7% Plunge For Amsterdam Stocks As Trade War Fears Rise

Table of Contents

Trade War Uncertainty Shakes Investor Confidence in Amsterdam

The direct link between escalating global trade tensions and the decline in Amsterdam stock prices is undeniable. Uncertainty surrounding future trade policies creates a climate of fear, directly impacting investment decisions. Businesses hesitate to invest in expansion or new projects, while investors become more risk-averse, leading to sell-offs.

- Increased tariffs impacting Dutch exports: Higher tariffs on Dutch goods make them less competitive in international markets, reducing export revenues and impacting company profitability.

- Reduced global demand due to trade disputes: Trade wars often lead to a slowdown in global economic activity, decreasing demand for Dutch products and services.

- Negative sentiment towards international trade impacting investment: The overall uncertainty surrounding global trade discourages both domestic and foreign investment in the Netherlands.

- Specific sectors heavily impacted: The technology and agricultural sectors, heavily reliant on international trade, have been particularly vulnerable to this downturn.

Analysis of the 7% Drop in Amsterdam Stock Market Indices

The 7% drop significantly impacted the AEX index, Amsterdam's primary stock market index. This represents a substantial loss in market capitalization, exceeding previous fluctuations observed in recent years. The severity of the decline is a clear indication of the market's reaction to the escalating trade war fears.

- Percentage drop for key individual stocks: Several prominent companies listed on the AEX experienced double-digit percentage drops, reflecting the widespread impact of the market downturn.

- Comparison with other European stock market performance: While other European markets also experienced some decline, the 7% drop in Amsterdam was notably steeper, highlighting the specific vulnerability of the Dutch market to trade war anxieties.

- Impact on specific sectors: The financials and energy sectors, traditionally sensitive to global economic conditions, were particularly affected by the downturn.

- Technical analysis: Chart patterns reveal a sharp sell-off, indicating panic selling amongst investors.

Impact on Dutch Economy and Businesses

The stock market decline has significant ripple effects on the broader Dutch economy. Decreased business activity, reduced consumer spending, and a potential decline in foreign investment are all likely consequences. The government's response and potential mitigation strategies will be crucial in managing this economic challenge.

- Potential for job losses: Reduced business activity may lead to job losses across various sectors, further impacting consumer confidence.

- Reduced consumer spending: Economic uncertainty often leads to reduced consumer spending, creating a negative feedback loop that exacerbates the economic slowdown.

- Impact on foreign investment: The negative sentiment surrounding the Dutch stock market may deter foreign investors, hindering economic growth.

- Government response: The Dutch government will likely implement fiscal or monetary policies to stimulate the economy and mitigate the negative impacts of the stock market plunge.

Global Trade War Implications and Future Outlook for Amsterdam Stocks

The Amsterdam stock market's performance is intrinsically linked to the broader global trade landscape. The ongoing trade disputes significantly impact investor sentiment and future market outlook. Predicting the future is inherently challenging, but analyzing potential scenarios helps in understanding the risks.

- Short-term and long-term predictions: Short-term forecasts suggest continued volatility, while long-term projections depend heavily on the resolution (or escalation) of the global trade war.

- Potential scenarios: The Amsterdam stock market's recovery depends on factors such as the outcome of trade negotiations, global economic growth, and investor confidence.

- Advice for investors: Investors should diversify their portfolios and carefully assess their risk tolerance before making any investment decisions in the Amsterdam stock market.

- Alternative investment opportunities: Exploring alternative investment options can help mitigate the risks associated with the current market volatility.

Conclusion: Navigating the Uncertainties in the Amsterdam Stock Market

The 7% plunge in Amsterdam stocks, driven by escalating trade war fears, has sent a clear signal of the market's fragility. The impact extends beyond the stock market, influencing the Dutch economy and businesses. Staying informed about global trade developments and understanding the interconnectedness of global markets is crucial. To make informed investment decisions, stay updated on Amsterdam stock market trends and trade war developments. Utilize resources that provide real-time data and analysis to navigate the complexities of this volatile market. Understanding the nuances of Amsterdam stock market performance and global trade war news is key to navigating these challenging times.

Featured Posts

-

Analysis 8 Stock Market Jump On Euronext Amsterdam Following Trump Tariff News

May 25, 2025

Analysis 8 Stock Market Jump On Euronext Amsterdam Following Trump Tariff News

May 25, 2025 -

Bbc Radio 1s Big Weekend Full Lineup Featuring Jorja Smith Biffy Clyro And Blossoms

May 25, 2025

Bbc Radio 1s Big Weekend Full Lineup Featuring Jorja Smith Biffy Clyro And Blossoms

May 25, 2025 -

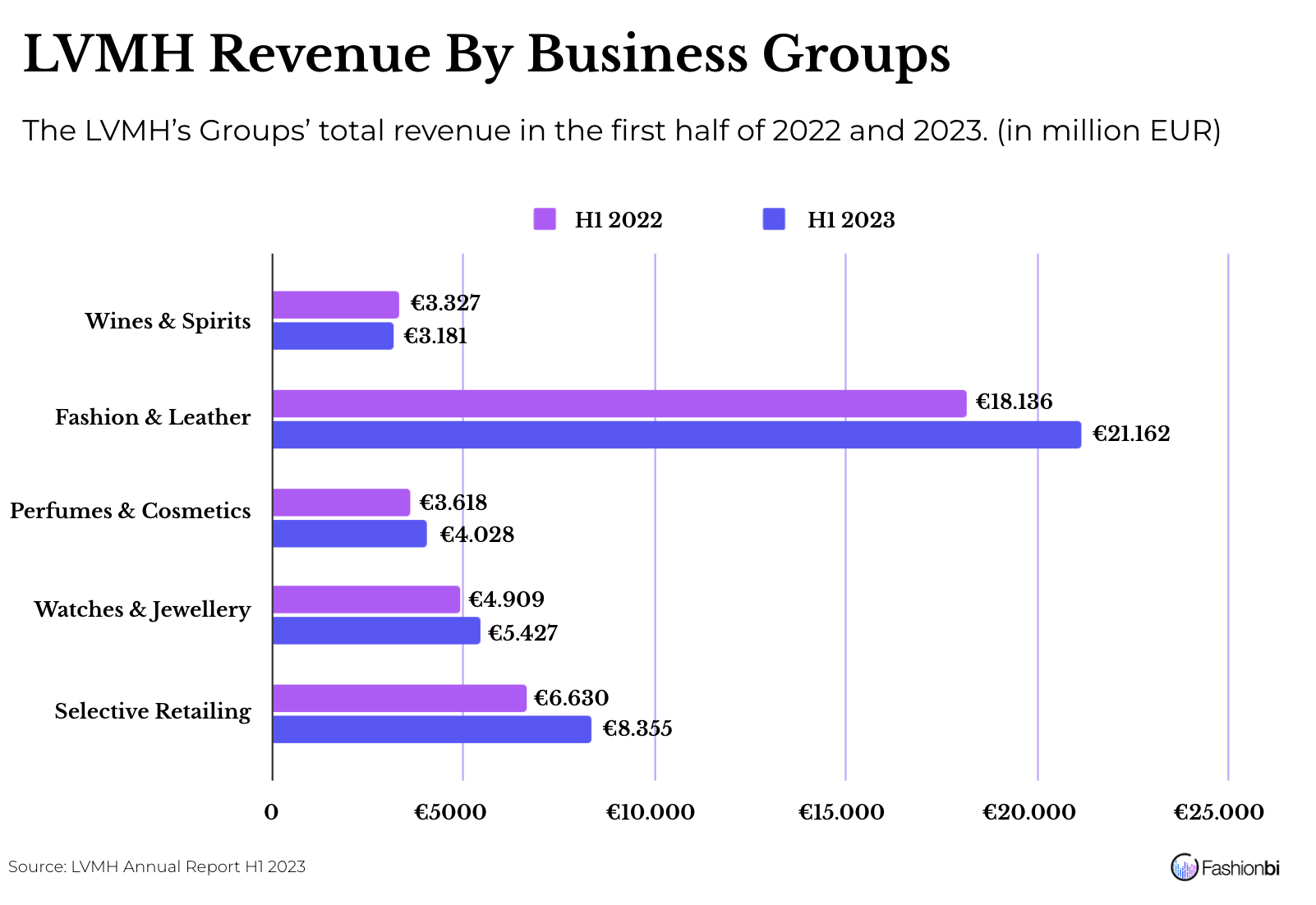

Lvmhs Q1 Sales Miss Target Leading To 8 2 Share Price Drop

May 25, 2025

Lvmhs Q1 Sales Miss Target Leading To 8 2 Share Price Drop

May 25, 2025 -

French Pms Dissent Key Decisions Questioned Under Macron Presidency

May 25, 2025

French Pms Dissent Key Decisions Questioned Under Macron Presidency

May 25, 2025 -

Yevrobachennya Shlyakh Do Uspikhu Ta Podalsha Dolya Peremozhtsiv 2014 2023

May 25, 2025

Yevrobachennya Shlyakh Do Uspikhu Ta Podalsha Dolya Peremozhtsiv 2014 2023

May 25, 2025

Latest Posts

-

Rising Temperatures The Spread Of Internal Parasite Fungi

May 25, 2025

Rising Temperatures The Spread Of Internal Parasite Fungi

May 25, 2025 -

The Rise And Fall Of Black Lives Matter Plaza A Washington D C Story

May 25, 2025

The Rise And Fall Of Black Lives Matter Plaza A Washington D C Story

May 25, 2025 -

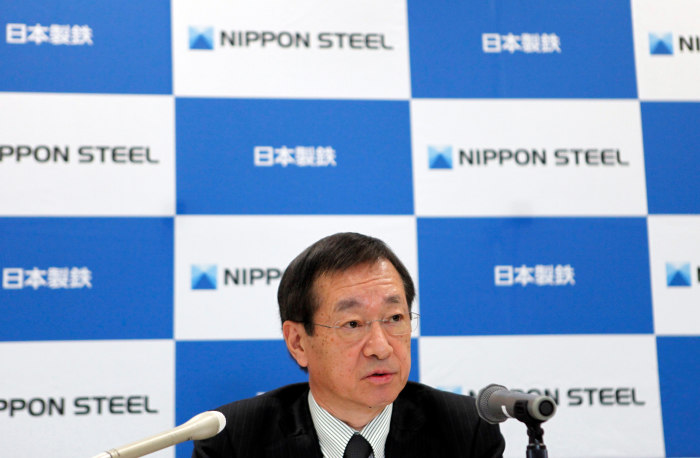

The Nippon U S Steel Deal A Look At Trumps Role And Future Impacts

May 25, 2025

The Nippon U S Steel Deal A Look At Trumps Role And Future Impacts

May 25, 2025 -

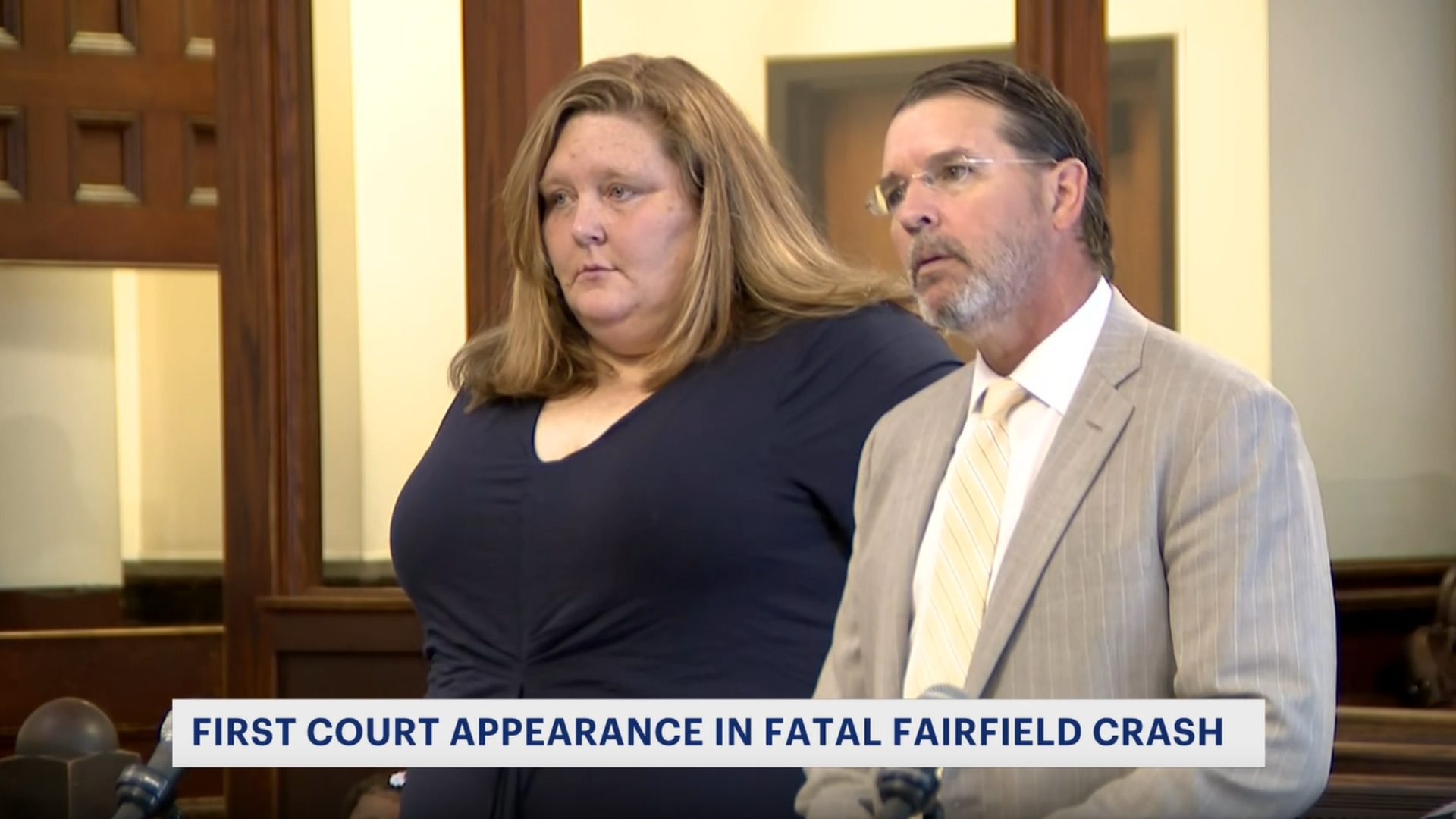

Murder Case From 19 Years Ago Georgia Man And Nanny Charged

May 25, 2025

Murder Case From 19 Years Ago Georgia Man And Nanny Charged

May 25, 2025 -

A Sixth Century Vessel From Sutton Hoo Exploring Its Role In Burial Ceremonies

May 25, 2025

A Sixth Century Vessel From Sutton Hoo Exploring Its Role In Burial Ceremonies

May 25, 2025