A Place In The Sun: Top Tips For Successful Overseas Property Investment

Table of Contents

Thorough Research: Laying the Foundation for Overseas Property Investment

Before diving into the world of international property, thorough research is paramount. This lays the groundwork for a successful and profitable overseas property investment.

Understanding the Market: Identifying Lucrative Locations

Identifying lucrative locations is crucial for maximizing your return on investment. Consider factors such as:

- High rental yields: Areas with strong tourism or a large expat community often offer higher rental yields.

- Capital appreciation potential: Look for locations with strong economic growth and increasing property values.

- Stable political and economic climate: Political and economic stability are essential for long-term investment security.

- Developed infrastructure: Good infrastructure, including transportation, utilities, and healthcare, is vital for both rental appeal and your own comfort.

Examples of popular overseas property investment hotspots: Portugal's Algarve, Spain's Costa Blanca, parts of Greece, and certain areas of Southeast Asia consistently attract international investors. However, thorough market research is crucial; what's popular isn't always profitable. Consult market research reports, browse local property websites like Idealista (Spain) or Rightmove (UK for international properties), and speak to local real estate agents to gain an accurate understanding of the market dynamics.

Analyzing Property Types: Choosing the Right Investment

Different property types suit different investment goals and risk tolerances.

- Apartments: Generally offer higher rental yields due to greater demand, but potentially less capital appreciation than other options. Maintenance costs are typically lower.

- Villas: Often offer better long-term capital growth potential, but may have higher maintenance costs and lower rental yields. They also command higher purchase prices, leading to higher upfront investment.

- Land: Purchasing land offers potential for significant long-term growth but requires significant patience and carries a higher degree of risk due to potential development delays or changes in zoning regulations.

Consider the maintenance costs associated with each property type, local property taxes, and the potential rental income you can expect. Your choice should align with your financial goals and risk appetite.

Due Diligence: Investigating the Property's Legal Status

Due diligence is non-negotiable. Thorough checks prevent costly mistakes and legal issues down the line.

- Professional property survey: Essential to identify any structural issues or boundary disputes.

- Title search: Verifies the legal ownership of the property and ensures there are no outstanding claims or liens.

- Local legal advice: Crucial to understand local laws and regulations concerning property ownership and transactions.

Ignoring these steps can lead to purchasing properties with undisclosed issues, resulting in significant financial losses. Engage qualified professionals to conduct these investigations.

Navigating the Legal and Financial Aspects of Overseas Property Investment

Securing financing and understanding the legal implications are crucial aspects of successful overseas property investment.

Securing Financing: Exploring Your Options

Financing your overseas property purchase requires careful consideration.

- Mortgages: Many international banks offer mortgages for foreign property buyers, but the terms and conditions can vary significantly.

- International bank loans: These offer another avenue for financing, often with competitive interest rates, but require thorough research and comparison of lenders.

- Currency exchange risks: Fluctuations in exchange rates can impact the overall cost of your purchase and repayments.

Carefully compare interest rates, fees, and loan terms from multiple lenders. Consider the implications of currency fluctuations and seek advice from a financial advisor experienced in international transactions.

Legal Considerations: Understanding Local Laws and Regulations

Navigating the legal landscape of overseas property investment is complex.

- Legal counsel: Engage a local lawyer specializing in property law to guide you through the purchase process and ensure compliance with local regulations.

- Property ownership laws: Understand the nuances of property ownership in your chosen country, including inheritance laws and restrictions on foreign ownership.

- Tax implications: Be aware of the tax implications for foreign investors, including capital gains tax, property taxes, and inheritance tax.

Ignoring these aspects can lead to significant financial and legal problems. Professional legal advice is invaluable.

Working with Professionals: The Power of Expertise

Leveraging the expertise of professionals significantly increases your chances of success.

- Local real estate agents: They possess in-depth market knowledge and can assist with finding suitable properties and navigating local customs.

- Lawyers: Provide critical legal guidance, ensuring your transaction complies with local laws and protecting your interests.

- Financial advisors: Offer expertise on financing options, currency exchange, and overall financial planning.

Choosing reputable professionals with strong track records is essential for a smooth and successful investment.

Managing Your Overseas Property Investment for Long-Term Success

Effective management is key to maximizing your returns and minimizing risks in the long term.

Property Management: Finding the Right Approach

Managing your overseas property requires careful consideration of several options.

- Self-management: Requires significant time and effort, but offers greater control. Suitable only if you are familiar with property management and have the time to dedicate to it.

- Hiring a property manager: Delegates much of the responsibility to a local professional, simplifying the process but incurring additional costs.

- Using a letting agency: Handles tenant management, rent collection, and maintenance, relieving you of many responsibilities, but taking a cut of rental income.

The best approach depends on your available time, resources, and familiarity with local regulations.

Risk Mitigation Strategies: Protecting Your Investment

Protecting your investment requires a proactive approach to risk management.

- Insurance: Secure comprehensive building insurance, landlord insurance (if applicable), and potentially other forms of insurance depending on location and property type.

- Diversification: Don't put all your eggs in one basket. Diversifying your investment portfolio across different properties and locations minimizes risk.

- Contingency planning: Develop a plan to address potential issues such as currency fluctuations, political instability, or natural disasters.

Proactive risk management helps to safeguard your investment from unexpected events.

Long-Term Growth: Maximizing Your Returns

Sustaining and increasing the value of your property is crucial for long-term success.

- Renovations and upgrades: Strategic renovations and upgrades can increase rental income and property value.

- Capital improvements: Investing in energy-efficient improvements can enhance the property’s appeal and reduce operating costs.

- Rental income management: Efficiently managing rental income and reinvesting profits ensures long-term growth.

Staying updated on market trends and adapting your investment strategy as needed are vital for maximizing your return on investment.

Realizing Your Dream with Successful Overseas Property Investment

Successful overseas property investment hinges on thorough research, meticulous planning, and professional guidance. Remember the importance of understanding the market dynamics, navigating the legal and financial aspects, and establishing a long-term management strategy. Owning overseas property offers not only the potential for substantial financial rewards but also the lifestyle benefits of owning a piece of paradise. Start your journey toward securing your “place in the sun” today by researching potential markets, seeking professional advice, and taking that first step towards successful overseas property investment. [Link to relevant resources or services]

Featured Posts

-

Latest Draw Results Lotto Lotto Plus 1 And Lotto Plus 2

May 03, 2025

Latest Draw Results Lotto Lotto Plus 1 And Lotto Plus 2

May 03, 2025 -

Guido Fawkes On Energy Policy Reform Key Changes And Impacts

May 03, 2025

Guido Fawkes On Energy Policy Reform Key Changes And Impacts

May 03, 2025 -

Shell Recharge Enjoy Up To 100 Off Hpc Ev Charging On The East Coast This Raya

May 03, 2025

Shell Recharge Enjoy Up To 100 Off Hpc Ev Charging On The East Coast This Raya

May 03, 2025 -

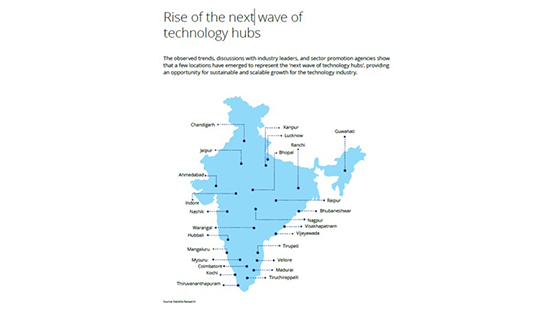

The Countrys Emerging Business Hubs An Interactive Map

May 03, 2025

The Countrys Emerging Business Hubs An Interactive Map

May 03, 2025 -

L Intelligence Artificielle Une Strategie De Patriotisme Economique Pour L Europe Selon Macron

May 03, 2025

L Intelligence Artificielle Une Strategie De Patriotisme Economique Pour L Europe Selon Macron

May 03, 2025

Latest Posts

-

The Monkey Reboot Facing The Challenge Of A 666 Million Horror Legacy

May 04, 2025

The Monkey Reboot Facing The Challenge Of A 666 Million Horror Legacy

May 04, 2025 -

Three Months To Go Will The Monkey Reboot Reach The High Bar Set By Its Predecessor

May 04, 2025

Three Months To Go Will The Monkey Reboot Reach The High Bar Set By Its Predecessor

May 04, 2025 -

The Bittersweet Return Of Tony Todd In Final Destination Bloodlines

May 04, 2025

The Bittersweet Return Of Tony Todd In Final Destination Bloodlines

May 04, 2025 -

The Return Of The Scariest Final Destination Death 22 Years Later

May 04, 2025

The Return Of The Scariest Final Destination Death 22 Years Later

May 04, 2025 -

Iconic Final Destination Death Scene Resurfaces After Two Decades

May 04, 2025

Iconic Final Destination Death Scene Resurfaces After Two Decades

May 04, 2025