A Simple Approach To High Dividend Returns: The Most Profitable Strategy

Table of Contents

The benefits of focusing on high-dividend yield strategies are substantial. They offer a reliable stream of passive income, allowing you to supplement your existing income and potentially reduce your reliance on volatile market fluctuations. Furthermore, a well-managed high-dividend portfolio can contribute significantly to long-term wealth building, allowing your investments to grow exponentially over time.

Understanding Dividend Investing Fundamentals

Defining Dividend Yield and its Importance

Dividend yield is a crucial metric for dividend investors. It represents the annual dividend per share relative to the stock's price. The calculation is simple:

Annual Dividend / Stock Price = Dividend Yield

For example, a stock with an annual dividend of $2 and a price of $50 has a dividend yield of 4% (2/50 = 0.04). A higher dividend yield generally indicates a higher potential for passive income.

It’s crucial to distinguish between dividend yield and dividend growth. While dividend yield shows the current return, dividend growth reflects the rate at which the dividend payments increase over time. Companies with both a high yield and a history of consistent dividend growth are particularly attractive for long-term investors.

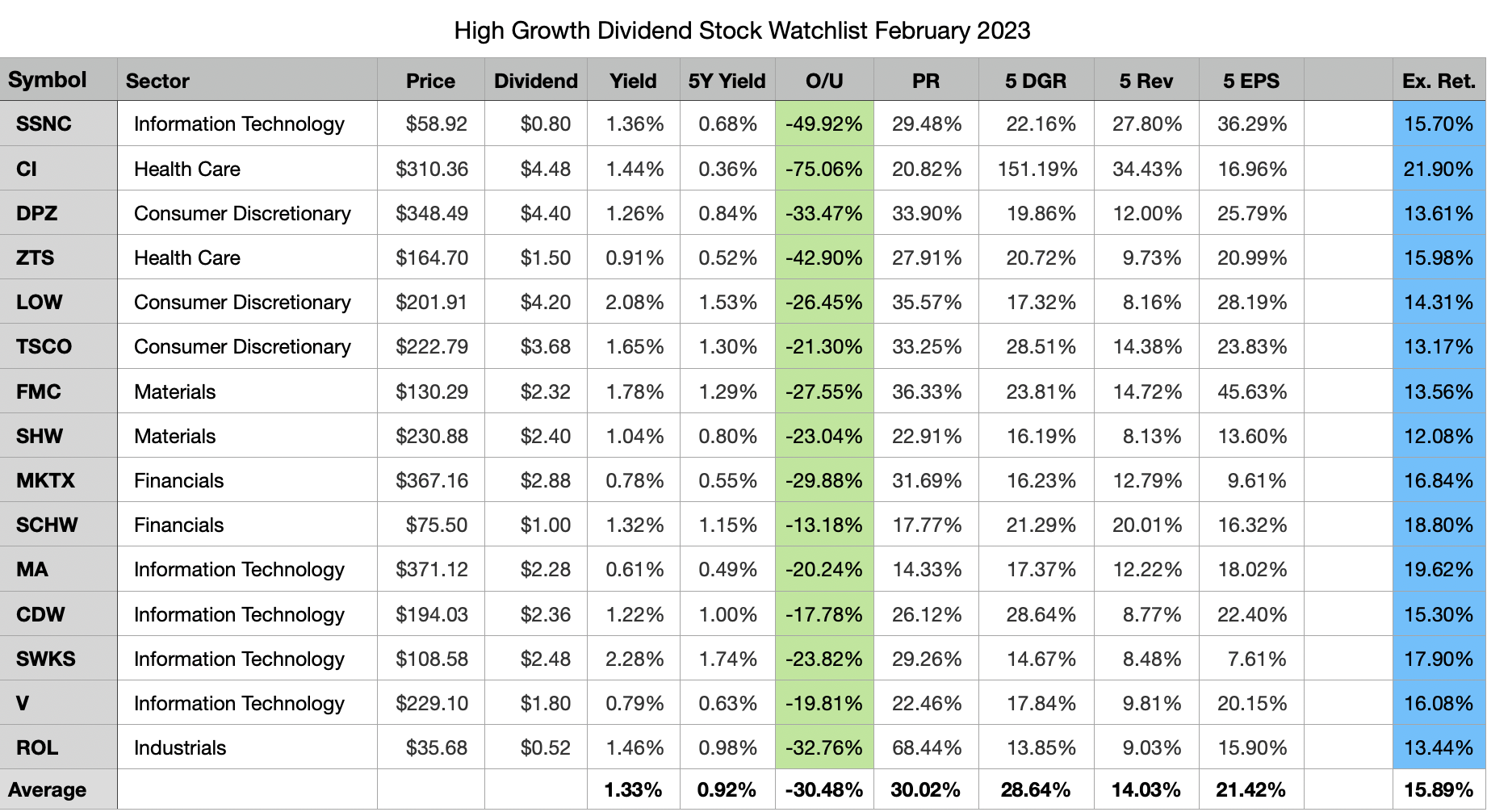

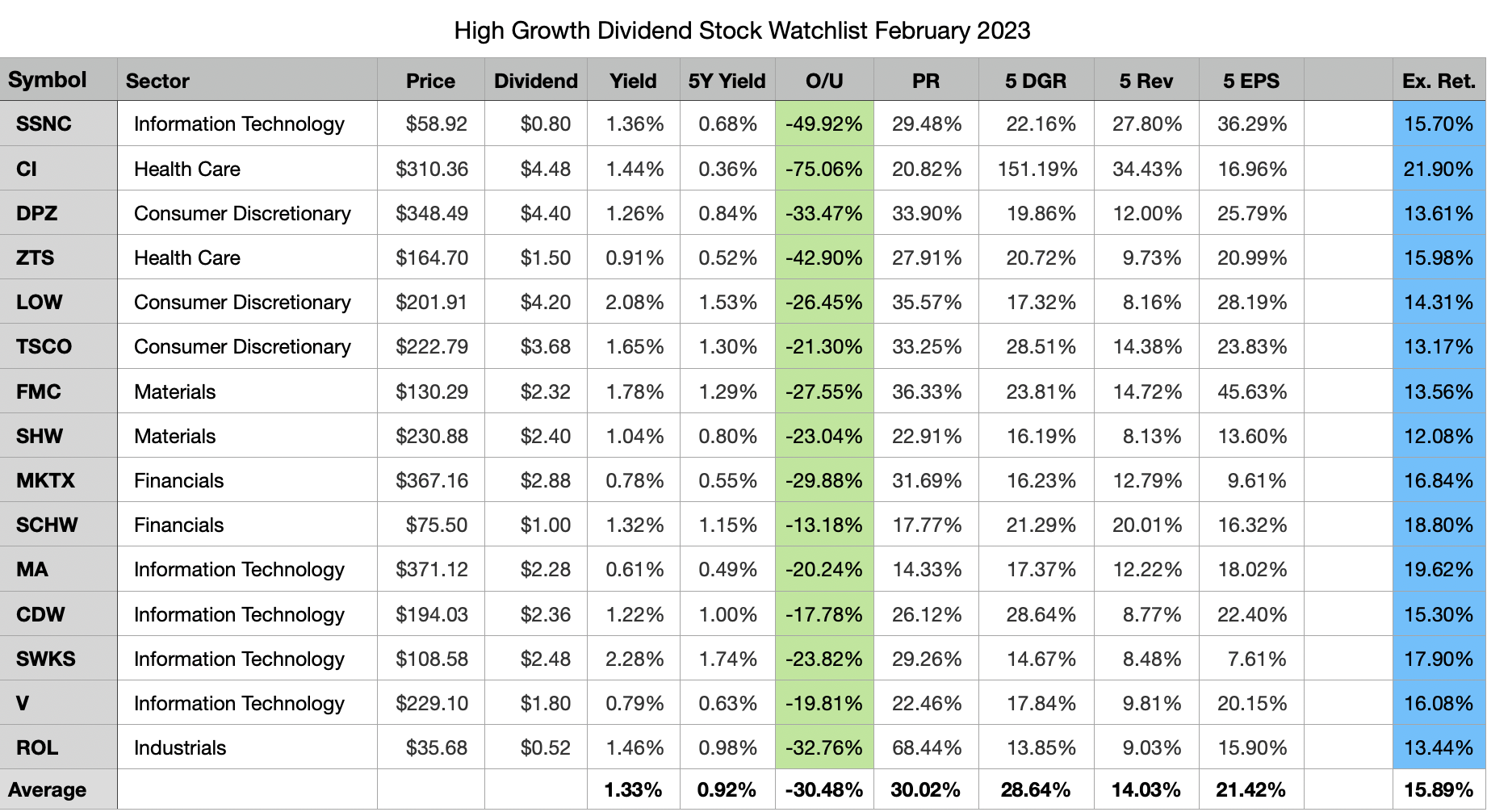

Understanding the payout ratio is equally important. This metric shows the percentage of a company's earnings that are paid out as dividends. A sustainable payout ratio generally lies between 30% and 70%, indicating the company can comfortably maintain its dividend payments without jeopardizing its growth and financial stability.

Identifying Reliable High-Dividend Stocks

Due diligence is paramount when selecting high-dividend stocks. Thorough research is essential to identify reliable companies with a history of consistent dividend payments. This includes:

- Analyzing company financials: Scrutinize balance sheets, income statements, and cash flow statements to assess the company's financial health.

- Assessing company stability: Consider factors such as market share, competitive landscape, and management quality.

- Reviewing dividend history: Examine the company's track record of dividend payments to assess its consistency and growth.

Leverage financial screening tools and resources to streamline your research. Many online platforms offer filters to find stocks based on dividend yield, payout ratio, and other relevant metrics. Prioritize companies with a long, consistent history of dividend payments, signifying financial stability and a commitment to returning value to shareholders.

Risk Management in High-Dividend Investing

High-dividend stocks, while attractive, carry inherent risks. The most significant risk is the potential for dividend cuts. Companies facing financial difficulties may reduce or eliminate their dividend payments, impacting your income stream.

To mitigate these risks:

- Diversify your portfolio: Spread your investments across multiple sectors and industries to reduce the impact of any single stock underperforming.

- Analyze company financial health: Thoroughly analyze the company's financial health and future prospects before investing. Look for strong balance sheets, consistent earnings, and a sustainable payout ratio.

- Monitor market trends: Stay informed about macroeconomic factors that could impact the performance of your investments.

Building a High-Dividend Portfolio

Diversification Across Sectors and Industries

Diversification is crucial for managing risk in any investment portfolio, and it’s particularly important when focusing on high dividend returns. Spreading investments across various sectors minimizes the impact of poor performance in any single sector. Consider these examples:

- Real Estate Investment Trusts (REITs): Offer exposure to the real estate market, often providing high and consistent dividends.

- Utilities: Generally provide stable and predictable dividends due to the essential nature of their services.

- Consumer Staples: Companies producing everyday goods usually maintain consistent sales and dividends.

Dollar-Cost Averaging (DCA) Strategy

Dollar-cost averaging (DCA) is a powerful strategy for mitigating market volatility. Instead of investing a lump sum at once, you invest a fixed amount at regular intervals (e.g., monthly or quarterly). This reduces the risk of investing a significant amount at a market peak.

- DCA helps to average out the purchase price of your investments, reducing the impact of short-term market fluctuations.

- It’s a particularly effective strategy for long-term investors aiming for consistent growth.

Reinvesting Dividends for Compound Growth

Reinvesting dividends, often through a Dividend Reinvestment Plan (DRIP), is a cornerstone of building wealth through dividend investing. By reinvesting your dividends, you buy more shares, increasing your income stream and accelerating your growth through the power of compounding.

- The longer you reinvest dividends, the more significant the impact of compounding becomes, leading to exponentially larger returns over time.

- DRIPs often offer the convenience of automatic reinvestment, simplifying the process and maximizing returns.

Monitoring and Adjusting Your Portfolio

Regularly Reviewing Company Performance

Regularly reviewing the performance of the companies in your portfolio is crucial for maintaining a healthy and profitable investment strategy. Monitor key financial metrics such as:

- Earnings per share (EPS): Indicates the company's profitability.

- Debt levels: High debt can signal financial instability.

- Payout ratio: Ensures the dividend is sustainable.

Adapting to Market Changes

Markets are dynamic, and it's essential to adapt your portfolio to changing conditions and company performance. This includes:

- Identifying underperforming stocks: Research and address stocks that consistently underperform expectations.

- Rebalancing your portfolio: Periodically rebalance your portfolio to maintain your desired asset allocation.

- Exploring new opportunities: Stay informed about emerging companies and sectors that align with your investment goals.

Tax Implications of Dividend Income

Dividend income is typically taxable, and the tax rate depends on your individual tax bracket and the type of dividend (qualified or non-qualified). Seek professional financial advice to understand the tax implications and plan accordingly.

Unlocking the Potential of High Dividend Returns

Achieving high dividend returns involves a multi-faceted strategy encompassing diversification, due diligence, and dividend reinvestment. By carefully selecting reliable high-dividend stocks, managing risk through diversification, and utilizing strategies like dollar-cost averaging and dividend reinvestment, you can build a portfolio that generates a consistent stream of passive income and contributes to long-term wealth building. A well-managed high-dividend portfolio provides financial security, enabling you to achieve your financial goals and enjoy the benefits of passive income. Start your journey towards securing high dividend returns today! Use the simple strategies discussed here to build a robust and profitable investment portfolio. [Link to a relevant resource, e.g., a dividend investing calculator]

Featured Posts

-

Jay Kelly O Ti Prepei Na K Serete Gia Tin Tainia Toy Netflix

May 11, 2025

Jay Kelly O Ti Prepei Na K Serete Gia Tin Tainia Toy Netflix

May 11, 2025 -

Debbie Elliott Key Achievements And Legacy

May 11, 2025

Debbie Elliott Key Achievements And Legacy

May 11, 2025 -

Selena Gomez And Benny Blanco A Deep Dive Into The Cheating Scandal Rumors

May 11, 2025

Selena Gomez And Benny Blanco A Deep Dive Into The Cheating Scandal Rumors

May 11, 2025 -

John Wick 5 Reimagining The Narrative A New Target After The High Table

May 11, 2025

John Wick 5 Reimagining The Narrative A New Target After The High Table

May 11, 2025 -

Anchor Brewing Company Shuttering Its Doors After 127 Years

May 11, 2025

Anchor Brewing Company Shuttering Its Doors After 127 Years

May 11, 2025