A Podcast Guide To Thriving During Periods Of Low Inflation

Table of Contents

Understanding Low Inflation and its Implications

Low inflation, generally defined as a sustained Consumer Price Index (CPI) increase of less than 2% annually, signifies a slow and steady rise in the general price level of goods and services. Unlike deflation (a decrease in the general price level), low inflation doesn't typically signal an impending economic crisis, but it can impact your financial strategies. Several factors can contribute to low inflation, including decreased consumer demand, technological advancements leading to increased productivity, and a strong currency.

Low inflation differs significantly from deflation. While low inflation indicates slow price growth, deflation implies falling prices. Deflation, while seemingly beneficial, can be detrimental as consumers delay purchases expecting further price drops, leading to reduced economic activity.

-

Examples of Low Inflation Scenarios and Their Impact:

- Scenario 1: A 1% annual CPI increase might lead to modest growth in wages, but savings accounts yield minimal returns, potentially eroding purchasing power over time.

- Scenario 2: Low inflation can make borrowing cheaper, encouraging debt accumulation if not managed carefully. However, it also means that returns on investments might be slower.

-

Keywords: Low inflation, deflation, economic indicators, interest rates, consumer price index (CPI), purchasing power.

Optimizing Savings and Investments in a Low Inflation Environment

Low inflation necessitates a proactive approach to savings and investments. Simply keeping money in a traditional savings account might result in a net loss of purchasing power. Therefore, diversifying your portfolio and exploring high-yield options becomes crucial.

-

High-Yield Savings Accounts and CDs: These offer better returns than standard savings accounts, helping your money keep pace with (or slightly outpace) inflation. However, interest rates are still relatively low in a low-inflation environment, so careful comparison-shopping is crucial.

-

Diversification: Spread your investments across different asset classes (stocks, bonds, real estate) to mitigate risk and potentially achieve higher returns.

-

Index Funds and ETFs: These offer diversified exposure to the market at a low cost, making them a suitable option for long-term investors during periods of low inflation.

-

Alternative Investments: Real estate and commodities can offer inflation hedges, but these investments carry higher risk. Thorough research and professional advice are essential before investing in these areas.

-

Bullet Points:

- Example: A high-yield savings account might offer 2.5% APY, slightly outpacing a 2% inflation rate.

- Example: A diversified portfolio could include index funds tracking the S&P 500, bonds, and a small allocation to real estate investment trusts (REITs).

- Risk Assessment: Understand the risk tolerance associated with each investment before committing capital.

-

Keywords: Savings accounts, CDs, high-yield savings, diversification, index funds, ETFs, real estate investment, commodity investment, risk management, portfolio optimization.

Budgeting and Debt Management Strategies for Low Inflation Periods

Even during low inflation, disciplined budgeting and debt management are paramount. Low inflation doesn't negate the importance of financial prudence.

-

Create a Realistic Budget: Track your income and expenses meticulously. Identify areas where you can reduce spending without sacrificing your quality of life.

-

Reduce Debt: Strategies such as debt consolidation (combining multiple debts into one loan) or balance transfers (moving high-interest debt to a lower-interest credit card) can help you save money on interest payments.

-

Mindful Spending: Avoid impulse purchases and focus on needs over wants. Utilize budgeting apps to track expenses and monitor your progress.

-

Bullet Points:

- Tip: Negotiate lower interest rates with your lenders.

- Tip: Utilize budgeting apps like Mint or YNAB to track expenses and create a realistic budget.

- Tip: Automate your savings by setting up regular transfers from your checking to your savings account.

-

Keywords: Budgeting, debt management, debt consolidation, balance transfer, mindful spending, expense tracking, financial planning.

Leveraging Low Inflation for Career Advancement and Entrepreneurship

Low inflation often presents opportunities for career growth and entrepreneurship. A stable economic environment can foster business expansion and job creation.

-

Career Advancement: A stable economy often translates into a competitive job market, creating opportunities for salary negotiations and career progression.

-

Entrepreneurship: Starting a business during low inflation can be advantageous as the cost of goods and services remains relatively stable.

-

Challenges: Competition can be fierce, and securing funding might require a robust business plan.

-

Bullet Points:

- Example: Industries like technology, healthcare, and essential services tend to thrive even during low inflation.

- Strategy: Research salary benchmarks before negotiating your salary.

- Resource: Utilize resources like the Small Business Administration (SBA) for assistance with starting a business.

-

Keywords: Career advancement, entrepreneurship, business opportunities, salary negotiation, job market trends, business planning.

Thriving in a Low Inflation Economy: Your Podcast Takeaways and Next Steps

This Podcast Guide to Thriving During Periods of Low Inflation has highlighted the importance of proactive financial planning, even in a low-inflation environment. By implementing the strategies discussed – optimizing savings and investments, managing debt effectively, and seeking opportunities for career advancement or entrepreneurship – you can navigate this economic landscape successfully. Remember, consistent budgeting, diversification, and mindful spending are key to long-term financial success. Start your journey to financial success during low inflation by implementing these strategies and learning more through our [Podcast Name/Resource Link] – your ultimate Podcast Guide to Thriving During Periods of Low Inflation.

Featured Posts

-

How To Watch 1923 Season 2 Episode 6 Tonight For Free

May 27, 2025

How To Watch 1923 Season 2 Episode 6 Tonight For Free

May 27, 2025 -

Victor Osimhens 33rd Goal A Brace Leads Galatasaray To Victory Against Sivasspor

May 27, 2025

Victor Osimhens 33rd Goal A Brace Leads Galatasaray To Victory Against Sivasspor

May 27, 2025 -

Mitigating Us Tariff Impacts A Roadmap For Enhanced Canada Mexico Trade

May 27, 2025

Mitigating Us Tariff Impacts A Roadmap For Enhanced Canada Mexico Trade

May 27, 2025 -

Alien Earth Sxsw 2025 Shorts 6 Easter Eggs Discovered And What They Could Mean

May 27, 2025

Alien Earth Sxsw 2025 Shorts 6 Easter Eggs Discovered And What They Could Mean

May 27, 2025 -

Kai Cenat Faces Backlash After Friends Racist Jokes

May 27, 2025

Kai Cenat Faces Backlash After Friends Racist Jokes

May 27, 2025

Latest Posts

-

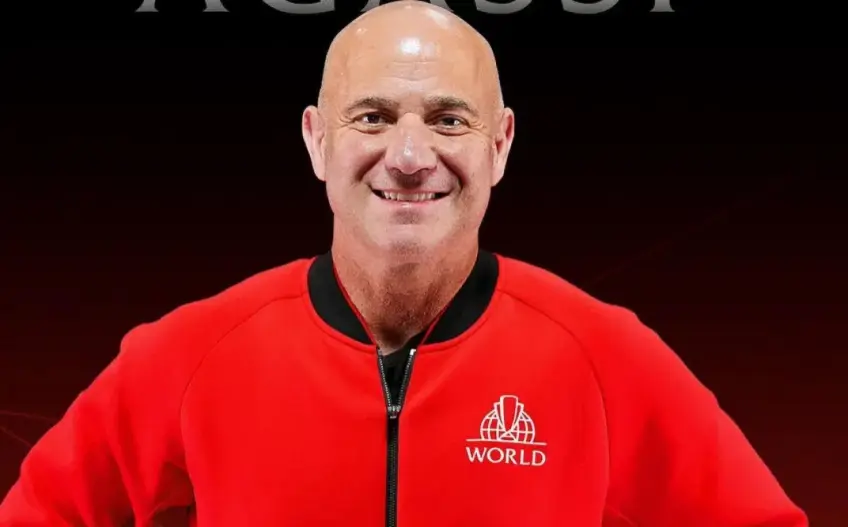

Aamir Khans Daughter Ira Shares Surprise Post Agassi Encounter

May 30, 2025

Aamir Khans Daughter Ira Shares Surprise Post Agassi Encounter

May 30, 2025 -

Ira Khans Shocking Revelation After Meeting Andre Agassi

May 30, 2025

Ira Khans Shocking Revelation After Meeting Andre Agassi

May 30, 2025 -

Dezvaluiri Andre Agassi Frica De Esec Si Presiunea Meciurilor Importante

May 30, 2025

Dezvaluiri Andre Agassi Frica De Esec Si Presiunea Meciurilor Importante

May 30, 2025 -

Agassi Marturii Inedite Despre Presiunea Din Tenisul De Elita

May 30, 2025

Agassi Marturii Inedite Despre Presiunea Din Tenisul De Elita

May 30, 2025 -

Nervi De Otel Andre Agassi Vorbeste Despre Anxietatea Dinaintea Competitiilor

May 30, 2025

Nervi De Otel Andre Agassi Vorbeste Despre Anxietatea Dinaintea Competitiilor

May 30, 2025