitable Declaration Ministerielle

May 30, 2025 -

A69 Le Sud Ouest Attend Une Decision Sur La Reprise Des Travaux

May 30, 2025

A69 Le Sud Ouest Attend Une Decision Sur La Reprise Des Travaux

May 30, 2025