A Simple Path To High Dividend Income

Table of Contents

Understanding Dividend Investing Basics

What are Dividends?

Dividends are payments made by a company to its shareholders, representing a share of the company's profits. They're a crucial aspect of dividend stocks, differentiating them from capital gains (profits earned from selling a stock at a higher price than its purchase price). Understanding dividends is key to successful high-yield dividend portfolio building.

- Defining Dividends: A portion of a company's earnings distributed to shareholders.

- Types of Dividends:

- Regular Dividends: Paid out consistently at fixed intervals (quarterly is common).

- Special Dividends: One-time payments, often reflecting exceptional company performance.

- Tax Implications: Dividends are taxable income, subject to your individual tax bracket. The tax rate can vary depending on whether the dividends are qualified or non-qualified.

Keywords: Dividend stocks, dividend yield, dividend payout ratio

Identifying High-Yield Dividend Stocks

Finding companies with consistently high dividend payouts requires careful research and a strategic approach. Several strategies can help you locate promising high-yield dividend stocks for your portfolio.

- Screening Stocks by Dividend Yield: The dividend yield represents the annual dividend per share relative to the stock price (Annual Dividend/Share Price). A higher yield generally indicates a higher dividend payout. However, always consider the underlying company's financial health.

- Examining Payout Ratios and Dividend History: The payout ratio shows the percentage of earnings paid out as dividends. A sustainable payout ratio is crucial for long-term dividend growth. Review the company's history of consistent dividend payments to gauge its reliability.

- Considering Industry Sectors Known for High Dividends: Certain sectors, like REITs (Real Estate Investment Trusts) and utility stocks, are often known for their high dividend yields. These can be valuable additions to a diversified high dividend income portfolio.

Keywords: High yield dividend stocks, dividend screening, REITs, utility stocks

Building a Diversified Dividend Portfolio

The Importance of Diversification

Concentrating your investments in a few stocks carries significant risk. Diversification is crucial for mitigating this risk and building a stable high dividend income portfolio.

- Reducing Portfolio Volatility: A diversified portfolio reduces the impact of individual stock price fluctuations on your overall returns.

- Mitigating Losses from Individual Stock Underperformance: If one company underperforms, the impact on your overall portfolio is lessened due to the presence of other investments.

- Achieving a Balanced Portfolio: Diversification helps create a balanced portfolio that aligns with your risk tolerance and investment goals.

Keywords: Portfolio diversification, risk management, asset allocation

Creating a Balanced Dividend Portfolio

Balancing risk and reward requires careful consideration of different investment strategies and asset classes when building your high dividend income portfolio.

- Examples of Diversified Portfolios: A mix of REITs, utilities, and consumer staples can provide a balance of income and stability.

- Varying Dividend Payout Frequencies: Consider a mix of stocks paying dividends monthly, quarterly, or annually to provide a more consistent income stream. This strategy is particularly valuable for those seeking regular high dividend income.

Keywords: Dividend portfolio, balanced portfolio, investment strategy

Managing Your Dividend Income

Reinvesting Dividends for Growth

Reinvesting your dividends is a powerful strategy that leverages the principle of compounding to accelerate wealth building.

- DRIPs (Dividend Reinvestment Plans): Many companies offer DRIPs, allowing you to automatically reinvest your dividends to purchase more shares.

- The Snowball Effect of Compounding: Reinvesting dividends allows your earnings to generate further income, creating a snowball effect that significantly boosts long-term growth.

- Long-Term Investment Strategies: A long-term perspective is crucial for maximizing the benefits of dividend reinvestment and compounding.

Keywords: Dividend reinvestment, DRIP, compounding interest

Tax Implications of Dividend Income

Understanding the tax implications of dividend income is essential for effective financial planning.

- Qualified vs. Non-Qualified Dividends: The tax rate on dividends depends on whether they are qualified (generally taxed at lower rates) or non-qualified.

- Tax Rates: Your tax bracket will determine the applicable tax rate on your dividend income.

- Consulting a Financial Advisor: Seeking professional advice from a financial advisor can help you navigate the complexities of dividend taxation and optimize your tax strategy.

Keywords: Dividend tax, tax implications, qualified dividends

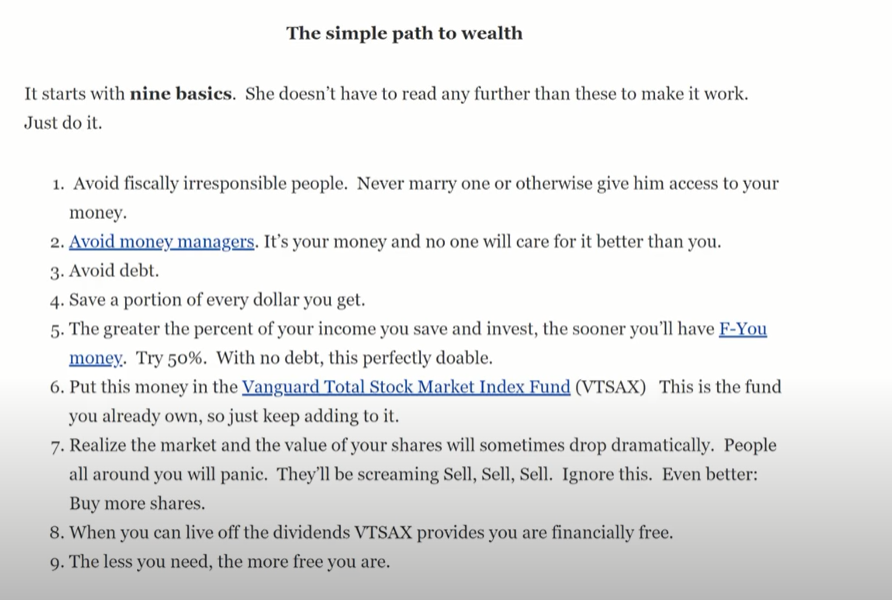

Your Journey to a Simple Path to High Dividend Income

Building a successful high-dividend income portfolio involves careful research, diversification, and consistent reinvestment. This strategy offers a powerful path toward passive income and enhanced financial security. Remember the key steps: research high-yield dividend stocks, create a diversified portfolio across different sectors, and reinvest your dividends to leverage the power of compounding.

Start building your path to high dividend income today! Research dividend stocks, create a diversified portfolio, and watch your passive income grow. Embrace the potential of high dividend income investing and secure your financial future. Start your high dividend income investing journey now!

Featured Posts

-

Greenlands Autonomy Under Pressure The Implications Of Trumps Policies

May 10, 2025

Greenlands Autonomy Under Pressure The Implications Of Trumps Policies

May 10, 2025 -

May 8th 2025 A Look Back At The Trump Administration Day 109

May 10, 2025

May 8th 2025 A Look Back At The Trump Administration Day 109

May 10, 2025 -

Overcoming Rejection The Journey Of A Footballer From Wolves To Europes Top Team

May 10, 2025

Overcoming Rejection The Journey Of A Footballer From Wolves To Europes Top Team

May 10, 2025 -

Wynne Evans Health Scare Illness Details And Potential Showbiz Comeback

May 10, 2025

Wynne Evans Health Scare Illness Details And Potential Showbiz Comeback

May 10, 2025 -

El Bolso Hereu De Dakota Johnson Sencillez Y Estilo

May 10, 2025

El Bolso Hereu De Dakota Johnson Sencillez Y Estilo

May 10, 2025