A Place In The Sun: Practical Tips For Buying Abroad

Table of Contents

Researching Your Chosen Location

Before you even start browsing property listings, thorough research is crucial. This involves understanding the local market, assessing the potential risks and rewards, and considering the practical implications of living abroad.

Understanding Local Markets

- Analyze Property Prices: Research property prices in your desired area using online portals like Rightmove (UK), Zillow (US), or local equivalents. Compare prices across different neighborhoods to identify the best value for your budget. Consider the type of property (villa, apartment, etc.) and its features.

- Factor in Additional Costs: Beyond the purchase price, remember to factor in property taxes, local council taxes (if applicable), potential renovation costs, and ongoing maintenance expenses. These hidden costs can significantly impact your overall budget.

- Rental Income Potential: If you plan to rent out your property, research rental yields in the area. Online resources and local real estate agents can provide insights into average rental income and occupancy rates. This helps assess the investment potential of your overseas property.

- Local Economy: Analyze the local economy and its future prospects. A thriving economy generally translates to better property value appreciation and rental income. Research job markets, tourism sectors, and government initiatives that might influence the area's growth.

Visa and Residency Requirements

This aspect is often overlooked but critically important. Understanding your visa options is essential for long-term ownership and enjoyment of your overseas property.

- Visa Research: Investigate the visa requirements for long-term stays or residency permits in your chosen country. Each country has different rules and regulations for foreign property owners.

- Documentation: Understand the process of obtaining necessary documentation, including proof of funds, health checks, and criminal background checks. The requirements can be extensive and vary greatly depending on your nationality and the country you're targeting.

- Tax Residency: Consider the tax implications of becoming a tax resident in your chosen country. This impacts your tax liabilities on both your global income and the property itself. Professional tax advice is highly recommended.

- Legal Counsel: Consult with an immigration lawyer specializing in your target country. They can provide guidance on navigating the often complex visa and residency application processes.

Finding the Right Property and Working with Professionals

Finding the right property and securing the purchase requires professional guidance. Working with experienced professionals can significantly streamline the process and mitigate potential risks.

Working with a Local Real Estate Agent

Using a reputable local real estate agent is highly recommended.

- Market Expertise: A local agent possesses in-depth knowledge of the local market, including pricing trends, legal nuances, and cultural norms.

- Navigating Complexities: They can help navigate the legal and cultural complexities of purchasing property abroad, saving you time and potential headaches.

- Finding a Trustworthy Agent: Research agents carefully, seeking recommendations and checking online reviews. Ensure they are licensed and reputable.

- Clear Communication: Clearly define your needs and requirements (budget, property type, location) to your agent to ensure they find properties that meet your criteria.

Due Diligence and Legal Advice

Thorough due diligence is paramount to avoid potential problems after the purchase.

- Property Checks: Conduct thorough due diligence on the property, including verifying property ownership, checking for any encumbrances (mortgages, liens), and reviewing title deeds meticulously.

- Legal Representation: Engage a solicitor or lawyer specializing in international property transactions. They will review the purchase contract, advise on legal compliance, and protect your interests throughout the process.

- Contract Review: Understand the terms of the purchase contract fully before signing. Don’t hesitate to ask questions or seek clarifications if anything is unclear.

- Surveys and Inspections: Arrange for necessary surveys and inspections to identify any structural issues or potential problems with the property.

Financing Your Overseas Property Purchase

Securing financing for your overseas property purchase requires careful planning and comparison.

Securing a Mortgage Abroad

- Mortgage Options: Explore mortgage options available to foreign buyers. Banks and lenders often have specific requirements for non-resident borrowers.

- Interest Rates and Terms: Understand the interest rates and loan terms offered by different lenders. Compare offers carefully to find the best deal.

- International Mortgages: Compare the costs and conditions of international mortgages, taking into account any fees or charges associated with foreign borrowing.

- Currency Exchange: Consider the implications of currency exchange rates and potential fluctuations on your mortgage repayments.

Alternative Financing Options

Beyond mortgages, several alternative financing options exist.

- Cash Purchases: A cash purchase eliminates the complexities of securing a mortgage but requires significant upfront capital.

- Private Financing: Consider private financing options from individuals or institutions, although these may come with higher interest rates or stricter terms.

- Investment Partnerships: Explore property investment partnerships with others to share the cost and risk.

- Tax Implications: Understand the tax implications of each financing method, as these can vary significantly depending on your nationality and the country of purchase.

Navigating the Legal and Administrative Processes

The legal and administrative aspects of buying property abroad can be complex. Understanding local laws and regulations is essential.

Understanding Local Laws and Regulations

- Building Codes: Research building codes, planning permission, and environmental regulations. These vary greatly between countries.

- Ownership Restrictions: Be aware of any restrictions on foreign ownership of property in your target country. Some countries have limitations on the percentage of properties that can be owned by foreign nationals.

- Legal Compliance: Seek legal guidance to ensure complete compliance with all local laws and regulations throughout the buying process.

- Inheritance Laws: Understand the implications of inheritance laws in the country where you are buying property.

Currency Exchange and Transfer Costs

Currency exchange can significantly impact your overall costs.

- Exchange Rates: Factor in currency exchange rates and transfer fees when calculating your budget. These fees can add up.

- Currency Services: Consider using a reputable currency exchange service to minimize costs and exchange rate risks.

- Fluctuations: Understand the potential impact of currency fluctuations on your investment. Exchange rates can shift significantly, affecting your purchase price and future costs.

- Hedging Strategies: Explore hedging strategies to minimize exchange rate risks, particularly if you’re making a large purchase.

Conclusion

Buying a "place in the sun" is a rewarding but complex process. By carefully researching your chosen location, engaging experienced professionals, including a local real estate agent and a solicitor specializing in international property, and understanding the legal and financial implications, you can significantly increase your chances of a successful purchase. Remember to prioritize thorough due diligence, seek expert advice, and carefully consider all aspects before making such a significant investment. Don't delay your dream – start your journey to finding your perfect overseas property today! Begin your search for your ideal "place in the sun" now!

Featured Posts

-

The India Us Standoff Justice Vs De Escalation

May 03, 2025

The India Us Standoff Justice Vs De Escalation

May 03, 2025 -

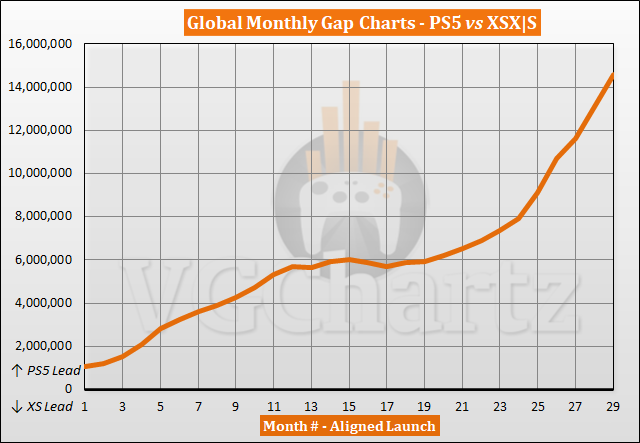

Ps 5 Vs Xbox Series X S A Detailed Look At Us Sales Figures

May 03, 2025

Ps 5 Vs Xbox Series X S A Detailed Look At Us Sales Figures

May 03, 2025 -

Makron I S Sh A Novye Sanktsii Protiv Rossii V Svyazi S Ukrainoy

May 03, 2025

Makron I S Sh A Novye Sanktsii Protiv Rossii V Svyazi S Ukrainoy

May 03, 2025 -

Vatican Le Tu Ne Devrais Pas Etre Ici De Trump A Macron Decryptage

May 03, 2025

Vatican Le Tu Ne Devrais Pas Etre Ici De Trump A Macron Decryptage

May 03, 2025 -

Gueclendirilen Avrupa Is Birligi Son Gelismeler Ve Analizler

May 03, 2025

Gueclendirilen Avrupa Is Birligi Son Gelismeler Ve Analizler

May 03, 2025

Latest Posts

-

Body Heat I Epistrofi Mias Klasikis Tainias Me Tin Emma Stooyn

May 04, 2025

Body Heat I Epistrofi Mias Klasikis Tainias Me Tin Emma Stooyn

May 04, 2025 -

I Emma Stooyn Kai To Rimeik Toy Body Heat Mia Pithani Synergasia

May 04, 2025

I Emma Stooyn Kai To Rimeik Toy Body Heat Mia Pithani Synergasia

May 04, 2025 -

Emma Stone Sto Rimeik Tis Tainias Body Heat Pithanes Ekselikseis

May 04, 2025

Emma Stone Sto Rimeik Tis Tainias Body Heat Pithanes Ekselikseis

May 04, 2025 -

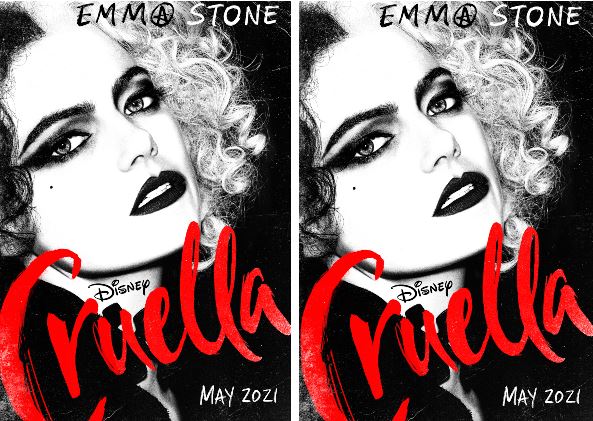

Bollywood News Disneys Cruella Trailer Showcases Epic Rivalry

May 04, 2025

Bollywood News Disneys Cruella Trailer Showcases Epic Rivalry

May 04, 2025 -

Emma Stone And Emma Thompson Face Off In New Cruella Trailer

May 04, 2025

Emma Stone And Emma Thompson Face Off In New Cruella Trailer

May 04, 2025