ABN Amro Under Scrutiny For Bonus Practices: Potential Fine Looms

Table of Contents

The Nature of the Alleged ABN Amro Bonus Misconduct

The investigation into ABN Amro's bonus schemes centers around several key allegations of misconduct:

-

Lack of Transparency in ABN Amro Bonus Schemes: Critics argue that the bank's bonus structure lacks sufficient transparency, making it difficult to determine whether bonuses are fairly awarded and aligned with company performance. This opacity potentially violates regulatory guidelines on corporate governance and ethical business practices. The absence of clear metrics and criteria for bonus allocation leaves room for subjective decision-making, raising concerns about potential bias and favoritism.

-

Excessive Bonuses Paid by ABN Amro: The size of bonuses paid to senior executives has drawn significant criticism, especially considering ABN Amro's recent financial performance and the prevailing economic climate. The perceived disconnect between performance and reward fuels the ongoing investigation and raises questions about the bank's commitment to responsible financial management. Detailed analysis of the bonus payouts compared to industry benchmarks is needed to determine whether the amounts were truly excessive.

-

Potential Violations of Dutch and EU Regulations: The investigation is examining whether ABN Amro's bonus practices violate Dutch and EU regulations concerning financial institutions' compensation policies. These regulations are designed to prevent excessive risk-taking encouraged by unsustainable bonus structures. Failure to comply with these regulations could result in severe penalties for the bank.

-

Negative Impact on Shareholder Value due to ABN Amro Bonus Practices: Some investors argue that the substantial bonus payouts negatively impacted shareholder value, triggering closer scrutiny from investor groups and regulatory bodies. The argument is that resources allocated to bonuses could have been better used for investments or shareholder returns. This raises concerns about the alignment of executive interests with those of shareholders.

The Potential Consequences for ABN Amro

The potential repercussions for ABN Amro are substantial and far-reaching:

-

Significant Financial Penalties: Depending on the investigation's findings, ABN Amro could face substantial fines for violating bonus-related regulations. The exact amount remains uncertain, but it could run into millions of euros, significantly impacting the bank's financial stability.

-

Severe Reputational Damage: The negative publicity surrounding the investigation has already tarnished ABN Amro's reputation. Further revelations could severely erode public trust and investor confidence, impacting the bank's ability to attract and retain clients and investors.

-

Mandatory Changes to Compensation Policies: The investigation may force ABN Amro to overhaul its bonus structures to ensure greater transparency and compliance with regulatory requirements. This could involve significant changes to internal policies, procedures, and potentially even the organizational structure responsible for compensation decisions.

-

Accountability for Executives: Individuals involved in designing and implementing the bonus schemes could face personal consequences, ranging from disciplinary action to legal proceedings. This underscores the personal liability associated with unethical or illegal bonus practices.

Wider Implications for the Financial Sector

The ABN Amro case highlights broader concerns within the financial sector regarding executive compensation:

-

Increased Scrutiny Across the Banking Industry: The investigation is likely to prompt increased scrutiny of bonus practices across the entire banking industry, leading to stricter regulation and a greater emphasis on transparency. This could trigger a wave of internal reviews and policy changes within other financial institutions.

-

The Need for Ethical Compensation Models: The case emphasizes the need for ethical and responsible executive compensation structures that are aligned with long-term value creation, risk management, and shareholder interests. This requires a shift towards performance-based incentives that are clearly defined and transparent.

-

Potential for Regulatory Reform: The outcome of the investigation could influence future regulatory reforms aimed at curbing excessive risk-taking and promoting fairer compensation practices. This could lead to stricter regulations and increased oversight of executive compensation across the financial sector.

Conclusion: Understanding the Implications of ABN Amro Bonus Practices

The investigation into ABN Amro's bonus practices has raised serious concerns about transparency, fairness, and potential regulatory violations. The potential consequences for ABN Amro are severe, including substantial fines and lasting reputational damage. This case serves as a cautionary tale, highlighting the importance of ethical and responsible compensation structures within the financial industry. The ongoing scrutiny of ABN Amro's bonus practices underscores the need for robust regulatory frameworks and a broader conversation about responsible executive compensation. Stay informed about the developments in this case to understand the evolving landscape of ABN Amro bonus practices and their broader implications for the financial industry. Further research into ABN Amro bonus practices and similar cases will be crucial in shaping future regulatory reforms.

Featured Posts

-

Late Snowfall Hits Southern French Alps Impact Of Stormy Weather

May 21, 2025

Late Snowfall Hits Southern French Alps Impact Of Stormy Weather

May 21, 2025 -

The Costco Campaign And Saskatchewan Politics A Panel Discussion

May 21, 2025

The Costco Campaign And Saskatchewan Politics A Panel Discussion

May 21, 2025 -

New The Amazing World Of Gumball Teaser Trailer On Hulu Premiere Date Announced

May 21, 2025

New The Amazing World Of Gumball Teaser Trailer On Hulu Premiere Date Announced

May 21, 2025 -

Prediksi Juara Liga Inggris 2024 2025 Peran Krusial Sang Pelatih Di Liverpool

May 21, 2025

Prediksi Juara Liga Inggris 2024 2025 Peran Krusial Sang Pelatih Di Liverpool

May 21, 2025 -

Is A Logitech Forever Mouse Finally Possible

May 21, 2025

Is A Logitech Forever Mouse Finally Possible

May 21, 2025

Latest Posts

-

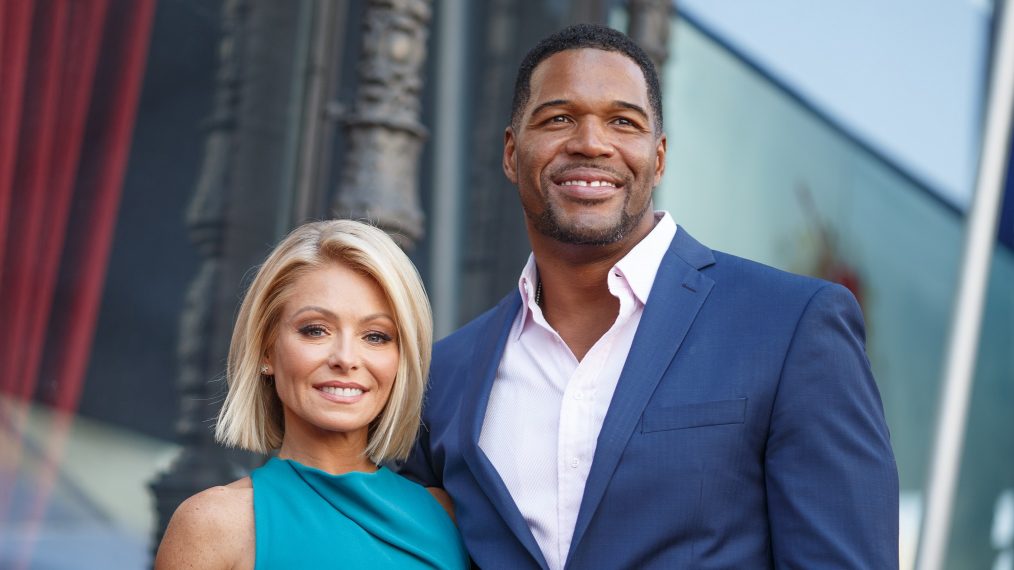

Michael Strahans Interview Strategy Winning The Ratings Game

May 21, 2025

Michael Strahans Interview Strategy Winning The Ratings Game

May 21, 2025 -

The Michael Strahan Interview A Victory In The Ratings Race

May 21, 2025

The Michael Strahan Interview A Victory In The Ratings Race

May 21, 2025 -

Weather Anchor Ginger Zee Claps Back At Aging Comment

May 21, 2025

Weather Anchor Ginger Zee Claps Back At Aging Comment

May 21, 2025 -

Successful Madrid Open Debut For Sabalenka

May 21, 2025

Successful Madrid Open Debut For Sabalenka

May 21, 2025 -

Analyzing Michael Strahans Interview Coup During A Ratings War

May 21, 2025

Analyzing Michael Strahans Interview Coup During A Ratings War

May 21, 2025