A Call For Fiscal Prudence: Rebuilding Canada's Economic Future

Table of Contents

The Urgent Need for Debt Reduction

Canada's burgeoning national debt poses a serious threat to its economic future. Addressing this requires a multifaceted approach combining both responsible spending and revenue generation.

Understanding Canada's Current Debt Situation:

- Current National Debt: Canada's national debt continues to climb, placing a significant burden on future generations. According to recent reports from the Parliamentary Budget Officer (PBO), the debt-to-GDP ratio remains high, exceeding [Insert most recent data from a credible source, e.g., Statistics Canada]. This represents a substantial increase from [Insert previous relevant data point].

- Growth Trajectory: The current trajectory indicates a continued rise in the national debt unless proactive measures are implemented. Increased interest payments on existing debt further exacerbate the problem, consuming a larger portion of the government budget each year. [Insert data on interest payments as percentage of budget].

- Implications for Future Generations: The current debt levels will necessitate significant tax increases or spending cuts in the future, potentially limiting opportunities for future generations. This could impact crucial areas such as education, healthcare, and infrastructure development.

Strategies for Debt Reduction:

- Cutting Unnecessary Government Spending: A comprehensive review of government spending is necessary to identify areas for potential cuts without compromising essential services. This requires rigorous analysis of program effectiveness and elimination of wasteful spending. Examples could include streamlining bureaucratic processes and reducing overlapping programs.

- Increasing Tax Revenue through Targeted Measures: While tax increases should be considered carefully to avoid stifling economic growth, targeted measures focused on high-income earners or corporate tax loopholes may be necessary. It's crucial that such measures are implemented strategically to minimize impact on the lower and middle classes.

- Improving the Efficiency of Government Programs: Investment in technology and process improvements can significantly enhance the efficiency of government programs, reducing administrative costs and improving service delivery. This can free up resources for debt reduction or for reinvestment in vital areas.

- Examples from Other Countries: Countries like [mention examples, e.g., Sweden, Germany] have successfully implemented debt reduction strategies through a combination of spending cuts and revenue increases, offering valuable lessons for Canada. However, it's important to note that each country's circumstances are unique and solutions need to be tailored to Canada's specific context.

Investing in Strategic Infrastructure Development

Investing in modern and efficient infrastructure is crucial for driving economic growth and creating a more competitive Canada. This requires a long-term vision and a commitment to sustainable development.

Infrastructure Gaps and Economic Growth:

- Critical Need for Investment: Canada faces significant infrastructure deficits in areas such as transportation (roads, bridges, public transit), energy (renewable energy sources, smart grids), and communication networks (high-speed internet access). These gaps hinder economic productivity and competitiveness.

- Multiplier Effect: Infrastructure investments stimulate economic activity through job creation in construction, related industries, and the broader economy (the multiplier effect). This creates a ripple effect of increased economic output and prosperity.

- Successful Project Examples: [Mention successful infrastructure projects in Canada, outlining their positive economic and social impacts – e.g., rapid transit systems in major cities, modernized port facilities].

Prioritizing Sustainable and Efficient Infrastructure Projects:

- Sustainable Practices: Prioritizing sustainable and environmentally friendly infrastructure projects is essential. This includes incorporating green technologies, reducing carbon emissions, and promoting energy efficiency.

- Public-Private Partnerships: Public-private partnerships (P3s) can provide a viable funding mechanism for large-scale infrastructure projects, leveraging private sector expertise and capital. However, careful consideration must be given to transparency and accountability in such arrangements.

- Innovative Technologies: Utilizing innovative technologies and materials can help reduce costs and improve the lifespan of infrastructure assets, promoting long-term economic benefits.

Fostering Innovation and a Competitive Workforce

Investing in human capital and fostering a culture of innovation are essential for long-term economic growth and prosperity. This requires a concerted effort to improve education and skills development, attract and retain talent, and stimulate research and development.

Investing in Education and Skills Development:

- Importance of STEM Education: Investment in science, technology, engineering, and mathematics (STEM) education is critical for building a competitive workforce in the rapidly evolving technological landscape.

- Lifelong Learning Programs: Supporting lifelong learning programs and reskilling initiatives helps workers adapt to changing job market demands, maintaining their employability and competitiveness.

- Government Support for R&D: Government support for research and development through grants, tax credits, and other incentives is crucial for fostering innovation and technological advancement.

Attracting and Retaining Talent:

- Immigration Policies: Attracting skilled workers through effective immigration policies is vital for filling labour shortages and fostering economic growth. These policies need to be streamlined and aligned with the needs of the Canadian economy.

- Competitive Compensation Packages: Offering competitive compensation packages and creating an attractive work environment are essential for attracting and retaining top talent within Canada.

Conclusion

Fiscal prudence is not merely a matter of balancing budgets; it's a strategic imperative for building a secure and prosperous future for Canada. By adopting a balanced approach that combines debt reduction, strategic infrastructure investment, and a commitment to human capital development, Canada can foster a sustainable and resilient economy capable of meeting the challenges of the 21st century. The path forward requires political will and a shared commitment to responsible financial management. Let’s work together to build a stronger Canada through sound fiscal policies and embrace fiscal prudence to secure Canada's economic future.

Featured Posts

-

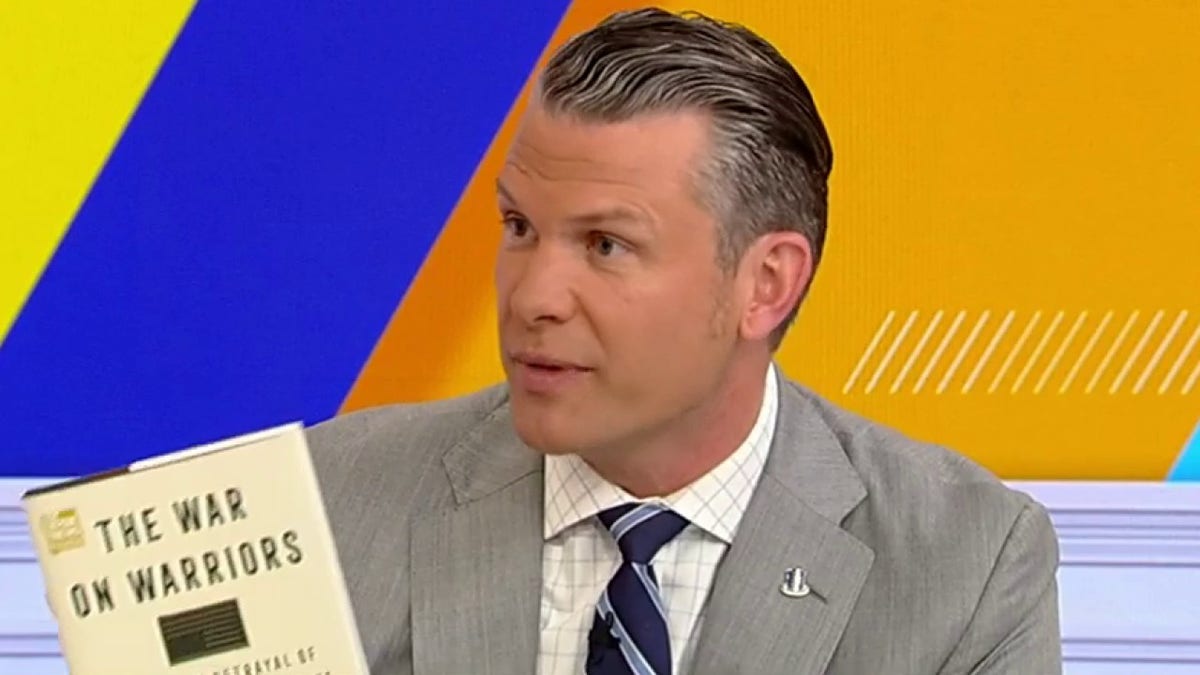

Pete Hegseth And The Trump Agenda Navigating The Signal App Controversy

Apr 24, 2025

Pete Hegseth And The Trump Agenda Navigating The Signal App Controversy

Apr 24, 2025 -

The Bold And The Beautiful Spoilers Liams Medical Crisis And Fight For Survival

Apr 24, 2025

The Bold And The Beautiful Spoilers Liams Medical Crisis And Fight For Survival

Apr 24, 2025 -

The Countrys Best New Business Locations A Detailed Overview

Apr 24, 2025

The Countrys Best New Business Locations A Detailed Overview

Apr 24, 2025 -

Nba All Star Weekend Herros 3 Pointer Triumph And Cavs Skills Challenge Success

Apr 24, 2025

Nba All Star Weekend Herros 3 Pointer Triumph And Cavs Skills Challenge Success

Apr 24, 2025 -

Understanding The Value Of Middle Managers Benefits For Employees And The Organization

Apr 24, 2025

Understanding The Value Of Middle Managers Benefits For Employees And The Organization

Apr 24, 2025

Latest Posts

-

Find Your Jessica Simpson Kimono Cardigan At Walmart 29 Bestseller

May 12, 2025

Find Your Jessica Simpson Kimono Cardigan At Walmart 29 Bestseller

May 12, 2025 -

New Song Jessica Simpson Hints At Husband Eric Johnsons Infidelity

May 12, 2025

New Song Jessica Simpson Hints At Husband Eric Johnsons Infidelity

May 12, 2025 -

Jessica Simpson Allegedly Hints At Eric Johnson Cheating In New Music

May 12, 2025

Jessica Simpson Allegedly Hints At Eric Johnson Cheating In New Music

May 12, 2025 -

Jessica Simpsons New Song Hints At Eric Johnson Infidelity

May 12, 2025

Jessica Simpsons New Song Hints At Eric Johnson Infidelity

May 12, 2025 -

Jessica Simpson Walmart Kimono Cardigan Shop The 29 Bestseller

May 12, 2025

Jessica Simpson Walmart Kimono Cardigan Shop The 29 Bestseller

May 12, 2025