ABN Amro: Potential Fine From Dutch Central Bank Over Bonuses

Table of Contents

The Alleged Violations: Why is ABN Amro Under Scrutiny?

ABN Amro is under scrutiny from the DNB for alleged violations concerning its bonus structures and payouts. The DNB's concerns center around the bank's apparent disregard for crucial regulations designed to ensure responsible remuneration and mitigate excessive risk-taking. These alleged violations challenge the core principles of sound risk management and regulatory compliance within the financial sector.

-

Insufficient consideration of risk management in bonus schemes: The DNB alleges that ABN Amro's bonus schemes inadequately factored in long-term risks, potentially incentivizing short-sighted, high-risk behavior among employees. This directly contradicts the DNB's guidelines on risk-based bonuses.

-

Non-compliance with DNB guidelines on responsible remuneration: ABN Amro is accused of failing to meet the DNB's standards for responsible remuneration, potentially leading to excessive bonus payouts that are not aligned with sustainable business practices and responsible lending.

-

Potential breaches of responsible lending practices linked to bonus structures: The DNB's investigation suggests a possible link between ABN Amro's bonus structures and irresponsible lending practices. This implies that bonus incentives may have inadvertently encouraged lending practices that pose significant financial risks.

-

Lack of transparency in bonus calculations and allocation: The DNB alleges a lack of transparency in how ABN Amro calculates and allocates bonuses, hindering independent oversight and accountability. This opacity makes it difficult to assess whether the bonus system is fair and aligns with responsible lending principles.

While the DNB hasn't publicly released specific examples, the investigation suggests a systemic issue within ABN Amro's remuneration policy that needs immediate attention. The keywords surrounding this section are crucial to understanding the core issue at hand, highlighting the lack of compliance with DNB regulations.

Potential Impact of the Fine on ABN Amro

The potential consequences for ABN Amro are significant and multifaceted, extending beyond mere financial penalties. A hefty fine from the DNB would severely damage the bank's reputation and impact investor confidence, potentially leading to a drop in its stock price.

-

Financial penalties imposed by the DNB: The DNB has the authority to impose substantial financial penalties, potentially running into millions of euros, significantly impacting ABN Amro's profitability.

-

Reputational damage and loss of investor confidence: A DNB fine would severely damage ABN Amro's reputation, eroding trust among clients and investors, leading to potential capital flight and reduced business opportunities.

-

Increased regulatory scrutiny and potential for stricter oversight: The DNB is likely to increase its scrutiny of ABN Amro's operations, possibly leading to stricter regulatory oversight and limitations on future business activities.

-

Impact on employee morale and retention: The scandal could negatively impact employee morale and retention, as talented individuals may seek employment with institutions perceived as having stronger ethical practices and robust risk management structures. The potential reputational risk is a major concern for the future of the bank.

ABN Amro's Response and Future Actions

ABN Amro has acknowledged the DNB's investigation and stated its commitment to cooperating fully. The bank has initiated several measures to address the alleged violations and strengthen its regulatory compliance program.

-

Internal investigations and audits: ABN Amro has launched internal investigations and audits to thoroughly assess its bonus schemes and identify areas for improvement.

-

Changes to bonus structures and remuneration policies: The bank is reportedly reviewing and revising its bonus structures and remuneration policies to ensure better alignment with DNB guidelines and responsible lending principles.

-

Enhanced risk management procedures: ABN Amro is strengthening its risk management procedures to better identify, assess, and mitigate financial risks associated with its operations, including its compensation practices.

-

Strengthened regulatory compliance programs: The bank is enhancing its regulatory compliance programs to ensure ongoing adherence to DNB regulations and other relevant financial industry standards. Implementing a robust remediation plan is key to regaining trust.

Wider Implications for the Dutch Banking Sector

The ABN Amro case carries significant implications for the Dutch banking sector as a whole. It underscores the importance of robust risk management and regulatory compliance across the industry. The DNB's actions send a clear message to other Dutch banks, emphasizing the need for continuous evaluation and improvement of internal practices.

-

Increased pressure on other banks to review their bonus systems: Other Dutch banks are likely to come under increased pressure to review their own bonus systems and ensure compliance with DNB regulations.

-

Potential for stricter regulations from the DNB: The case could prompt the DNB to introduce stricter regulations for the entire banking sector, enhancing oversight and promoting better risk management practices.

-

Impact on the competitiveness of Dutch banks: Increased regulatory scrutiny and potential for stricter regulations could impact the competitiveness of Dutch banks compared to their counterparts in other countries with potentially less stringent rules.

Conclusion: The ABN Amro Bonus Fine: What's Next?

The DNB investigation into ABN Amro's bonus practices reveals alleged violations concerning risk management, responsible lending, and regulatory compliance. The potential fine carries significant financial and reputational consequences for ABN Amro, impacting investor confidence and potentially leading to stricter regulatory oversight. This case also underscores the broader need for enhanced risk management and regulatory compliance within the Dutch banking sector. The repercussions of the ABN Amro bonus scandal could reshape the regulatory landscape and the future of banking bonuses in the Netherlands. Stay informed about developments in the ABN Amro and the DNB investigation to understand the evolving implications of this critical situation for the future of financial regulation.

Featured Posts

-

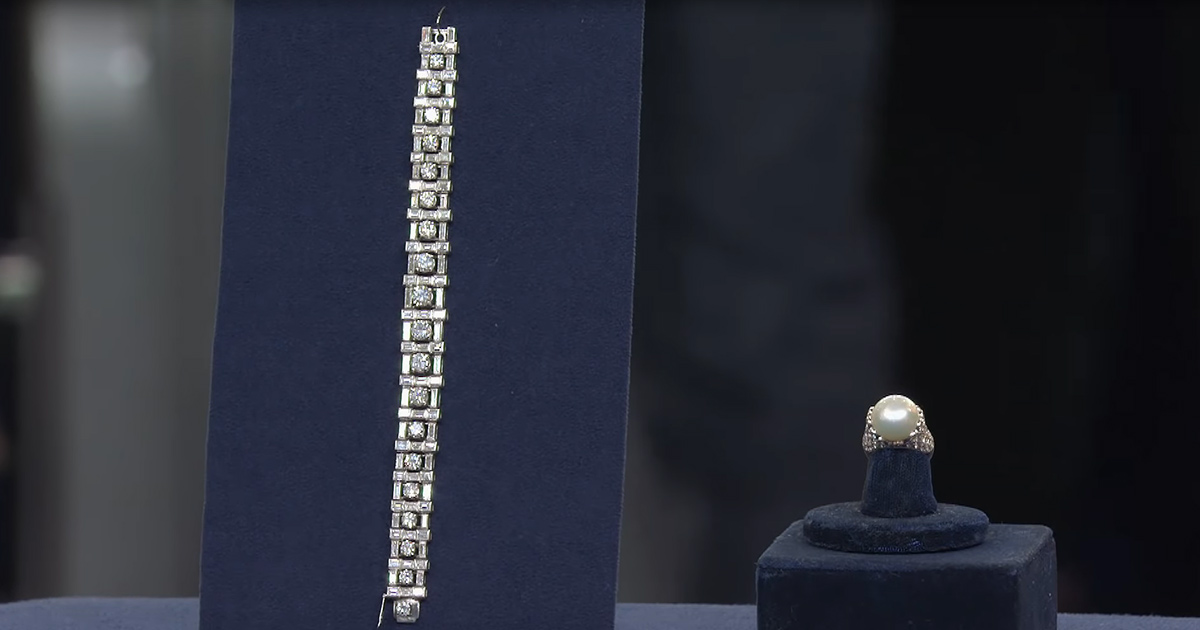

Antiques Roadshow A National Treasure And A Shocking Arrest

May 21, 2025

Antiques Roadshow A National Treasure And A Shocking Arrest

May 21, 2025 -

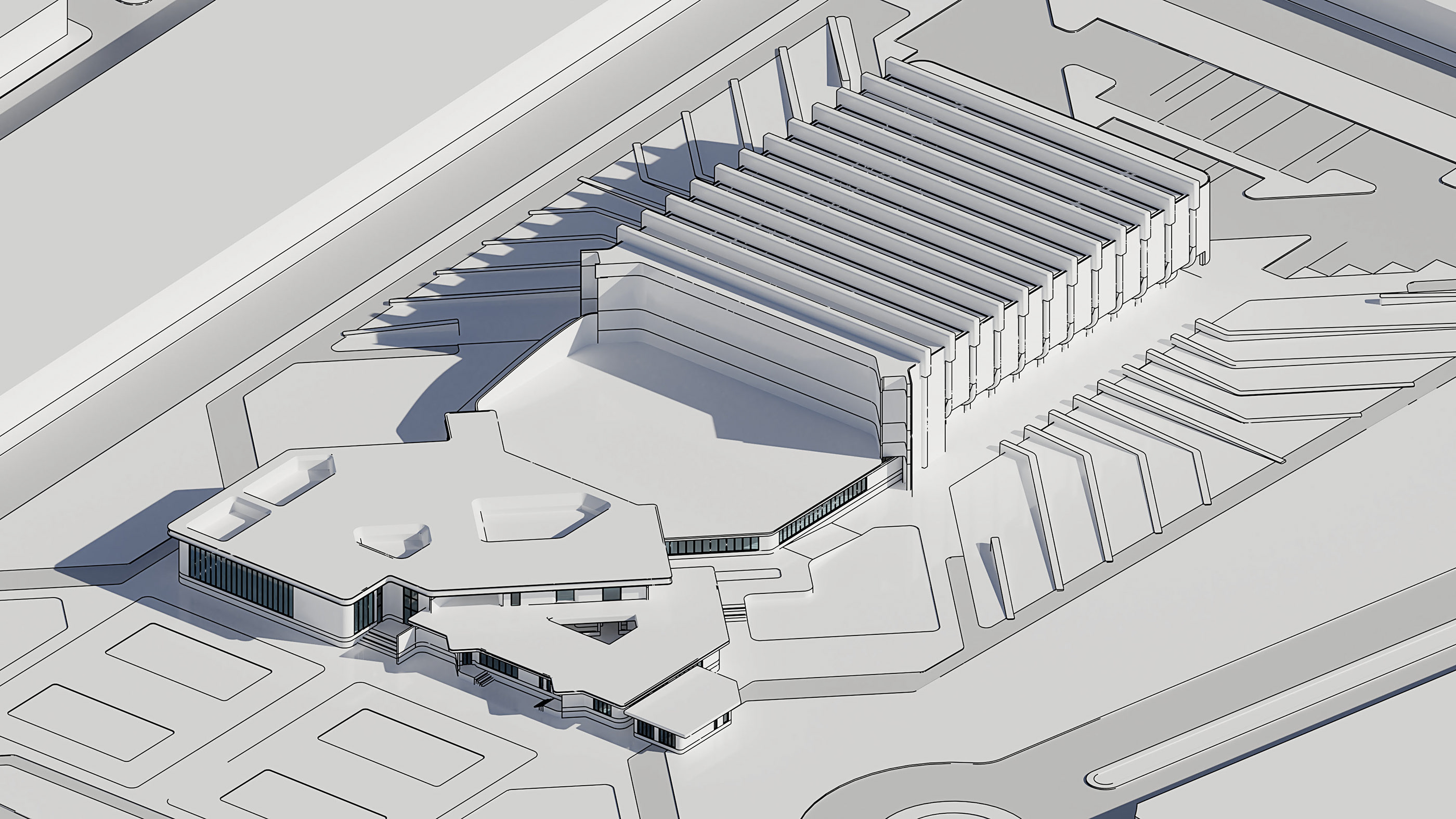

Nices Ambitious Olympic Swimming Pool Plan

May 21, 2025

Nices Ambitious Olympic Swimming Pool Plan

May 21, 2025 -

L Espace Julien Accueille Les Novelistes Avant Le Hellfest

May 21, 2025

L Espace Julien Accueille Les Novelistes Avant Le Hellfest

May 21, 2025 -

Peppa Pigs New Baby Sister The Sweet Story Behind Her Name

May 21, 2025

Peppa Pigs New Baby Sister The Sweet Story Behind Her Name

May 21, 2025 -

Tikkie Gebruiken Een Handleiding Voor Nederlandse Bankieren

May 21, 2025

Tikkie Gebruiken Een Handleiding Voor Nederlandse Bankieren

May 21, 2025

Latest Posts

-

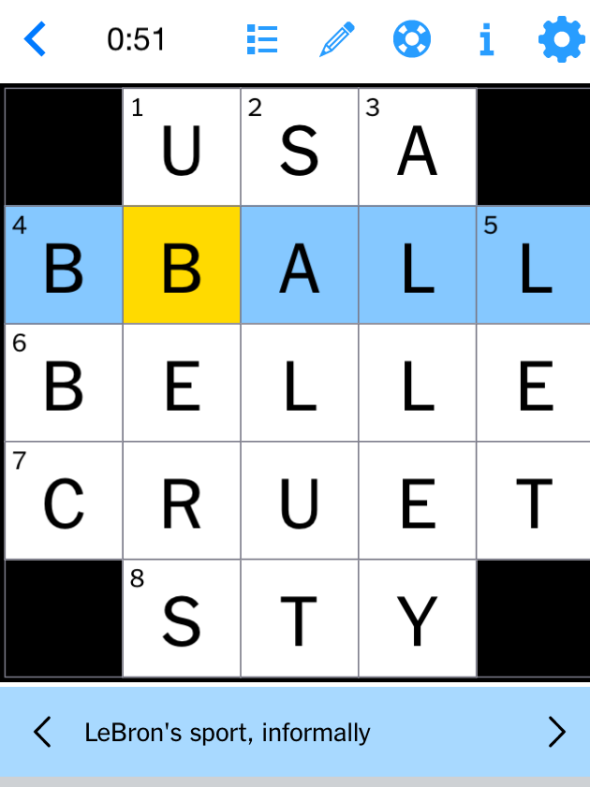

Solve The Nyt Mini Crossword March 5 2025 Answers And Hints

May 21, 2025

Solve The Nyt Mini Crossword March 5 2025 Answers And Hints

May 21, 2025 -

Nyt Mini Crossword March 5 2025 Solutions And Clues

May 21, 2025

Nyt Mini Crossword March 5 2025 Solutions And Clues

May 21, 2025 -

Unpacking Trumps Aerospace Deals An Analysis Of Promises And Outcomes

May 21, 2025

Unpacking Trumps Aerospace Deals An Analysis Of Promises And Outcomes

May 21, 2025 -

A Comprehensive Look At Trumps Aerospace Deals Assessing The Reality

May 21, 2025

A Comprehensive Look At Trumps Aerospace Deals Assessing The Reality

May 21, 2025 -

Analyzing The Canadian Tire Hudsons Bay Merger A Cautious Approach

May 21, 2025

Analyzing The Canadian Tire Hudsons Bay Merger A Cautious Approach

May 21, 2025