ABN Amro Facing Investigation: Dutch Central Bank Scrutinizes Bonus Payments

Table of Contents

The Nature of the ABN Amro Bonus Investigation

The DNB's investigation into ABN Amro's bonus payments focuses on several key areas. The scrutiny extends beyond simply the size of the bonuses awarded. Investigators are examining the selection criteria used to determine bonus recipients, ensuring fairness and transparency. Crucially, the investigation is also examining whether the bank complied with all relevant regulations concerning executive compensation and responsible banking practices. The core of the investigation centers around potential violations of financial regulations, including:

- Non-compliance with responsible banking practices: Did ABN Amro adhere to principles of prudent risk management when determining bonus payouts? Were bonuses potentially incentivizing excessive risk-taking?

- Potential conflicts of interest: Did any conflicts of interest influence the allocation of bonuses? Were decisions made in the best interests of the bank and its shareholders, or were other factors at play?

- Breaches of regulatory guidelines on executive compensation: Did ABN Amro's bonus scheme comply with all Dutch and European Union regulations regarding executive pay, including limitations on the size and structure of bonuses?

The timeframe of the investigation is currently ongoing, and while preliminary findings haven't been publicly released, the DNB's commitment to a thorough examination is evident. Keywords: ABN Amro bonus scandal, regulatory compliance, executive compensation, responsible banking.

The Role of the Dutch Central Bank (DNB)

The Dutch Central Bank (DNB) plays a vital role in overseeing the financial stability and integrity of the Netherlands' banking sector. The DNB possesses significant authority to regulate and supervise financial institutions, including the power to investigate potential violations of banking regulations. The DNB has a history of taking decisive action against banks found to be non-compliant. This investigation demonstrates a commitment to maintaining high standards of conduct within the Dutch financial system. If ABN Amro is found to have violated regulations, the DNB possesses several enforcement powers:

- Issuing fines: Substantial financial penalties can be levied against the bank.

- Imposing restrictions on operations: The DNB could limit ABN Amro's activities or impose restrictions on its business practices.

- Public reprimands: A public statement condemning ABN Amro's actions could severely damage the bank's reputation.

Keywords: Dutch Central Bank, DNB, financial regulation, supervisory powers, penalties, sanctions.

Potential Impact on ABN Amro and the Broader Financial Sector

The ABN Amro bonus investigation carries significant potential consequences. Reputational damage is a major concern for the bank, potentially impacting its ability to attract and retain clients and talent. Investor confidence is also at risk, which could lead to:

- Share price volatility: Fluctuations in ABN Amro's share price are likely as investors react to developments in the investigation.

- Loss of investor trust: Negative publicity could erode investor confidence, leading to capital flight.

- Increased regulatory scrutiny for other banks: The investigation could prompt the DNB to increase its scrutiny of bonus structures and compensation practices across the entire Dutch banking sector.

- Changes in bonus structures across the sector: This investigation may lead to a broader review and potential reform of bonus schemes in the Netherlands, aiming for greater alignment with responsible banking principles.

The implications extend beyond ABN Amro itself, potentially influencing the regulatory environment and shaping future bonus practices across the Dutch financial sector. Keywords: Reputational risk, investor confidence, market impact, financial stability, regulatory reform.

Conclusion: ABN Amro Bonus Investigation: Looking Ahead

The ABN Amro bonus investigation highlights the ongoing challenges of balancing executive compensation with responsible banking practices and regulatory compliance. The potential penalties for ABN Amro are significant, ranging from substantial fines to reputational damage and operational restrictions. The broader impact on the Dutch financial sector could involve increased regulatory scrutiny and changes to bonus structures across the industry. The investigation is ongoing, and further updates are anticipated. Stay updated on the ABN Amro bonus scandal and its implications for responsible banking and financial regulation. Follow the latest developments in the ABN Amro investigation by the Dutch Central Bank to understand the evolving landscape of financial regulation and its impact on the Dutch banking sector. Learn more about the scrutiny of ABN Amro's bonus payments and its implications for the future of banking practices. Keywords: ABN Amro, Dutch Central Bank, bonus payments, investigation, financial regulation, update.

Featured Posts

-

The Crumbling College Towns How Enrollment Drops Hurt Local Economies

May 21, 2025

The Crumbling College Towns How Enrollment Drops Hurt Local Economies

May 21, 2025 -

Trans Australia Run Will The Record Fall

May 21, 2025

Trans Australia Run Will The Record Fall

May 21, 2025 -

Saskatchewan Political Panel Federal Leaders Visit Sparks Controversy

May 21, 2025

Saskatchewan Political Panel Federal Leaders Visit Sparks Controversy

May 21, 2025 -

New Trans Australia Run Attempt Challenges Existing Record

May 21, 2025

New Trans Australia Run Attempt Challenges Existing Record

May 21, 2025 -

Southern French Alps Weather Update Late Season Snow And Storms

May 21, 2025

Southern French Alps Weather Update Late Season Snow And Storms

May 21, 2025

Latest Posts

-

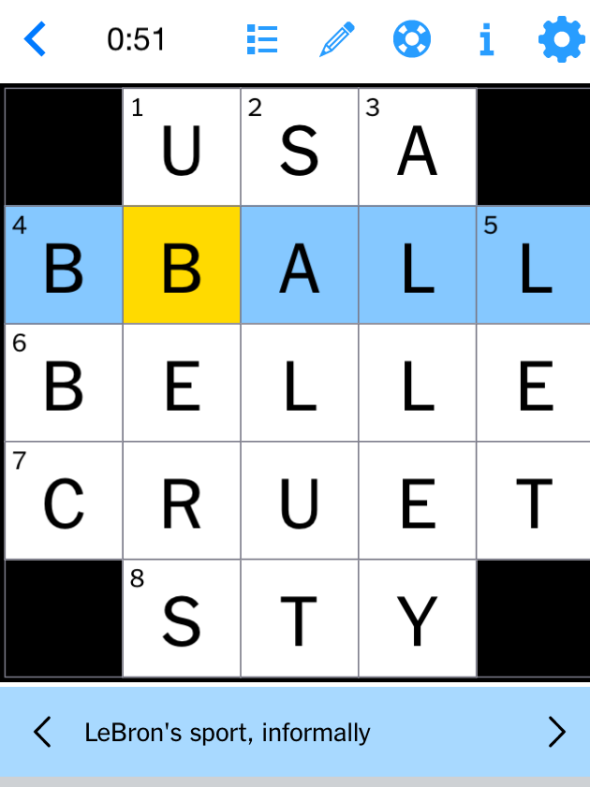

Solve The Nyt Mini Crossword March 5 2025 Answers And Hints

May 21, 2025

Solve The Nyt Mini Crossword March 5 2025 Answers And Hints

May 21, 2025 -

Nyt Mini Crossword March 5 2025 Solutions And Clues

May 21, 2025

Nyt Mini Crossword March 5 2025 Solutions And Clues

May 21, 2025 -

Unpacking Trumps Aerospace Deals An Analysis Of Promises And Outcomes

May 21, 2025

Unpacking Trumps Aerospace Deals An Analysis Of Promises And Outcomes

May 21, 2025 -

A Comprehensive Look At Trumps Aerospace Deals Assessing The Reality

May 21, 2025

A Comprehensive Look At Trumps Aerospace Deals Assessing The Reality

May 21, 2025 -

Analyzing The Canadian Tire Hudsons Bay Merger A Cautious Approach

May 21, 2025

Analyzing The Canadian Tire Hudsons Bay Merger A Cautious Approach

May 21, 2025