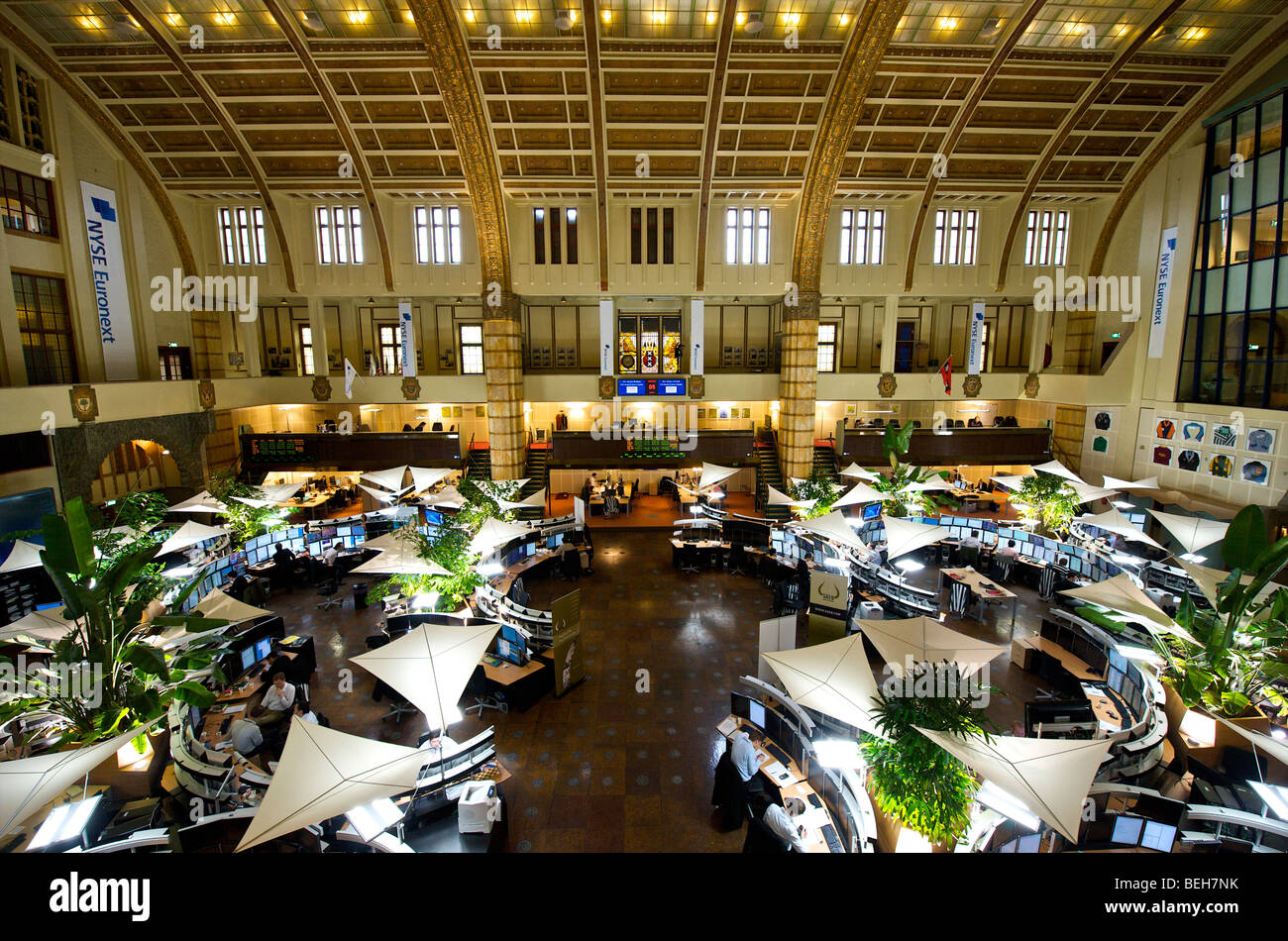

8% Stock Market Increase On Euronext Amsterdam: Impact Of Trump's Tariff Plan

Table of Contents

Understanding the Initial Market Reaction to Trump's Tariff Announcements

The initial announcement of Trump's tariff plans was met with widespread negative sentiment across global markets. Many predicted a downturn, fearing a potential escalation of the trade war and its damaging effects on international commerce. However, the Euronext Amsterdam market defied expectations, exhibiting a surprising positive shift. This counter-intuitive reaction necessitates a closer examination of the underlying factors.

- Sectors Affected: While some export-oriented sectors initially experienced losses, others surprisingly benefited. Technology companies, for instance, might have seen increased demand due to shifts in global supply chains.

- Specific Company Performances: Individual company performance varied widely. Some companies heavily reliant on US imports might have initially suffered, while others, perhaps less exposed to direct tariff impacts, experienced significant gains. Tracking specific company data from this period is crucial for a complete understanding.

- Analyst Predictions: Initial analyst predictions were largely pessimistic, forecasting negative growth. The unexpected positive shift on Euronext Amsterdam prompted a re-evaluation of these predictions, highlighting the unpredictable nature of market reactions to such policy changes.

Analyzing the Unexpected Positive Impact on Euronext Amsterdam

The positive impact on Euronext Amsterdam following the tariff announcements is not easily explained by a direct, positive effect of the tariffs themselves. Several alternative explanations warrant consideration:

- Portfolio Rebalancing: Investors may have strategically rebalanced their portfolios, shifting investments towards European markets perceived as relatively safer havens amidst the trade war uncertainty. This could have artificially inflated the Euronext Amsterdam index.

- Global Economic Conditions: The unexpected rise could be attributed to broader global economic conditions unrelated to tariffs. Strong European economic indicators or positive news from other sectors might have contributed to the increase.

- Other Influencing News: Simultaneous positive news unrelated to tariffs, such as breakthroughs in other geopolitical situations or positive economic reports, could have overshadowed the negative effects of the tariff announcements.

The Role of Sector-Specific Impacts and Diversification

The response of Euronext Amsterdam to the Trump tariff plan wasn't uniform across all sectors. Some sectors experienced significant gains, while others faced losses. This highlights the importance of diversification in mitigating risk.

- Positively Affected Sectors: Certain sectors, potentially those benefiting from reduced competition from US imports or those involved in supplying alternative sources to affected industries, saw significant growth.

- Negatively Affected Sectors: Export-oriented businesses, particularly those heavily reliant on the US market, were likely negatively impacted by increased tariffs and trade barriers.

- Diversification's Importance: A diversified investment portfolio proved crucial during this period of market volatility. Investors with a spread of investments across various sectors and geographies were better positioned to weather the storm.

Long-Term Implications and Future Market Volatility

The long-term impact of Trump's tariff plan on Euronext Amsterdam remains uncertain. The initial surge doesn't necessarily indicate sustained positive growth. Trade disputes inherently introduce substantial market risk and volatility.

- Future Market Movements: Predicting future market movements remains challenging. Ongoing developments in the trade war and the overall global economic climate will significantly impact Euronext Amsterdam's performance.

- Investor Recommendations: Investors should maintain a cautious approach, closely monitoring market developments and adjusting their portfolios accordingly. Diversification and risk management remain paramount strategies.

- Geopolitical Repercussions: The broader geopolitical implications of the trade war extend far beyond the immediate impact on Euronext Amsterdam. The long-term consequences for global trade and economic stability are significant and still unfolding.

Conclusion: Euronext Amsterdam Stock Market – Navigating Tariff Uncertainty

The 8% increase on Euronext Amsterdam following the announcement of Trump's tariff plan was a surprising development, highlighting the complex interplay of factors that influence market movements. While some sectors benefited, others suffered, underscoring the importance of diversification in mitigating risk. Navigating this uncertainty requires staying informed about Euronext Amsterdam's performance and understanding the global implications of trade policies. To effectively manage your investments in times of global trade uncertainty, continue monitoring market news and consult with financial advisors to make informed decisions. Stay informed about Euronext Amsterdam and the evolving landscape of global trade to protect and grow your investments.

Featured Posts

-

Chto Udalos Nashemu Pokoleniyu Vzglyad Na Uspekhi I Neudachi

May 25, 2025

Chto Udalos Nashemu Pokoleniyu Vzglyad Na Uspekhi I Neudachi

May 25, 2025 -

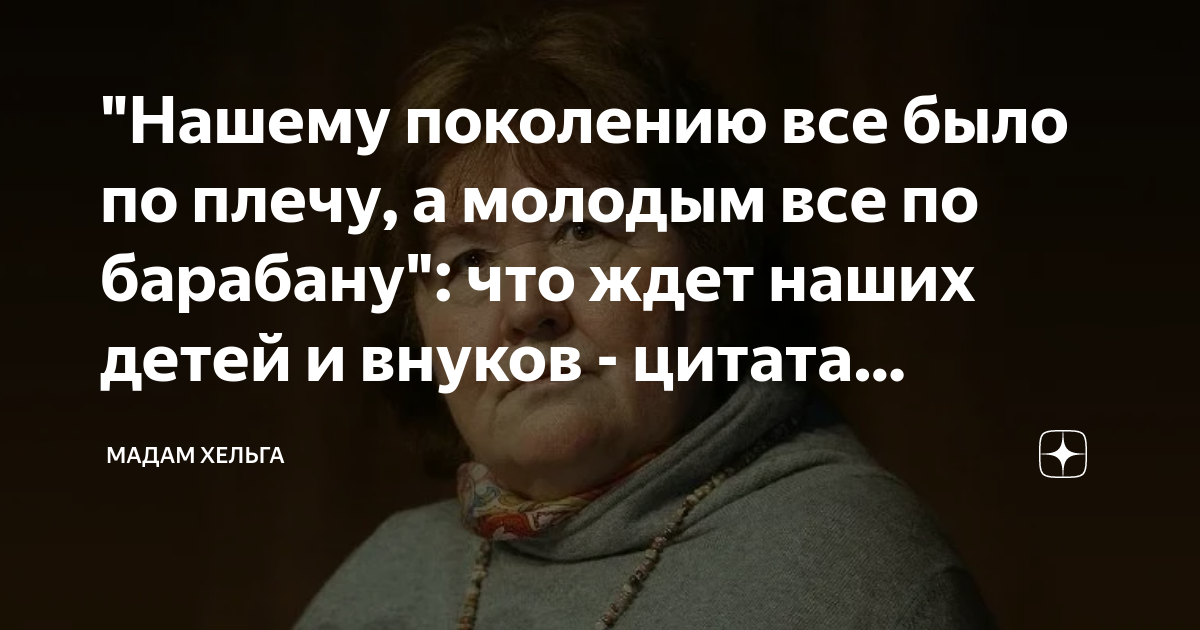

Neden Porsche 956 Araclari Tavanlardan Asili

May 25, 2025

Neden Porsche 956 Araclari Tavanlardan Asili

May 25, 2025 -

Apple Stock Aapl Price Analysis Identifying Crucial Support And Resistance Levels

May 25, 2025

Apple Stock Aapl Price Analysis Identifying Crucial Support And Resistance Levels

May 25, 2025 -

Proposed Hijab Ban For Minors In France Macrons Party Takes A Stand

May 25, 2025

Proposed Hijab Ban For Minors In France Macrons Party Takes A Stand

May 25, 2025 -

Sean Penns Continued Support For Woody Allen A Me Too Analysis

May 25, 2025

Sean Penns Continued Support For Woody Allen A Me Too Analysis

May 25, 2025

Latest Posts

-

Farrows Plea Hold Trump Accountable For Venezuelan Gang Member Deportations

May 25, 2025

Farrows Plea Hold Trump Accountable For Venezuelan Gang Member Deportations

May 25, 2025 -

Actress Mia Farrow Demands Trumps Arrest For Venezuelan Deportation Policy

May 25, 2025

Actress Mia Farrow Demands Trumps Arrest For Venezuelan Deportation Policy

May 25, 2025 -

Actress Mia Farrow Seeks Trumps Imprisonment Regarding Venezuelan Deportations

May 25, 2025

Actress Mia Farrow Seeks Trumps Imprisonment Regarding Venezuelan Deportations

May 25, 2025 -

From Fame To Shame 17 Celebrities Who Lost It All

May 25, 2025

From Fame To Shame 17 Celebrities Who Lost It All

May 25, 2025 -

The Downfall 17 Celebrities Whose Careers Imploded

May 25, 2025

The Downfall 17 Celebrities Whose Careers Imploded

May 25, 2025