Addressing High Stock Market Valuations: BofA's Reassurance For Investors

Table of Contents

BofA's Assessment of Current High Stock Market Valuations

Acknowledging the Elevated Levels

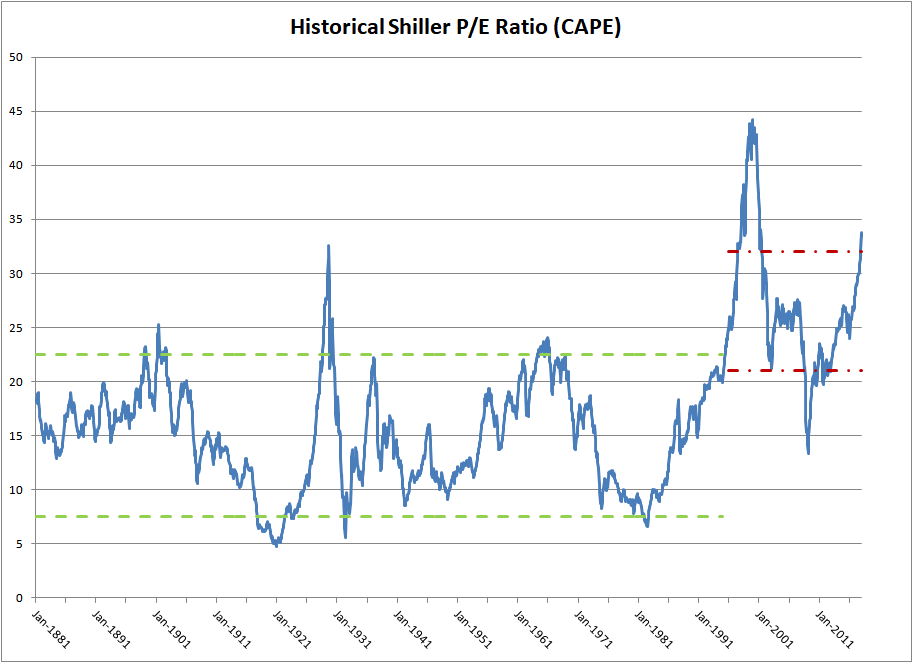

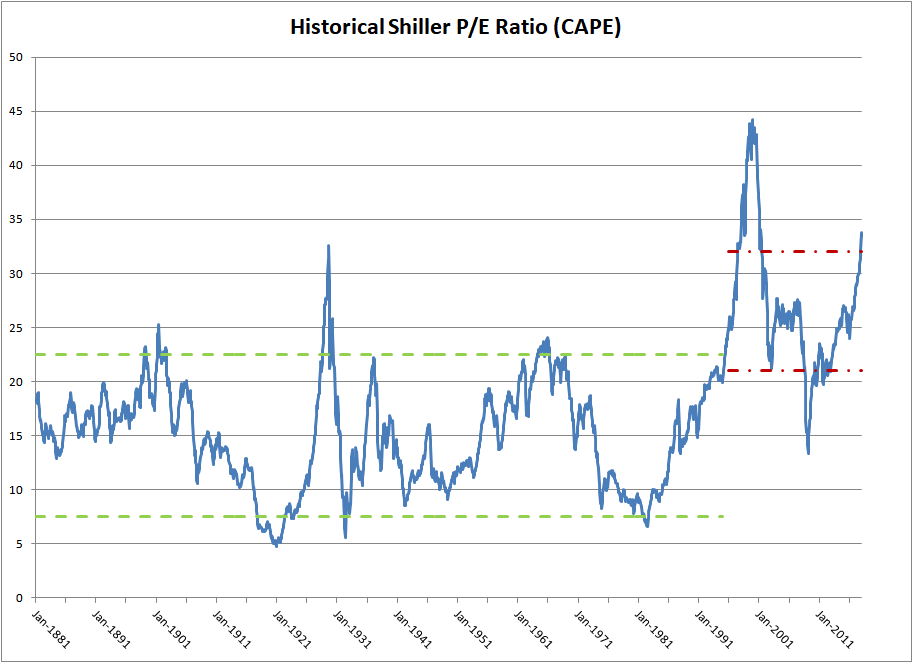

BofA analysts readily acknowledge that current valuations are indeed high compared to historical averages. They utilize several key metrics to assess this, including the widely used Price-to-Earnings (P/E) ratio and the more cyclical Shiller PE ratio (also known as the CAPE ratio, which accounts for inflation-adjusted earnings over a ten-year period).

- High Valuation Metrics: Recent data shows P/E ratios exceeding long-term averages for the S&P 500 and specific sectors like technology. The Shiller PE ratio also indicates elevated valuations compared to historical norms.

- Sectors with Higher Valuations: Technology, consumer discretionary, and communication services are frequently cited as sectors exhibiting particularly high valuations.

- Limitations of Valuation Metrics: It's crucial to remember that solely relying on valuation metrics can be misleading. Factors like market sentiment, future growth expectations, prevailing interest rate environments, and unexpected geopolitical events significantly influence stock prices and can temporarily justify higher valuations.

Factors Mitigating Valuation Concerns

BofA highlights several factors that could mitigate concerns about these high stock market valuations:

- Strong Corporate Earnings: Many companies have reported robust earnings, exceeding expectations and demonstrating resilience even in the face of economic uncertainty.

- Anticipated Future Growth: Despite current economic headwinds, projections for future growth in certain sectors, fueled by technological innovation and emerging markets, remain positive.

- Low Interest Rate Environment (or Trajectory): While interest rates are rising, BofA's analysis might consider the potential for a pause or even a future rate cut depending on the economic outlook. Lower interest rates often support higher valuations as they reduce the cost of borrowing for companies and investors.

- Technological Advancements: Breakthroughs in technology continue to disrupt industries and create new growth opportunities, potentially justifying premium valuations for companies leading these advancements.

- Inflationary Pressures: Whilst inflation impacts valuations negatively, the rate of increase may be easing, making future earnings projections slightly more reliable.

These factors can significantly influence investor behavior and market dynamics, potentially justifying, at least partially, the higher valuations observed.

BofA's Strategic Recommendations for Investors

Maintaining a Long-Term Perspective

BofA likely advises investors to avoid knee-jerk reactions to short-term market volatility driven by concerns over high stock market valuations.

- Advantages of Long-Term Investing: Long-term investing allows investors to ride out market fluctuations and benefit from the power of compounding.

- Importance of Diversification: Diversifying your portfolio across different asset classes and sectors helps mitigate risk and reduce the impact of any single investment performing poorly.

- Mitigating Short-Term Fluctuations: A well-diversified, long-term strategy significantly reduces the emotional impact of short-term market fluctuations.

Selective Stock Picking & Sector Allocation

Navigating high stock market valuations effectively requires a discerning approach to stock selection and sector allocation.

- Less Vulnerable Sectors: BofA might suggest focusing on sectors with strong fundamentals, consistent earnings growth, and less sensitivity to interest rate changes. This might include defensive sectors like healthcare or consumer staples.

- Importance of Fundamental Analysis: Thorough due diligence, including fundamental analysis of a company's financials, competitive landscape, and management team, is crucial when selecting individual stocks.

- Growth Potential and Financial Health: Evaluate companies based on their growth potential, financial health (debt levels, profitability), competitive advantage, and management quality.

Risk Management Strategies

Managing risk is paramount in any market environment, particularly when dealing with high stock market valuations.

- Diversification Strategies: Diversification across asset classes (stocks, bonds, real estate) and geographic regions is a cornerstone of effective risk management.

- Hedging Techniques: Explore hedging strategies to mitigate potential losses in a down market. Options contracts or inverse ETFs might be considered but with a full understanding of their risk profile.

- Understanding Personal Risk Tolerance: Align your investment strategy with your personal risk tolerance, financial goals, and time horizon. Avoid taking on excessive risk that could jeopardize your financial well-being.

Conclusion

This article has examined Bank of America's assessment of current high stock market valuations. BofA acknowledges the elevated levels but points to mitigating factors offering a more nuanced picture than immediate cause for alarm. Their recommendations emphasize the importance of a long-term investment perspective, selective stock picking, and robust risk management strategies.

While high stock market valuations present challenges, understanding BofA's perspective and implementing the strategies discussed can empower you to navigate the market effectively. Don't let concerns about high stock market valuations paralyze you – develop a robust investment plan tailored to your individual needs and risk tolerance. Learn more about managing your portfolio in the face of high stock market valuations and build a strategy for long-term success.

Featured Posts

-

L Influence D Elon Musk Sur La Propagation De L Ideologie D Extreme Droite En Europe Via X

May 26, 2025

L Influence D Elon Musk Sur La Propagation De L Ideologie D Extreme Droite En Europe Via X

May 26, 2025 -

Analyse De L Utilisation De X Par Elon Musk Pour Soutenir L Extreme Droite Europeenne

May 26, 2025

Analyse De L Utilisation De X Par Elon Musk Pour Soutenir L Extreme Droite Europeenne

May 26, 2025 -

Tour Of Flanders 2024 Pogacar And Van Der Poels Epic Battle

May 26, 2025

Tour Of Flanders 2024 Pogacar And Van Der Poels Epic Battle

May 26, 2025 -

Implantation Future Des Locaux Rtbf A Liege Les Dernieres Actualites

May 26, 2025

Implantation Future Des Locaux Rtbf A Liege Les Dernieres Actualites

May 26, 2025 -

Roland White Reviews Imagine The Academy Of Armando On Bbc 1 A Comedy Masterclass Review

May 26, 2025

Roland White Reviews Imagine The Academy Of Armando On Bbc 1 A Comedy Masterclass Review

May 26, 2025

Latest Posts

-

Game 2 Pacers Vs Knicks Tyrese Haliburton Betting Analysis And Picks

May 28, 2025

Game 2 Pacers Vs Knicks Tyrese Haliburton Betting Analysis And Picks

May 28, 2025 -

Tyrese Haliburton Performance Predictions Pacers Vs Knicks Game 2

May 28, 2025

Tyrese Haliburton Performance Predictions Pacers Vs Knicks Game 2

May 28, 2025 -

Pacers Vs Knicks Game 2 Tyrese Haliburton Prop Bets And Predictions

May 28, 2025

Pacers Vs Knicks Game 2 Tyrese Haliburton Prop Bets And Predictions

May 28, 2025 -

Nba Game Pacers Vs Hawks Time Tv Channel And Live Stream March 8

May 28, 2025

Nba Game Pacers Vs Hawks Time Tv Channel And Live Stream March 8

May 28, 2025 -

Pacers Vs Hawks On March 8th Where To Watch And Game Time Details

May 28, 2025

Pacers Vs Hawks On March 8th Where To Watch And Game Time Details

May 28, 2025