Ackman's Trade War Prediction: US Vs. China

Table of Contents

Bill Ackman's Stance on the US-China Trade Conflict

Bill Ackman, founder and CEO of Pershing Square Capital Management, is a highly respected figure in the investment world. His firm is known for its long-term, value-oriented investment strategy. While Ackman hasn't explicitly laid out a singular, sweeping "prediction," his public comments and investment decisions reveal a cautious, if not bearish, outlook on the long-term effects of the ongoing trade conflict between the US and China. His perspective is shaped by concerns about the potential for prolonged economic disruption and geopolitical instability.

- Specific statements/predictions: While Ackman hasn't offered a precise timeline or magnitude of impact, his concerns regarding the ongoing technological decoupling between the US and China, coupled with his investment moves, strongly suggest a belief that the trade conflict will have a lasting negative impact on certain sectors. He hasn't explicitly stated a specific prediction regarding the future of the trade war itself, but his actions indicate worry.

- Affected companies/sectors: Ackman’s portfolio shifts and public statements often indirectly point towards sectors likely to be negatively impacted. For example, increased scrutiny on Chinese technology companies and concerns about supply chain disruptions could affect various US companies with significant ties to China.

- Relevant links: [Insert links to relevant news articles or interviews where Ackman discusses the US-China trade relationship. Replace this bracketed information with actual links].

Key Factors Influencing Ackman's Prediction

Ackman’s assessment likely incorporates several crucial factors contributing to the complexity of the US-China trade relationship. These considerations likely form the basis of his cautious outlook.

- Geopolitical tensions: The increasing geopolitical rivalry between the US and China, extending beyond trade to encompass technology, military, and ideological differences, significantly influences the situation. Escalation in any of these areas could further exacerbate the trade conflict.

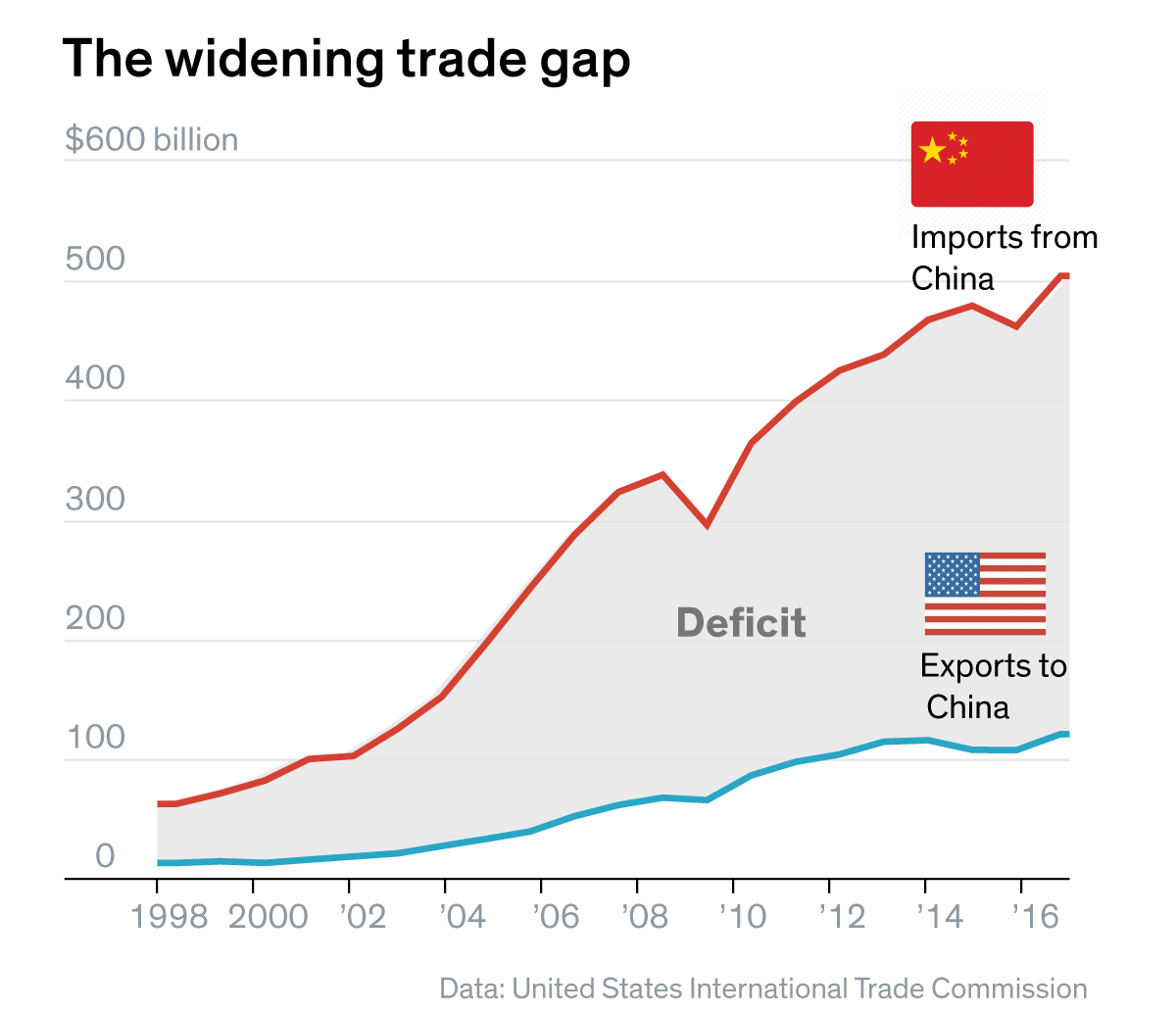

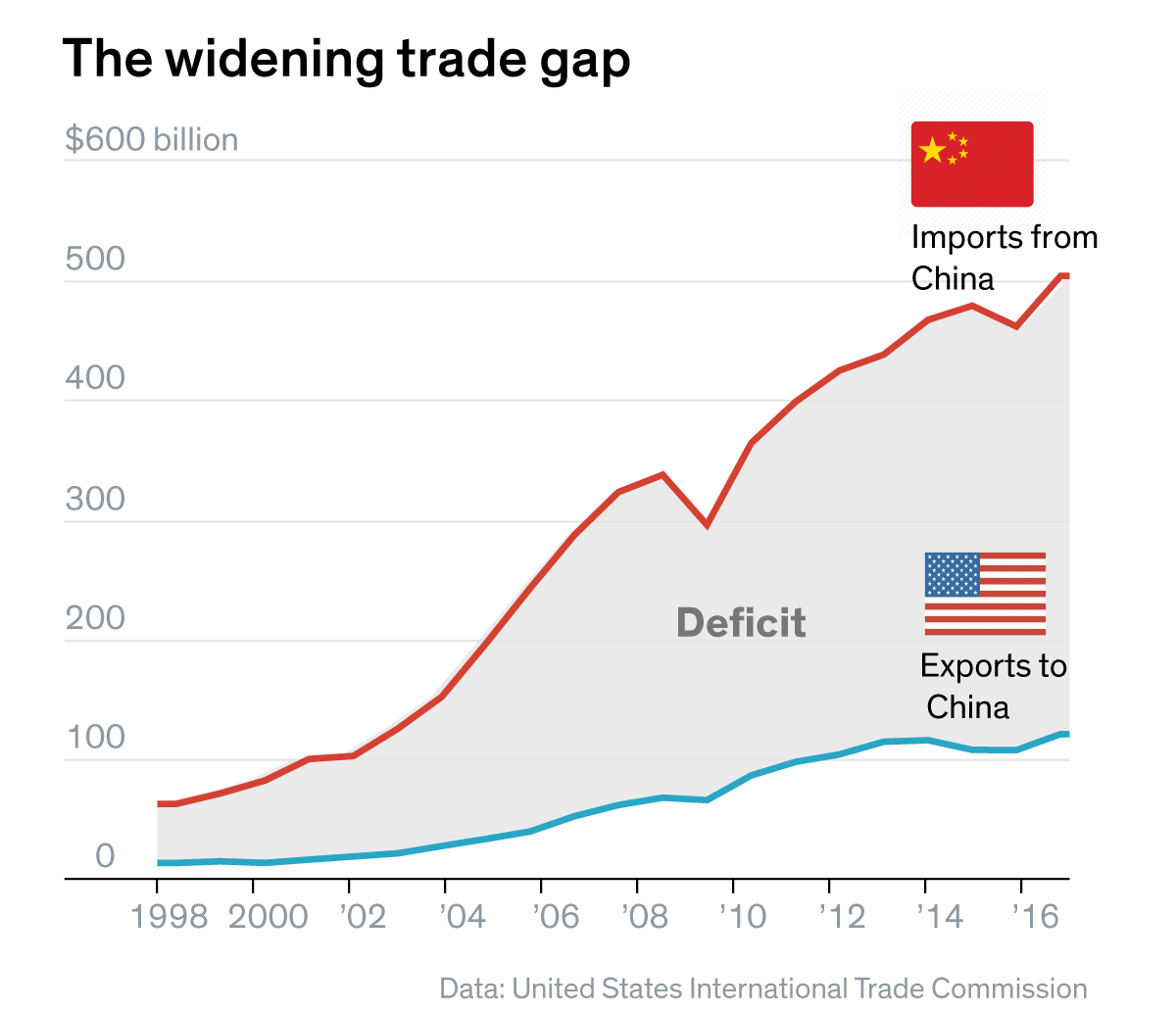

- Economic indicators: Key economic indicators like inflation, GDP growth rates in both countries, and the strength of the US dollar are all likely factored into Ackman's assessment. The negative impacts of tariffs and trade restrictions on consumer prices and overall economic health are significant concerns.

- Technology and intellectual property: The battle for technological dominance and concerns over intellectual property theft are central to the trade dispute. This technological decoupling is a major element affecting Ackman's view.

- Supply chains: Disruptions to global supply chains, caused by tariffs and geopolitical tensions, are a significant source of concern. The intricate web of global trade has become increasingly vulnerable due to the trade war.

Potential Implications of Ackman's Prediction

If Ackman's implied concerns materialize, the consequences could be far-reaching:

- Global stock markets: A prolonged trade war could lead to increased market volatility and potentially a global stock market correction, affecting investor confidence worldwide.

- Specific industries: Industries heavily reliant on trade between the US and China, such as technology, manufacturing, and agriculture, would likely face significant challenges.

- Global trade relationships: The US-China trade conflict could reshape global trade relationships, potentially leading to the formation of new trade blocs and alliances.

- Consumer prices and inflation: Increased tariffs and trade restrictions could contribute to higher consumer prices and inflation in both the US and China, affecting purchasing power.

Alternative Perspectives and Counterarguments

It's important to acknowledge that not all analysts share Ackman's cautious outlook. Some believe that the US and China can find a way to de-escalate tensions and reach a mutually beneficial agreement.

- Opposing viewpoints: Some argue that the trade war might be a temporary disruption, and both economies will adapt and find new avenues for growth. Others point to the potential for technological innovation spurred by decoupling.

- Limitations of Ackman's perspective: While Ackman's insights are valuable, it's crucial to remember that predicting geopolitical events is inherently uncertain. His perspective might not fully capture the potential for unexpected developments or successful negotiation between the two countries.

- Uncertainty: The future of the US-China trade relationship remains highly uncertain, making accurate predictions challenging.

Investing Strategies Based on Ackman's Prediction

Ackman's implied concerns underscore the need for prudent investment strategies in a volatile market.

- Risk mitigation: Investors should consider diversifying their portfolios across different asset classes and geographies to mitigate risks associated with the trade war.

- Affected sectors: Depending on Ackman's implied bearishness, investors may want to carefully evaluate their exposure to sectors particularly vulnerable to trade disruptions.

- Due diligence: Thorough due diligence is crucial before making any investment decisions, especially in a period of heightened uncertainty.

Conclusion

Bill Ackman's perspective on the US-China trade conflict, while not a definitive prediction, highlights the significant risks associated with escalating tensions. His concerns regarding the long-term economic and geopolitical ramifications deserve careful consideration. The potential implications for global markets, specific industries, and consumer prices are substantial. Understanding the nuances of Ackman's Trade War Prediction is crucial for adapting investment strategies and navigating the uncertainties of the evolving US-China relationship. Learn more about Ackman's trade war prediction and its implications by staying updated on the latest developments. Make informed investment decisions by carefully considering all perspectives on this complex situation and the potential impact of Ackman's Trade War Prediction.

Featured Posts

-

Bundestag Elections And Key Business Indicators Their Impact On The Dax

Apr 27, 2025

Bundestag Elections And Key Business Indicators Their Impact On The Dax

Apr 27, 2025 -

Ariana Grandes New Hair And Tattoos Seeking Professional Help

Apr 27, 2025

Ariana Grandes New Hair And Tattoos Seeking Professional Help

Apr 27, 2025 -

Pne Groups German Portfolio Expands New Permits For Wind And Pv Projects

Apr 27, 2025

Pne Groups German Portfolio Expands New Permits For Wind And Pv Projects

Apr 27, 2025 -

The Growing Trend Of Betting On The Los Angeles Wildfires

Apr 27, 2025

The Growing Trend Of Betting On The Los Angeles Wildfires

Apr 27, 2025 -

Green Bay Packers Two Chances At A 2025 International Game

Apr 27, 2025

Green Bay Packers Two Chances At A 2025 International Game

Apr 27, 2025

Latest Posts

-

Pirates Defeat Yankees In Extra Innings With Walk Off

Apr 28, 2025

Pirates Defeat Yankees In Extra Innings With Walk Off

Apr 28, 2025 -

Walk Off Win For Pirates Against Yankees

Apr 28, 2025

Walk Off Win For Pirates Against Yankees

Apr 28, 2025 -

Pirates Edge Yankees After Extra Innings Battle

Apr 28, 2025

Pirates Edge Yankees After Extra Innings Battle

Apr 28, 2025 -

Yankees Lose Heartbreaker To Pirates On Walk Off Hit

Apr 28, 2025

Yankees Lose Heartbreaker To Pirates On Walk Off Hit

Apr 28, 2025 -

Pirates Win Walk Off Thriller Against Yankees In Extras

Apr 28, 2025

Pirates Win Walk Off Thriller Against Yankees In Extras

Apr 28, 2025