Addressing High Stock Market Valuations: A BofA Analysis For Investors

Table of Contents

BofA's Assessment of Current Market Conditions

BofA Merrill Lynch's recent analysis reveals a cautious outlook on current high stock market valuations. Their assessment utilizes various key metrics, including Price-to-Earnings ratios (P/E ratios) and the cyclically adjusted price-to-earnings ratio (Shiller PE), to gauge market health. These metrics compare current stock prices to historical earnings, providing a context for valuation levels.

-

Key findings from BofA's research regarding current valuation levels: BofA highlights that many major market indices are trading at levels significantly above their historical averages, suggesting potential overvaluation in certain sectors. Their research points to elevated valuations across several asset classes.

-

Comparison to historical valuations and potential deviations: The analysis draws comparisons between current P/E ratios and those observed during previous market cycles, identifying significant deviations from long-term averages. This suggests a potential vulnerability to corrections.

-

Specific sectors identified as overvalued or undervalued by BofA: BofA's research often pinpoints specific sectors deemed overvalued based on their current valuations and future growth prospects. Conversely, they may identify undervalued sectors presenting potentially better risk-adjusted returns. Specific sector calls vary based on the timing of the report, so reviewing the most recent BofA analysis is crucial for up-to-date insights.

Factors Contributing to High Stock Market Valuations

Several macroeconomic factors have contributed to the current environment of high stock market valuations. Understanding these factors is essential for assessing the sustainability of current market levels.

-

Low interest rates and their impact on stock prices: Exceptionally low interest rates globally have pushed investors towards higher-yielding assets, including stocks. This increased demand has driven up stock prices, contributing significantly to elevated valuations.

-

The role of quantitative easing and other monetary policies: Central banks' extensive use of quantitative easing (QE) programs has injected significant liquidity into the markets, further fueling asset price inflation, including stocks. These policies aim to stimulate economic growth, but they can also inflate asset bubbles.

-

Impact of technological advancements and growth expectations: The rapid pace of technological innovation and associated growth expectations in sectors like technology and biotechnology have attracted substantial investment, driving up valuations in these areas.

-

Influence of investor sentiment and market psychology: Positive investor sentiment and a "fear of missing out" (FOMO) mentality can create a self-fulfilling prophecy, pushing stock prices higher even in the face of potential overvaluation.

Risks Associated with High Valuations

Investing in a highly valued market carries inherent risks that investors must carefully consider. Understanding these risks is crucial for developing a robust investment strategy.

-

Increased risk of market corrections or crashes: High valuations make markets more susceptible to sharp corrections or even crashes. A sudden shift in investor sentiment or an unexpected negative economic event could trigger a significant market downturn.

-

Potential for lower future returns: When markets are highly valued, the potential for future returns is typically lower than in markets trading at more historically average valuations. Investors may experience slower growth in their portfolios.

-

The impact of rising interest rates on valuations: A rise in interest rates can significantly impact stock valuations. Higher rates increase borrowing costs for companies and make bonds a more attractive alternative to stocks, potentially leading to a decline in stock prices.

-

Geopolitical risks and their influence on market stability: Geopolitical uncertainty and events, such as international conflicts or trade wars, can introduce significant volatility into the market, further exacerbating the risks associated with high valuations.

Strategies for Navigating High Stock Market Valuations

Based on BofA's analysis and established market wisdom, several strategies can help investors navigate the complexities of high stock market valuations.

-

Diversification strategies to mitigate risk: Diversifying your portfolio across different asset classes (stocks, bonds, real estate, etc.) and sectors can significantly reduce your overall risk exposure.

-

Sector-specific investment recommendations (based on BofA's findings): BofA's research often highlights specific sectors they consider undervalued, offering potential opportunities for investors seeking better risk-adjusted returns. Always refer to the most current reports.

-

Consideration of alternative investment options: Exploring alternative investment options, such as private equity or hedge funds, can offer diversification benefits and potentially higher returns, although these options often come with higher risk.

-

Importance of a long-term investment horizon: Maintaining a long-term investment horizon can help you weather short-term market fluctuations and benefit from the long-term growth potential of the markets.

Conclusion

BofA's analysis highlights that current high stock market valuations present both opportunities and challenges for investors. Understanding the contributing factors, such as low interest rates and positive investor sentiment, is crucial. However, investors must also be aware of the associated risks, including potential market corrections and lower future returns. By employing strategies like diversification, careful sector selection based on reputable research such as BofA's analysis, and maintaining a long-term perspective, investors can better navigate this complex market environment and mitigate potential risks. Understanding and addressing high stock market valuations is crucial for informed investment decisions. Use this BofA analysis as a starting point to refine your investment strategy and mitigate potential risks. Learn more about navigating high stock market valuations by [link to relevant resource or further BofA research].

Featured Posts

-

House Of Kong Gorillaz Mark 25 Years With New Exhibition And London Performances

May 30, 2025

House Of Kong Gorillaz Mark 25 Years With New Exhibition And London Performances

May 30, 2025 -

Lima Enfrenta Frio Extremo Recomendaciones Del Senamhi Para Protegerse

May 30, 2025

Lima Enfrenta Frio Extremo Recomendaciones Del Senamhi Para Protegerse

May 30, 2025 -

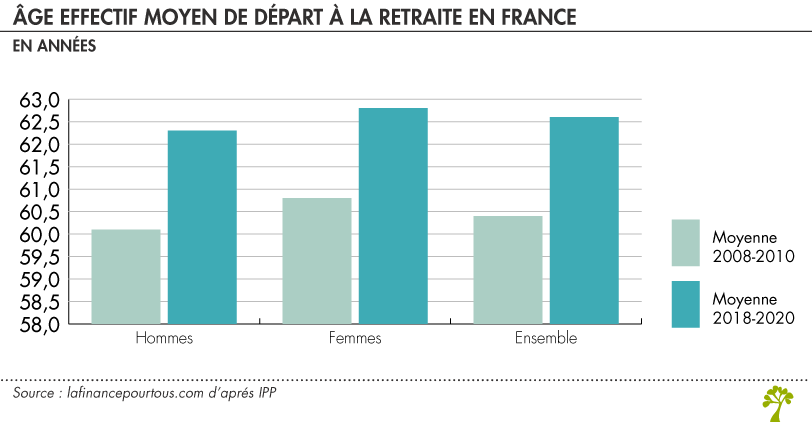

Age De Depart A La Retraite Discussions Secretes Entre Le Rn Et La Gauche

May 30, 2025

Age De Depart A La Retraite Discussions Secretes Entre Le Rn Et La Gauche

May 30, 2025 -

8 Ways Trumps Trade War Is Hurting The Canadian Economy

May 30, 2025

8 Ways Trumps Trade War Is Hurting The Canadian Economy

May 30, 2025 -

Tileoptiko Programma Savvatoy 5 4 Ti Na Deite

May 30, 2025

Tileoptiko Programma Savvatoy 5 4 Ti Na Deite

May 30, 2025